Canada’s Carbon Colony: You will Not own a Home, nor be Happy

Commentary by Dan Fournier, published June, 3, 7:35 EDT on fournier.substack.com

I was tempted to name this article ‘EXPOSÉ: Canadian Residents & Businesses are about to be Carbon-Taxed into Oblivion, 2024-2026 edition’ as a follow-up to my October, 2022 article of a similar name since there are so many parallels between what I wrote back then and what is coming down the pike in Canada.

While the masses are distracted by who will be [s]elected as our next Prime Minister – be it the same Dufus-in-Chief Justin Castreau, slick speaker Pierre Poilievre, or even globalist bankster snakester Mark Carney – the control grid apparatus continues to be stealthily assembled brick-by-brick by the sellout enablers who are stupidly helping to facilitate even their own slavery.

The main premise of this article is to demonstrate the ultimate goal of the greater Climate Con and how it is being employed and exploited to further impoverish Canadians and make home affordability a thing of the past (not only for the younger generations, but for everyone), as per the tenets of the United Nations 2030 Agenda.

This article is segmented into the following parts (click links to access the desired parts):

1. Introduction & Summary of my first Exposé on the Carbon Tax Scam

3. The Enablers: Canada’s Big Banks + Office of the Superintendent of Financial Institutions (OSFI)

Summary Overview:

Parts 1 & 2 provide background information and the broader context, i.e., how we got here, and where we’re headed.

Part 3 is where it gets a bit technical, under the hood so to speak. It shows how they are stealthily putting the looting mechanism in place.

Part 4 shows the ultimate consequences of these climate schemes – particularly on how it will destroy the ability for home ownership in Canada.

Part 5 is concerned with raising awareness of the schemes and what Canadians can do now to push back against the steal, before it’s too late.

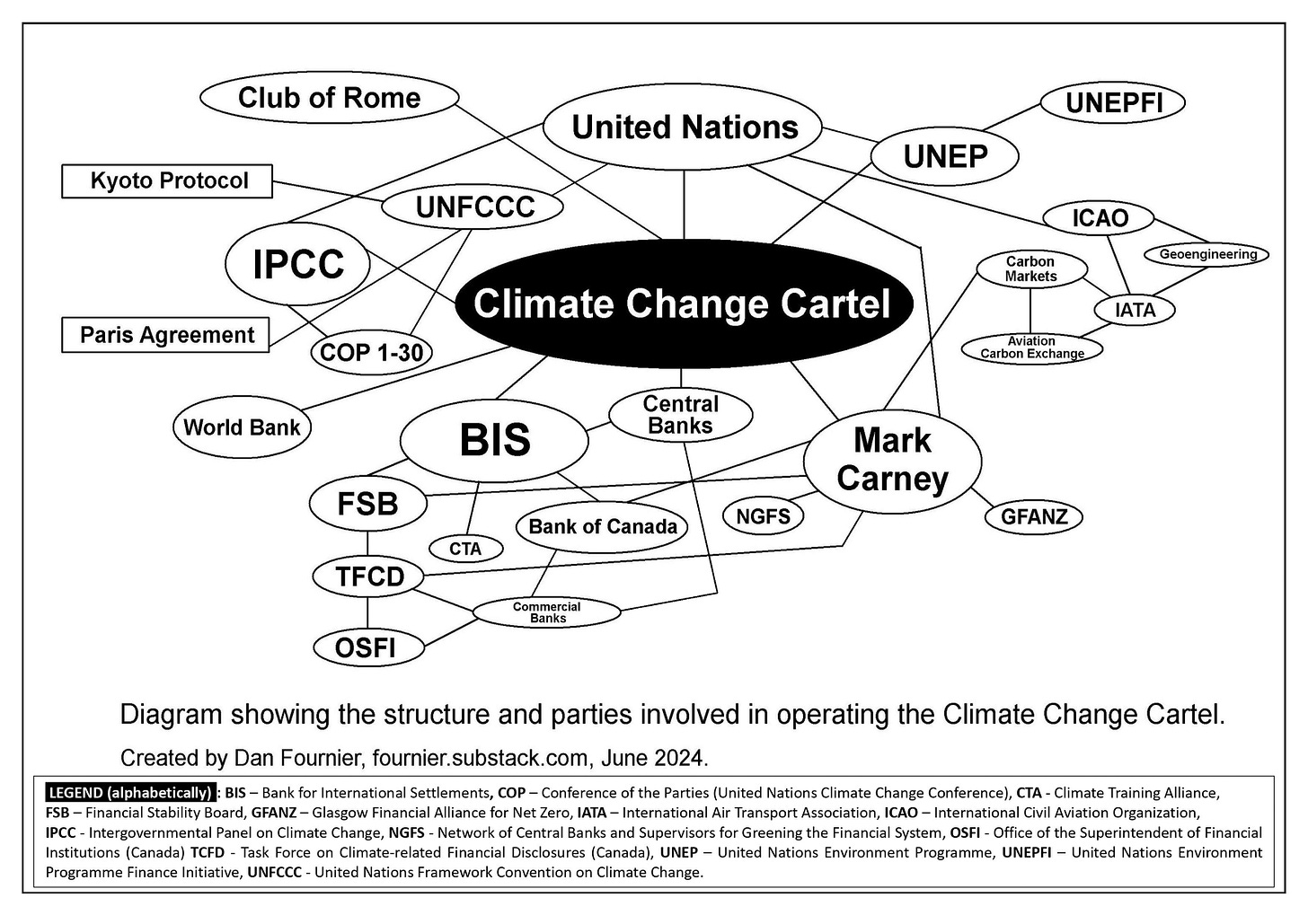

Part 6 shows a mind map that simplifies the broader Climate Scam exposing the principal actors/participants (cartel) behind it.

1. Introduction & Summary of my first Exposé on the Carbon Tax Scam

1.1 Climate Change

“Climate Change” is indeed real in the sense that climate is constantly changing; that is a bloody given. Duh.

Apparatchiks left and right will play the “Climate Denier” card to ridicule anyone who challenges the prevailing climate orthodoxy, not even realising the absurdity of this bullet phrase. Nobody is freakin’ denying climate; rather, they are denying the ridiculous false claims made by automatons who worship at the altar of the climate-change-industrial-complex cult.

The “Climate Change” narrative, scientism, profiteering industry is, and has always been, a monumental hoax from its very inception.

If you have a different view of “Climate Change” and think that our planet is boiling & doomed and that you shouldn’t have children in order to save it, then this article is not for you and I’d suggest you become pen pals with Greta Thunberg and return to your safe space echo chamber. Have a nice life and don’t forget to keep up-to-date on your Covid-19 (non bioweapon of course) booster shots.

Climate Activist Greta Thunberg showing her fellowship and allegiance to Freemasonry (all seeing eye). The photo on the right is her as a child with her Masonic parents.

We are the carbon that they want to eliminate and if you are too blind and ignorant to realise that, then move along please.

1.2 Carbon Tax Scam (summary)

As alluded to previously, I wrote an article in October of 2022 outlining the means by which various mechanisms were taking root through the federal government, our financial institutions, regulators and other parties.

These are all mechanisms that are aligned with the general Climate Scam, its net zero objectives, the United Nations’ Intergovernmental Panel on Climate Change (IPCC) and SDG 13 Goal, carbon markets, and so on.

In a nutshell, these mechanisms are purposely designed and crafted with five broad goals in mind, namely:

decreasing the supply of cheap and affordable energy (such as oil, natural gas, and nuclear);

looting trillions of dollars from nations and their citizens through various forms of Carbon Taxes (federal and air travel for instance); hence,

impoverishing the masses; thus,

depopulating the planet; and,

implementing a “Climate Action” apparatus which will act as the glue that will usher in Digital IDs and Central Bank Digital Currencies (CBDCs) for total control over human beings in order to further enslave and financially strangle them.

The United Nations has been central to this broader endeavour which can only be referred to as the greatest, most monumental swindle ever perpetrated in human history.

The World Economic Forum (WEF) has also played a huge role in these crimes against humanity.

And even The Global Fund has learned how to extort billions from countries such as Canada.

Here are some Key Takeaways of my 2022 article EXPOSÉ: Canadian Residents & Businesses are about to be Carbon-Taxed into Oblivion:

The Climate Change narrative is, for the most part, an exaggerated fabrication concocted by powerful interests with dubious agendas that doesn’t hold up to scientific scrutiny.

Starting in 2035, no new gas or diesel cars & trucks will be allowed.

The Canadian Oil & Gas sector will be put extinct by the year 2050.

Small & Medium sized businesses will find it increasingly difficult to get loans due to net-zero policies.

Canadian consumers will be greatly taxed to support all the climate-related policies and measures that are currently being implemented in Canada and elsewhere.

While it is a long article, I would mostly like to focus on two sections (4. New Regulatory Institutions to manage it all + Banking on Insanity) and provide summary points from them since they outline the parties that are implementing these looting mechanisms.

1.2.1 Regulatory Institutions

An important point to highlight here is that there are many financial regulatory institutions which have been set up around the world. The main idea is to have sound rules and standards to be adopted in order to ensure stable financial institutions and markets.

Some are national and specific to each nation, while others are international.

Here, since we are focused on finance and banking, it is imperative to underline that it is the international regulatory bodies aligned with the International Banking Cabal who dictate global standards.

These standards then trickle down as policies to be implemented by member nations’ respective central banks, financial regulators and, ultimately, their financial institutions (such as commercial banks, insurance companies, pension funds, and the like).

These international regulatory bodies may appear as separate entities, but in fact they (at least the most important ones) are affiliated with the International Banking Cabal which is lead by the Bank for International Settlements (BIS). There are several, but here are the main ones of importance since they are each quite prominent and powerful:

The Basel Committee on Banking Supervision (BIS-affiliated)

The Financial Stability Board (BIS-affiliated)

In short, these two entities pretty much dictate global policy with regards to finance and banking.

They have been doing so in Canada since at least the mid-seventies.

More on these entities below.

1.2.1.1 International: Financial Stability Board (FSB)

Most people are unfamiliar with the Financial Stability Board (FSB).

Headquartered in Basel, Switzerland, the FSB is affiliated with the Bank for International Settlements (BIS) and is essentially the strong arm regulator of the BIS, the central bank of central banks.

The FSB’s stated main purpose is to ensure the stability of the global financial system.

In recent years, the FSB has focused a lot on so-called Climate Change which it sees as a threat along with its associated “risks,” sparking global initiatives to address them.

“The FSB is coordinating internationally the work to address climate-related financial risks,” states an October 12, 2023 page on their website.

They attempt to conflate climate-related risk with financial stability:

“Climate-related risks are far-reaching and differ from other risks to financial stability. Climate-related risks may be , and their effects on the financial system subject to substantial uncertainty and tail-risk.”

They fail, however, to provide any tangible evidence of such climate-related risks, but instead offer subjective or speculatory pronouncements (“may be”) when trying to establish their link to financial stability.

Total hogwash.

Yet, that is not preventing them from establishing roadmaps and international policies to further legitimise the fairy tale in order to pursue this money-spinner.

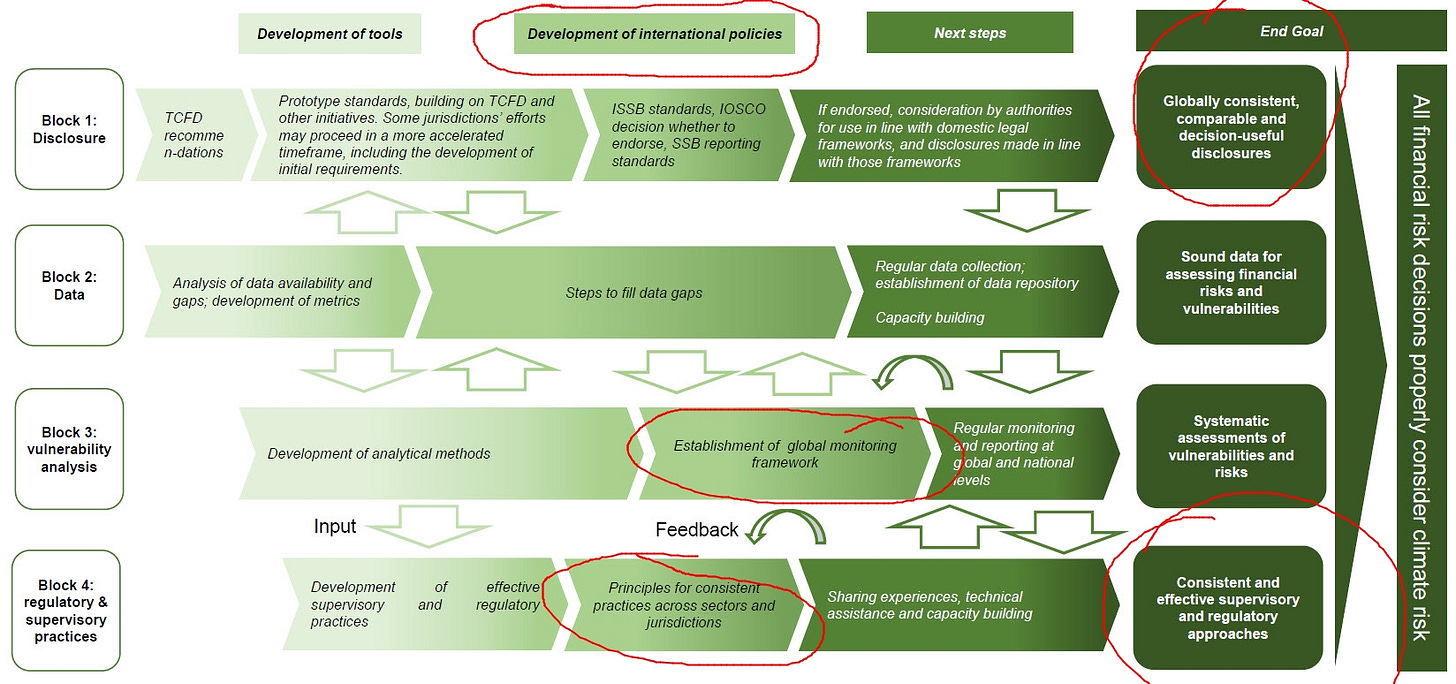

Stylised overview of the FSB’s roadmap for addressing climate-related financial risks (with emphasis added in red to underscore the goal of standardised international reporting). Source: Financial Stability Board – Climate-related risks.

As can be seen from the FSB infographic above, their goal is to have all member countries be in total alignment with these climate risks disclosures.

In reality, this is all a facade used to cloak their real objective, i.e., to use Climate Change as a means to impose crushing regulations and reporting standards from their members in order to funnel even more money their way (their primary way is through interest-bearing loans).

We must also not forget that our very own Mark Carney (former Bank of Canada & Bank of England Governor) was the former chair of the Financial Stability Board (FSB) from 2011 to 2018.

In late 2019, Carney took on a specialised role – United Nations' special envoy on climate action and climate finance.

Screenshot of a December 1, 2019 article from the CBC – Former Bank of Canada governor Mark Carney to serve as UN special envoy on climate.

Are you starting to see how this is all connected?

It’s a BIG club; and we ain’t in it.

But wait, the FSB isn’t stopping there. In fact, they’ve created a whole entity that will be charged with overseeing this swindle, namely the TCFD.

1.2.1.2 Task Force on Climate-related Financial Disclosures (TCFD)

In recent years the FSB created a special arm called the Task Force on Climate-related Financial Disclosures (TCFD) which has a mission (notice Mark Carney in the linked source) to:

“develop voluntary, consistent climate-related financial risk disclosures for use by companies in providing information to investors, lenders, insurers, and other stakeholders.”

Don’t be fooled by the term “voluntary” from the excerpt above; for, these climate-related financial risk disclosures will eventually be made mandatory (proof further down in this post).

Another BIS affiliated outfit called the Basel Committee (formally the Basel Committee on Banking Supervision) establishes banking regulations and standards for banks worldwide. Member central bank Governors meet every two months at the BIS for Basel Committee meetings to concretise these. They state that their recommendations or guidelines are not legally binding, and it is up to each central bank Governor of member countries to decide whether to implement them or not. But in reality, bank governors have no choice but to follow suit, lest they be promptly replaced.

So, the main point to retain here is that the Task Force on Climate-related Financial Disclosures (TCFD) is BIS/FSB-controlled entity that has been set up as a mechanism by which banks and financial institutions of member countries are required to play ball with regards to assessing “climate-related risks” and emissions reporting which will serve as a basis for carbon taxing.

In my prior report from 2022, I mentioned that publicly-listed companies could voluntarily report their climate disclosures, but by 2024, it was set to become mandatory as indicated by the Canadian Government.

Task Force on Climate-related Financial Disclosures 2022 Status Report, page 100.

We are of course now reaching that point, and I will outline further below in Section 3 with the Office of the Superintendent of Financial Institutions (OSFI) – which appears in the image capture above – how this is now being established.

I had also mentioned that the Canada Pension Plan (CPP) intends to make climate disclosures a requirement for all companies that are to be included in its portfolio holdings.

With the CPP, we are not talking about some chump change here. We are talking about an entity with investments or assets under management of over $632 billion.

The CPP, needless to say, is a very powerful entity in the Canadian investment landscape. Along with investments in international/global businesses and real estate, they of course also hold shares in Canadian companies.

The CPP appears to be fully committed to the Climate Con and net zero follies.

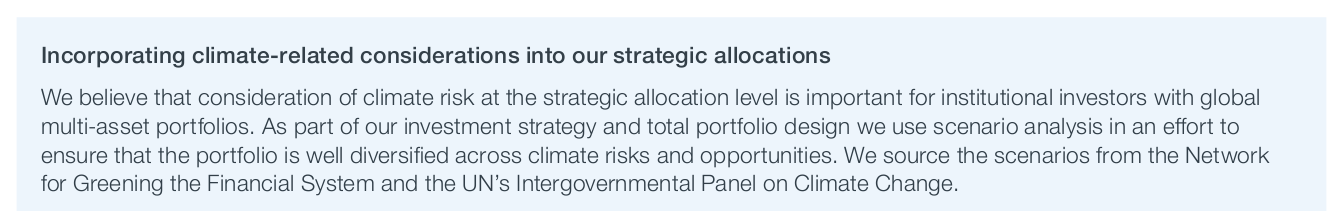

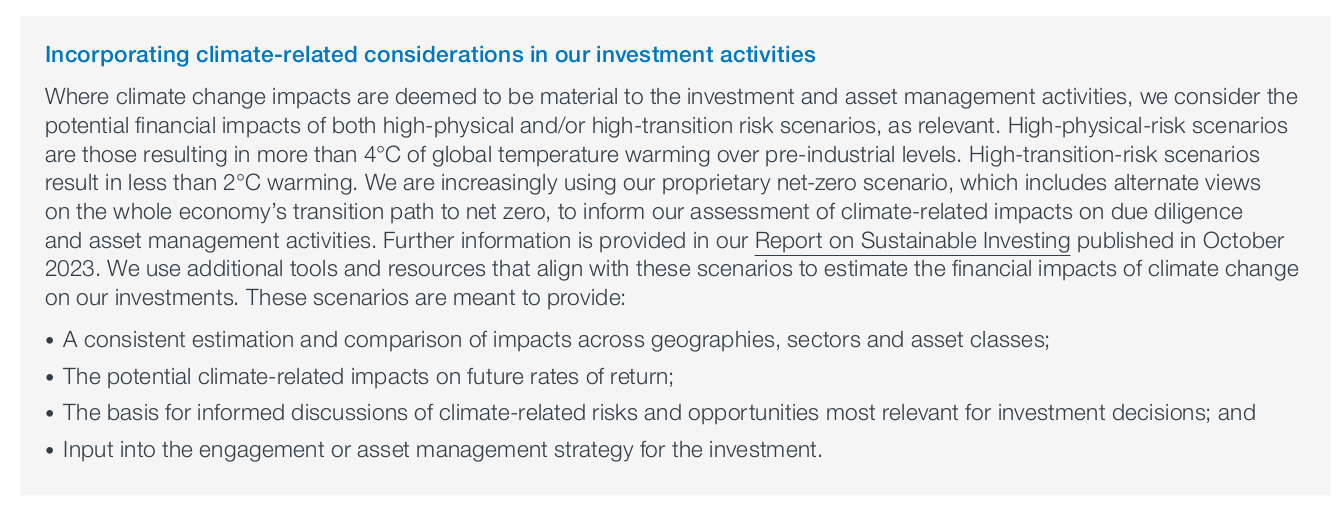

Excerpt from page 18 of CPP Investments’ 2024 Annual Report.

Notice how they mention the consideration of ‘climate risk’ at the ‘strategic allocation level’ which implies that they will only, at least eventually, allocate holdings for entities/companies that are climate risk-oriented and will submit to the cult.

Also notice how they will use ‘scenario analysis’ in their selection strategy and that these scenarios will be sourced by the United Nations’ Intergovernmental Panel on Climate Change (IPCC) rather than on Canadian/domestic bodies or experts in the field. This is key.

In other words, representatives from an unelected bodies like the IPCC, or even Paris-based Network for Greening the Financial System (NGFS) will be the overlords who decide the metrics for assessing climate risks which member countries must follow.

How convenient.

And can you take a wild guess at who helped launch the Network for Greening the Financial System (NGFS)? Wait-for-it, Mark Carney! Surprise surprise surprise.

Excerpt from page 20 of CPP Investments’ 2024 Annual Report.

CPP Investments further indicates (image above) how they will incorporate climate-related considerations, including a variety of risks (such as ‘transition risks’ and ‘physical risks’).

What is particularly noteworthy in the passage above is the reference to [a] ‘transition risk’ of average [global] warming of 2°C.

Why is this noteworthy? Because it is a fallacy concocted by the IPCC and their muppets who have set a target of a maximum of 2°C of allowable “global warming” by the end of this century (the year 2100). There’s also the 1.5°C target for 2050.

While the reader may not see this as significant now, pay attention; for, later in Section 3 of this post, it will become evident that they are going to use this as an important benchmark for their climate-risk scenarios that will form part of the basis upon which they will carbon tax participants (and ultimately, you).

1.3 Climate [Digital] Wallets

It is also worth mentioning that there are many other carbon-taxing schemes taking shape – too many to list in this article – to not only coerce national governments into forking over billions to these globalist entities, but do the same for their citizens through technocratic theft devices such as “climate wallets.”

We already heard about this from the Davos “elites” two years ago.

Investigative journalist Whitney Webb has talked about these cons in several interviews. The following one gives a good general overview of their approaches – which often involve test piloting the programs in underdeveloped or developing countries or regions (like in Africa or Latin/South America), like they do with vaccines.

For a more detailed look at these kinds of schemes, there are two other videos that can be consulted for more findings of Webb’s investigations:

The Jimmy Dore Show – Wall Street Is Pulling HUGE Climate Scam On Latin America! (alternate link via Facebook)

TFTC - Debt Slavery and the Carbon Credit Coup | Whitney Webb and Mark Goodwin

Finally, Webb’s article Debt From Above: The Carbon Credit Coup is an excellent resource to consult (alternate link here) which focuses on the Green+ stratagem (which is basically about land appropriation through carbon credits), among many other foul deals.

2. Brothers in Arms: United Nations & Bank of Canada

“Everyone has to play their role when we’re thinking about climate change and how we’re going to adjust. And in terms of the Bank of Canada, we see our role as favouring a stable and well-functioning financial system. And that’s really the aspect that we kinda see a large part of how we can help. We’re trying to get, as [I] kinda mentioned in the speech, trying to help getting the information that’s needed for the financial system to be able to evaluate and kinda disclose risk. And we’re trying to help by leading by example of how ourselves are gonna try to disclose the risks that we see on our balance sheet and our situation.” - Deputy Governor Paul Beaudry back in November of 2021.

“Kinda disclose risk” eh, Deputy Governor Beaudry. Got it.

A quick visit to the Bank of Canada’s website provides ample insight as to how our central bank is aligned with the Climate Scam, at least for the past five years (chronologically):

In 2019, the Bank joined the Network of Central Banks and Supervisors for Greening the Financial System and began building climate-related risks into its Financial System Review.

May 2020 Staff Discussion Paper: Scenario Analysis and the Economic and Financial Risks from Climate Change (full PDF)

Financial System Hub, June 24, 2020: Bank of Canada contributes to new publications by the Network for Greening the Financial System

November 16, 2020 Press Release: Bank of Canada and OSFI launch pilot project on climate risk scenarios

November 3, 2021 Press Release: Bank of Canada announces climate change commitments for COP26

Annual Report 2021: Advancing the Bank’s climate change work

January 14, 2022 Technical Report (PDF): Assessing Climate-Related Financial Risk: Guide to Implementation of Methods

December 18, 2023 Discussion Paper/Document (PDF): Supporting the Transition to Net-Zero Emissions: The Evolving Role of Central Banks

December 20, 2023 Discussion Paper/Document (PDF): Understanding the Systemic Implications of Climate Transition Risk: Applying a Framework Using Canadian Financial System Data

The first bullet point above links to the website of an organisation called the Network of Central Banks and Supervisors for Greening the Financial System, or NGFS for short.

This is a very significant association; for, it shows the interconnectedness of the Bank of Canada with the usual suspects, namely the Bank for International Settlements (BIS) and the United Nations. From a July 2021 press release:

There is mention of the Climate Training Alliance (CTA) which also notably links a connection to the International Association of Insurance Supervisors.

This is notable since the entire Insurance industry is also being re-vamped to align with the Climate Cult’s ethereal fairy tales.

Accordingly, expect to see in the coming years insurers demanding their clients adhere to strict climate emissions targets and the like, lest they be refused insurance coverage.

This will apply not only to businesses who wish to obtain insurance (property, fire, liability, etc.), but also for individuals – to insure their homes and automobiles.

It’s all being prepared and developed without the general population even having the faintest clue of what dystopian requirements are coming down the pike.

The NGFS press release also shows us the mastermind behind it. Can you guess? Yep, Mark Carney again!

“Coordinated under Climate Finance Adviser Mark Carney’s COP26 agenda, the Bank for International Settlements (BIS), the International Association of Insurance Supervisors (IAIS), the Central Banks and Supervisors Network for Greening the Financial System (NGFS) and the UN-convened Sustainable Insurance Forum (SIF) will collaborate to enhance the availability of training resources for national financial authorities responding to climate risks.

…

Mark Carney, COP26 Private Finance Advisor and UN Special Envoy for Climate Action and Finance: "We need to share knowledge, refine and improve the approach to climate risk management. To this end, the BIS, NGFS, IAIS and Sustainable Insurance Forum's new Central Banks’ and Supervisors’ Climate Training Alliance (CTA) will help build capacity in central banks, improving the efficiency, effectiveness and accessibility of climate risk training and knowledge-sharing for these institutions. It will provide training across supervision of climate risks, climate scenario analysis, and how to reflect climate in collateral management, ensuring the financial sector has the knowledge and tools to effectively measure and manage climate risks by COP26 and beyond."”

Not finished.

Alongside his FSB-TCFD buddy Mike Bloomberg, Mark Carney is also the mastermind behind the Glasgow Financial Alliance for Net Zero (GFANZ) which was launched in April of 2021 in partnership with the United Nations Framework Convention on Climate Change (UNFCCC) to “coordinate efforts across all sectors of the financial system to accelerate the transition to a net-zero global economy.”

The UNFCCC framework is essentially an international treaty by the United Nations to keep its members focused and aligned on the climate scam.

Are you sick of him yet?

I swear. No matter which stone you turn over, you always seem to find this same nuclear-resistant indestructible cockroach flapping his restless overreaching tentacles.

“Externalities”

I could go on with many more examples of how the Bank of Canada (and Canadian commercial banks, for that matter) are acquiescing to these climate looting schemes, but let me end with an amusing propaganda video produced by our beloved central bank (with your tax dollars, of course).

In this video, the narrator describes “externalities” which are hidden costs that we face.

But the joke here is really on us.

Why?

Because the countless resources and hours that bank employees spend on fabricating climate-related doomsday scenarios, models, reporting systems, and the like all need to be paid for at the end of the day.

One can easily imagine how many millions of dollars of operating costs banks incur conducting these pointless/fruitless activities that bring nothing tangible of value to society.

And who do you think pays for these hidden costs? You the consumer, of course, with your hefty bank fees and other direct and indirect costs. Have you noticed how much monthly bank fees have increased in the past several years? This, with an exponentially decreasing amount of personalised service in exchange for funnelling us into those extremely frustrating and ill-conceived maniacal automated services.

Moreover, other hidden costs associated with the mismanagement of bank resources include increased stress and anxiety they cause to their customers who have no choice but to adhere to all these new costs and nonsensical requirements, as well as the time they waste for going the extra mile and conforming to it all.

So much time, energy, and effort is being deployed for these climate follies.

Can you imagine if those resources were put to better and more productive endeavours – say like coming up with more sound ways to help out struggling businesses and individuals that are barely able to make ends meat?

Multiply this opportunity cost across all the other sectors that have fallen victim to the Climate Cult. In aggregate, the costs are immeasurable – particularly those that will be borne by generations to come.

If these follies continue, what will Canada look like in 2030? In 2050?

3. The Enablers: Canada’s Big Banks + Office of the Superintendent of Financial Institutions (OSFI)

“When buying and selling are controlled by legislation, the first things to be bought and sold are legislators.” – P. J. O'Rourke, American author & journalist

Okay, now here’s where it might get a bit technical. But, make no mistake, this is perhaps the most important and revealing part, i.e. how they are planning to siphon your financial wealth whilst making home ownership in Canada extremely difficult, if not impossible.

“The takedown of our freedoms will not come by violent force. It will come by an unholy alliance between governments, global NGO’s, shadowy think tanks, insurance companies and, of course, the banking industry.

It will come in the form of regulations centered around carbon reduction and climate change. But what happens when science doesn’t back up their globalist agenda. In the case of OSFI (Office of the Superintendent of Financial Institutions), they just make up the science to suit.” - source

The OSFI (Office of the Superintendent of Financial Institutions) is a regulatory institution which, I surmise, is unknown to 99.9% of Canadians.

The OSFI is an independent agency of the Government of Canada reporting to the Minister of Finance whose mandate is to regulate and supervise more than 400 financial institutions and 1200 pension plans.

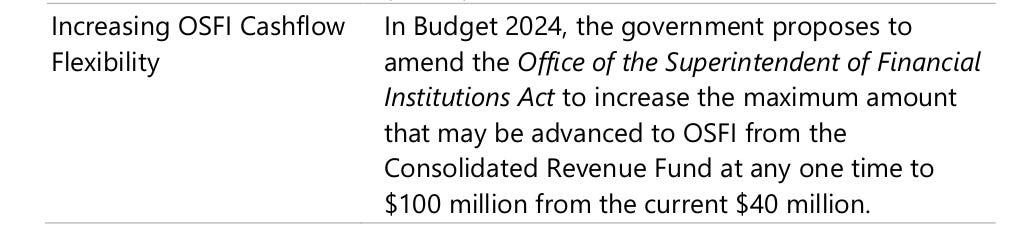

In its 2024 budget, the federal government proposes to significantly increase the amount of funds that can be advanced to the agency:

This is likely due to increases in workloads at the OSFI with regards to a significant increase in climate change related risk assessment, contingency planning, and regulation [with emphasis added]:

“It is evident to us that volatility will arise from several identifiable sources. While we may not know their trajectory, known or emerged risks such as climate change and digitalization, are already shaping how we work, how we manage risk, and how we regulate and supervise.” - OSFI 2022-2025 Strategic Plan

3.1 OSFI’s Standardized Climate Scenario Exercise

Part of mitigating climate change risks are detailed in a recent (April 11, 2024) Guidance document titled Standardized Climate Scenario Exercise – Draft for consultation (PDF here).

This document, abbreviated as SCSE, is extremely telling when one knows how to read it carefully – to read between the lines, so to speak.

So, in this section I will be getting the scalpel out to dissect its most telling parts exposing the malignant rot that has infected this regulatory agency host.

Right at the start in section 1. Introduction, in the second paragraph it states the following [with emphasis added]:

“Climate-related risks, including physical and transition risks, could have significant impacts on the safety and soundness of financial institutions, and the broader Canadian financial system. Building financial resilience against intensifying climate-related risks requires institutions to address vulnerabilities in their business model, their overall operations, and ultimately on their balance sheet.”

This establishes a deceptive tone regarding the entire premise of their guidance document. It’s a short paragraph, yet offers a lot to unpack:

Concerning “climate-related risks, physical and transition risks are important terms that will be covered a bit later.

They state that climate-related risks “could” have significant impacts. This is a key word. Could doesn’t mean causation or correlation; rather it is a speculatory word/statement. Moreover, nowhere in the guidance document is there evidence which demonstrates that climate change is real; the entire guidance document and rationale is based on an assumption.

“Financial resilience” is a United Nations / Agenda 2030 / WEF buzzword that is very often used as a justifier of many of their policy initiatives (e.g. resilient communities, resilient cities, etc.). It is a buzzword similar to sustainable and inclusive.

“intensifying climate-related risk,” – there is no evidence provided that climate [change] risks are intensifying. That’s, yet again, speculation on the part of the OSFI.

“requires institutions to address...” Here is an immediate indication that, as a regulator, they are going to require financial institutions and pension funds to play ball with their baseless schemes outlined in their guidance document (which I will address and debunk in the rest of this section).

“...their overall operations, and ultimately on their balance sheet.” Two things here. First, with regards to institutions’ or companies’ operations implies that they will be required to incorporate these climate risk models into their financial and accounting systems. Next, as these will arguably incur significant implementation costs, their balance sheets will indeed be affected (to the down side). They try to make it seem as though it is climate change risks that will cut in to their profits; but in fact, it will be all the extra expenditures incurred to implement these nonsensical risk scenarios and reporting requirements that will hinder their bottom line. Consider the lost productivity.

So, there you have in a nutshell.

The rest of this section will be mostly to show how they specifically intend to impose these follies on banks, insurance companies, pension funds, other financial institutions and, eventually, nearly all businesses across Canada, large or small.

3.2 The Devil is in the Details

Let’s dive in the meat and potatoes of this SCSE Guidance document by the OSFI.

In section 1. Introduction, you can see that the United Nations Environment Program Finance Initiative has helped to draft the SCSE.

One can easily wonder whether this supranational UN outfit was chiefly responsible for its contents.

It’s not entirely clear why the Bank of England was involved in the draft as well as the Office of the Comptroller of the Currency based in the United States, for their is no additional mention of it in the report.

In section 2. Standardized Climate Scenario Exercise overview, they attempt to provide a broad framework for climate-related risk [with emphasis added]:

“OSFI’s approach to developing the SCSE recognizes that climate scenario analysis is in its nascency...Risk sizing is a complex and difficult undertaking given the uncertainty associated with climate scenario analysis. The underlying modelling that links climate risks to financial risks is relatively untested, and the second order impacts of climate change are highly complex. Therefore, instead of sizing the risks, the SCSE will focus on risk discrimination and exposure assessments. While absolute risks can be hard to measure, OSFI believes that risk discrimination, i.e., identifying relative risks between counterparties, industries, and even FRFIs is achievable, even utilizing relatively less sophisticated approaches and modeling [(sic)] methodologies.”

For a first observation, they are recognising that risk “sizing” is, understandably, a challenge.

The important part, though, relates to modelling, as this is basically the entire premise behind the SCSE and the benchmark system through which parties will have to adhere to.

The reader may recall that it was the modelling folly (of he the contended possible spread of the SARS-CoV-2 virus) that lead to harsh lockdowns during the Covid-19 Scamdemic where we needed 2 weeks, cough cough, to “flatten the curve.” Remember?

The OSFI’s model system seeks to link climate risks with financial risks in order to assign quantifiable values to these risks – which will eventually serve as a means of ranking (debasing), and taxing institutions.

It should be obvious to anyone that climate risks would vary tremendously among different sectors and institutions. For instance, a logging company that sources its raw materials from large forests would entail forest/wildfire risks and hence could suffer huge financial losses. Whereas a consulting business would be less exposed or affected by climate change and thus assume less risk.

So, what they are trying to do here is devise a system whereby they can “package up” climate risks that can be pinned on entire sectors or industries with different classifications/levels.

Having specific climate scenario modelling systems for each and every institution or company would simply not be feasible. That is why broad-based models/scenarios are ideal for their looting scheme.

In section 2.1 Objectives, the OSFI lists three key objectives. The first focuses on quantifying the risks.

The second is to have federally regulated financial institutions (FRFIs) quantify climate risks through scenario exercises and in their financials. It also seeks to include or quantify risks depending on the geographic location of the institution. So, for example, regions that are more prone to wildfires would entail higher risk ratios.

In addition, they include real estate considerations/risks such as to which particular energy and heating sources are used at an institution. So, if an institution is using a heat source that is considered more polluting such as with an oil-based heating furnace, then its risk score would be higher. If the institution uses a fleet of gasoline- or diesel-fuelled trucks or cars instead of electric vehicles, their risk scores would be higher.

Despite these obvious differences across sectors, industries, and institutions, the third objective, nonsensically, seeks to “establish a standardized quantitative assessment of climate related risks.”

In section 3. Climate transition risk for commercial exposures, they talk about [climate] risk drivers and risk parameters. They say that “climate transition risk drivers” stem from three sources:

Policy changes to adapt the economy to a low-carbon setup (e.g., stringent carbon-pricing policies to limit emissions, stricter energy efficiency standards);

Technological changes (e.g., the introduction of more competitive low-carbon technologies);

Changes in consumer preferences (e.g., environmentally concerned consumers tilting their decisions towards sustainable products)

The first one is key because we know that the current Canadian Liberal government is unswervingly focused on a very aggressive stance towards net zero and the use of greener energies.

The consequence of this will be on institutions’ ability to adapt to these changes. If they don’t, their risk scores will be higher and they will be considered more problematic and less likely able to secure loans in the future to sustain or expand their operations.

Here is an illustrative example from section 4 of the SCSE document itself:

“As carbon tax policies lead to an increase in energy prices, borrowers may be under higher levels of stress due to the higher costs of maintaining and operating these properties. This additional stress may impact borrower PDs.”

So, in the case above – we can assume that the institution is a commercial bank who issues real estate loans. As “carbon tax policies” may change, i.e., the government may decide to carbon tax businesses that don’t use more environmentally-friendly heating sources, the risk the bank assumes becomes greater. This is so because if the business now has to pay more for heating expenses, its ability to pay back the loan becomes negatively affected which would entail an increase in default risk for the bank.

The same can be said for individuals and family homes, should banks eventually decide to associate these same kinds of risks on their residential loans. For instance, if homeowners are reluctant to substitute their oil furnaces or wood stoves for heat pumps, they could be considered more risky as borrowers.

Consequently, the banks would have increased lending risks and would thus require higher premiums from borrowers. It’s basic math.

Needless to say, this would make home affordability even more challenging for individuals/families.

Also in section 4, they say that “exposures to properties that are powered or heated by carbon-intensive sources such as fossil fuels or natural gas may be impacted by the transition to net-zero.”

This is a ridiculous statement. Natural gas is one of the cleanest and most energy-efficient heating sources. Once again, they provide zero proof that natural gas is a pollutant and damaging to the environment. More hogwash by a regulator who, demonstratably, knows nothing about science.

In section 3 they talk about ‘transition scenarios’ and ‘scenario data sources’. This is also key to their entire scheme (scam).

The former refers to the broader net zero transition which they categorise in three distinct narratives, or policy actions:

Below 2℃ immediate - an immediate policy action toward limiting average global warming to below 2℃ by 2100.

Below 2℃ delayed - a delayed policy action toward limiting average global warming to below 2℃ by 2100.

Net-zero 2050 (1.5℃) - a more ambitious immediate policy action scenario to limit average global warming to 1.5℃ by 2100 that includes current net-zero commitments by some countries.

These are what I meant earlier in this post when I talked about 1.5℃ and 2℃.

They are long term targets with the latter, 1.5℃ - commonly referred to as net zero being the most ambitious one.

In a nutshell, they are scenarios that will be used to determine credit risk and market risks which are defined in sections 3.4 and 3.5 of the document, respectively.

In section 3.2.2 they also mention that other metrics such as carbon price and Gross Domestic Product (GDP) come into play.

In the same section, apart from their own SCSE scenarios / models / data sources, they also include those of the Bank of Canada and Mark Carney’s (aforementioned) Network of Central Banks and Supervisors for Greening the Financial System (NGFS).

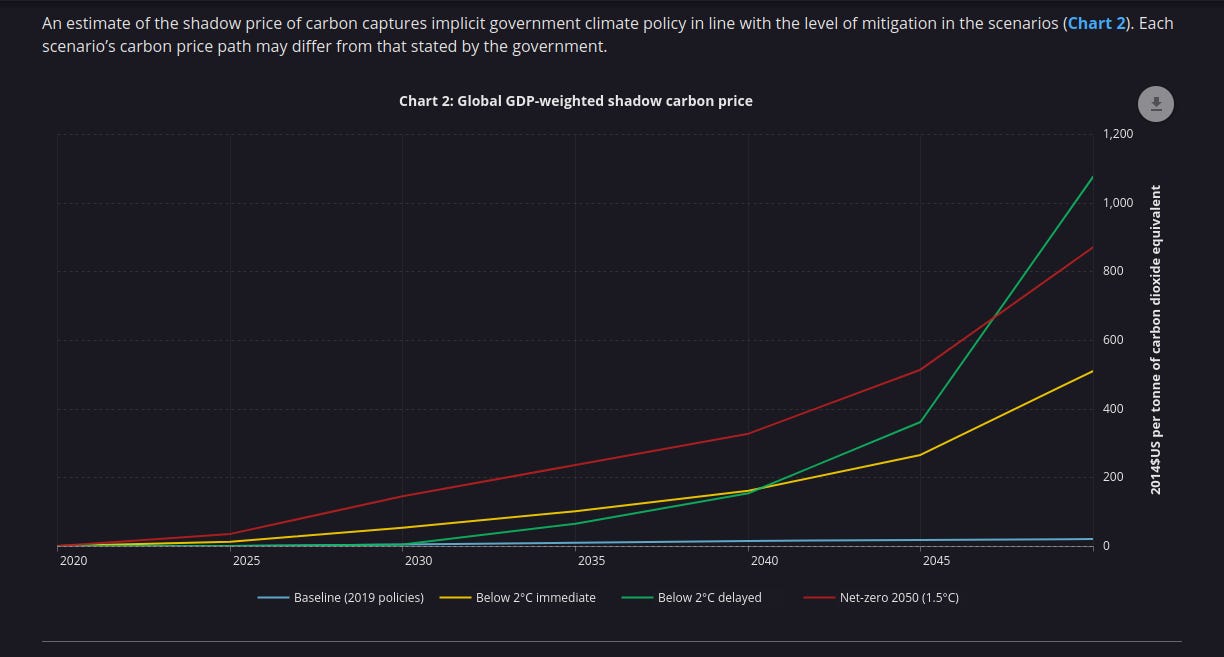

The Guidance document links to the scenario data developed by the Bank of Canada from which we can see the following chart:

As can be seen from the chart above, Global GDP-weighted carbon prices start to rise around 2025 and elevate, rising sharply from the decade starting in 2040.

The January 1, 2025 price for the Net zero 2050 (1.5℃) carbon is at US2014$36.77 which would balloon to over US2014$872 by the year 2050 which represents a 23x increase in the price of carbon.

Assuming they would use this benchmark for carbon pricing, one can easily see how carbon taxes would increase exponentially over time, absolutely strangling institutions and individuals should these metrics be used.

Call it speculation on my part, but I believe their plan is to implement such benchmarks in their standardised climate scenario model(s) whereby member countries will have little say in the matter.

The Bank of Canada model data is based on the Emissions Policy Prediction and Analysis model from the Massachusetts Institute of Technology (MIT-EPPA) while NGFS’ is based on other international models.

Section 3.3 puts industry sector classification as a critical aspect the SCSE uses to measure impacts of climate transition scenarios on financial risks. In other words, different sectors of the economy would score differently on their climate impacts and risks.

This way, they can more easily create measures which are based on Greenhouse gas (GHG) emission data, as they tend to be fairly consistent depending on the sector (with some higher such as in the oil & gas sector, versus a lower one, say in the educational sector for instance).

In my October 2022 post, I explained how the other regulator – the Task Force on Climate-related Financial Disclosures (TCFD) had as its mission to:

“develop voluntary, consistent climate-related financial risk disclosures for use by companies in providing information to investors, lenders, insurers, and other stakeholders.”

And though they state that these emissions risks disclosures (by institutions/companies) would be initially voluntary, they are to become mandatory by 2024, as indicated in the 2022 TCFD Status Report: Task Force on Climate-related Financial Disclosures.

Moreover, in the report it is mentioned that governments around the world align their economies to net zero through what is called Nationally Determined Contributions (NDCs).

“Under the Paris Agreement, countries are required to submit national greenhouse gas emission reduction targets, called Nationally Determined Contributions (NDCs), every five years. Each successive NDC is required to be more ambitious than the previous one.”

And Canada’s target for 2030 is stated as follows:

“Canada’s target up until today was to reduce greenhouse gas emissions by 30% below 2005 levels by 2030...Prime Minister Trudeau announced a target of 40-45% reductions below 2005 levels by 2030.”

Canada’s commitment to these levels were cemented by Prime Minister Justin Trudeau at the United Nations Climate Change Conference UK 2021.

Canadian Prime Minister Justin Trudeau speaking at the United Nations Climate Change Conference UK 2021 [43:33 to 48:53 mark]. AUTHOR NOTE (2023-07-11): The UNCC have removed this video (it might still be hidden somewhere here); however, the Trudeau’s segment can still be seen on YouTube via the following link.

In his speech, apart from affirming that [pollution] emissions will be priced, Trudeau mentioned the following regarding carbon pricing:

“We know, pollution pricing is key to getting emissions down while getting innovation up and running. Our carbon price trajectory is one of the most globally ambitious ones. And it’s rising to $170 a ton in 2030. This is a meaningful price on pollution designed not just to make life cleaner, but also make life more affordable and less expensive for Canadians.”

Firstly, there is zero evidence that carbon pricing itself leads to a reduction in pollution.

And, I’m not exactly sure how increases in the price of carbon is going to “make life more affordable and less expensive for Canadians,” but what else can you expect from a pathological liar like Trudeau?

Flooding & Wildfires

Flooding

The last section of the OSFI’s Standardized Climate Scenario Exercise (SCSE) document I’d like to focus on is 5.5 Hazards.

This section is concerned with two ‘physical risk exposures’, or hazards, in Canada which are: flooding and wildfires.

For the former, they will use data from a firm called riskthinking.AI which is financially backed by Bloomberg (yes, the same Bloomberg mentioned before, namely Michael Bloomberg – Mark Carney’s climate buddy). Always the usual suspects, of course.

In the greater Climate Change Hoax, floods have often been used as a scare tactic – particularly stemming from the unproven notion that the polar ice caps are melting at unprecedented rates. Sorry Al Gore, this turned out to be false, a big fat lie.

But floods can still be used for the current ongoing Climate Scam. And that is what they appear to be doing.

Though floods have long been a part of the Canadian landscape – especially in early Spring when accumulated snow and ice from the previous winter start melting – the government is nonetheless trying to sound the alarm about them.

Moreover, there appears to be no substantial indication that flooding in Canada poses a major climate risk or threat. Flood mapping data, past and current, can be obtained here and here for those who are inclined to dig into the complex data sets.

Perhaps again speculation on my part, but it really appears to be a steaming heap of foul-smelling bullshit.

Apart from a dubious and highly questionable Bank of Canada/OSFI flood project paper, the OSFI’s SCSE document lists the following eleven regions as having exposure to flood risks:

Vancouver, British Columbia

Calgary, Alberta

Edmonton, Alberta

Winnipeg, Manitoba

Kitchener-Waterloo-Cambridge, Ontario

Ottawa-Gatineau, Ontario/Québec

Montréal, Québec

Québec City, Québec

Sherbrooke, Québec

Saguenay, Québec

Fredericton, New Brunswick

I can only speak for the Sherbrooke region in Quebec where I have lived for most of my life. Floods are actually quite uncommon. Historically, they have occurred very sporadically, with rare major floods occurring during early Spring following a Winter with a lot of snowfall at a frequency of roughly one per decade.

Both the OSFI’s SCSE and the Bank of Canada are basing their analyses on presumptions rather than factual, on-the-ground, data.

“We assess the potential financial risks of current and projected flooding caused by extreme weather events in Canada,” the Bank of Canada paper commences.

Yes, unfavourable flood projections can be derived from a panoply of models; and, “extreme weather events” can happen. But, these are once again speculation.

Yet, that doesn’t prevent them from assigning risk metrics to it.

The Bank of Canada paper seeks to tie these so-called flooding risks to residential real estate portfolios of Canadian financial institutions [with emphasis added]:

“We focus on the residential real estate secured lending (RESL) portfolios of Canadian financial institutions (FIs) because RESL portfolios are an important component of FIs’ balance sheets and because the assets used to secure such loans are immobile and susceptible to climate-related extreme weather events. We build a loan-level dataset from the residential RESL portfolios of some federally and provincially regulated FIs. We use current and projected flood events under different climate scenarios to apply shocks to these portfolios. We then control for private flood insurance using data from a variety of property and casualty insurers based in Canada.”

Apart from how they will use projected “flood events” under “different climate scenarios” to assess risk, we can clearly see from the above passage that they intend to assign flood risks to both lenders (banks) and insurers (insurance companies).

What this means is that if you are a homeowner (with a mortgage) who lives in a zone that is designated a flood risk (according to their model), you will be considered a greater risk to the lender and may have to pay an additional premium (to compensate for the additional risk the bank assumes).

Moreover, if your home is in a geographical area that is designated a flood risk, then it may be difficult, if not impossible, for you to get insurance – in which case no bank will be willing to offer you a mortgage loan.

Are we starting to see how this scheme will work?

Wildfires

It should also be prefaced that the Canadian government has been deceptive in the way it has attributed wildfires in the 2023 season, as I have reported in a previous article (in particular, consult the section What may have caused these large fires?).

High instances or arson, for example, have been conveniently left aside since they did not fit the climate change narrative.

As with flooding, the SCSE guidance document focuses on presumptive scenario modelling.

We know that alleged temperature increases are central to the climate change narrative and orthodoxy.

So, temperature is conveniently tied to the unfounded notion that higher temps results in higher instances of drought and wildfires (correlation is not causation); other factors such as poor forest management, incidents of arson, limited firefighting units, and lightning tend to get ignored in cases of wildfires.

As alleged increases in temperatures would supposedly entail increased wildfire risk, the OSFI has teamed up with Environment and Climate Change Canada (ECCC) to develop and publish fire weather index projections as early as this year (see section 5.5.2 Wildfire).

These projections will “use weather outputs from global climate models to estimate the extent to which the weather aspect of wildfire danger will be affected by changing climate conditions.”

Again, they state that global climate models will be used. What do these have to do with conditions in Canada?

These projections are published on ClimateData.ca which, by their own words, include speculatory language and uncertain sources.

Honestly, their projections appear to be mere fantasy or fairy tales. Take your pick.

To demonstrate, I obtained projected data for my own city of Sherbrooke on their website which stated the following [with emphasis added]:

“For the 1971-2000 period, the annual average temperature was 5.3 ºC. Under a high emissions scenario, annual average temperatures are projected to be 8.0 ºC for the 2021-2050 period, 10.0 ºC for the 2051-2080 period and 11.8 ºC for the last 30 years of this century.”

Even to the uninitiated, predicting temperature changes for a specific location nearly eight decades into the future is absolute nonsense, given the complexities of temperature dynamics.

But hey, let’s see what it looks like anyhow:

As can be seen from the projection chart above, all of the three scenarios lead to a dramatic increase in temperature.

There are no projections for possible decreases in temps. Why not?

Is it not possible for volcano eruptions to occur over the course of the rest of this century which could have a cooling effect like that of the 1991 Mount Pinatubo eruption in the Philippines which actually decreased world temps?

From the chart above, the highest projection (red line) ending in the year 2100 (at the end of this century), puts the median temperature at a boiling 38.1℃ and the range between 36.3℃ and 42.3℃. Even the lower temperate estimate sits at 34.4℃.

Compared to current averages taken from the past few decades and considering their tremendous gap with the stated projections, these temperatures and ranges do not seem at all plausible for Sherbrooke, Quebec.

This fuzzy math doesn’t add up at all. Even if you take historical data for almost any city in the world, finding such huge temperature gaps over a seven decade period is a fools errand at best. I dare any climatologist to produce a single example of such kind of occurrence (note that the Comments section of this post is open to all).

If you were to try Yellowknife in the Northwest Territories, you would still obtain a lower-end medium temp estimate of 30.0℃ and an upper-bound range of 37.2℃.

Perhaps your grandchildren and great-grandchildren will enjoy the warmer temps and won’t need to take those expensive trips down south to escape winter.

Can these modelled estimates be any more ridiculous?

Can they really take us for such gullible imbeciles?

Go ahead and try it for your own city/location.

To sum up this section of my article, it certainly appears that the OSFI’s Standardized Climate Scenario Exercise SCSE Guidance document is nothing more than a ploy which establishes a framework that will be used to levy unjustified and overbearing carbon taxes on Canadian businesses and individuals, effectively destroying home ownership as well as impeding Canadians from starting their own business and crushing existing business owners.

If you think otherwise, I would love to hear your take on it by leaving your thoughts in the Comments section below.

4. Bye Bye Home Ownership in Canada

In Section 3 of this post above, the reader has seen what the Canadian branch of the Climate Change Cartel (see section 6 below) has been scheming for their long term plans.

The current Liberal Government with its reckless fiscal irresponsibility, burgeoning budget deficits, ballooning debt, and rampant inflation has already caused tremendous financial (and psychological/emotional) stress and hardships on Canadians.

“In this year’s federal budget, the government has again demonstrated its proclivity to increase taxes, spending and borrowing. In 2024/25 alone, federal program spending will reach a projected $483.6 billion—an increase of $16.1 billion compared to the previous budget’s estimates. The Trudeau government is now on track to record the eight highest years of per-person inflation-adjusted spending in Canadian history by the end of 2025/26. Part of this increase in spending will be funded by borrowing, with a deficit of $39.8 billion this year and deficits exceeding $20 billion for the subsequent four years. There’s no plan to return to balanced budgets and debt interest costs are now equivalent to the annual GST revenue collected.” - The Fraser Institute Blog – Irresponsible fiscal management—the main theme of government budgets in 2024, April 27, 2024

As for housing, these ill-conceived, nonsensical, reckless, and detrimental policies is setting the stage for an even more over-inflated real estate market.

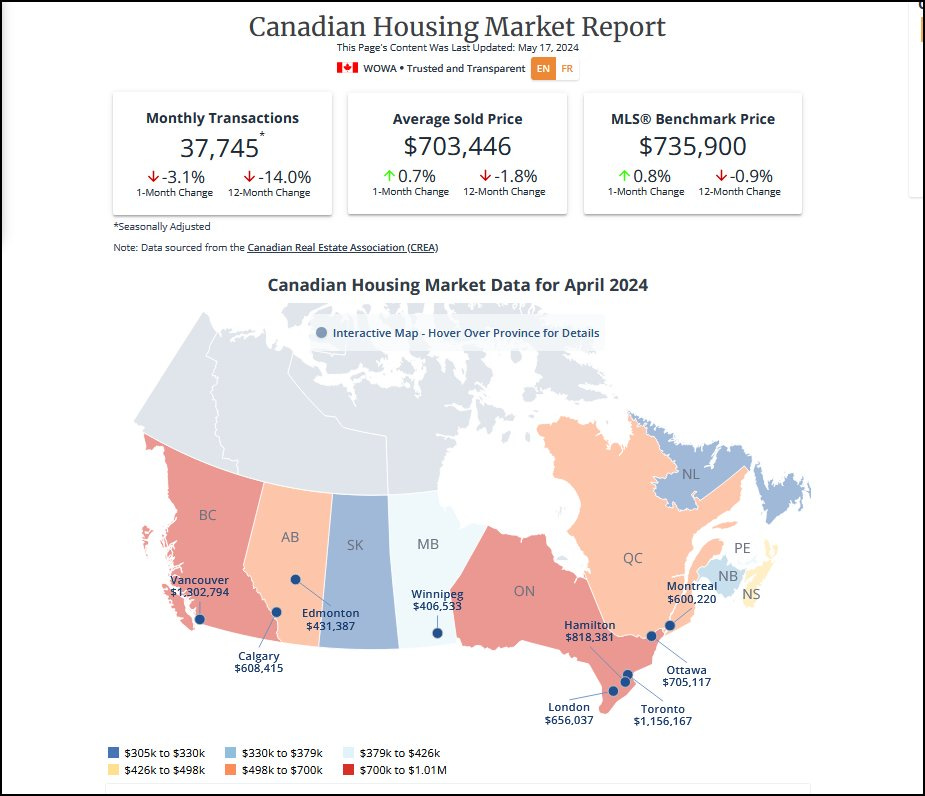

Home foreclosures are on the rise, and home affordability has significantly plummeted in recent years with the latest average price for a home in Canada at over $700,000.

WOWA.ca – Canadian Housing Market Report Data for April 2024.

In fact, average house prices have gone from an average of about $500,000 to almost $800,000 between January of 2020 until January of 2022, according to Fortune Magazine:

To make matters worse, the Liberal Government’s outrageous carbon taxes have further strangled every stratum in society.

In the summer of 2023, I interviewed Canadian energy expert Allan MacRae and asked him whether any of the carbon taxes collected went to environmental programs. He assured me that they did not, but rather simply went into the government’s coffers.

What is perhaps even more frustrating are the incessant lies and omissions we get from these “elected” officials commanding these highly-destructive policies.

Take Chrystia Freeland for instance.

You know the one who unethically and illegally sits on the Board of Trustees of the World Economic Forum and, as Minister of Finance, sends billions of our taxpayer dollars to her beloved Ukraine.

No conflicts of interest whatsoever here folks.

No investigations by our “law enforcement” agencies either.

Oh, and yes this is the same Chrystia Freeland who laughed when she and the Trudeau Cabinet she sits on abused their authority by freezing bank accounts of honest Canadians who had contributed to the Freedom Convoy.

Not only has she lied, cheated, and stolen, but the Minister of Finance stubbornly refuses to answer questions about how much has been collected in carbon taxes so far (click the following image for video, alternate link here):

Are you pissed off [again] yet?

Unless Canadians start to rise up, this entire carbon swindle is about to get much much worse.

They are only getting started.

Who knows what our beloved Mark Carney was scheming this past weekend at the highly secretive Bilderberg Meeting (of which he was also a participant in 2023, 2022, 2021, 2019, 2018, 2012, and 2011) Note that Chrystia Freeland was an attendee in 2023 and 2022.

Climate was on the agenda; so, for sure they are already preparing the next phases of the Climate Scam.

5. What You Can Do About This Shit Now

5.1 Get Educated

The first thing is to recognise that the entire climate change narrative is indeed a monumental hoax and swindle.

Next on the list should entail either informing or challenging family and friends about this con and how it affects them and their livelihoods – especially financially.

You should also consider that the climate change narrative is but one of three pillars the globalists have in their New World Order style enslavement system, with the other two being a Digital ID and a Central Bank Digital Currency (CBDC) or equivalent digital currency (no more cash).

You see, “climate action” will act as the principal driver of behaviour; it will dictate many aspects of your life:

Where you can travel to.

How your [digital] money can be used.

What you can buy.

What you can’t buy.

What you can eat.

What benefits you can receive.

What energy sources you can use to heat your home, drive your car, etc.

How many children you can have.

The depraved globalists who really run this world (Mark Carney merely being but one of their many disposable enablers) are incessantly obsessed not only with their greed – by trying to siphon every single penny they can from you, but also to satisfy their insatiable lust for ever increasing amounts of power and control over every single aspect of your life.

If you are over 30 or 40 years old, just look at how life has changed over the past couple of decades. More taxes, more regulations, more corruption, more inflation, more constraints, more worries, etc.

But the good news is that life if what you make of it and how you respond to such kinds of oppression.

Humans have a funny way of adapting and resisting such kinds if tyranny. Just study history and you will see countless iterations of this cat and mouse game.

5.2 Get Active

Though this article may come across as a bleak foreboding, it is really meant to serve as a wake-up call.

A wake-up call to get your house in order (pardon the pun).

Be proactive rather than reactive.

By this, I mean to do everything you can now before the dangerous changes heeded in this work really start to manifest and ramp up.

The good news is that their devious schemes take years to come to fruition.

Though I personally doubt that this particularly scheme outlined in Part 3 of this post will be successful, I still believe that they are nevertheless going to attempt to roll it out over the next few/several years.

One thing is for sure: if nobody does anything to push pack (like with geoengineering), then it will undoubtedly continue. Ignorance and impassiveness leads to submission and, ultimately, slavery.

The trick is to not play their game.

While I could talk about what you can do in order to avoid falling victim to a Digital ID or CBDC, I’d rather focus on the main premise of this article. That is to say, how you must not give up on your dream of being a home owner. And if you are already a home owner, on not losing what you’ve worked so hard to obtain.

Purchasing a home – or even maintaining one for that matter – inevitably requires a lot of cash/income.

Younger generations in Canada may feel overwhelmingly discouraged or desperate when looking at the current housing market. Rents can be sky high across the country, and mortgages equally so.

While everybody’s personal situation is different, here are some things you can consider regardless of your age and level of income:

Re-consider your lifestyle

Are you living beyond your means? What can you do to re-adjust to a simpler, more affordable routine? It’s your spending habits that make you rich, not your salary. How can you save more, spend less? What possessions do you no longer need and could sell for cash? How can you and your partner or family members generate additional streams of income? Do you have a budget and regularly save?

Try to pay off your mortgage quicker

I know this could be really difficult. But the faster you can pay off your mortgage, the less interest you need pay, and the less chances the bank has to repossess your home. This can happen for a number of reasons such as late payments, increases in interest rates (should you have a variable rate mortgage) that significantly hinder your ability to make your monthly payments, loss of employment, sickness, not being able to obtain adequate insurance coverage (as was described earlier in this post), etc.

Have you considered re-negotiating your mortgage with another bank or credit union that can offer you a better interest rate? This option is easier than you think and can save you thousands of dollars per year.

If your household has two cars, do you really need them both? Or, can you manage without one of them? Repairs are now getting increasingly expensive. If you have car loans from the bank, this can save you money that can be used to pay your house mortgage quicker.

Ask yourself: Is my money really safe in the bank?

What is money?

How would your bank react if you went there today and asked to withdraw just a few thousand dollars of your savings?

Would you consider converting some of your cash to physical gold and silver (monies that have maintained their purchasing power for millennia)? What about Bitcoin?

Have you considered the steady decline in the value of the debasing fiat Canadian dollar and how this erodes your purchasing power?

How can you at least maintain the value of your wealth?

Plan for emergencies

In case of an emergency (1 week, 1 month, 3 months, or longer) would you have enough cash to cover your basic needs (food, water, necessities) and pay your bills?

Consider leaving Canada

While this may seem scary or unfeasible to many, it is much easier than you think. Yours truly did this in 2008, living abroad for 13 years in a country where the cost of living was much cheaper. I had transferred savings out of Canada to buy a house there and never regretted it.

Housing costs vary from country to country, but can be much lower than in Canada, especially in places like Latin/South America, Eastern Europe, and Southeast Asia.

For existing homeowners, read about how a couple from Fergus, Ontario sold their house and got a French château for the same price.

See also videos from another Canadian couple (Jill & Randy) originally from Victoria, B.C. from their YouTube channel Travel & Explore Now:

Rules on home ownership also vary from country to country. In most places, you can buy as a foreigner or at least be able to rent a decent place that can easily be much cheaper than in Canada.

Shop around and be sure to consider the cost of living for destinations abroad as well as other local considerations, including language.

Have a family with kids? It is still very much doable depending on your profession.

If you are a digital nomad, i.e., work mostly from your computer / online, then why limit yourself? (see all the countries offering digital nomad visas)

Some countries have no property taxes (such as Thailand) which can save you a lot of money in the long term.

Consider Property Taxes

Home affordability also has to do with how much property tax you are required to pay on your home (either quarterly or yearly). Such taxes have gone up tremendously in the past years due to skyrocketing housing prices.

Try to forecast what you would need to pay in the coming years in property taxes. Calculate how much you would need to pay in property taxes if you keep your house for 20, 30 years or longer; you may be surprised at how much you are forking over to your municipal government. Ask yourself: what do I get in return for these taxes?

Consider a Mobile Home / RV

More and more Canadians are buying Recreational Vehicles (RVs) or Mobile Homes. They can be much cheaper alternative to traditional houses.

Some work remotely from them too.

While rules about where RV owners can park or station their vehicles (and for how long) can vary across provinces and locations, they nonetheless can serve as a more affordable alternative to a traditional house.

If you lose your job and need to relocate to another area, an RV / Mobile Home can be advantageous.

You can also save on travel & lodging expenses if you enjoy travelling across Canada.

Those are but some tips. Feel free to share more, or things you have personally done, in the Comments section below.

6. ‘Climate Change Cartel’ Mind Map

Great crimes, schemes, and swindles require great obfuscation in order to be successful.

The globalists oligarchs are extremely gifted at concealing their evil, criminal enterprises and undertakings.

They will devise all sorts of schemes with dishonourable intentions which they will cloak as benevolent, life-saving programs that will benefit humanity.

The United Nations and World Economic Forum are masters at this.

From its very inception, the United Nations – spearheaded by the likes of billionaire oligarch John D. Rockefeller Jr. – has been involved in countless endeavours such as Agenda 2030 with its Sustainable Development Goals (SDGs) and eugenics (also a Rockefeller affair), but to name but a few.

They are able to accomplish these enterprises through complex webs of interrelated entities that function together to arrive at their goals.

These can be multi-decade goals, or even multi-century goals.

What is key, again, is to obfuscate or disguise the entities and actions involved.

Only when we take a holistic view and map out the interconnectedness between these entities do we start to visualise (and realise) how their entire scheme functions and operates.

For the Great Climate Con, the following entities represent the major players who are responsible for it (click image for larger version):

The diagram above provides a simplified overview of the scheme. There are many other organisations that are involved in this scheme. But I wanted to keep it simple enough so as to make it somewhat understandable.

Though it is slightly adapted for a Canadian perspective (with the Bank of Canada, TFCD, and OSFI), the diagram can easily be updated for any country that is participating in the Great Climate Con. All one would need to do is substitute Bank of Canada with their own central bank, and TFCD/OSFI with their own regulators.

The diagram also includes a section (mid-right) about geoengineering since a large part of real climate change has been caused by multi-decade intentional operations of spraying different levels of our atmosphere with harmful chemicals and metals; I have extensively documented this in my four part investigative series on the subject (which runs at over 300 pages), particularly in Part 4.

Geoengineering has caused a tremendous amount of environmental and health-related damage to nearly every country of our planet.

And members of the Climate Change Cartel have been using it, with great effectiveness, as a means by to justify the imposition of harsh regulatory measures related to climate change as well as the carbon graft (through Carbon Markets – many which are omitted from the diagram) which funnels trillions of dollars towards their way.

Two key questions remain to be answered:

How much longer can they hide it?

How much longer will citizens of the world put up with it?

Time will tell.

Share far and wide.

In Peace & Liberty,

7. Addenda

7.1 Environment and Climate Change Canada (ECCC) already jockeying the FLOODING card

When writing this article I knew that both wildfires and flooding were imporant cards in their Climate hand.

That is why I had created a specific sub-section for this in anticipation of more [baseless] rhetoric that we would be seeing coming out of the Climate Change Cartel in the coming months and years.

I must be psychic or something. Maybe it’s my third eye. Who knows?

Well, it took less than a week for two key cartel members in Canada to start sounding the alarm bells about this very, non existent, “threat.”

Just yesterday (June 6) Minister of Environment and Climate Change, Steven Guilbeault made a post on X, formerly known as Twitter, introducing and positioning the flooding boogeyman threat in the minds of Canadians:

Eco-terrorist Guilbeault is an avid eco-nut who is constantly spewing climate alarmism on a nearly daily basis. Last summer it was with wildfires.

Steven Guilbeault (right, in the orange Greenpeace jumpsuit) smiling while being arrested back in 2021 when he was an activist for Greenpeace. Photo source: Aaron Harris/The Canadian Press via CBC News.

And this summer, it will likely be flooding, as these Climate Clowns will continue to position there lies in order to justify the egregious measures that have been layed out in detail in this post.

The June 6 Guilbeault post provides a non-descriptive map showing border areas along Canada coasts. There is absolutely no information on this meaningless map regarding actual flood threats such as particular areas where water levels are deemed higher than normal. Therefore, the only purpose of this post is to try to convey that there is some kind of flooding issue, when in reality there isn’t.

This is how these psychopaths operate. And Guilbeault is extremely gifted at this kind of psychological manipulation (which some would call torture) through his verbal diarrhea and incessant gaslighting on social media.

Guilbeault’s post also links to a news release from ECCC ttled Canada expands and improves warning system for coastal flooding.

After reviewing the contents of the news release, I have found no indication whatsoever that there is any kind of new flooding problem.

The “news” release appears to be nothing more than propaganda along with a few power grabs which are described below.

The release commences with a speculatory tone (same kind of speculation as was previously shown in this post): [with emphasis added]

Increased impacts of coastal flooding are expected in the future due to global sea-level rise in combination with the increased intensity of extreme weather associated with climate change.

“The Government of Canada is working to confront the devastating impacts of climate change, including the increasing frequency and severity of flooding,” stated Harjit S. Sajjan, President of the King’s Privy Council for Canada, Minister of Emergency Preparedness, and Minister responsible for the Pacific Economic Development Agency of Canada in the release.

The release provides no evidence at all that “global sea-levels” are rising, nor do they for “extreme weather” that is caused by climate change. None. Zippo. Zilch.

I have made a media request to Kaitlin Power, the Senior Press Secretary and Communications Advisor from ECCC who is listed on the release, for comment on related evidence of these allegations of increased flooding and extreme weather events along with other questions. Should a reply be forthcoming, it will be appended to this addendum.

The release states that since May of this year ECCC has implemented a comprehensive coastal flooding prediction and alerting program to “issue coastal flooding forecasts and alerts using both the probability and expected impact of an event.”

Previously ECCC monitored and issued coastal flooding alerts for regions along Canada’s Atlantic coast, but now it has expanded its scope to include alerts for Canada’s Pacific and Arctic coasts, the St. Lawrence, and the Great Lakes.

This shows us that they want to centralise control at the federal level to be able to impose their will on regions across various provinces.

The release also states that ECCC will now use the term “coastal flooding” instead of “storm surge” which makes sense since they want to now shift the focus on flooding.

So, there’s little doubt that the regulatory institutions (such as the OSFI mentioned in this post) are going to be using these flooding “forecasts” by ECCC when determining ‘physical risk exposures’ which were described earlier in this post.

This will be done to indirectly increase taxes on businesses based on non-existent threats and mere predictions and possibilities.

7.2 Bill S-243 - A Senate bill introduced to align all of Canada’s major financial institutions with the Climate Looting Scam

Senator Rosa Galvez (or, more likely her handlers) introduced Senate Bill 243, An Act to enact the Climate-Aligned Finance Act and to make related amendments to other Acts (Short title: Enacting Climate Commitments Act) which appears seek to enact legislation to force various Canadian financial institutions to play ball with the climate reporting, or the broader Climate Scam, if you will.

The entire bill stinks to high heaven.

If it passes, it will essentially strong-arm Canadian financial institutions to play ball with the Climate Cult, lest they be cancelled and completely shut of of operating in Canada - no loans, no exports, no nothing!

So, let us have an initial look at what’s in this bill and how they are going to do just that (should the bill pass the Senate, then the House of Commons, and receive Royal Ascent).

First though, the entire premise of the bill is base the on the climate change lie and deception. The first “whereas”in its text confirms it:

Whereas there is a broad scientific consensus and high confidence that anthropogenic greenhouse gas emissions cause global climate change and present an unprecedented risk to the environment — including its biological diversity — to human health and safety, to economic prosperity and to the stability of the Canadian financial system;

There is no “broad scientific consensus” that “greenhouse gas emissions cause global climate change.” There perhaps exists consensus among those scientists who are associated with the IPCC, but not with a broad base of scientists across the globe.

Nor does there exist any studies that confirm some kind of threat to the “stability of the Canadian financial system.”

These are complete fabrications.

So, the entire premise of the bill is flawed from the very beginning.

But let’s have a look at its entrails nonetheless to see what kind of changes it has in store for Canadian institutions.

The Dirty Details

Firstly, at the start of the text of the bill in Part 1 it states a truer name for the act itself [with emphasis added]:

An Act to require certain financial and other federally regulated entities to mitigate and adapt to the impacts of climate change

Put simply, this will require entities to “mitigate and adapt to the impacts of climate change.”

By mitigate they mean that the entities will have to: perform their own reporting (climate disclosures / C02 emissions / Risk Scenario analyses).

And by adapt they will be forced to be in alignment with established norms (which will likely be internationally set - as shown in this post).

The purpose of the Act is to align the activities of reporting entities with the “public interest objective” of achieving climate commitments. These “climate committments” were addressed earlier in this post (see Trudeau & net zero, for instance).

They will achieve these committments through a number of means, including:

“ensuring that appropriate oversight are developed by supervisory and regulatory authorities” (as I already described/demonstrated in this post)

“requiring directors, officers and administrators to align entities with climate commitments” (idem)

Without going into too much detail of the entire text of the bill, we must pay particular attention to Part 5 - Enforcement and Orders.

The underlined (in red) part from the screen capture text of the bill above states that the [Office of the] Superintendent of Financial Institutions - the OSFI - makes the rules and imposes them so as to align entities (hereunder) to their standards. Here are the entities they are referring to (b to f):

So, basically these entities include banks, lenders, insurance companies, and [federally-regulated] pension plans.

And by banks they mean your bank too, of course.

Insurance companies will also have to be in alignment with the diktats of the OSFI - much in the same kind of way that was illustrated in Section 3.2 of this post).

Same goes for the Pension Plans such as the Canada Pension Plan (CPP) - which inherently implies all the corporations held within its portfolio holdings.

The Bank of Canada will also need to play ball. To achieve this, the bill seeks to amend the current Bank of Canada Act in the following manner:

Put simply, the OSFI would have de facto power over our central bank to force it to comply with whatever climate measures they see fit when devising their monetary policies and other policies. Think I am exaggerating? Then have a look at this:

That is a tremendous power-grab which would leave room for far-reaching abuses which could result in wastage and dire consequences.

Where do Carbon Taxes & Markets come into play?

Glad you asked. Part 6 - Financial Products Alignment Action Plan covers this in a fairly disguised, but nevertheless evident, fashion.

What they mean by “to incentivize financial products that support climate commitments” they really mean favouring Carbon markets; and by “taxation legislation” they imply Carbon taxes.

Come on. You must have more spare change hidden somewhere underneath the cushions of your couch, no? If not, maybe you’ll have to get a second, or third, or fourth job to have more funds to funnel over to your Canadian overlords who will then funnel them over to their globalist overloads….

Are we starting to see how they sneakily insert these malicious schemes in bills?

Do you all really think that the Sponsor of this bill Senator Rosa Galvez, actually wrote it?

Sure, she has good environmental credentials and seems like an overall very nice woman (I mean that sincerely).

That being said, do you really think she has the financial and banking know-how to have drafted all the climate finance intricacies and related language found in this bill?

If you do, I have a bridge to sell you.

Not done yet.

In order to implement such an over-encompassing bill on financial institutions and other entities across Canada, there would need to be some kind of mechanism to ensure that provinces would be on board / in alignment with all these shenanigans, right?

Well, not to worry; for, that is covered too!

Whooopie!

What’s a country without collaboration? Or is it coercion? I can never tell the difference.

Bill S-243 has already passed the second reading in the Senate and is in Consideration in committee. It seems like it will likely pass in the Senate, then reach a First reading in the House of Commons.

Surprisingly (or perhaps unsurprisingly) there seems to be little buzz or attention on this bill which could have very dire impacts on the future financial landscape in Canada.

Should it pass and achieve Royal Ascent (become law), carbon taxes could become even more exponentially egregious on Canadian businesses, and ultimately on consumers like you and me.

Are we paying attention yet?

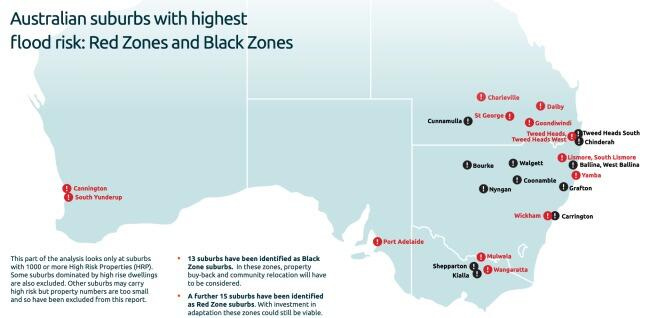

7.3 Test-Run in Australia: How Scammy Climate Models & the Shady Insurance Industry are colluding together