How the [Public] Bank of Canada was taken over by the [Private] Bank for International Settlements (BIS)

Commentary by Dan Fournier, published Thursday, March 14, 14:10 EDT on fournier.substack.com

“Once a nation parts with control of its currency and credit, it matters not who makes the nation’s laws. Usury, once in control, will wreck a nation. Until the control of the issue of currency and credit is restored to government and recognized as its most sacred responsibility, all talk of the sovereignty of parliament and of democracy is idle and futile” - William Lyon Mackenzie King, Tenth Prime Minister of Canada, 1935

Let this brief post serve as a paramount lesson in Canadian history which ought be known to all and never be forgotten.

Canadians have been betrayed on a monumental scale, not only once, but twice.

First, by Pierre Elliot Trudeau and his Liberal Government.

Second, by the Supreme Court of Canada.

Summary Timeline

1930: The Bank for International Settlements (BIS) is established.

1934: Chartered under the Bank of Canada Act, the Bank of Canada is established under private ownership and becomes the central bank.

1938: The Bank of Canada is nationalised (made public) and designated as a Crown Corporation by the William Lyon Mackenzie King Government.

1939 to 1974: The Canadian Government borrows on an interest-free basis from its central bank.

1974: The Bank for International Settlements (BIS) forms the Basel Committee with the Pierre Trudeau Liberal Government joining in the deliberations.

1974: Trudeau’s Federal Government stops borrowing from the Bank of Canada and henceforth begins to borrow from private banks at interest.

2011: The Committee On Monetary and Economic Reform (COMER) files a lawsuit against the Bank of Canada.

2012: The Canadian Government had paid C$1 trillion in interest (twice its national debt) to the private lenders on its debt.

2015: Justin Trudeau becomes Prime Minister of Canada.

2017: The Supreme Court dismisses the Constitutional Bank of Canada (COMER) case.

2023: The Canadian National Debt reaches C$1.178 trillion

[Unlike Politicians & the Media] Numbers Don’t Lie

Before showing some fancy graphs, let’s start with the raw numbers.

Feel free to notice the differences in incremental changes from year to year.

Net federal government financial debt (in millions of dollars)

The following numbers (in millions, from 1930 to 2008) are sourced from Statistics Canada.

1867 $75.7

...

1913 $314.3

...

1930 $2,178

1931 $2,262

1932 $2,376

1933 $2,596

1934 $2,730

1935 $2,846

1936 $3,006

1937 $3,084

1938 $3,102

1939 $3,153

1940 $3,271

1941 $3,649

1942 $4,045

1943 $6,183

1944 $8,740

1945 $11,298

1946 $13,421

1947 $13,048

1948 $12,372

1949 $11,776

1950 $11,626

1951 $11,427

1952 $11,163

1953 $11,151

1954 $11,092

1955 $11,229

1956 $11,241

1957 $10,967

1958 $11,015

1959 $11,627

1960 $12,047

1961 $12,394

1962 $13,378

1963 $14,079

1964 $15,262

1965 $15,748

1966 $15,381

1967 $15,866

1968 $16,713

1969 $17,396

1970 $18,095

1971 $18,581

1972 $19,328

1973 $20,123

1974 $21,580 (the year we stopped borrowing interest-free)

1975 $24,769

1976 $28,573

1977 $32,629

1978 $45,846

1979 $59,040

1980 $72,555

1981 $86,280

1982 $99,600

1983 $128,302

1984 $164,532

1985 $209,891

1986 $245,151

1987 $276,735

1988 $305,438

1989 $333,519

1990 $362,920

1991 $395,075

1992 $428,682

1993 $471,061

1994 $513,219

1995 $550,685

1996 $578,718

1997 $588,402

1998 $581,581

1999 $574,468

2000 $561,733

2001 $545,300

2002 $534,690

2003 $526,492

2004 $523,648

2005 $523,344

2006 $514,099

2007 $508,122

2008 $490,412

NOTE: The following numbers are also from Statistic Canada (fiscal year ends March 31):

2009 $492,352 (Sept.)

2010 $504,236

2011 $551,380

2012 $576,530

2013 $602,420

2014 $618,426

2015 $611,346

2016 $616,919

2017 $636,195

2018 $668,637

2019 $683,290

2020 $704,167 (Covid-19 Pandemic begins)

2021 $1,035,266 (The Debt reaches over a trillion dollars)

2022 $1,140,117

2023 $1,178,824

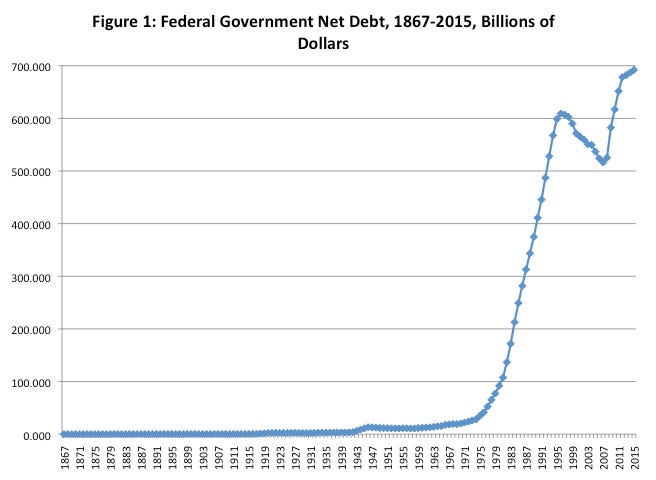

And now for the chart from The Fraser Institute (until 2015) to put things in a visual perspective, showing the steep upward trajectory of our debt starting from 1975:

Figure 1: Federal Government Net Debt, 1867-2015, Billions of Dollars. Source: The Fraser Institute’s A really quick history of Canada’s federal debt, March 9, 2016.

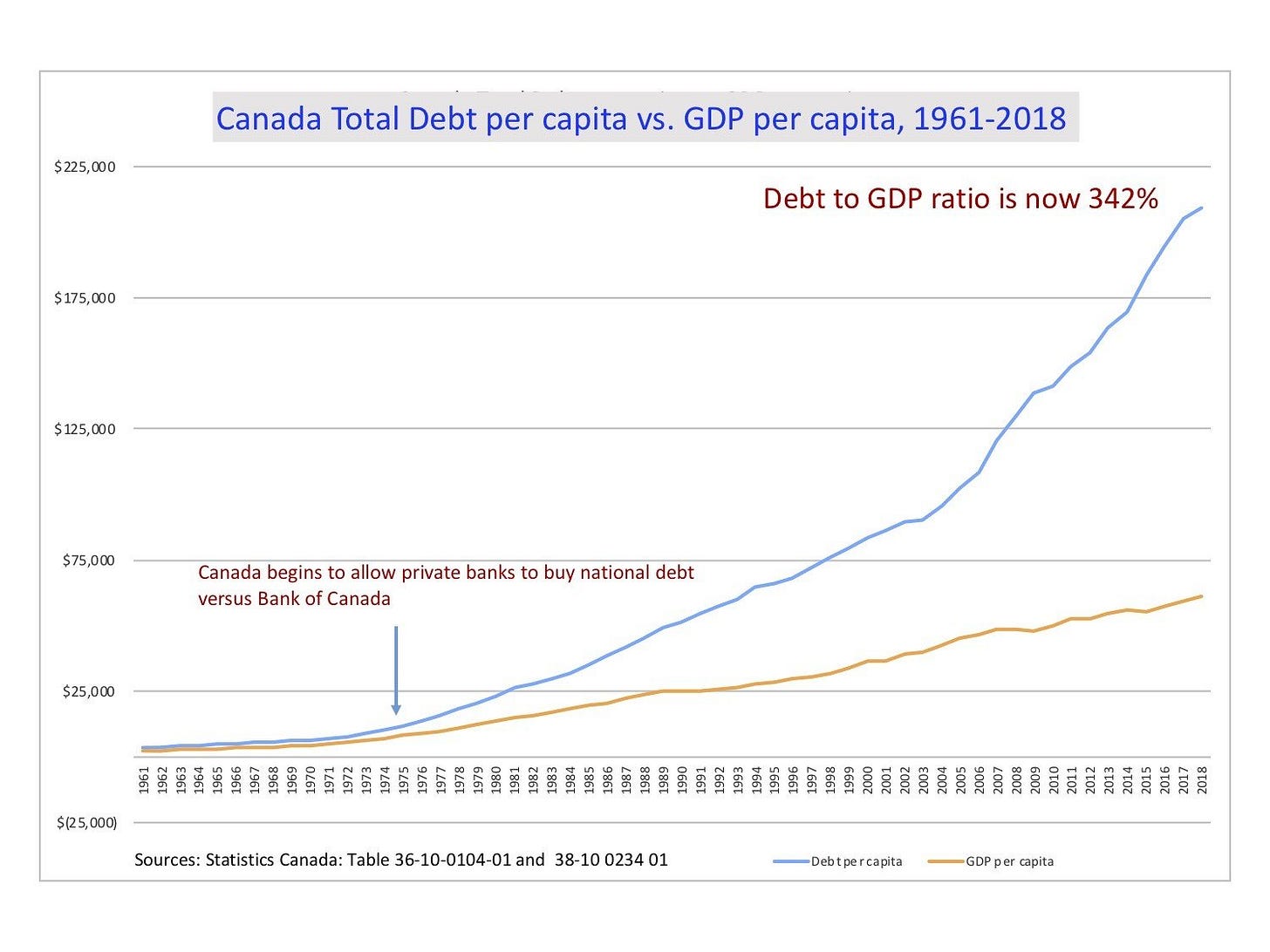

Here is another chart showing Canada’s Total Debt per capita vs. GDP per Capita (from 1961 to 2018):

Canada Total Debt per capita vs. GDP per capita, 1961-2018. Source: LinkedIn – And free us of our debts: Returning Canada to a public banking model by Mark Anielski, January 13, 2019.

The graph above also shows how our Debt per capita (i.e., per person) has steeply increased since 1974-1975.

While these two graphs do not show the data for the years past 2015 and 2018, respectively, you can easily plot or visualise their continued paths.

As the header of this section says, the numbers don’t lie.

We are often told by politicians that the “budget will balance itself” and that “interest rates are at historic lows,” and that “inflation is tame” but the numbers and, surely, your monthly budget expenditures tell a completely different story.

What the Hell Happened?

A lengthy and detailed account of what lead to this could be provided; but instead, a more simplified version will suffice since the objective here is for this critical lesson to be learned, digested (if possible) and remembered.

In short, two monumental betrayals, or what some would call treason, occurred.

One happened half a century ago, and the other less than a decade ago.

Before describing these two betrayals, we must first understand that traditionally, leading up to 1974 the Government of Canada was able to borrow money from The Bank of Canada without the burden of paying interest since this central bank is a public institution.

We must also understand that in the early- to mid-1970s inflation started to rise sharply (partly because of the 1973 oil crisis happening at the time), with rates topping 10% in 1975.

The crisis brought about new economic schools of thought and monetary policies (like monetarism or gradualism) and ideologies such as neoliberalism which favoured the expansion of credit – better known as money printing (for which banks increase the money supply and then lend it to governments at interest).

“The maintenance of an average rate of growth of the money supply no higher than the long-term average rate of growth of the production of goods and services in Canada ...is required if the inflation is to be brought under control” – Gerald Bouey then Governor of the Bank of Canada, Saskatoon Manifesto, September 22, 1975. Source.

Note that at the end of the government fiscal year of 1974, the Canadian Debt was C$21 billion, compared to over C$1.2 trillion today.

Betrayal #1 in 1974: Prime Minister Pierre Trudeau

Prime Minister Pierre Trudeau in 1975. Photo source: Wikipedia.

In 1974 through the reckless and traitorous actions by the Prime Minister Pierre Trudeau and then Governor of the Bank of Canada Gerald Keith Bouey, a new era emerged which has put Canada on the destructive path of an expansionary monetary policy which has brought about gargantuan levels of debt and soaring inflation.

Graph showing Canada’s increase in Money Supply (M1) from 1976 to 2022. Source: Bank of Canada via Trading Economics.

By the phrase ‘expansionary monetary policy’ from the last paragraph, I mean the increase in the money supply (which in economics is referred to as M1).

So, as is clearly shown in the graph above, Canada’s money supply began to increase at a significant pace just past 1976.

As per a Bank for International Settlements document from March 2001, the “Basel Committee was established as the Committee on Banking Regulations and Supervisory Practices by the central-bank Governors of the Group of Ten countries at the end of 1974 in the aftermath of serious disturbances in international currency and banking markets.”

As a member of the Group of Ten, Canada was part of this Basel Committee (formally the Basel Committee on Banking Supervision) which was formed in 1974 and is a BIS-led group that agrees on standards for bank capital, liquidity and funding.

Moreover, the Basel Committee provides a forum for regular cooperation on banking supervisory matters.

It is named the Basel Committee since it is headquartered in Basel, Switzerland (as is the case for the headquarters of the BIS)

In Short, the BIS or Bank for International Settlements is a central bank of central banks which steers its member banks towards monetary and financial cooperation.

While it may be seen or considered as a dignified organisation, in reality the BIS is an unregulated supranational entity that has no supervising authority and is not accountable to anyone or any country.

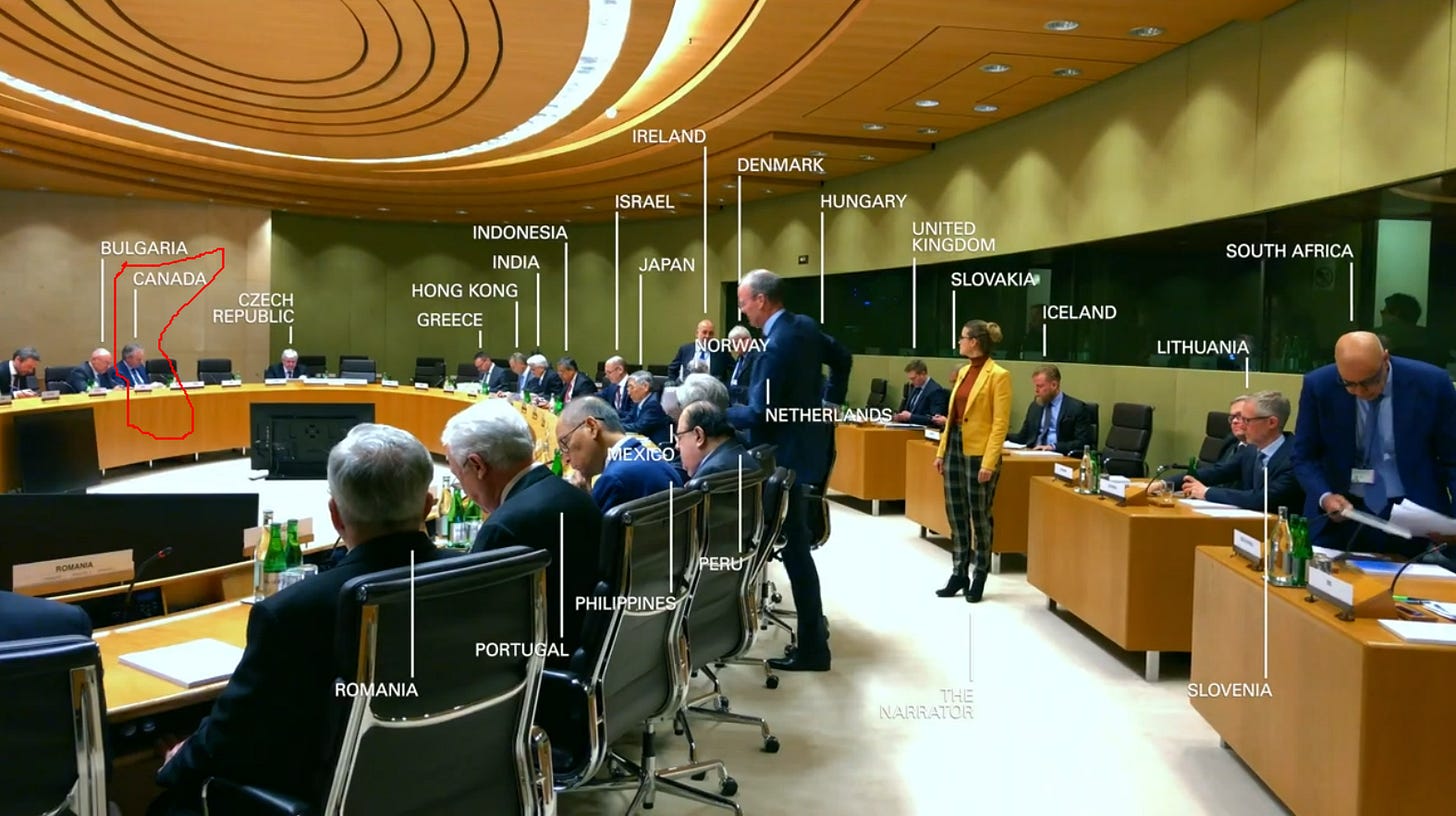

Member central bank Governors meet every two months at the BIS.

Each year there can be over 200 meetings.

All its meetings are conducted in secrecy and their minutes, speeches, and documents remain strictly confidential and privy only to attendees.

This is not conjecture, it is clearly affirmed by a spokesperson for the BIS as per the following official video:

Near the end of the video the spokesperson states:

“Well, as I expected we had to leave the meeting right on time. These discussion among the [central bank] Governors can only be really open and honest if confidentiality is maintained.”

Earlier in the video, she also says:

“The main purpose of BIS meetings is to build consensus among central banks and supervisory authorities. Once consensus is reached here, it is up to each central bank or supervisory authority to see to it that the outcome is implemented in their home countries.”

These statements are overtly and ominously telling, as they confirm that ultimately it is the central banking authority, i.e., the BIS itself, who gets to decide which monetary or financial policies get implemented by individual countries.

This implementation is communicated by the respective central bank Governor and consequently by the central bank itself.

Screenshot of the video ‘This is the BIS’ showing various central Bank Governors during a bimonthly ‘All Governors’ Meeting’ including Canada’s (labelled and circled in red, presumably Tiff Macklem, the Bank of Canada Governor at the time of this meeting). Source: Bank for International Settlements YouTube channel, dated Feb. 2, 2022.

Not even our elected officials (Members of Parliament) can know of the secret dealings that take place with these committees at these meetings.

Yet, directives and policies that emerge from our central bank, The Bank of Canada, originate from this supranational entity.

A superb introductory video on the BIS is found in the last section of this post along with additional related notes from this author.

That being said and coming back to the primary issue at hand, there is little doubt that the expansionary monetary policies conducted by the Bank of Canada in the years that have followed the creation of the Basel Committee in 1974 (with the first meeting taking place in 1975), have originated from there and continue to the present day.

A 2018 article by Canadian Dimension states it succinctly [with emphasis added]:

“In 1974 the Bank for International Settlements (the bank of central bankers) formed the Basel Committee to ostensibly establish global monetary and financial stability. Canada, i.e., the Pierre Trudeau Liberals, joined in the deliberations. The Basel Committee’s solution to the “stagflation” problem of that time was to encourage governments to borrow from private banks, that charged interest, and end the practice of borrowing interest-free from their own publicly owned banks. Their argument was that publicly owned banks inflate the money supply and prices, whereas chartered banks supposedly only recycle pre-existing money. What they purposefully suppressed was that private banks create the money they lend just as public banks do. And as banking specialist Ellen Brown states:

The difference is simply that a publicly-owned bank returns the interest to the government and the community, while a privately-owned bank siphons the interest into its capital account, to be reinvested at further interest, progressively drawing money out of the productive economy. ”

Put simply, it is a scam since a public central bank could lend the same money to a Government interest-free whereas a private central bank (or chartered banks) charges interest which inevitably leads to increased levels debt (as was clearly and painfully) demonstrated in the previous section of this post.

What journalist John Ryan from Canadian Dimension wrote back in 2018 is to the point [with emphasis added]:

“It appears that this decision was made without informing Canada’s parliament. This was such a fundamental change of policy that it should not only have been debated in parliament, this should have been put to a national referendum. Strangely, even when this became known, this was apparently never questioned by the opposition parties, especially the NDP, and never revealed in the media. Strange indeed.”

As such, we have Pierre Trudeau and Bank of Canada Governor Gerald Bouey to thank for this miscarriage of duty which has resulted in soaring levels of debt and rampant inflation.

Betrayal #2 in 2017: The Supreme Court of Canada

Before demonstrating the betrayal of the Supreme Court of Canada it is first important to explain who had initiated the lawsuit against them.

It was the Committee on Monetary and Economic Reform, or COMER on the behalf of plaintiffs (listed further below in this post).

COMER is a Toronto-based think tank that advocates for necessary changes in monetary policy and economic reform.

“We argue that a fair, equitable economic theory is well within our grasp, a theory within which monetary policy may be constructively brought into being for the benefit of all Canadians,” states their About page.

In December of 2011, COMER filed a lawsuit (press release here; see also the Amended Statement of Claim), a constitutional challenge to the Bank of Canada and the Minister of Finance in refusing to provide interest-free loans to the federal and provincial governments.

This was “the central reason the bank was set up initially in 1937,” stated Rocco Galati – the constitutional lawyer said during a February 11, 2015 press conference.

While the case is not a simple one, Galati summarised it in broad strokes during this press conference which can be viewed hereunder.

During his talk, Galati emphasised how Canada, its provinces and even its municipalities had been able to secure interest-free loans for major infrastructure projects:

“This is how historically we paid our World War II debt, we paid for the Trans-Canada Highway, we paid for the St. Lawrence Seaway, and we paid for the explosion of the building of universities in the [19]60s and [19]70s across the country.”

The lawsuit also challenged the joining of Canada to the Bank for International Settlements (BIS) in what Galati correctly refers to as “foreign private bankers.”

Constitutional Lawyer Rocco Galati. Image source and credit: Aaron Harris for The Toronto Star.

After noting that Canada is the only G20 member with a public bank, the lawyer also confirmed the level of secrecy that the Governor of the Bank of Canada and the Finance Minister maintain due to its connection to the BIS [with emphasis added]:

“the minutes of the meetings that our bank Governor has with these other bankers – even though he reports them to the ministers, Minister of Finance and Parliament – he claims are held secret and we’re not allowed to know the the the the content of those meetings. That’s also being constitutionally challenged.”

Later in his talk Galiti destroys the ridiculous claim made by the Finance Minister that borrowing from the public bank instead [or a private one] would cause inflation which he refers to as a “metric ton of horse shit.”

Further commenting on the case, Galati mentioned that at the first level the government [lawyers] brought a motion to strike the whole claim (which runs at about 25-26 pages) based on the grounds that it was not “justiciable” and that the courts didn’t have the right or the expertise to hear the case.

The claim was struck, and Galati appealed on behalf of the Plaintiffs (William Krehm and Ann Emmett).

Galati was successful on the second level (of the judicial proceedings) in that the constitutional challenge part of the claim (with respect to the manner in which the bank was managed) could remain.

The COMER case went through five and a half years of litigation.

Without getting into the lengthy details and specifics, suffice it to say that this case found a path all the way to the Supreme Court of Canada.

Tragically for Canada, its provinces, and people, though, the Constitutional Bank of Canada case was ultimately dismissed by the highest court.

Part of COMER’s statement (archived here) on the matter includes the following:

“Toronto, May 31, 2017 – After nearly 5.5 years of contentious litigation between the Committee On Monetary and Economic Reform (COMER) and the Government of Canada involving three separate Federal Court and two additional Federal Court of Appeal hearings resulting in contrary decisions, on May 4, 2017, the Supreme Court of Canada dismissed COMER’s “leave” (permission to appeal) application from the second judgment of the Federal Court of Appeal.

Following established practice, the federal Supreme Court does not issue reasons when it dismisses a leave application. The dismissal by the Supreme Court of the Leave application, means only that the Court does not want to hear the appeal. The jurisprudence on this is clear: it does not mean that the lower court decisions are correct in law. The possible reasons for the Supreme Court not wanting to hear the case are many and various, including the washing of their hands or “deference” to the political process – hence, this is why reasons are not issued by the Supreme Court in leave dismissals.”

Put simply and though the reason for dismissing the case was not specifically mentioned, it appears that the Supreme Court of Canada sought to abrogate or distance itself from the case on the grounds that it was deemed too political in nature.

Moreover, the disastrous ballooning of our national debt and rampant inflation have caused countless hardships on Canadians whilst our Members of Parliament continue to approve budgets for which we can ill afford to continuously borrow billions of dollars at hefty interest costs to the benefit of private banks.

Though this author is not a lawyer and merely a journalist and proud citizen of Canada, it is my staunch reasoned opinion that a case as important as this one with monumental implications for the well being of Canada as a whole, its provinces, and municipalities along with its millions of inhabitants, that much more care and consideration should have been granted to this constitutional case by the Supreme Court of Canada and its judges.

They have GRAVELY FAILED in their solemn duty and responsibility to be impartial and void of the excuse or cowardly facade of having wanted to remain apolitical.

They have – whether purposely, incompetently, under coercion or external pressure – betrayed the Canadian public to the benefit of foreign bankers.

And that, unless this matter somehow becomes resuscitated, is for generations to come.

The Basel Committee & BIS Secrecy

Though dating from October of 2014, Stephan Smith has produced an excellent explanatory video titled The Bank for International Settlements -The Most Powerful Bank in The World (alternate video link here) which I strongly encourage the reader to watch.

Moreover, I have also written extensively about the BIS on my Substack and during interviews.

I have also provided a little known secret of this shady supranational organisation – who none of us have elected, by the way.

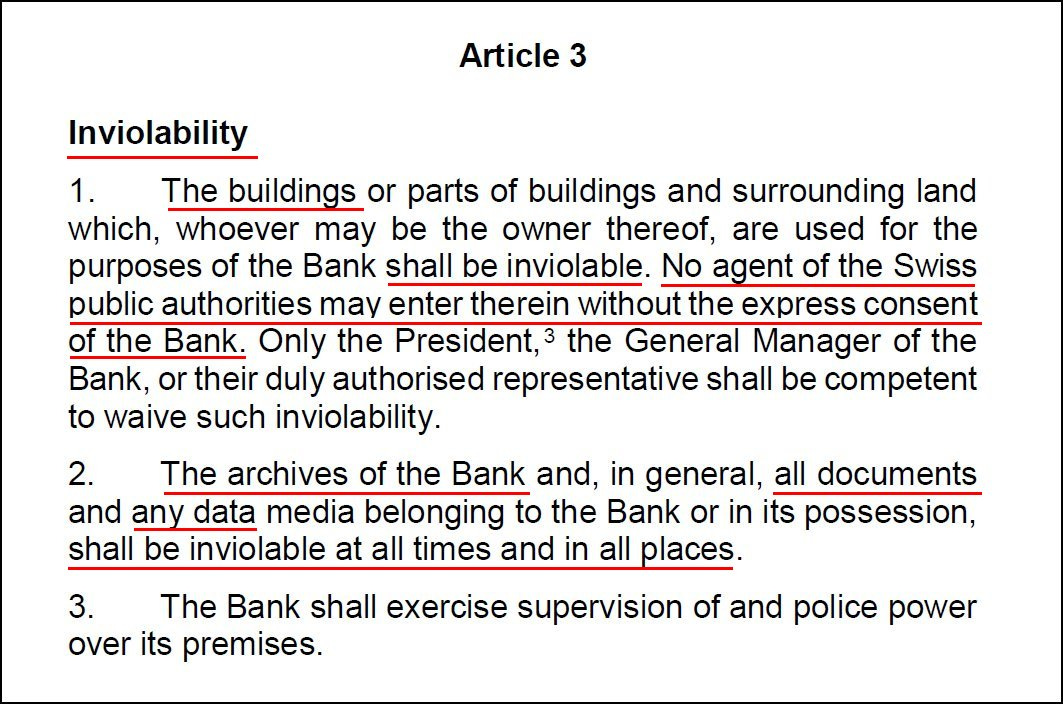

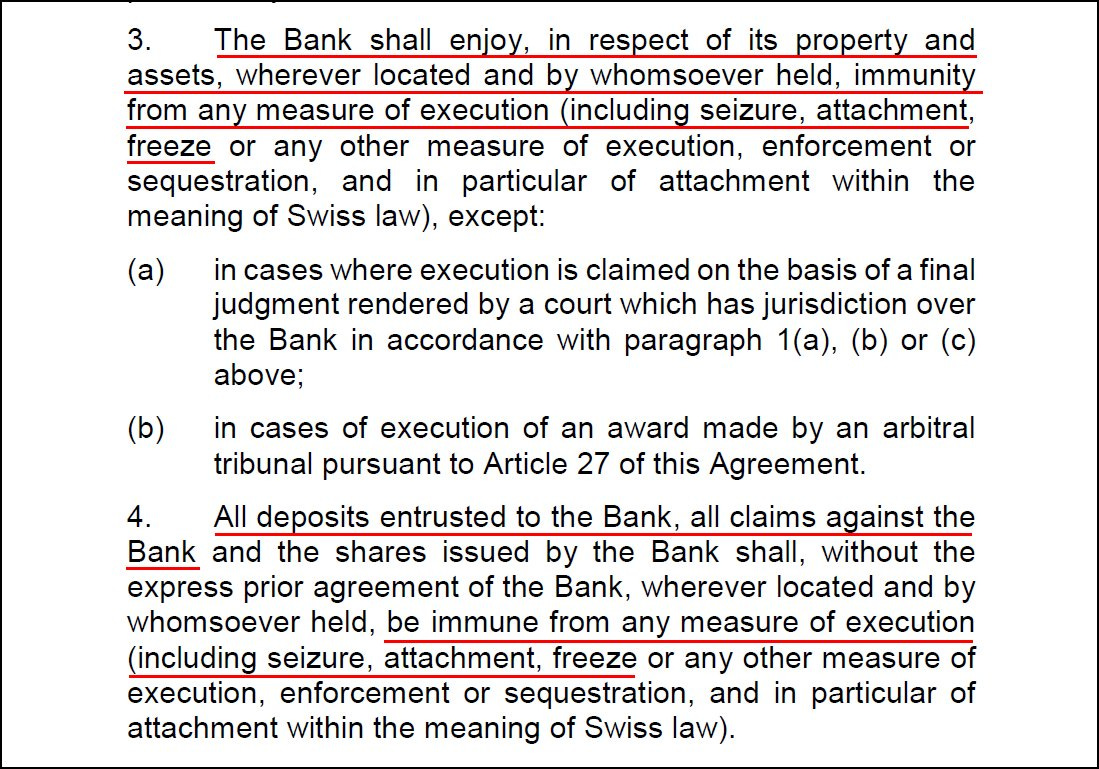

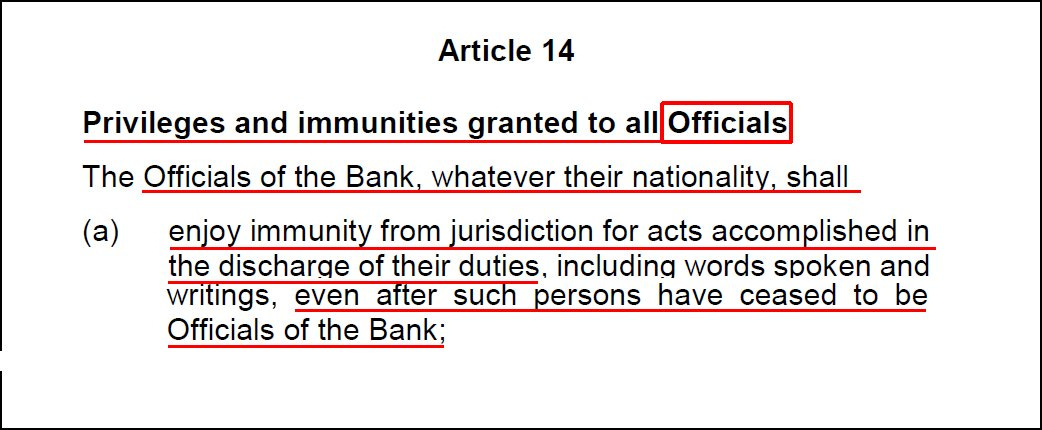

That is to say (as was mentioned by our dear friend Stephan Smith from the video above), that the BIS has a special agreement with the Swiss government in that it enjoys total immunity from prosecution.

This is not conjecture, for it is clearly written and can be consulted in their own official document titled Agreement between the Swiss Federal Council and the Bank for International Settlements to determine the Bank’s legal status in Switzerland (archived here).

Apart from the BIS and its employees not having to pay income taxes (unlike us slaves) here are but some of the privileges and immunities they hold:

How to Fix This? Is there Hope?

First, it should be noted that the Bank of Canada still is and remains a public bank.

It appears that the ?only? way to fix this would be for a new similar claim to be brought, perhaps by a larger or more noticeable group of plaintiffs.

The masses would also need to mobilise at the court houses at every step of the process to remind judges that they are watching over their actions and will, collectively, hold them to account in The Court of Public Opinion.

Whether that happens or not is up to you.

The alternative is to remain a financial slave and impose that same dreary fate on your children and theirs.

Time will certainly tell.

Wisdom is action.

Recommended Reading & Resources

Here are some excellent resources (especially the first two) which you can consult to learn more.

CanuckLaw.ca – Restoring The 1934 Bank Of Canada Act, May 27, 2019

Canadian Dimension – The Bank of Canada should be reinstated to its original mandated purposes, March 21, 2018

Committee on Monetary and Economic Reform (Comer), The Economic Think Tank of Canada

UNDERSTANDING Canada – Much Ado about 1974: The Bank of Canada in the 70s, Nov. 23, 2019

Cultural Action Party of Canada – Cover-Up: How Pierre Trudeau Established International Banking’s CONTROL Of The Canadian Economy, October 28, 2020

rabble.ca – Can the courts liberate the Bank of Canada? April 17, 2015

GlobalResearch.ca – Oh Canada! Imposing Austerity on the World’s Most Resource-rich Country, April 1, 2012

Bank for International Settlements:

And if you are not that familiar with the Bank for International Settlements then these sources should help.

BIS Official website, www.bis.org

Video: The Bank for International Settlements - The Most Powerful Bank in The World, Oct. 8, 2013

Investopedia – Basel Committee on Banking Supervision: Meaning, How it Works, Updated August 6, 2022

Financial Crime Academy – The Basel Committee: The Important Set of International Banking Regulations, November 29, 2023

I am the eye in the sky

Looking at you

I can read your mind

I am the maker of rules

Dealing with fools

I can cheat you blind

- Alan Parsons, Eye In The Sky

Support Independent Journalism

As an independent journalist, I take great care and pride in providing my audience with quality investigatory work and writings.

This is the kind of work that is seldom reported on in as much detail by the mainstream media, for they also tend to avoid the subjects and sometimes controversial topics that I, myself cover.

As an independent, I get paid very little for this work, for the bulk of my revenue comes from Substack subscriptions, and I am mostly surviving and supporting my family by means of personal savings.

You can support my work by considering a paid subscription to my Substack – Dan Fournier’s Inconvenient Truths (for only $5 a month, or $50 a year).

I am still waiting for a Founding Member for my Substack which could be you.

For one-time donations, you can also buy me a coffee.

If you are unable to support my work financially, it is greatly appreciated if you can share it on your social media feeds, for this brings additional exposure (and much needed eyeballs) which can lead to new paid subscribers.

Your comments are most welcome and appreciated and can be given in the Comments section below.

I sincerely thank you for your time and support.

May God bless you all.

In Peace & Liberty,

Addendum (2024-03-16) - Twitter/X Spaces: Bank of Canada Treason?

Last night I joined in a Twitter/X Spaces organised by WogPog where I conversed on this issue with some very intelligent and articulate individuals. Though there were some occasional technical sound issues, the talk is very well worth the listen.

You can listen to a replay of it on Rumble (note: I start speaking around the 24:36 mark):

Addendum (2024-03-20) - What makes a Central Bank a public institution?

An extremely eloquent post (archived here) was made by Buck (who also figured as a participant of the discussion Bank of Canada Treason? mentioned in the previous Addendum above) which answers the key question What makes a Central Bank a public institution? along with other very astute observations which makes for a MUST READ by all.

Click on the link above or image below to view and read it in its entirety.

The quality of this post by Buck is so outstanding that I wanted to include it as an addendum to this post for increased visibility and posterity, and to make sure it doesn’t get drowned in depths of X’s vast ocean.

Thank you Buck for your amazing contribution to this critical discussion.

Disclaimer:

None of what appear in this Commentary is to be taken as legal or financial advice.

See the author’s About page for full disclaimer.

Good-Going bringing this to light Dan!

We must not forget how the pieces of the Big ( Canadian Banking ) Picture came together. 👍🏻👍🏻

I did not realize Canada sold out to the central bankers fraud so late in our history. 1974. Wow. I also read somewhere that the CRA is part of the. BIS. tax collection is so effective because so much of a countries dollars are swept away by the central bankers. All while the country increasingly falls apart and inflation ensures an ever increasing pot of money for central bankers. What a scam. One I think countries have attempted to fight off for centuries.