Welcome to the thirty-second episode of Dan Fournier’s Down the Rabbit Hole podcast.

Guest: Bill Holter

Bill Holter is popular financial commentator and precious metals expert whom I’ve been following for over a decade and a half.

In this podcast we discuss the current monetary reset taking place in the United States (and collective West), focusing on the markets (equity & bond markets, gold & silver, derivatives), banking sector, and what major event could bring about the new beast system.

You won’t want to miss what Bill has to say, as what he’s been predicting for over a decade is currently unfolding at a rapid and alarming pace.

Alternative Podcast Links, listen on:

Spreaker (download the .mp3 for later listening)

Show Time Stamps

NOTE: Please be aware that during the recording of this podcast there was a big storm which affected certain parts of the interview. I have thus had to edit out some segments and some slight gaps may appear in the podcast.

[00:00 to 00:56] Podcast intro.

[00:57 to 02:35] Welcoming my guest Bill Holter along with a short biographical background.

[02:36 to 06:59] For my first question, I asked Bill about his years spent living in Costa Rica and what additional perspectives he learned about the U.S. from the outside looking in. In this segment Bill also mentioned the movie called The Big Short which focused on the housing bubble of the 2007-2008 Financial Crisis.

[07:00 to 12:51] This segment focused on a financial (monetary) metric called M2 which represents the money supply. I first mentioned that back in late 2019 (and the following couple of years) we saw a massive expansion of the money supply in both the U.S. (to the tune of 4 trillion dollars) and Canada (about half a trillion Canadian dollars) amidst the conveniently timed Covid-19 Scamdemic. I thus asked Bill a two-part question on whether he sees the Fed in the U.S. re-start the money printers again and if so, to guesstimate the amount (in trillions). Bill made the observation that when discussing M2, it is important to consider the velocity of money (which means the the rate or rapidity at which money is exchanged in an economy).

[12:52 to 15:29] For the next question, I ask my guest his take on what could happen to citizens’ retirement accounts (IRAs & 401ks) in the U.S. in the event of a market (stocks/bonds/dollar) crash. Importantly, Bill mentioned a book and documentary film called The Great Taking (see Show Notes below for more details on this).

[15:32 to 18:02] Here, the focus is on a new monetary system. I thus ask Bill whether he sees Western countries agreeing on some kind of new Bretton Woods system and whether the new currency could be backed by something of value such as gold. Perhaps unsurprisingly, Bill mentioned that in such a case, the price of gold would have to be reset to a much higher price (5x or 10x, or even higher).

[18:03 to 21:57] The focus here is with regards to some kind of major EVENT that could happen in order to transition from the old system to the new [monetary] system. I mentioned that in 2023 I had published an article (from a 2-part series) which posited that such an event would consist of some kind of major false flag cyberattack that would be blamed on Russia, China, or Iran. I further emphasized that this kind of event would really fit the bill since its aftermath would result in mandatory Digital IDs which is a pre-requisite for a Central Bank Digital Currency (CBDC) or new digital dollar. Interestingly, Bill mentioned that, apart from a whole bunch of possible event scenarios, they could even stage some kind of UFO/alien invasion – which, ironically, is actually what I had written about in my first article for that series.

[22:04 to 27:00] Before asking my next question, I made a bold prediction that we could see a repeat of what happened during the Great Depression wherein 80% of banks (smaller/regional) failed; and that larger banks such as JP Morgan, Goldman Sachs, and Citigroup could absorb the failing banks to increase their power. I also mentioned that though President Donald Trump asserted there would be no CBDC, he never said there would be no digital dollar. Moreover, I mentioned that just over a week ago (April 24) the Board of Governors of the Federal Reserve System issued a press release which basically gave the green light for banks to issue what they call dollar tokens (which is just another name for stablecoins); and that the Fed even previously [2023] clarified the terminology on this, stating “For the avoidance of any doubt, any bank liabilities (including deposits) that meet the definition of dollar token are dollar tokens.” In other words, dollars in bank accounts would be recognized as tokens. (see the related section below in the Show Notes on this) I thus asked Bill whether he thought a large number of smaller/regional banks could go bust and if he sees dollar tokens becoming the new currency in the U.S. In his answer, Bill said that he didn’t know what the new currency will be, but that it will not be U.S. dollars and that the [overall] direction is towards some kind of CBDC. He also observed that even the large banks could get in trouble due to their humongous derivatives exposure should those bets turn sour. Finally in this segment, I referred to a group of “systemically important” banks called the G-SIBS (a.k.a. “too big to fail”, see also here) and that it was our very own Canadian Prime Minister, Mark Carney, who at the time was responsible for creating this group while he was head of the Financial Stability Board (FSB).

[27:01 to 30:15] My next question was in two parts. The first focused on something called the Gold-Silver Ratio (which is simply a measure of how many ounces of silver are needed to purchase one ounce of gold). I noted the the current ratio (near the time of recording with the price per ounce of gold being U.S.$3,412 & silver U.S.$33.07) was about 101 to 1 (though it was actually 103 to 1). Since Bill is a precious metals expert, I asked him whether this ratio would decrease by the end of this year or soon after. He mentioned that the ratio should drastically come down, closer to 10 to 1 since that is the ratio at which these precious metals actually come out of the ground.

[30:16 to 35:07] The second part of the question was with regards to another ratio, namely the Dow-Gold Ratio (which is a financial metric that expresses the price of the Dow Jones Industrial Average in ounces of gold). At the time of recording, the ratio was at 12.67. I noted that in the last 100+ years, the ratio had dipped below 3 on a few occasions. I thus asked Bill whether he thought the ratio could see another large dip. He then clarified what could occur given the dynamics of the markets.

[35:08 to 36:41] For the last question, I ask Bill what advice he would give for people to protect themselves amidst these market uncertainties.

[36:42 to 37:00] Finally, Bill shares where people can follow his work (see related section at the end of this post for links) and I thank him for his time.

[37:11 to 39:48] Outro (song) - White Rabbit by Grace Slick of Jefferson Airplane.

Show Notes

The Great Taking

During the podcast, my guest Bill mentioned a book and documentary film called The Great Taking.

The book’s author, David Rogers Webb, spent over two decades investigating and analysing the current laws that have been put in place by the banking cabal which will, in a nutshell, secure them as the ultimate creditors (recipients) of assets in the event of a huge market crash.

In other words, they are positioned well ahead of you to have first dibs on assets held in banks, brokerages / financial institutions, essentially depriving [bank] depositors and investors from the assets they thought they owned.

These laws, such as bail-in ones, have already been put in place in most countries in the west.

As Bill suggests, it is worthwhile for you to question and research whether or not you really own the assets – cash in your bank account and stocks & bonds in your brokerage account – or if you are merely an unsecured creditor to those assets; in other words, he urges you to read and understand what has been presented in The Great Taking (full PDF eBook version, online HTML version). You can also watch the documentary film hereunder:

I would also recommend having a look at the following related article:

The Electronic Takeover of Every Asset on Earth, “The Great Taking,” and the Control of Humanity, by Gary D. Barnett

I have created a short video clip (Rabbit Short) where Bill describes what could unfold in the event of a major market crash (see section below to access the clip).

The EVENT

As I’ve written about in the introductory part of one of my series, a major event – the likes of a Pearl Harbour attack or 9/11 – will be conducted to bring about the next monetary system which is long overdue. It’s inevitable.

As to what exactly this event will be, it is hard to say.

But during the podcast, I posited that it would consist of a major false flag cyberattack that will be blamed on either Russia, China, or Iran, as I extensively detailed back in August of 2023 in my article Cyber Attack Crisis.

The main reasons I stated that this will be the likely event is that in its aftermath, they will finally be able to only permit internet access with a biometric Digital ID which they absolutely need as a pre-requisite for their CBDC or digital dollar equivalent.

Having some kind of mandatory Digital ID to access the internet fits the globalists / international banking cabal’s plans to censor dissident voices, like yours truly, who expose their malfeasance.

These globalists are already making plans to make biometric facial recognition mandatory for air travel at all airports.

Here is an excerpt of an interview I gave to investigative journalist Johnny Vedmore explaining why a [false flag] cyber attack would be so effective for the globalists:

Since publishing my article more than 20 months ago, I have added 11 addenda to it, debunking alleged smaller-scale false flag [fabricated] “events” that were blamed on those three boogeymen (Russia, China, and Iran).

And China has been the one which they have more recently focused on (including a fabricated hit piece from this week).

Given the Cold-War-esque rhetoric intensifying against China, Russia, and Iran, coupled with the increased amount of propaganda pushed by a pro-war/corrupt/captured mainstream media, it is not hard to see what they are conditioning the masses for. Call it predictive programming, if you will.

Digital Dollar TOKENS coming to your U.S. bank

During the podcast I explained that even though President Trump said there would be no CBDC in the United States, he never said there wouldn’t be a digital dollar.

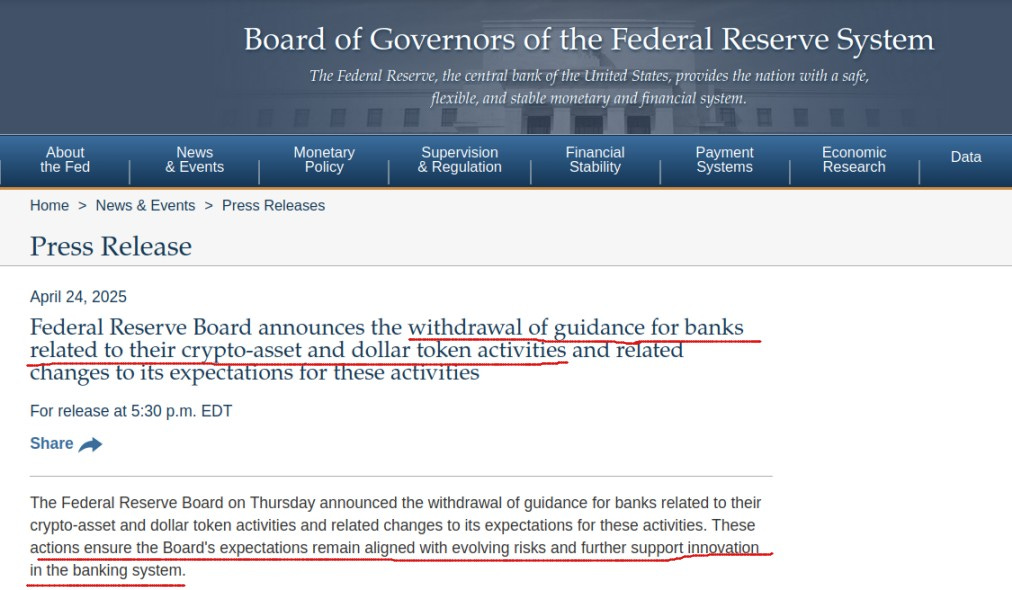

I also mentioned that just recently (on April 24) the Board of Governors of the Federal Reserve System issued a press release which basically gave the green light for banks to issue what they call dollar tokens (which is just another name for stablecoins).

Here is a screenshot of the press release [with emphasis added in red]:

As you can see from the screen capture above, the Fed’s Board mentions that this policy is “aligned with evolving risks” and to “support innovation in the banking system.”

So, it’s not that difficult to read between the lines, so to speak. The risks can include a dollar crash (or blow up of the bond/Treasury market), and the innovation the new monetary instrument, i.e., the new tokenised digital dollar they are undoubtedly planning to soon launch.

Furthermore, I also mentioned in the podcast that the Fed had previously (2023) clarified the terminology on this, stating:

“For the avoidance of any doubt, any bank liabilities (including deposits) that meet the definition of dollar token are dollar tokens.”

In other words, dollars in bank accounts would be recognized as tokens.

Hence, if they remove cash, then we all know it’s game over since you’ve lost control over your money.

We have yet to know who will issue the digital dollar tokens. I personally doubt that the U.S. Government would create another central bank to replace the [private] Federal Reserve. The current Fed, as we know it, could even be terminated (by an act of Congress). And the issuance and management of the new tokenised digital dollar could be done by both the U.S. Department of the Treasury and a consortium of private large banks such as JPMorgan et al.

As a caveat, it is hard to say for sure what will unfold.

In addition, we have yet to know the full characteristics that a tokenised digital dollar would entail. But, it is certainly conceivable – even likely – that it would consists of some combination of CBDC-like programmability which could limit its use by whomever holds it, i.e., think:

be imposed a negative interest rate on the holdings of your account,

being only allowed to spend in certain places or on certain items, or come with an expiry date,

etc.

It would then be wise for Americans to keep an eye on upcoming events and press releases by its private central bank, the Fed, in the coming weeks and months for news on a new tokenised digital dollar.

Rabbit Shorts

The Great Fail & The Great Taking

In this clip, Bill explains how laws are already in place which would see cash in your bank account and stocks & bonds in your brokerage account be taken from you in the event of a major crash with financial institutions & bank failures as per David Rogers Webb's book and documentary called The Great Taking.

We [the U.S.] are the Bad Guy!

In this clip, Bill Holter explains his time living out of the United States in Costa Rica, how he learned that the U.S. does not honour its agreements, and how they are "the bad guy." On a more positive note, he also explains how enriching it is to live in another country, as to better learn its language and culture.

Addendum (2025-05-22): Recommended video interview with Bill on Miles Franklin

Came across this wonderful video from Miles Franklin where Andy Schectman interviews Bill. They focus a lot on Bill’s background which includes his time playing hockey as a young man (which I kick myself to not have found and asked him about), stories about his time in Costa Rica, being a skilled horseman (not a cowboy!), his contrarian moves in the investment world and more. It is very much worth the watch!

Signing Off

You can follow Bill’s work or contact him via the following:

Bill Holter’s profile as a broker for Miles Franklin.

email: bholter@proton.me

What are your thoughts on any of the subjects discussed in this podcast? How do you see this GREAT MONETARY/FINANCIAL RESET playing out? What major EVENT do you see happening? Feel free to leave them in the Comments section below.

Learn more about Dan Fournier’s Down the Rabbit Hole podcast and the meaning behind its name:

I also came across another great video that explains the Mad Truth of Alice in Wonderland & Why It Matters:

Signing off with Grace Slick’s White Rabbit:

See you next time.

Plea for your Support

Most articles and podcasts are free, but please support the work of this independent journalist by considering a paid subscription to his Substack (for only $5 a month, or $50 a year), buying me a coffee, and/or following his Twitter.

Disclaimer:

None of what appears in this podcast and post by the author and guest is to be taken as financial or investment advice. See the author’s About page for full disclaimer.

Share this post