EXPOSÉ: Canadian Residents & Businesses are about to be Carbon-Taxed into Oblivion

by Dan Fournier, Opinion, published Monday, Oct. 24, 13:15 EDT on fournier.substack.com

Key Takeaways:

The Climate Change narrative is, for the most part, an exaggerated fabrication concocted by powerful interests with dubious agendas that doesn’t hold up to scientific scrutiny.

Starting in 2035, no new gas or diesel cars & trucks will be allowed.

The Canadian Oil & Gas sector will be put extinct by the year 2050.

Small & Medium sized businesses will find it increasingly difficult to get loans due to net-zero policies.

Canadian consumers will be greatly taxed to support all the climate-related policies and measures that are currently being implemented in Canada and elsewhere.

As this exposé will be somewhat comprehensive, it is divided into the following parts:

The Climate Change Deception

Why is the Climate Change agenda so important?

Carbon Markets, the WEF and other Pushers of Climate Doom

New Regulatory Institutions to manage it all

Businesses’ Carbon Footprint & Tax

Banking on Insanity

New 'Carbon Labelling' for Products with added 'Climate Tax'

Individuals' Carbon Footprint & Tax

Tracking it all on the Blockchain

Conclusion & Final Warning

1. The Climate Change Deception

‘Climate Change’ has served as the new moniker ever since its predecessor – ‘Global Warming’ (defined as the rising temperatures of the surface of our planet caused by human-driven emissions) – failed to hold up to scientific scrutiny.

Whichever one you want to call it, it has largely been one giant deception levied on the unsuspecting masses to perpetuate a climate of fear, guilt, and alarmism. And there is plenty of evidence that indicates this, if one is inclined enough to do some basic examination about it, including its origins.

While of course there are plenty of legitimate claims regarding real climate change and the degradation of our natural environment due to human and commercial activities, a lot of them are the result of purposeful acts committed by disreputable actors such as those involved in geoengineering.

For instance, Solar Radiation Management, weather manipulation (such as droughts), aerosol spraying, military operations, among others, are the real man-made contributors to climate change in that they pose serious threats to human health and our natural environment, namely the air that we breathe, fauna, plants, agriculture, our lakes and other biological ecosystems. Why aren’t the climate alarmists covering these contributors?

Club of Rome

Regarding the origins of Global Warming & Climate Change, it has been well documented that they have been artificially brought about several decades ago by a group of elites behind a think tank called the Club of Rome.

When speaking about Agenda 21 and the Club of Rome, former Australian politician Ann Bressington stated (alternate link here) the following [emphasis added]:

“Ladies and gentlemen, the origins of the environmental movement as we see it began back in 1968 when the Club of Rome was formed. The Club of Rome has been described as a crisis think tank which specialises in crisis creation. The main purpose of this think tank was to formulate a crisis that would unite the world and condition us to the idea of global solutions to local problems. In a document called The First Global Revolution, … it stated: ‘In searching for a new enemy to unite us, we came up with the idea that pollution, the threat of global warming, water shortages, famine and the like would fit the bill.’ …, that’s the origin of global warming ladies and gentlemen.”

The Club of Rome is still actively involved in activities related to Climate Change. And at first glance it all seems quite legitimate. But the power and influence wielded by its well-connected membership leaves much to be scrutinized.

As recently as August, 2022, The Daily Skeptic published a piece titled 1,200 Scientists and Professionals Declare: “There is No Climate Emergency which challenges the political fiction that humans cause most or all of climate change, as opposed to the evolutionary forces of nature which have rendered gradual climatic transitions over millions of years. The article makes reference to the ‘World Climate Declaration (WCD)’ through which the scientists have asserted the following salient points:

“Climate policy relies on inadequate models

Climate models have many shortcomings and are not remotely plausible as policy tools. They do not only exaggerate the effect of greenhouse gases, they also ignore the fact that enriching the atmosphere with CO2 is beneficial.”

“CO2 is plant food, the basis of all life on Earth

CO2 is not a pollutant. It is essential to all life on Earth. More CO2 is favorable for nature, greening our planet. Additional CO2 in the air has promoted growth in global plant biomass. It is also profitable for agriculture, increasing the yields of crops worldwide.”

“Global warming has not increased natural disasters

There is no statistical evidence that global warming is intensifying hurricanes, floods, droughts and suchlike natural disasters, or making them more frequent. However, there is ample evidence that CO2mitigation measures are as damaging as they are costly.”

“Climate policy must respect scientific and economic realities

There is no climate emergency. Therefore, there is no cause for panic and alarm. We strongly oppose the harmful and unrealistic net-zero CO2 policy proposed for 2050. Go for adaptation instead of mitigation; adaptation works whatever the causes are.”

Real science should allow all sides of any given debate to flourish.

There should be no such thing as “the science is settled”, or “a scientific consensus exists…”

The late Michael Crichton – who graduated summa cum laude from Harvard College, received his MD from Harvard Medical School, taught anthropology at Cambridge University, and wrote at MIT – once observed:

“If it’s consensus, it isn’t science. If it’s science, it isn’t consensus.”

In other words, we should always question everything and challenge prevailing narratives, even if that means being subject to ridicule or being assigned absurd labels such as ‘climate deniers’ or ‘conspiracy theorists’.

Sure, there are real threats that plague our natural environment and we should all strive to be good environment stewards, but that does not exclude our collective obligation to be properly informed and have the courage to speak out when needed.

2. Why is the Climate Change agenda so important?

An honest examination of Climate Change would be incomplete without looking at its principal motivation, or raison d'être.

Why are the powers-that-be so interested in this Climate Change agenda?

The answer to that is relatively simple. This crisis serves a very unique and critical purpose. As it has been fabricated by the same types who have perpetrated many other crises (war, pandemics, etc.), their ultimate goal here is to provide a mechanism by which they can tax and collect exorbitant sums of money from the masses (business and individuals).

This money is required to pay the interest (and original capital) resulting from the excessive orgies of monetary debt they have issued over the last several decades by excessive money printing.

World debt as of October 20, 2022 amounts to over $72 trillion dollars.

World debt as of Oct. 20, 2022, source: worlddebtclocks.com

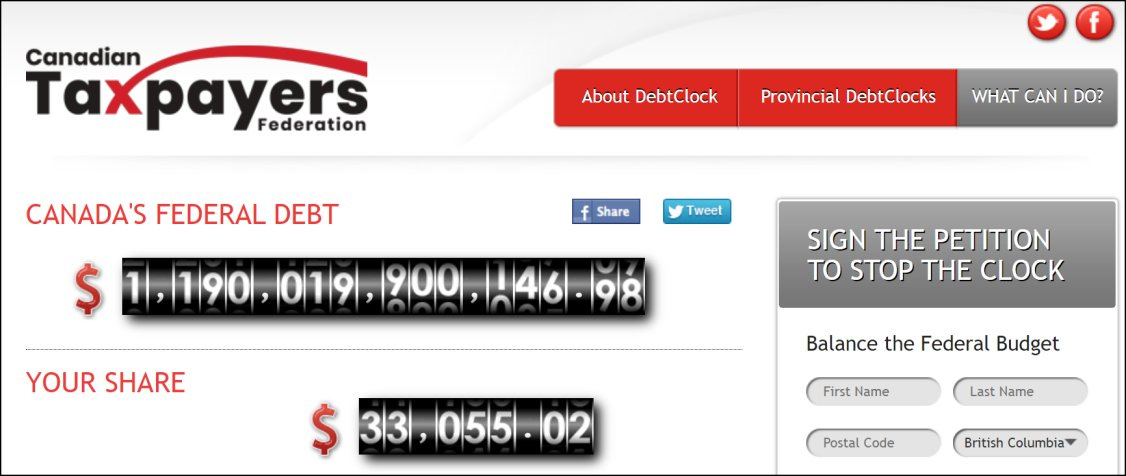

While the United States accounts for a large portion of this debt, Canada also has a significant portion at over C$1.1 trillion according to the Canadian Taxpayers Federation:

Canadian debt as of Oct. 20, 2022, source: https://www.debtclock.ca/

Somebody has to pay for it all, and they rather it be you and me than them, even though it is all their making.

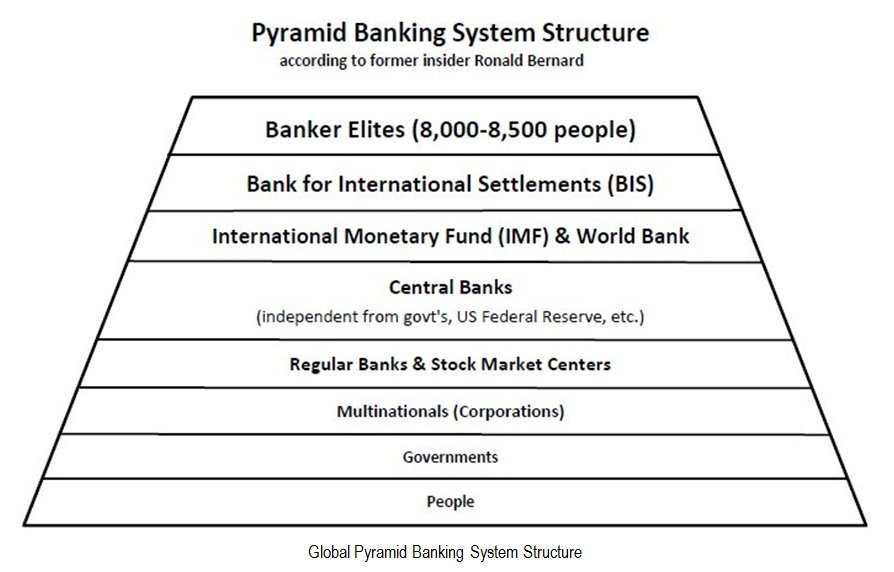

They are part of a network of financial elites, or an International Banking Cabal if you prefer – spearheaded by the Bank for International Settlements (the central bank of central banks), the International Monetary Fund (IMF), The European Central Bank, and all other central banks around the world which are private corporations who serve the interests of their real masters, not the governments and the people.

International Banking Cabal Pyramid, source: Liberty Academy blog

We are talking about the equivalent of $US trillions of debt that needs to be repaid; and one of the only means by which this can be done (other than re-issuing more debt to pay the existing debt – which they have carelessly done over the last decade or so) is through taxation.

Relatedly, the author will demonstrate later in this exposé just how much they are poised to collect through Carbon and Climate-related taxes (to pay for this decades-long swindle).

Lastly, it is no coincidence as to why we are seeing massive inflation around the world these days. The financial system is oversaturated with debt and its effects on the credit markets is causing massive disruptions and volatility.

And it’s about to get a lot worse.

3. Carbon Markets, the WEF and other Pushers of Climate Doom

Sadly, the elitist forces pushing the Climate Change agenda are steadfastly and stubbornly determined to propagate it on a global scale using all means and connections at their disposable – which are significantly substantial, to say the least. And they have been doing so unabatedly for the past several years – especially though supranational and globalist organizations such as the United Nations (UN) and the World Economic Forum (WEF).

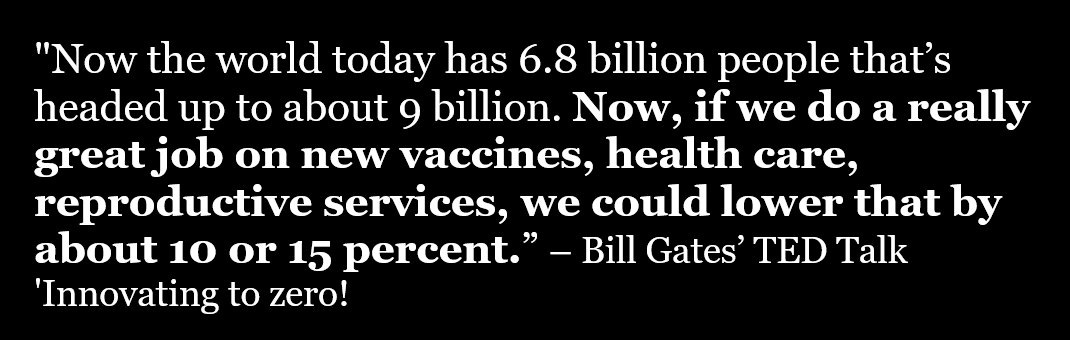

Bill Gates and Mark Carney figure among some of their most outspoken peddlers. While the former has been unashamedly pushing the Climate Change agenda (as well as population control through eugenics and vaccines), the latter has been one of its key architects working frenziedly in the dark shadows of our financial system.

Both Gates and Carney are mongering merchants of the Net Zero lunacy.

In short, they seek a zero, yes 0, greenhouse gas (CO2) emissions target which is absolute nonsense, for C02 is an essential building block of nature and life itself. Without it, we would not exist.

These merchants are huckstering this folly, for without it, they peddle, the world will come to an end.

In this regard, they are pushing two key target dates for implementation: 2030 and 2050 by which the whole planet – all governments, companies, and individuals need to completely cease producing CO2.

This is absolute madness.

And the fact that most of the planet is going along with this hoodwinking mass psychosis is quite troubling and disheartening.

Are the masses completely disconnected from reality?

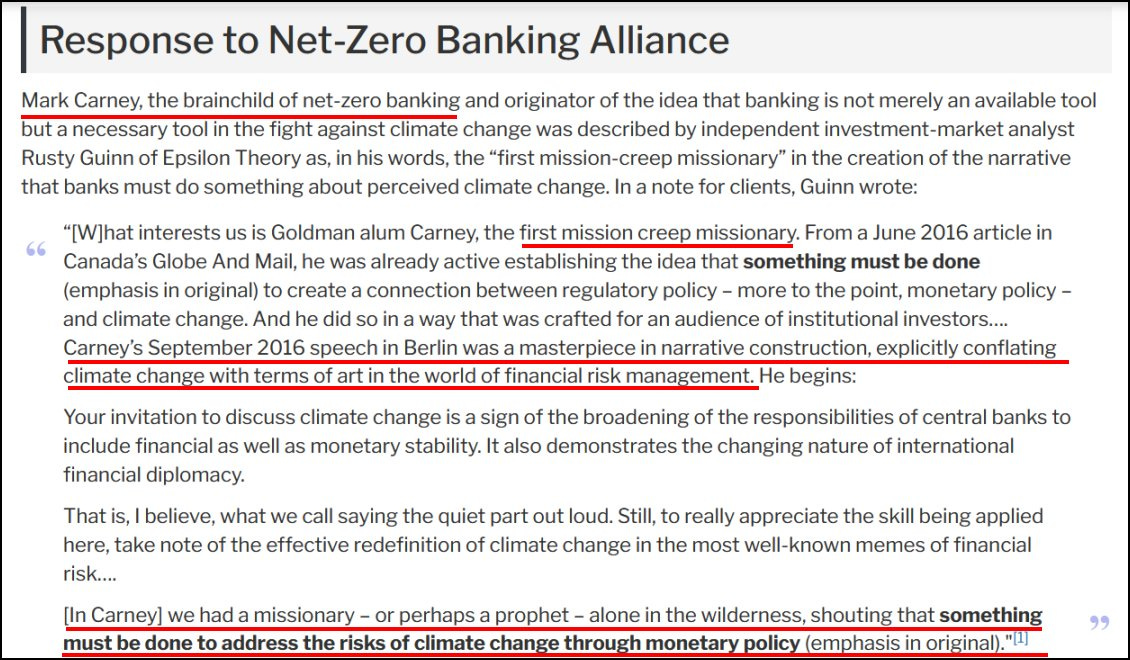

For the reader to fully grasp the remainder of this exposition, we must turn our attention back to its principal architect – Mark Carney.

Who is Mark Carney?

As Daniel Craig, Roger Moore, Sean Connery – pick-your-favorite – is the quintessential James Bond, Mark Carney is the quintessential elite banker.

Mark Carney in front of The Bank of England logo, image source

Former governor to The Bank of Canada (2008-2013) as well as The Bank of England (2013-2020), Carney thereafter took on a specialised role – United Nations' special envoy on climate action and climate finance.

This is a post specifically designed to construct the complex apparatus by which all publicly-listed companies and financial institutions will be required to submit climate and ESG (Environmental, Social, and Governance) data to their respective national regulators, lest they be penalized and shut out of the financial and credit markets altogether.

From the CBC article [emphasis added]:

“The Bank of England said Carney would seek to make the impact of climate change central to financial reporting, risk management and the calculation of returns ahead of a global summit in Glasgow in November 2020.”

“The disclosures of climate risk must become comprehensive, climate risk management must be transformed, and investing for a net-zero world must go mainstream," Carney said in a statement.

Early last year, Carney appeared amongst a panel to discuss Carbon Markets at the World Economic Forum (WEF); the talk was titled Carbon Markets: A Conversation with Bill Gates, Mark Carney, Annette Nazareth and Bill Winters. In it, Carney reiterated the importance of reaching the [impossible] absolute net zero target (of CO2 emissions). In no uncertain terms, he exclaimed the goal sought, namely “the climate disclosures in main accounts [of companies]”.

As an interesting side note about this talk, Bill Gates claimed that there was a total of 51 billion tons of emissions (CO2) to account for (yearly) and that each ton is priced (in tradable carbon credit markets) at US$400. Quick math suggests that they inherently consider this total carbon market to represent a stunning 20 quadrillion and 400 billion dollars (i.e., 51b tons @ $400 per ton). And if we are to surmise that this is what they intend to account for with regards to carbon/climate reporting and taxation, we can deduce that it would represent a potential tax grab of US$728 billion per year until the year 2050. Now we are talking about some serious gravy train!

What is perhaps even more revealing is the fact that Mark Carney was the former chair of the Financial Stability Board (FSB) from 2011 to 2018.

The FSB, headquartered in Basel (Switzerland) and affiliated with the Bank for International Settlements (BIS), is an international body that monitors and makes recommendations about the global financial system.

In his position as chair of the FSB and amidst the Great Financial Crisis of 2007-8, Carney, also a former Goldman Sachs executive, used his power and influence to protect his bankster buddies at HSBC (who had committed financial crimes) from prosecution during a post-crisis Parliamentary Inquiry into the matter.

All this was meticulously exposed and reported on by American attorney John Titus in his documentary All the Plenary’s Men (watch from 21:10 to 25:25 to see Carney at his best). So good was Carney’s testimony, that it landed him the position of Governor of the Bank of England – the first non-British to hold the post in its 318-year history.

“Some officials in the Department of Justice wanted to indict HSBC, according to e-mails unearthed by a subsequent congressional investigation. But Britain’s Chancellor of the Exchequer warned U.S. authorities that a prosecution could lead to “very serious implications for financial and economic stability.” HSBC was granted a deferred-prosecution agreement.” – The New Yorker: Why Corrupt Bankers Avoid Jail, July 31, 2017

4. New Regulatory Institutions to manage it all

How is all this talk about the FSB and Carney relevant to all this, the reader may ask.

Well, because in recent years the FSB created a special arm called the Task Force on Climate-related Financial Disclosures (TCFD) which has a mission to:

“develop voluntary, consistent climate-related financial risk disclosures for use by companies in providing information to investors, lenders, insurers, and other stakeholders.”

Though such a task force may seem innocuous, perhaps even noble, at first – especially since they frame it as a “voluntary” measure, we will soon discover that its true intention is to become an obligatory apparatus to which companies – at least publicly-listed ones and those under the purview of financial supervision such as banks, insurance companies, and other financial institutions – will absolutely be required to comply with (by reporting their “climate disclosures”).

This is prescribed to happen in phases leading up to the year 2024, as indicated in the 2022 TCFD Status Report: Task Force on Climate-related Financial Disclosures.

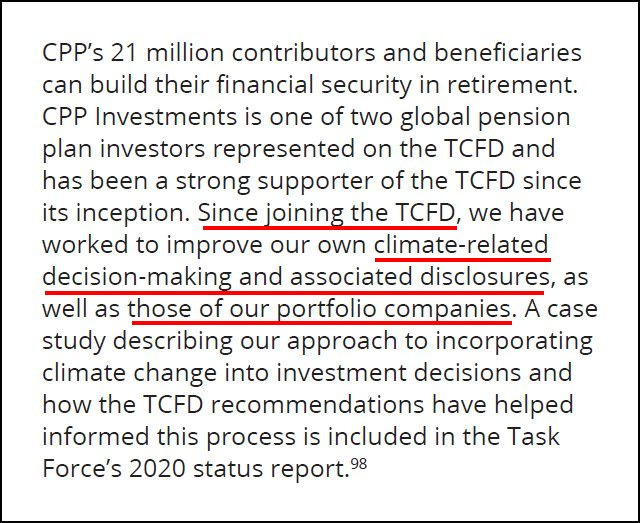

In this report, we can easily observe that the Canada Pension Plan (CPP) intends to make climate disclosures a requirement for all companies that wish to be included in its portfolio.

Task Force on Climate-related Financial Disclosures 2022 Status Report, page 93.

While this can also certainly appear as a noble endeavor (to only invest in climate-loving, tree-hugging companies), it ignores the stark reality regarding the additional costs that these companies will incur to design, staff, and implement these complex and opaque systems and measures, not to mention absorbing possible tax penalties should they not do so and fall in line with the prescribed norms and thresholds (whatever they may be at any given time).

Other suspect issues arise when examining the TCFD.

Firstly, it is chaired by Michael Bloomberg who is another well-known pusher of climate doom.

Next, its Twitter account shows 15.2K followers while most of its tweets only produce a handful of likes and comments; so, it’s almost as if, at prima facie, the account could be flooded with fake followers, perhaps to give the impression that it has an organic, pardon the pun, following. If one does take time to examine their followers, one might notice that a significant portion appears to indeed be bots. Elon?

TCFD’s Twitter account, screenshots taken on Oct. 21, 2022

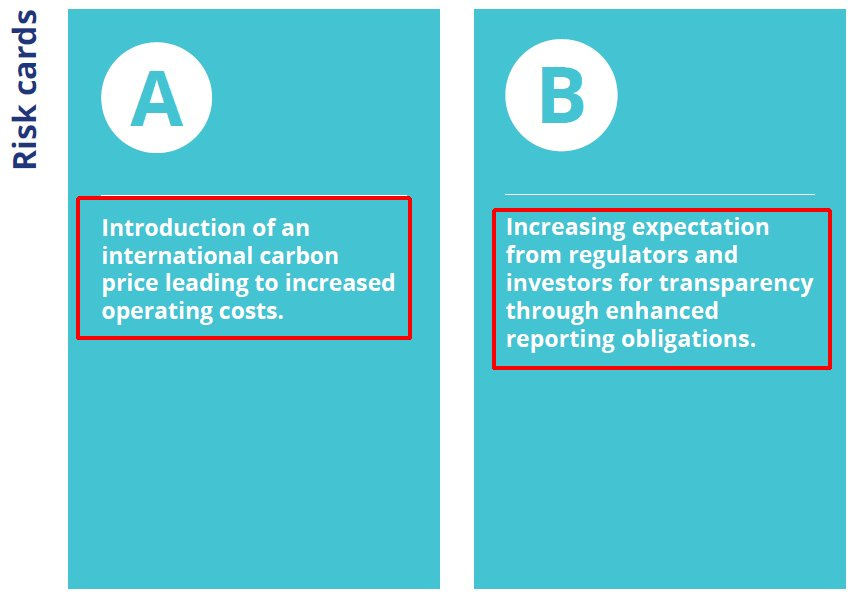

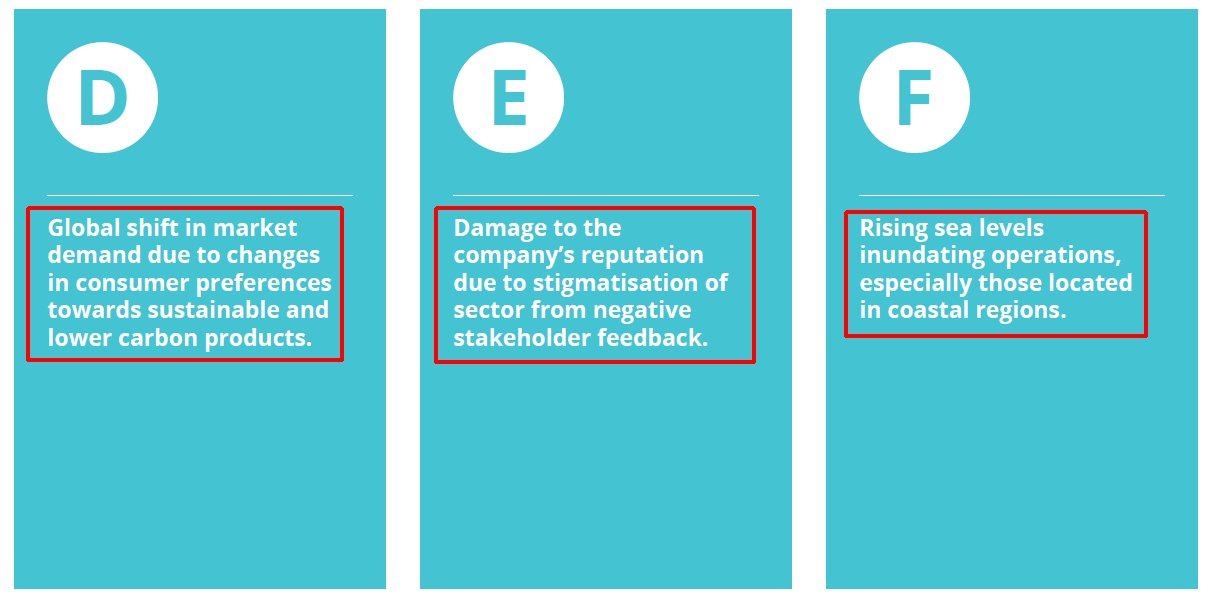

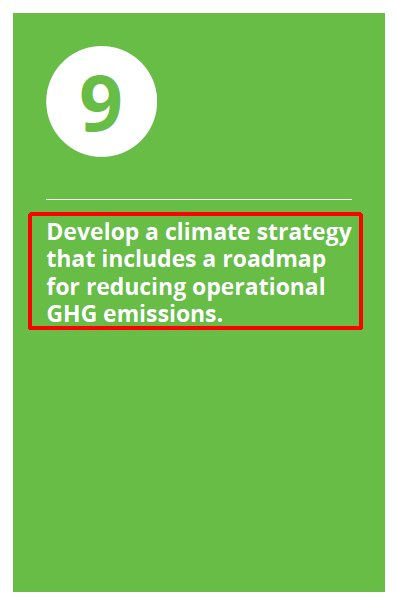

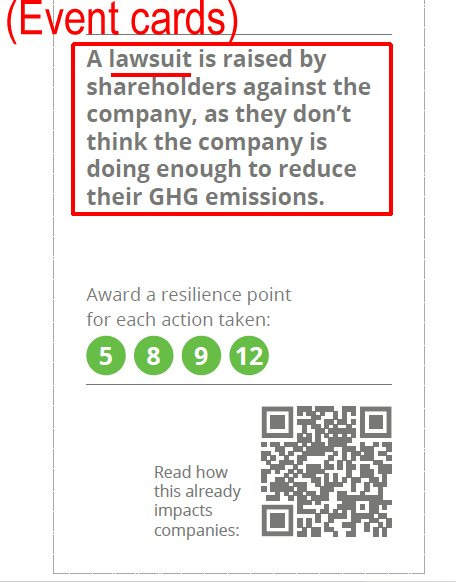

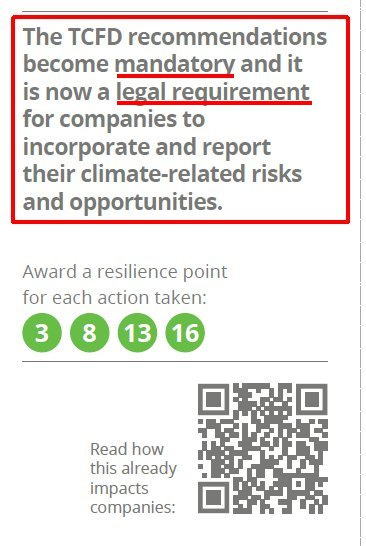

In addition, through their sister site, the TCFD Knowledge Hub, they have created a Climate Risk Card Game that wreaks of indoctrination mantras surrounding the need for absolute obedience to the Climate Change gods.

Companies are invited to download the game which puts them through various climate-related risks, events, and actions that they may encounter – almost as if to scare them into submission, or at least plague them with guilt should they not get all their climate ducks in a row.

Here are some interesting cards used in this game [emphasis added in red color]:

If the next-to-last one from above (“The TCFD recommendations become mandatory and it is now a legal requirement for companies to incorporate and report their climate-related risks and opportunities.”) is not enough to scare the companies into submission, then perhaps they are not properly reading between the lines. Little might they know that it will be mandatory – at least in Canada – starting in 2024 as is outlined further below in this work.

The last event card displayed above (“A global carbon price is adopted, and the company prepares for participation in the carbon market.”) suggests a potential, de facto, spot price for carbon, just like spot prices exist for crude oil and other traded commodities.

Accordingly, this spot price could be easily manipulated (most likely upwards) by the powers-that-shouldn’t-be much like they regularly do with gold and other commodities. Put another way, they could jack up the carbon price at any time to collect even more taxes.

Does this sound like a fun and exciting game you would look forward to playing at your company?

Edward Bernays must be blushing in his grave.

Now, back to more serious matters and the TCFD Status Report:

Task Force on Climate-related Financial Disclosures 2022 Status Report, page 93.

In a nutshell, according to Environment and Climate Change Canada, the Nationally Determined Contributions, or NDCs, are described as [emphasis and relevant links added]:

“Under the Paris Agreement, countries are required to submit national greenhouse gas emission reduction targets, called Nationally Determined Contributions (NDCs), every five years. Each successive NDC is required to be more ambitious than the previous one.”

And Canada’s target for 2030 is stated as follows:

“Canada’s target up until today was to reduce greenhouse gas emissions by 30% below 2005 levels by 2030. Yesterday, Prime Minister Trudeau announced a target of 40-45% reductions below 2005 levels by 2030.”

Canada’s commitment to these levels were cemented by Prime Minister Justin Trudeau at the United Nations Climate Change Conference UK 2021.

Canadian Prime Minister Justin Trudeau speaking at the United Nations Climate Change Conference UK 2021 [43:33 to 48:53 mark]. AUTHOR NOTE (2023-07-11): The slick/lying/deceiving propagandist parasites at the UNCC have removed this video; however, the Trudeau’s segment can still be seen on YouTube via the following link:

Though his speech is a bit lengthy to included in its entirety, here are some notable excerpts that are relevant to the present exposition [with emphasis added]:

“Canada is warming, on average, twice as quickly as the rest of the world. And in our north, it’s three times quicker.”

“The science is clear. We must do more, and faster…We’ve already laid the groundwork. In 2015 at the Cop in Paris, I committed that Canada would put a price on pollution…And Canadians supported it, in our last two elections.”

“We know, pollution pricing is key to getting emissions down while getting innovation up and running. Our carbon price trajectory is one of the most globally ambitious ones. And it’s rising to $170 a ton in 2030. This is a meaningful price on pollution designed not just to make life cleaner, but also make life more affordable and less expensive for Canadians.”

“…Just as globally we agreed to a minimum corporate tax, we must work together to ensure it is no longer free to pollute anywhere in the world. That means establishing a shared minimum standard for pricing pollution.”

“Of course, what’s even better than pricing emissions, is ensuring they don’t happen in the first place. Which brings me to my next major commitment: we’ll cap oil & gas sector emissions today and ensure they decrease tomorrow at a pace and scale needed to reach net zero by 2050. That’s no small task for a major oil & gas producing country. It’s a big step that’s absolutely necessary.”

[in French]:“C'est pourquoi le Canada s'est fixé comme objectif de vendre uniquement des voitures zéro-émissions et d'établir un réseau d'émission d'électricité à être émissions-nettes-zéro d'ici 2035. ” translated to English: “That's why Canada has set a goal of selling only zero-emission cars and establishing an electricity emissions network to be net-zero emissions by 2035.”

There are four main takeaways from Trudeau’s gloomy speech:

Pollution (emissions) will be priced;

Canada’s oil & gas sector will essentially become extinct by 2050;

Net zero (the equivalent of zero CO2 emissions) is an unyielding goal to be met by 2050;

New gas-powered cars and diesel-powered trucks will be completely prohibited in less than 13 years.

Do these seem like realistic, reasonable, and attainable goals to you and your business?

How will these impact your way of living or your ability to operate your business by the end of this decade?

Mandatory reporting

On page 100 of the TCFD Status Report appears the following:

Task Force on Climate-related Financial Disclosures 2022 Status Report, page 100.

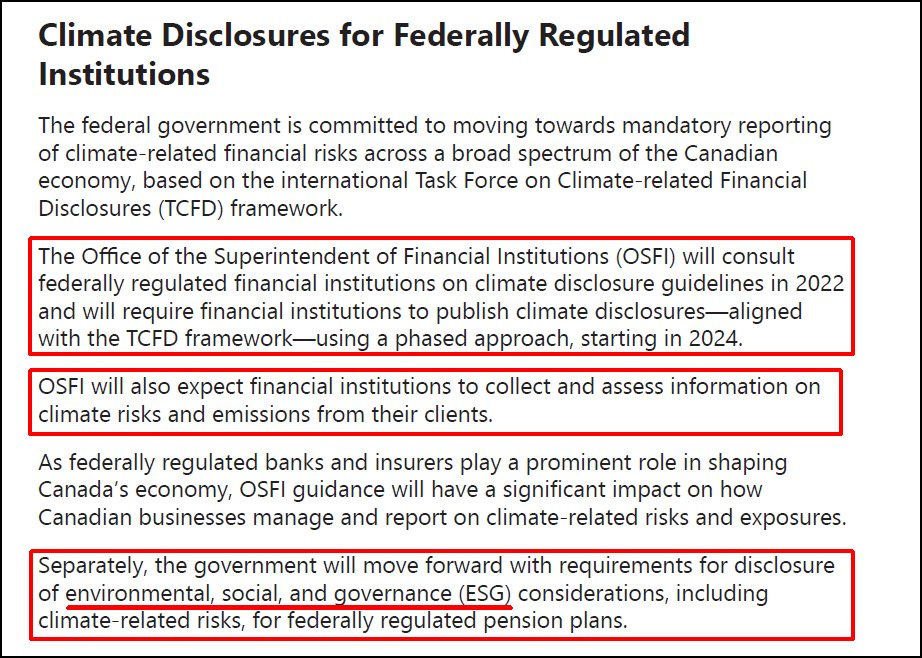

If the reader is unfamiliar with the OSFI, or Office of the Superintendent of Financial Institutions, they regulate banks, insurances companies, and financial institutions in Canada.

Those under their purview must adhere to strict rules and guidelines regarding their operations and financial reporting. The OSFI, will thus become one of the principal regulators in this climate reporting affair.

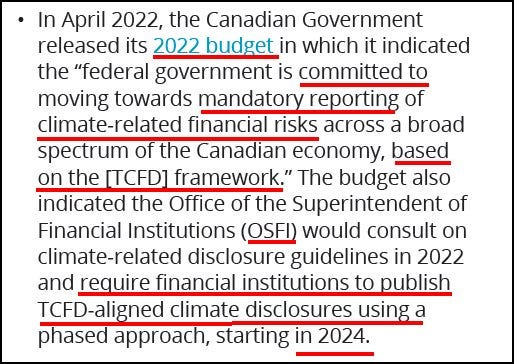

As indicated above, these Canadian companies will have no choice but to start making their climate disclosures no later than in 2024, also according to the following provision in the 2022 federal budget:

Canadian federal budget for 2022, page 106

It is also confirmed in a May 26, 2022 press release.

An inquiry by this author was made to the OSFI with many questions regarding the nature and specific standards that will be used for climate-related disclosures. Their Senior Media Relations Advisor did not provide the standards that are to be used by reporting companies, but rather referred to the related news release and draft guidelines (PDF). Therefore, it is quite difficult to know at this time what exactly companies will need to report.

For now, however, and according to this Climate Risk Management draft guideline, they mostly seem concerned with two types of risks: physical and transition and they define these as follows:

"Physical risks" refer to the financial risks from the increasing severity and frequency of extreme climate change-related weather events (i.e., acute physical risks); longer-term gradual shifts of the climate (i.e., chronic physical risks); and indirect effects of climate change such as public health implications (e.g., morbidity and mortality impacts).

“Transition risks” refer to the financial risks related to the process of adjustment towards a low-greenhouse gas (GHG) economy. These risks can emerge from current or future government policies, legislation, and regulation to limit GHG emissions, as well as technological advancements, and changes in market and customer sentiment towards a low-GHG economy.

While the former is quite unpredictable and hence difficult to measure or assess, the later are perhaps those that will be easier to quantify; for, GHG (greenhouse gas, or CO2) emissions are the ones that will be used as a yardstick for reporting and inherently taxation.

Lastly, we must add yet another institution that will regulate this new scheme, namely the Climate Disclosure Standards Board (CDSB) – an international consortium of business and environmental NGOs. As per the TCFD report, the CDSB will align disclosures using the TCFD Good Practice Guide. This guide provides more clarity on specific metrics which will be outlined in the next section.

5. Businesses’ Carbon Footprint & Tax

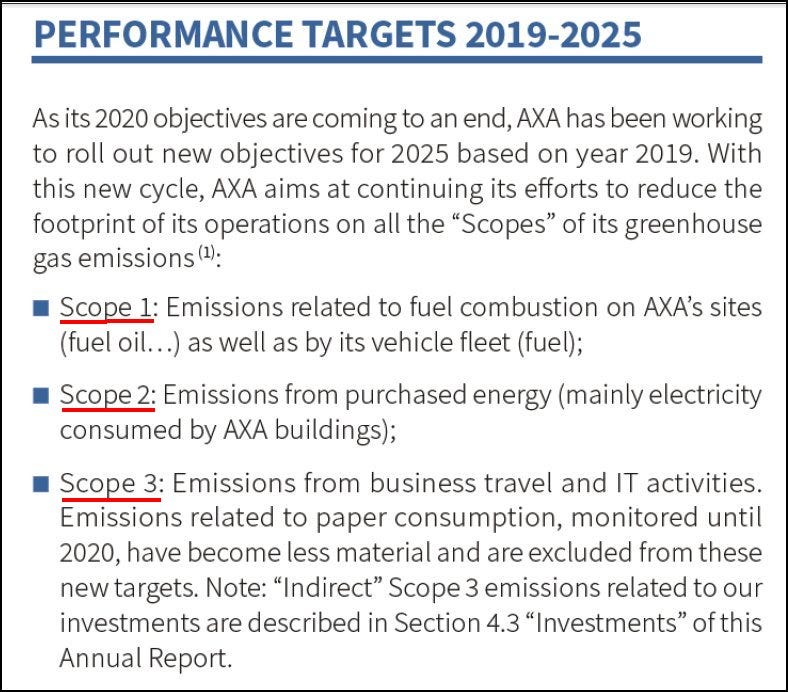

Section 3 of the TCFD Good Practice Guide provides “Metrics & Targets” relating to these TCFD climate-reporting disclosures, shedding a bit more light on the matter:

TCFD Good Practice Handbook, page 30

As we can see in the image above, reporting companies will have to account for 3 types (scopes) of emissions, basically:

fuel used by their cars & trucks (Scope 1);

their purchased energy such as electricity (Scope 2); and

emissions caused by their travel & office paper footprints.

Here is an example of what such reporting may look like:

Companies will have to set targets and state whether they have reached or exceeded them.

Though the whole process of determining risks and emissions appears quite complex, what is to be retained here is that, one way or another, companies will be subject to penalties for exceeding “acceptable” levels of GHG or carbon-related emissions and will most likely be taxed according to a pre-determined scale (according to their type of industry), not that dissimilar to what we find with our business and individual progressive tax scales.

The higher the emission score, or carbon footprint, the more tax the company will be subject to.

As Canadian companies already pay a lot in terms of a three-tier tax system (municipal, provincial, and federal), they will need to add yet another major category; specifically, by adding a new liability account to their accounting systems.

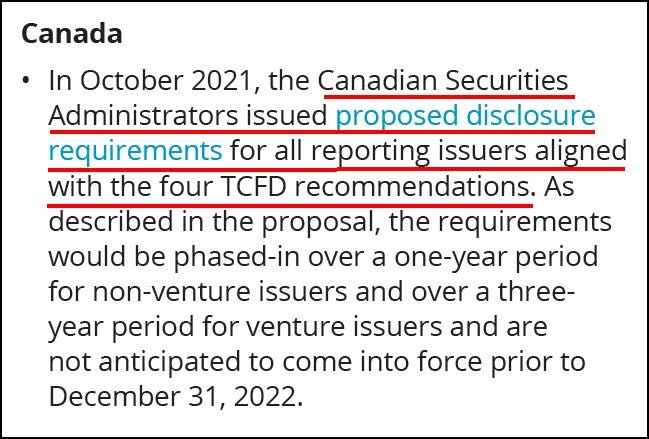

For now, even though it appears that only companies reporting to the Office of the Superintendent of Financial Institutions (OSFI) will be required to disclose their carbon footprint, companies listed on Canadian stock exchanges will also be subject to the same measures. To wit, the following is mentioned in the TCFD report [with emphasis added in red underlining]:

Task Force on Climate-related Financial Disclosures 2022 Status Report, page 100.

The Canadian Securities Administrator – the regulator for listed companies – will thus also require participants to disclose their climate risks and emissions.

Their 51-107 Disclosure Update report does shed slightly more light on what might comprise the standards to be followed. In it, a “GHG emissions reporting standard”, or “GHG Protocol” will be the means through which companies will calculate and report their GHG emissions. Yet this report also still doesn’t state specifically what these standards are.

To sum it up, it appears that no clear standards for measuring GHG emissions currently exist in the current TCFD framework. So, it is difficult to know what exactly they will be and when they will be fully established and imposed.

Finally, we must not exclude yet another reporting requirement which will also surely arise, namely companies’ ESG (Environmental, Social, and Governance) practices by which they will also be scrutinised and possibly further taxed or penalised.

We must also ponder: how long before all Canadian companies will be required to report their climate-related and GHG exposure?

6. Banking on Insanity

There are two main points in this section.

The first is on a broader or more global scale, for it demonstrates the extent to which the global banking sector has been usurped and strangled by this Climate Change agenda.

Most readers might be familiar with the controversial United Nations’ 2030 Agenda for Sustainable Development and its 17 goals. In line with these goals – particularly with goal #13 Climate Action we find one under the UN Environmental Program called Net-Zero Banking Alliance which describes its purpose as follows [emphasis and link added]:

“The industry-led, UN-convened Net-Zero Banking Alliance brings together a global group of banks, currently representing about 40% of global banking assets, which are committed to aligning their lending and investment portfolios with net-zero emissions by 2050. Combining near-term action with accountability, this ambitious commitment sees signatory banks setting intermediate targets for 2030 or sooner using robust, science-based guidelines.”

Forty percent here is quite significant, for it represents practically all of the Western banking clique since China, Russia, and most of Southeast Asia are not members to the alliance.

“The Alliance is convened by the UN Environment Programme Finance Initiative, and is a part of the Race to Zero. In addition, the Alliance also executes coordinated advocacy and alignment as the banking element of the Glasgow Financial Alliance for Net Zero and the climate-focused element of the Principles for Responsible Banking.”

The Glasgow Financial Alliance for Net Zero and Race to Zero represent very staunch commitments which support various goals under the broader net zero agenda.

The Principles for Responsible Banking, a UN based outfit, is a supranational organization which aims to dictate to its over 300 signatory banks “Principals” by which they are to align their core strategies, decision-making, and lending & investment practices so as to be in line with the Paris Climate Agreement – which is essentially the net zero commitment.

Note two key words in the previous paragraph – lending and investment. What this means is that member banks are drastically changing their lending and investment practices; in other words, they will most likely cease to lend and invest in companies that do not submit to the Climate Change ideology, no matter what industry or sector they operate in.

Put differently, businesses will most likely be shut out of the credit and capital markets if they do not spend a significant amount of time, effort, and capital into designing and implementing climate-reporting policies and procedures similar to those described in the previous sections of this article.

Kowtowing and unquestioning obedience to the Climate Gods is the new norm, Chinese style and all.

In Carney’s Canada, no stone is left unturned. The Canadian Banking Association is also making sure this will become the new norm. In a very recent post (Oct. 12, 2022) titled Focus: Banks in Canada Committed to a Net-Zero Economy by 2050, they made it clear, in no uncertain terms, that the Canadian banking sector is embarking on a monumental paradigm shift. In this communiqué, two related briefs, and “sustainable lending” efforts, the powerful trade association and lobby group not only ticks all the climate change checkboxes, but also pledges financial commitments in the hundreds of billions of dollars in support of “environmental and sustainable finance activities.”

“Hundreds of billions of dollars”, that’s a lot of Canadian bacon folks!

Furthermore, they are also ensuring that our Canadian banks will adhere to the TFCD (Task Force on Climate-Related Financial Disclosures) described earlier in this work.

Even further, they are developing “new metrics” to link environmental, social, and governance (ESG) factors to “bank group performance and executive pay.” This will ensure that CEOs and board members of businesses strictly cater to these metrics and climate emission benchmarks on a top-down basis while their broader employee base will have, as usual, very little say in the matter.

That’s not all. The focus by the CBA also notes that Canada’s six largest banks have joined the Net‑Zero Banking Alliance (NZBA) mentioned earlier and are aligning their lending and investing portfolios with the net-zero emissions by 2050 benchmark.

And it still doesn’t end there. Apologies. They are also aiming for banks to join the “RMI’s Centre for Climate-Aligned Finance and the Partnership for Carbon Accounting Financials”.

“Carbon Accounting Financials” would most likely require a not-so-little overhaul of the accounting systems (and standards) by which Canadian companies are required to report their accounts – in this case their new climate carbon related transactions and entries. That would also entail a significant change in academia and related accounting associations because accountants and auditors will need to be trained and updated in this regard.

We are talking about some serious, monumental shifts in the Canadian banking and financial landscapes, folks.

A 2021 Ballotpedia article titled Canada’s six largest banks join Net-Zero Banking Alliance (2021) sheds some much needed light on Canada’s climate posturing and how its principal architect – Mark Carney has coaxed participants [emphasis in red underlining]:

There is little doubt that Mark Carney (who also happens to be Vice Chair of Brookfield Asset Management) is a master wordsmith when it comes to prophesizing and conflating the notion of climate change with financial & monetary policies.

It’s all crafty and ingenious trickery and deception; and Carney is the chosen messiah for this conspiratorial endeavour – one that is poised to mark humanity forever.

We all know that central bankers have control over the money supply of nations through monetary policy. Linking climate agenda policies with monetary policies will ensure that central bankers will be able to inflate our money supplies to even higher, unfathomable, levels.

At least there’s some encouraging news. Many states in the U.S. have pushed back on these globalist policies. An October 19, 2022 Epoch Times article, 19 States to Investigate Banks for ESG-Style Commitment to UN Alliance, is essentially calling this a war between select states of the Union with those of the Rockefellers’ United Nations. Some highlights from the article [emphasis added]:

“A total of 19 state attorneys general have launched investigations of major financial institutions’ commitment to the U.N.-convened Net-Zero Banking Alliance.”

““The Net-Zero Banking Alliance is a massive worldwide agreement by major banking institutions, overseen by the U.N., to starve companies engaged in fossil fuel-related activities of credit on national and international markets,” Missouri Attorney General Eric Schmitt said in a statement regarding the investigations.”

“A May statement from the alliance states that it “does not support the financing of fossil fuel expansion” but notes that it “believes that immediate divestment from existing fossil fuel positions will not necessarily bring about the required real economy decarbonization that the world needs.””

So, in the Net-Zero Banking Alliance own words, it doesn’t even believe that these net-zero efforts will realise decarbonization.

In other words, they have set an unachievable target that they know will not amount to their true stated purpose (i.e., to save the planet from climate emissions).

Absolute madness.

Continuing with the Epoch Times piece:

““We are leading a coalition investigating banks for ceding authority to the U.N., which will only result in the killing of American companies that don’t subscribe to the woke climate agenda. These banks are accountable to American laws–we don’t let international bodies set the standards for our businesses,” Schmitt said.”

This statement touches upon the larger issue, namely that of ceding authority to a supranational organization with regards to their national laws and business standards.

The article continues with many of the same themes such as ESG and the like. The bigger worries here lie in the amount of time and efforts that will be required to push back on these.

We know that in the United States of America, states hold a significant amount of power regarding many aspects of society which could favor those, most likely red states, that wish to not partake in this globalist woke nonsense.

This may prove more difficult in Canada because of transfers by the federal government to provinces, among other factors.

Alberta in particular, because of its huge Oil sector, needs to carefully examine their current policies and stances and scrutinize what is in the works with regards to these net zero climate targets, lest they see their main source of income evaporate into the stratosphere.

Perhaps Alberta’s new Premier, Danielle Smith, can have the fortitude to push back on Trudeau & Carney’s highly destructive climate change policies, knowing what is at stake for the future well-being of all Albertans.

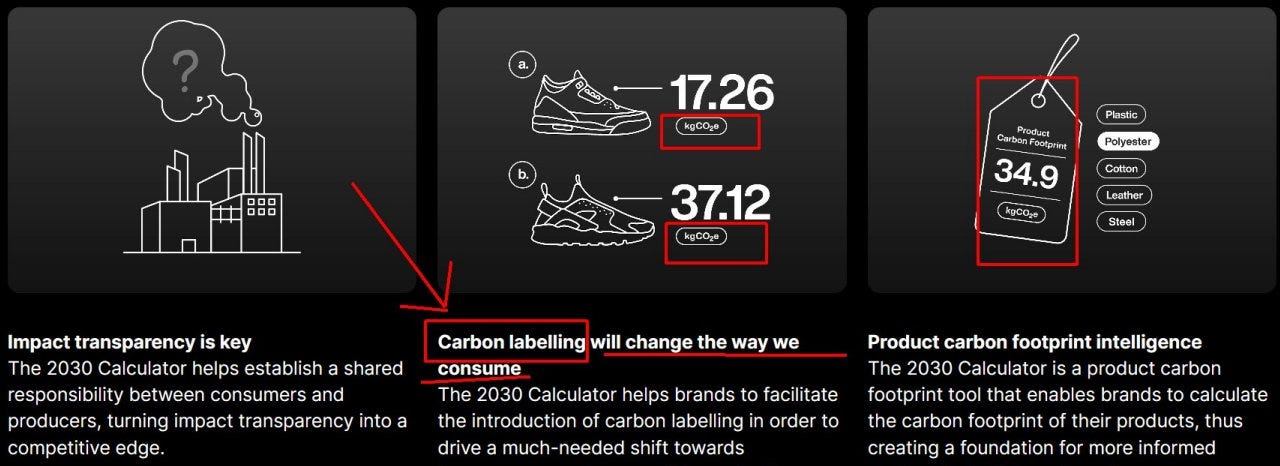

7. New 'Carbon Labelling' for Products with added 'Climate Tax'

If readers of this article think that all this carbon emission taxation is reserved solely for businesses, they should think again.

This global climate change agenda has metastasized itself into a colossal web, and its tentacles are absolutely everywhere.

Not only is it propagandised ad infinitum across mainstream and social media, it has also infected entire spans of companies’ value and supply chains including the retailers that sell their products as well as their marketing departments.

Companies left and right are redesigning and customizing their products, services, and advertising strategies to cater to the climate change agenda.

This includes labelling products to virtue signal their obedience to this fourth industrial revolution enterprise.

While thousands of relevant examples could be cited, here are but a few of them, and what they are poised to look like for the average consumer – along with the additional costs that will be appended onto prices.

Doconomy, a Swedish fintech company with apparent ties to the World Economic Forum (WEF), and a global network of clients and partners (to the tune of 750 million end-users), is leading the way by providing all the means necessary for companies and consumers to track their carbon footprints.

Not only do they have calculators – such as a Lifestyle Impact Calculator, Corporate Impact Calculator, and Product Impact Calculators (including the 2030 Calculator), but they are also facilitating partnerships with credit card companies (such as Mastercard) as well as a slew of other partners to ensure compliance to the net-zero gods.

As per the MarketWatch’s 2021 article Mastercard will let you track the climate impact of your spending habits, their intention is to track every single transaction their clients make and score them according to related carbon impacts. As stated by Chief Digital Officer John Lambert [emphasis added]:

“What we’re doing here is taking the calculator and embedding it inside the network so every transaction that moves through the network can be scored without the consumer having to do anything.”

How convenient. Card holders will thus inherently be scrutinized for their carbon consumption impact. Sorry Sir, your card’s been declined since you have reached your carbon credit limit.

And with regards to Mastercard’s own supply chain, Lambert stated:

“Mastercard is “already in good shape” when considering Scope 1 emissions, which are direct greenhouse gases from a company’s own sources, and Scope 2 emissions, which are tied to the purchase of electricity and other utilities that produce greenhouse gases. “We need to solve our Scope 3,” he said, referring to emissions that are linked to a company’s supply chain.”

And,

“Mastercard estimates that its supply chain accounts for more than 70% of its carbon footprint. It has been asking suppliers to make disclosures around their net-zero plans and will switch suppliers “if they cannot produce adequate answers,”

So, we can clearly see here that not only will they axe suppliers who do not acquiesce to climate disclosures, but will likely shut out actual consumers should their purchases exceed given carbon emission thresholds.

Relatedly, since 2019 Mastercard has already released a credit card with a “Carbon Emissions Limit”.

How long before Mastercard, Visa, and other credit card companies – including those issued by our Canadian banks – implement such restrictive measures?

As for product labelling, standards are already being established whereby products will have to indicate the carbon footprint that was used to produce it.

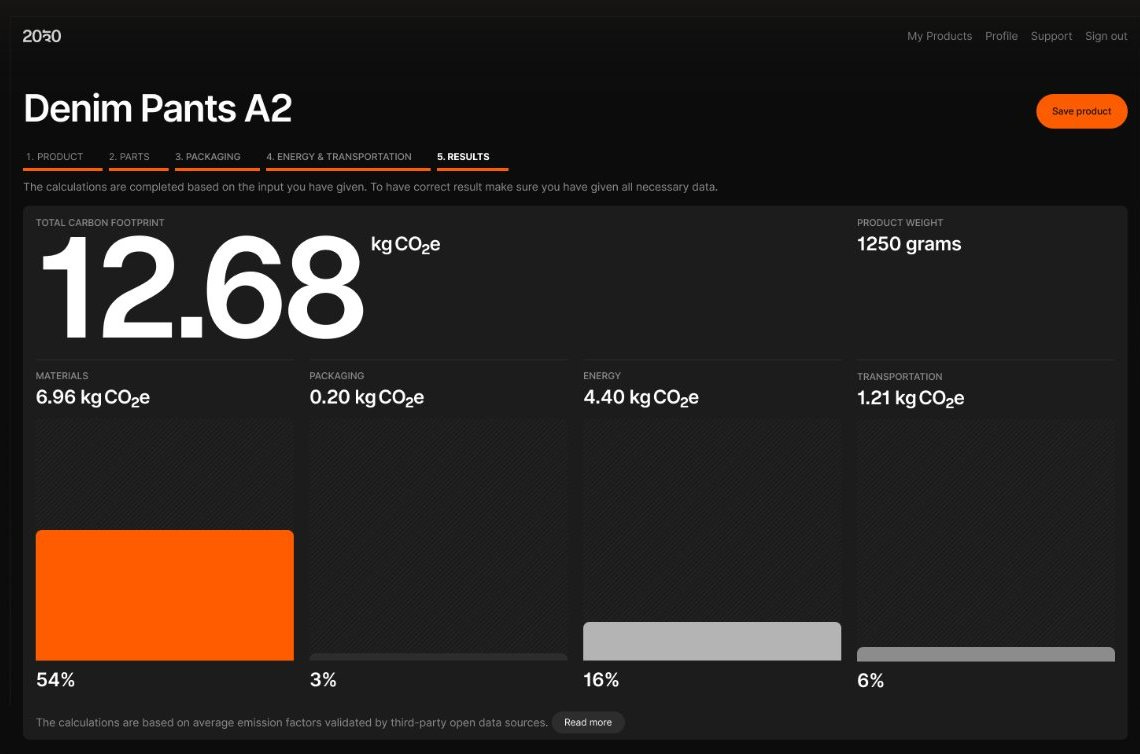

Doconomy’s Product Impact Calculator serves this very purpose. With it, brands will be able to “calculate their product’s environmental footprint with ease.” Aptly named the 2030 Calculator, the slick tool will permit companies to “quickly calculate the carbon footprint of their products, based on the emissions created from manufacturing and transport up until the point of sale.”

Everything from materials – packaging – transportation – and energy will be calculated in C02e units:

Doconomy’s Product Impact 2030 Calculator

Accordingly, the CO2e data will be labelled directly on products at the retail level:

The following screenshot provides us with a foreshadowing teaser of what is to come [emphasis added in red]:

In addition to all these marvels, Doconomy provides participating companies with a Corporate Impact Dashboard which works in similar fashion to the product impact one, but encompasses many more emission metrics spanning from Scope 1 ones to Scope 3 ones – all with the objective of “accurately” measuring their carbon footprints.

Consumers will also be subject to these additional emission costs since sellers will undoubtedly pass them on to them. Surprise, surprise.

Doconomy is also partnering with Plaid to enable carbon impact calculations for FinTechs and Financial Institutions to [emphasis added]:

“provide the world’s leading climate impact calculations, measuring impact per transaction in CO2e and H2O, to Plaid’s network of banks and FinTechs. The Plaid network connects with over 12,000 financial institutions and 6,000+ financial applications across the U.S, Canada, and Europe.”

We can see that Plaid is no small institution, for its network comprises over 12,000 financial institutions – many of which are in Canada.

8. Individuals' Carbon Footprint & Tax

As demonstrated in this exposé thus far, the average citizen will already be on the hook for a significant portion of these so-called carbon emission costs.

If financial institutions and credit card companies are practically all ready to go with the systems described herein to collect carbon taxes from their business clients, what will prevent them from doing the same to their individual clients?

Nothing.

They will do so and there’s no much you and me can do about it – unless we, the masses who greatly outnumber these swindlers, just say no. We all still have a say in where we park our hard-earned money and on what we spend it. Moreover, if enough of us would got to our banks and tell them we are pulling are savings out due to this folly, maybe they would reconsider adopting and implementing them.

Going forward, our collective decision-making will prove critical.

What can be perhaps even more worrisome is with regards to how we may be further carbon-taxed by our respective provincial and federal taxation authorities.

Each year we are required to complete a personal income tax return. What is to say that the Canada Revenue Agency (and provincial taxation agencies) won’t include new reporting lines in which our carbon footprint, or carbon credit score (analogous to the infamous Chinese social credit scores) will need to be entered (or somehow calculated) and declared as a taxable item?

This may seem somewhat far-fetched for now, but the extent to which they are pursuing these insane carbon emission policies proves that such a measure would not be beyond their consideration. After all, they are hungry to collect and suck additional tax dollars from each and everyone of us.

Another way individuals will be on the hook for this great carbon racket is at the pump.

Gasoline and diesel prices have already risen to record heights due in large part to the reduction in exploration for the oil & gas sectors as well as the punishments incurred by the companies operating in these industries.

Though extortionists such as Mark Carney continue to spew fantastical fairy tales that solar and wind will cover all our energy needs, the stark reality remains that they won’t and his words are complete and utter bullshit.

Moreover, the average Canadian does not have the financial means to by an electric vehicle such as a Tesla. We all need to drive to work, bring our kids to school, and go shopping for groceries. And the direction in which fuel prices are heading (due to the contributing factors stemming from this climate folly), most of us may not even have the option of continuing to use our gas-powered vehicles. How much money do you currently spend each month at the pump?

9. Tracking it all on the Blockchain

Tracking carbon emissions in the name of Climate Change would be incomplete without recording relevant transactions on a permanent ledger – for all to be able to see others’ carbon footprints.

As the new digital economy is driving us towards blockchain-based systems, there is no doubt that these carbon footprints discussed in this paper will need to reside on them for adequate reporting, tracking, and taxing.

In addition, carbon trading will require a fast and efficient platforms to ensure that investment banks and other institutional traders can profit from this new gravy train.

Who will be responsible for designing and developing such a system and what will it be comprised of?

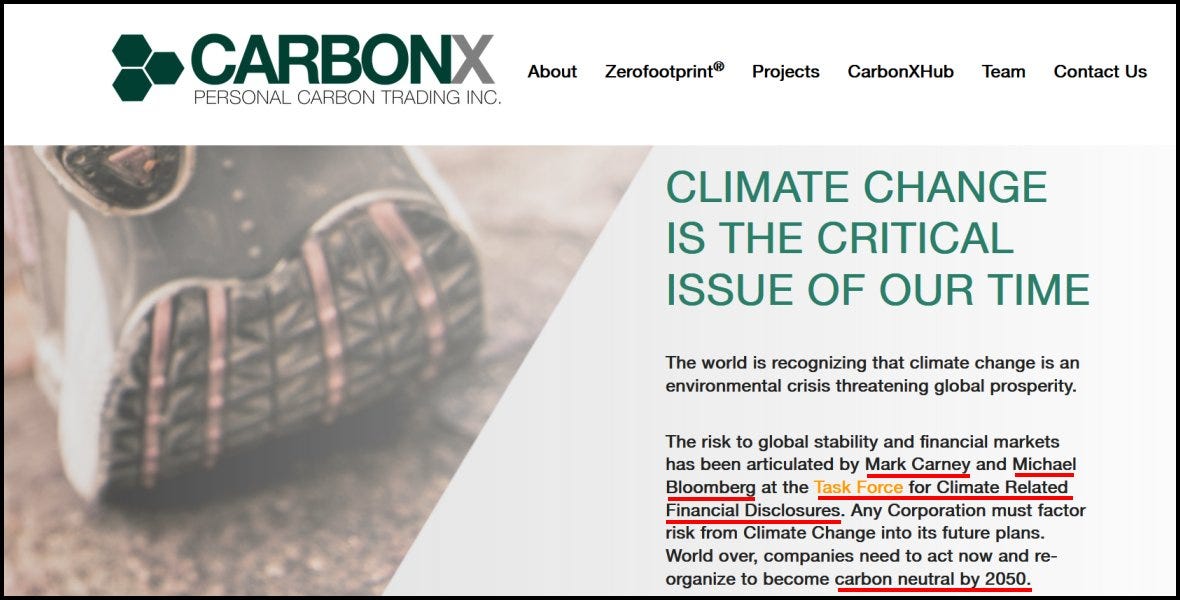

From this author’s perspective, the top contender has to be CarbonX and its Chairman Don Tapscott. The company’s home page provides us with undeniable hints as to why they may get the nod [emphasis added in red underlining]:

The usual suspects figure among it: Mark Carney, Michael Bloomberg, and the TFCD (Task Force for Climate Related Financial Disclosures), not to mention the not-so-subtle footprint on the left.

Further, the United Nations Sustainable Development Goals also figures prominently on its Projects page which indicates their subservience to the supranational organization and its questionable environmental agendas.

To evaluate this outfit, we must first have a look at its chairman, namely Don Tapscott.

Who is Don Tapscott?

Don Tapscott is a very well-known Canadian pioneer to all things relating to the ‘Digital Economy’. Tapscott is the CEO of The Tapscott Group as well as a contributor and Senior Advisor to the World Economic Forum (WEF).

Don Tapscott profile at the World Economic Forum

The popular and savvy entrepreneur doesn’t hide his Left-leaning, Democratic, and WEF loyalties. For, in a September, 2020 Coindesk article, he states the following [emphasis added]:

“The effects of all this were felt strongly in the United States, when President Donald Trump denied science and through his policies, personal example and divisive actions disarmed the nation from responding effectively to the pandemic. We all remember how he lost the election in November 2020, and refused to leave office, mobilizing armed militias and rank-and-file military personnel against their leadership to crush the mass demonstrations wanting to defend democracy. Fortunately, tens of millions of young people mobilized, and a general strike forced him to resign and hand over power.”

Either Mr. Tapscott is suffering from Trump Derangement Syndrome (TDS), or is purposely spewing WEF woke ideology to brainwashed zombified sycophants.

In the same article, Tapscott states that a universal basic income is needed and that:

“We need to price carbon into everything and reduce carbon emissions 90% by the year 2050. To do this, billions of people can be mobilized to fight climate change.”

What he really means here is that it will require billions to pay for this monumental scam.

But Tapscott is a great thinker. “Only those who understand the new paradigms as described in the latest book by Don Tapscott will not be displaced as individuals or businesses in the world of tomorrow,” stated none other than Klaus Schwab, Founder and Executive Chairman of the World Economic Forum in praise of one of Tapscott’s books.

Undoubtedly, just like Mark Carney, Tapscott is a true visionary. And the praise never ceases to end, for Tapscott himself applauds Mark Carney in a foreseeing 2016 LinkedIn article titled Mark Carney Has Started A Revolution By Embracing Fintech And Blockchain.

Like George Carlin use to say: “It’s a big club, and you ain’t in it.”

Don Tapscott co-founded the Blockchain Research Institute with his son Alex Tapscott.

According to its website, the Blockchain Research Institute (BRI) is an independent, global think tank, dedicated to exploring and sharing knowledge about the strategic implications of blockchain on business, government, and society. The BRI is funded by a consortium of international corporations and government agencies.

As far back as in 2017, the BRI, which is based in Toronto, has seen Canadian government agencies join its ranks which includes the provincial government of Ontario, the City of Toronto, and the Bank of Canada, as prominent members.

Don and Alex Tapscott, photo source: The Blockchain Research Institute

In July of 2020, the father and son duo wrote 5 ways blockchain can help the world better survive Covid-19 and the next crisis.

Screenshot [with emphasis added in red] from 5 ways blockchain can help the world better survive Covid-19 and the next crisis

And what is particularly concerning about this article (other than its near perfect alignment with the WEF and Klaus Schwab’s Great Reset), is its call for the “urgent need for global solutions” and how technologies can help prepare for the next crisis, i.e., the so-called climate crisis.

In the article, the Tapscotts advocate for the centralization of citizens’ health records along with a digital identity to better mitigate against challenges in fighting the Covid-19 Pandemic [emphasis added]:

“1. Digital identity, health records, and shared data

Data is the most important asset in fighting pandemics. If any useful data exists now, it sits in institutional silos. We need better access to the data of entire populations and a speedy consent-based data sharing system, like the University Health Network’s Patient Consent and Control pilot in Toronto. The trade-off between privacy and public safety need not be so stark. Through digital identities that enable us to share only the data needed, we can achieve both.”

It is stated black over white that they are seeking digital identities – most likely to secure those “billions of people [who] can be mobilized to fight climate change”.

If this seems like a far-fetched conspiracy theory drummed up by this author, think again.

The Bank of Canada has been hard at work preparing its upcoming CBDC (Central Bank Digital Currency) and it desperately needs the perfect blockchain technology and Fintech (Financial Technology) outfit to deploy it.

While it does remain to be seen which company or set of companies will be chosen to develop and implement the CBDC infrastructure for our new digital loonie, what remains certain is that Tapscott’s Blockchain Research Institute will play a key role.

From the Digital currencies and fintech: projects of its Research page, the Bank of Canada does re-emphasize that it is a founding member of the BRI which significantly indicates their importance to the Canadian CBDC project.

A final point of consideration regarding the blockchain we need to consider is the fact that Mark Carney has placed himself of the executive board of a notable digital payments company, namely Stripe.

Stripe is a multi-faceted North-American e-commerce, payments, and custom solutions platform that is involved in all kinds of blockchain projects ranging from digital identities to climate carbon tracking. Put simply, they seem to be the perfect fit to put forth all the necessary phone and computer Apps that the masses will use in the new digital slave economy.

Where the Blockchain Research Institute will provide the expertise with regards to the blockchain (hardware), Stripe is poised to provide the applications, most likely including the digital wallet to hold the Canadian CBDC, which will run on it (software).

Though we are most likely a few years away from a rollout of a Canadian CBDC, it is important for us to keep an eagle eye on who will be involved in developing its infrastructure along with which features they are planning to program into the digital currency.

Will these features include centralized tracking and carbon-taxing of our purchases? Many other questions also arise, and are left unanswered; but suffice it to say that we all need to be cognizant and diligent to what is headed our way.

10. Conclusion & Final Warning

The recent Covid-19 scamdemic has already cost Canadians – and billions around the globe – dearly in terms of lost jobs, businesses, and so on.

If this Climate Change looting scheme continues to be allowed and tolerated by the masses, it will destroy countless more small and medium-sized businesses and put millions more into poverty.

Sure, as proud Canadians we all love the environment and are, for the most part, its mindful stewards, but this climate doom and net-zero folly has to be abandoned in its current form – and preferably at the grassroots level. For, if it doesn’t, future generations of Canadians will be taxed into serfdom.

#TheClimateChangeHoaxMustGo

Note of disclaimer: None of the information contained in this article is to be taken as investment or financial advice. All opinions found therein are strictly those expressed by the author.

Notes:

This article is also published in:

The Counter Signal (abridged version)

And this article really shed's light on many of the myths propagated by the Climate Change brainwashed useful idiots: 'Zero Emissions' From Electric Vehicles? Here's Why That Claim Has Zero Basis, https://www.zerohedge.com/energy/zero-emissions-electric-vehicles-heres-why-claim-has-zero-basis

A great video by Jordan Peterson substantiating a lot of what I claim is a fabricated hoax: Wicked Globalists Are Causing Starvation and Poverty Under the Guise of Environmentalism, https://www.youtube.com/watch?v=tF5spyudTYA