One Great Financial Reset, Two New Monetary Systems

Prophetic commentary by Dan Fournier, published June 25, 2025 at 7:45 EDT.

Sections:

4. The Split: Two New Global Monetary Systems

4.1 SYSTEM #1: Tokenised Digital Currency for Western-Bloc Countries (lead by the BIS)

4.1.2 Agents of Change (those implementing) the new Western Monetary System

OPERATIVE #1: Scott Bessent

OPERATIVE #2: Howard Lutnick

OPERATIVE #3: JD Vance

OPERATIVE #4: Peter Thiel

OPERATIVE #5: David Sacks

OPERATIVE #6: Elon Musk

4.2 SYSTEM #2: The Eastern/Chinese Gold-backed Trade Settlement System

1. Introduction

Here we find ourselves at a crossroads, a critical juncture in human history.

As we are witnessing the final chapter in the current iteration of a decayed global financial system, monumental shifts have already begun to emerge, paving the way for what will serve as not one, but two new monetary systems which will define how commerce, trade, and geopolitical relations will continue forward into the rest of the 21st century.

This thesis will outline the causes, characteristics, and likely outcomes of what we will call The Great Financial Reset.

Like it or not, we are living in a digital age and practically everything will be digitised. This includes not only our money, but our very own identities, our assets, and nature itself.

A lot of background information will be provided in order for the reader to fully grasp the radical changes, good and bad, which inevitably lie ahead.

The main enablers who have been tasked to bring about these new systems will be revealed, along with their well-calculated methods.

Like with the creation of the United States Federal Reserve in 1913, the handlers, the ones who have devised one of the new systems, will also be revealed and exposed.

We will see how a major split between East and West over the past several decades has served as a springboard towards new paradigm shifts.

Finally, we will explore ways to best weather the storm and perhaps even profit from these coming changes.

As this will be a long ride, feel free to jump to any desired section by clicking on the links in the index section at the top of this post.

2. The Broader Geopolitical Context

"There are decades where nothing happens; and there are weeks where decades happen," – Vladimir Lenin

It is a fool’s errand to attempt to try to delineate a global financial and monetary reset without examining and contemplating broader geopolitical trends.

Therefore, this sub-section will do just that.

There are three main themes that are at play with regards to these geopolitical shifts, namely:

Moving from a unipolar hegemonic world to a multi-polar one;

Waning of the Anglo-American Special Relationship;

The Digitilisation of everything.

Inevitably, war almost always figures among such huge geopolitical shifts (and fading empires); so, we must add this to the overall equation.

And keep in mind that warfare isn’t restricted to the kinetic realm (soldiers, tanks, bombs, etc.). It also includes economic means along with evolutionary adaptations to its current fifth-generation iteration which includes cyber and cognitive battlefields.

Accordingly, allow me to offer my broader views on how such warfare tactics apply, directly or indirectly, to each of the thee main themes enumerated above.

2.1. Moving from a unipolar hegemonic world to a multi-polar one

Burdened by the costs (human, economic, social, political, and environmental) of its never-ending wars epitomised by its gargantuan debt (fast approaching $37 trillion), the American Empire is arguably approaching the end of its reign as an undisputed hegemonic power. It can ill-afford to maintaining its role as world police, nor maintain its 4,800 military sites in 160 countries including 750+ bases present in 80 countries (according to Al Jazeera as of July 2021).

In the past couple of decades, China has developed at breakneck speed, emerging as a superpower flexing its own military and economic might through the One Belt One Road initiative (a.k.a. the New Silk Road), solidifying its participation as a prominent member of the BRICS economic bloc, and fostering its numerous bilateral trading partnerships with countries around the globe.

While the United States can still easily coerce countries through its military and weaponised dollar system, it cannot do so with China, at least not directly.

Beijing is unafraid to defy Washington with regards to the numerous sanctions it has imposed on its strategic partners in Russia and Iran, but to name a few. Not only does China trade goods directly bypassing the U.S. dollar with these partners, but it has also developed its own rival international payments system called CIPS as a substitute to the weaponised SWIFT international payments system that the U.S. has longly abused.

Japan, a key U.S. ally has recently shown a sincere rapprochement with its long time archenemy China, as it resists Trump’s efforts to form a trade bloc against its main economic rival.

This reconciliation between these two Asian nations is further substantiated by commitments made by ASEAN (Association of Southeast Asian Nations), a major trading bloc and regional grouping of 10 states in Southeast Asia, whereby they agreed to further strengthen regional financial cooperation, as per a recent (May 4, 2025) joint statement of the 28th ASEAN+3 Finance Ministers’ and Central Bank Governors’ Meeting.

In Europe, the European Commission has deployed its own ‘Anti-Coercion Instrument’ dubbed the Bazooka to mitigate U.S. trade bullying.

In the Middle East, key U.S. ally Saudi Arabia has already begun selling its oil in currencies other than the U.S. dollar (see also here and here) with several of its trading partners.

Hence the trend is clear, the U.S. is no longer in a position where it can oppress countries that don’t acquiesce to their wanton vagaries, as these smaller nations band together for strength in numbers.

2.2 Waning of the Anglo-American Special Relationship

Breaking up is hard to do, it has been said. This is especially true with the century plus long special relationship which has existed between the United Kingdom and the United States of America.

“The rival [of the British Empire] that could not be immediately suppressed was the U.S., which declared independence in 1776. So recapture of the U.S. also became a priority.”

The quote from above comes from a post that nicely summarises how the British-American alliance came about – out of necessity to control the young superpower and infiltrate or subvert its key institutions so as to aggrandise British supremacy.

Many other works such as the following have been written which meticulously detail this British endeavour which was largely spawn by Cecil Rhodes to fulfill his call to “recover America for the British Empire,” as was laid out in his last will and testament in 1902.

Cecil Rhodes: the anatomy of empire, by John Marlowe, 1972 (for a background on Cecil Rhodes)

The Empire of "The City": The Secret History of British Financial Power (originally published in 1944), by E C Knuth (key backgrounder on British imperialism, see also the online 1983 edition)

New World Order: A Strategy of Imperialism (2016), by Sean Stone

see also my podcast interview with the author Sean Stone

It’s important to add that the socialist Fabian Society created in 1884 was, and still remains, a key institution that continues to implement Rhodes’ vision. One of the best books on the Fabian Society is ‘La Société fabienne: les maîtres de la subversion démasqués’ (English: The Fabian Society: The Masters of Subversion Unmasked) by French-Canadian author Guy Boulianne which I highly recommend.

A feature that is intricately entwined in the Anglo-American Special Relationship consists of how British banking – largely led by the Rothschilds banking dynasty – seized control of banking in the United States, particularly in the Woodrow Wilson era with the creation of the private U.S. Federal Reserve in 1913.

Fast-forward just over a century later and we are starting to witness an apparent downfall to this monetary system.

Signs of such cracks are becoming apparent as President Trump’s second term in office starts to reveal the unsustainability of the City of London’s financial machinations which have impoverished and financially enslaved Americans (and citizens of the world, for that matter) for over a century.

It’s a do or die predicament for Trump. Should his administration truly wish to sever the British Empire’s (and their various agents’) grasp on the American experiment, monumental shifts must convincingly and adroitly manifest themselves in the coming months.

Encouragingly, we’ve seen recent shots across the bow in this respect with more likely to come.

Military, Trump has made it somewhat clear that the U.S. will no longer serve the security needs of Europe by being NATO’s top contributor.

A consequence of Trump’s antangonistical rhetoric on NATO and his stance to end the war between Russia and Ukraine has rippled across the pond, exacerbating the special relationship with the U.K. In fact, British Prime Minister Keir Starmer called on his European allies to form a Coalition of the Willing which consists of 33 countries in order extend the war, including an insane 100-year pact to support Zelenskyy’s madness.

Though not pertaining directly to the U.S.-U.K. Special Relationship, U.S. Vice-President J.D. Vance recently castigated European leaders over their anti-democratic behaviour which consists of censorship and targeting of political opponents last February during the Munich Security Conference.

These combined factors have led Starmer’s U.K. to seek a new special relationship with the European Union, reversing Brexit – the previous withdrawal of the U.K. with the E.U.

Unless a radical reversal of U.S. policy or reconciliation with Britain occurs, the Anglo-American alliance will fade into the sunset.

2.3 The Digitilisation of everything

“Everything” might seem an exaggeration to most who just read this header above; but, let me assure you that the psychopaths who rule the world have already begun to digitalise nature itself – and I will briefly expand on that a bit later.

In the last four decades or so, our world has experienced a radical technological transformation as we transitioned into an information-based economy following industrial and agricultural based ones.

Personal computing in the 1980s and the introduction of the internet in the late 1990s and early 2000s have radically transformed how individuals obtain information and communicate with each other. Not since the invention of the Gutenberg printing press in the 15th century has society been so uplifted in such a significant manner.

“The point is, ladies and gentleman, that greed, for lack of a better word, is good. Greed is right, greed works. Greed clarifies, cuts through, and captures the essence of the evolutionary spirit. Greed, in all of its forms; greed for life, for money, for love, knowledge has marked the upward surge of mankind.” – Gordon Gekko, Wall Street (1987)

The interminable lust for financial gain, better known as greed, has seemingly been immutably encoded in the DNA of the rich “elite” who rule the world.

Over the centuries, they have constantly sought means by which to multiply their wealth. And during this period of the 1980s to present day, they have financialised every known asset or commodity known to man in order to reap additional benefits, be they financial, power, influence, or otherwise.

This would not have been possible without representing such assets in digital form.

Whether it is “dollars” in your bank account, shares of companies or funds [you think] you own in your brokerage account, or your profile(s) on social media, they are all stored and accounted for as a string of 0s and 1s on computer storage.

As such, they can disappear in a heartbeat should those controlling those 0s and 1s decide it.

For the most part the “money” (unbacked fiat currency) you have in your bank account technically belongs to the bank, as you are an unsecured creditor who sits at the bottom of the totem pole should the institution go bankrupt. The same isn’t true with physical cash (bills and coins) you have in your possession.

The trend, however, is clear. The Powers That Be want to eliminate the use of cash altogether.

And to do so, they must convert to 100% digital currencies whether they come in the form of Central Bank Digital Currencies (CBDCs) or digital dollars, digital euros, digital yuan or e-CNY, etc.

Unless there is a revolutionary-style push back by populations around the world to resist these fully digital currencies, they’re coming.

If they are able to successfully transition to 100% digital currencies, you will lose your financial freedom and they will be able to more easily control you and your family.

Apart from digital currencies, these same powers seek to tokenise (fractionalise and digitalise) almost every asset on Earth, including nature.

Financial and banking behemoths Blackrock and JPMorgan have already begun tokenising the natural world and assets such as resources from it.

Another trend, closely tied to the $3.5 trillion crypto market, consists of Real World Assets (RWAs) that has emerged as a significant sector in the financial industry.

RWA products offered by the likes of Blackrock will essentially consist of tokenising the rights of a variety of assets, including bonds, stocks, real estate, and even cultural assets (such as in the entertainment and sports industries with concerts, sporting events, memorabilia, etc.)

“All tradeable assets will be tokenised,” encapsulates the vision contemplated of Blackrock.

Perhaps one of the scariest possible outcomes of such a vision has to do with real estate (land and homes) that people own.

As opposed to a proper title and deed to a property, should tokenised versions of these become the norm, who is to say that they cannot easily be seized and transferred by malicious parties under dubious pretexts?

And by the Digitalisation of Everything I also am referring to the digitalisation of you.

Over the past couple of decades we have already witnessed how governments and business services have become mostly automated and digitised.

For instance, most customer service is now provided and delivered via electronic means rather than actual human beings. Whether it is automated phone services, chatbots, virtual and artificial intelligence (Ai) agents, or smartphone apps, the trend is clear in that pretty much all services will be delivered through such means. A smartphone app seems to exist for just about everything.

With this comes the need to properly authenticate peoples’ identities which is why the push for Digital IDs has been so unyielding by the so-called elite, particularly through their nefarious UN Agenda 2030 with its SDG goals.

This is why I have always said and written that a Digital ID is the first of three main pillars for their beast system.

To conclude, digitisation trends are moving at lightning speed and if we are not careful and resistant to such changes, our assets and livelihoods will undoubtedly be in jeopardy.

3. The End of Bretton Woods & Fed Dominance

As I described in a previous post, we are reaching the fourth and final (crisis) stage of what is called the Fourth Turning with the current monetary system (led by the U.S. dollar) coming to a close end.

Usually these monumental shifts come about with a great crisis such as the Japanese attack on Pearl Harbor in 1941 amidst World War II.

It’s not necessarily the kind of thing that happens all in one shot overnight. Rather, it occurs in several phases over months or even a few years with key events often seemingly disconnected from one another, but which are often integrally [and deceptively] connected.

Even though the U.S. dollar – the current anchor of global trade managed by the U.S. Federal Reserve – appears relatively strong in comparison to other fiat currencies, its days are numbered given the facts detailed further below in the remainder of Section 3.

The U.S. dollar system goes by the name of the Bretton Woods system which, since 1944, established the rules for commerce and trade relations for over 44 countries.

In the last couple of decades, many fissures have appeared in this system largely due to the United States abuse of its privilege of having the world reserve currency for international trade, and particularly in how it has been weaponised (along with SWIFT which is also described in this work) on the heavy-handed fist of the mighty American military machine.

Many countries are, therefore, opting to use alternative means of payment and are forging their own bi-lateral trade agreements to pay for international goods using their own currencies.

Trust, therefore, is a key factor in international trade.

Countries are now seeking and choosing friendlier partners such as China in order to trade and do business with which is based on confidence and mutual respect.

As the United States stubbornly wishes to retain its hegemonic power, it will continue to act in such a manner, strong-arming partners into submission. Some will acquiesce to their will, while others will divorce themselves from the abusive relationship.

What will emerge from this shift in the next few years will consist of two major monetary systems which are described in Section 4 of this work.

3.1 Cracks in the Dam: The Collapse of Fiat

Practically all national currencies now are fiat. That is to say they are issued by decree and not backed by anything of tangible value such as precious metals like gold or silver.

Without exception, governments worldwide have debased their respective currencies through large increases in supply.

The collapse of fiat doesn’t necessarily mean an inevitable death of the U.S. dollar.

Rather, it means that the fiat system upon which money has functioned for the past century is coming to its end.

The new digitalised system (which is described in the next section 4.1) will replace it.

As was alluded to earlier, we must not forget the war on cash that is an obvious observable trend that is occurring around the globe and particularly in the European Union, Sweden, and China.

3.2 The United States is Broke & its Dollar is being Destroyed

Even though most Western countries are littered with debt and cursed with rampant inflation, I will mainly focus on the United States since it still has the dollar as the anchor in global trade with its [overused & abused] global reserve currency status.

Anyway you look at it, the United States of America is broke.

They have been so for a long time.

The only reason it may not appear so lies with their – that is to say their central bank’s (Federal Reserve) – ability to print their currency in an unceasing manner; and that, they have been doing for decades.

Most nations that have fiat currencies (fiat means that it is not backed by a physical commodity such as gold or silver) do so by expanding their money supply.

But what makes the U.S. different, is the magnitude and pace at which they have been doing it.

By its very nature, a fiat currency system in which its supply base is augmented is a counterfeiting scam. And the United States has perfected the scam.

Continuously expanding a nation’s unbacked fiat money supply dilutes the value of each existing currency note which leads to inflation and, eventually, to hyperinflation.

One of the most famous cases of hyperinflation is that from the Weimar Republic (Germany). In order to pay its war debts (from WWI), they had to greatly increase the supply of German marks (their currency, sometimes referred to as Papermark). This of course led to the currency losing its value and purchasing power culminating in its eventual collapse.

Financial and precious metals expert Mario Innecco (a.k.a. Maneco64) whom I recently interviewed provided an excellent comparative chart on one of his broadcasts from his YouTube channel which is shown hereunder.

It makes a comparison German marks (in relation to gold) against U.S. dollars (also in relation to gold). On the left-hand side we can see the chart on how many German marks were needed as an equivalent to one gold mark; the figure – represented by a line shows a near vertical trajectory eventually leading to a figure of one trillion Papermarks required to buy one gold mark.

On the right-hand side we can see a similar chart pattern that has been occurring with the U.S. dollar. Notice the red line on both charts and the start of the vertical rise in the line on the U.S. chart. The overlapping pattern is unmistakable.

What this signifies is that the U.S. dollar is on the exact same trajectory as the Weimar Republic’s mark.

Consequently, what we can expect to see is a sharp vertical rise in the amount of U.S. dollars that will be required to purchase one ounce of gold.

Accordingly, expect the price of gold in U.S. dollars to soar in the coming months and years.

That is why they have been suppressing the price of gold for decades.

Elsewise, an elevated gold price would raise alarm bells or serve as a canary in the coal mine, so to speak, about how worthless the dollar is actually becoming.

Back in 2022, Patrick Barron from the Mises Institute wrote a piece titled The End of World Dollar Hegemony: Turning the USA into Weimar Germany (along with another excellent piece) which further details the decaying process of the currency.

When looking at inflation it’s important also to consider the velocity of money which is the rate or speed at which money is exchanged in an economy. In this context, it means that as more money (dollars in the U.S.) is circulated and spend for goods in an economy this leads, of course, to a rise in inflation. In the U.S., you can keep track of this metric, Velocity of M2 Money Stock (M2V), on the Federal Reserve’s website. Since 2020, this rate has been rising steadily.

I would sum up this sub-section with two thoughts. First, most people don’t comprehend the true nature of money and currencies and don’t know about or understand monetary history. Secondly, the U.S. dollar has commenced its death spiral and it could, in similar manner to the Weimar Republic example shown above, occur in a relatively short time span which could even be within two years.

3.2.1 U.S. Budget Deficits, Debt, and Debt Servicing (interest expense)

A budget deficit occurs when government expenses exceed revenue. It is usually calculated either on a quarterly or annual basis (in what we call a fiscal year).

What is the national deficit for the United States?

The annual budget deficit for 2024 has been calculated by the U.S. Department of the Treasury as $1.84 trillion.

Believe it or not, this is not the highest deficit for a single year. Back in 2020 during the Covid-19 Scamdemic, the U.S. racked up a whopping $3.3 trillion deficit for that year alone.

As a deficit implies the shortage of money for expenditures, the government needs to borrow, largely through the issuance of securities (including bonds) called Treasurys,

Of course, borrowing entails interest expenses incurred which are paid to the lenders at varying rates (often referred to as yield) depending on the type/length of the security.

And when you borrow in the trillions, annual interest expenses will be in the billions.

According to the U.S. Treasury Department's own figures (from 2010 to present day), the interest expense for 2024 alone accounted for $1.13 trillion with an average interest rate of 3.324%.

For fiscal year 2025, you can consult the interest expense for the U.S. Treasury Department here.

You can also consult Federal government current expenditures: Interest payments via the U.S. Federal Reserve website here (notice the very sharp rise since 2020).

The most important Treasury security is the U.S. 10-year bond. And it’s current yield (as of June 22, 2025) sits at 4.376%

As U.S. debt continues to balloon (see next sub-section), these rates will increase since borrowers will demand higher yields in order to compensate for the augmented risk of holding those bonds/securities.

This will further exacerbate the problem, and the U.S. will need to borrow even more just to cover its mammoth interest expenses, never mind the capital, on its debt issuance.

Alan Greenspan, a former Federal Reserve Chairman, previously stated that “the United States can pay any debt it has because we [the Fed] can always print money to do that.”

The current Fed Chair (read Looter-in-Chief), Jerome Powell, basically re-iterated a similar statement to that of Greenspan’s during a 60 Minutes interview five years ago.

These banksters are completely delusional.

While such statements may theoretically be true, we know that in reality and with mathematical certainty this just isn’t the case.

In terms of simple math, even a fifth grader could tell you that if the debt grows by $1.5 trillion per year, in 5 years (i.e, by 2030) it might increase by approximately $7.5 trillion, putting the total U.S. national debt to nearly $45 trillion.

Accordingly, yearly interest expenses would be increasingly greater due to compounding effects.

And the incompetent imbeciles at the Congressional Budget Office (CBO) live in a fantasy world anticipating that the average interest rate on federal debt will steadily remain below 4% until the year 2055. Pure lunacy.

Could they kick the can down the road a few more years? Possibly. But overall, the current fiscal path is not sustainable.

3.2.2 The U.S. Federal Reserve is officially bankrupt!

Yes, you read that header correctly. The Fed is bankrupt as per its own financial statements.

In October of 2023, Matthew Kratter from Bitcoin University released an excellent video titled The Fed Just Went Bankrupt (So Sad) which clearly demonstrates, as per the Federal Reserves own financial statements, that it is indeed bankrupt.

I will embed the video hereunder and follow up with more recent (updated) figures to show that this is still the case, but actually even worse.

Here are latest numbers with a few explanatory notes so as to make it all easily understandable.

We can view the Fed’s numbers on a quarterly basis. Matthew Kratter had used the figures for October 26, 2023, but I will use the ones for May 29, 2025.

These financial statements are officially called

Federal Reserve Balance Sheet: Factors Affecting Reserve Balances – H.4.1.

So, allow me to provide the key figures.

Don’t worry if you aren’t familiar with basic accounting. In a nutshell, accounting statements include those such as a Balance Sheet (sometimes called a Statement of Financial Condition) and an Income Statement.

In this case we will be looking at a the Fed’s Statement of Financial Condition which shows three key parts:

Assets (with it owns

minus Liabilities (what it owes)

equals its Equity or Capital (the difference)

Here are the numbers for May 29, 2025 (in millions):

Assets: 6,673,244 (this means about $6.67 trillion since we need to add six zeroes)

Liabilities: 6,627,727 (about $6.6 trillion)

Capital: 45,518 (about $45 billion)

Now, it would appear that the Fed has about $45 billion in Capital. But as Matthew Kratter explains in his video, we must account for a liability called ‘Other liabilities and accrued dividends’ which in this case is – 220,150. A footnote (#15) appears for this figure in their statement which says that this liability is for earnings remittances that are to be paid to the U.S. Treasury Department.

You see the way it works is that when the Fed makes a profit (after having paid all its expenses), it gives the remainder to the Treasury Department.

The problem is, however, that this figure is negative, i.e., -220,150 (roughly $220 billion) which means that this is a shortfall (in remittances to the Treasury Dept.) that are due (to be paid). The explanatory note #8 from section 6 of the statement confirms this and reads as follows:

“8. The Federal Reserve Banks remit residual net earnings to the U.S. Treasury after providing for the costs of operations, payment of dividends, and the amount necessary to maintain each Federal Reserve Bank's allotted surplus cap. Positive amounts represent the estimated weekly remittances due to U.S. Treasury. Negative amounts represent the cumulative deferred asset position, which is incurred during a period when earnings are not sufficient to provide for the cost of operations, payment of dividends, and maintaining surplus. The deferred asset is the amount of net earnings that the Federal Reserve Banks need to realize before remittances to the U.S. Treasury resume.”

Simply put, by saying “the Federal Reserve Banks need to realize before remittances to the U.S. Treasury resume” it means that the Fed itself needs to first earn these funds, and then remit (pay) them to the U.S. Treasury Dept.

In prior years, the Fed made enough money from its operations to have funds left over to pay the Treasury. But this is changing.

Commercial banks (such as JP Morgan, Goldman Sachs, Wells Fargo, etc.) who park their money at Fed earn interest. Remember, the Fed is a bank with accounts that pay interest. It’s the central bank for its member banks such as these commercial banks. And these interest payments to commercial banks have increased a lot recently. So, there’s nothing left to fork over to the Treasury Dept.

There’s also another factor at play (Gold certificate account) that Kratter explains, but to keep things simple, I’ll leave it aside.

When Kratter did this exercise in October of 2023, he determined that the Fed’s balance sheet basically indicated an equity (capital) of -$81.599 billion making the Fed essentially bankrupt.

Calculating for May 29, 2025, we arrive [45,518 – 230,727 which is the ‘Earnings remittances due to the U.S. Treasury’ taken from section 6] at an equity (capital) of -185,209, or roughly – $185 billion. And this is excluding the Gold certificate account adjustment which would increase the negative amount.

Most likely, this negative equity on the Fed’s balance sheet will worsen over time due to increased interest payments it needs to make to its [member] commercial banks, among other expenses.

The Fed is a private banking cartel and its principal owners are the large private commercial banks who earn a 6% dividend each and every year from the Fed.

These are crooks of the highest degree who have rigged the system to enrich themselves at the expense of the U.S. Government, i.e., the U.S. taxpayers, really.

3.2.3 What about the U.S. Government’s Secret Books?

Many in the West don’t know about this dirty little secret, but I suspect that Chinese officials must certainly be aware of it.

What am I talking about?

The United States not only has over $21 trillion in unaccounted money, but it also holds a separate set of secret books for its government accounts as per the FASAB Statement 56 accounting standards/rules which allows them to actually entirely (and legally) omit expenditures from their books.

So who knows how many more trillions of [printed] dollars are out there in existence.

And to help obfuscate this fraud, the United States Government repealed a propaganda ban back in 2013 so that it could legally lie to Americans (and the world) essentially giving them carte blanche on additional [unaccounted for] military spending and, most likely, to purchase their own bonds and prop up their stock [and other] markets.

4. The Split: Two New Global Monetary Systems

While it may be easy for many to think that a new single monetary system will replace the aforementioned dying U.S.-led Bretton Woods system, the reality clearly shows that this is highly unlikely given the current geopolitical tensions (including wars and proxy wars) and the irreconcilable chasm which divides the West and East (which includes BRICS & the Global South).

Though there’s always the possibility that countries (including EU members) could revert back to exclusively using their own respective national currencies, it appears more likely that nations will align themselves to either the Western block or the Eastern one.

The Western block system will be rebooted by those who have run it for the past several centuries, namely the rich families in the Rockefellers and banking dynasties including the Rothschilds since they still exert a domineering apparatus of [carrot and stick] control over their subjects (i.e., governments, industry, media and entertainment conglomerates).

In contrast, the Eastern block will, by necessity and preservation, decouple from the banking cabal (City of London & BIS) to form their own system. This way, they will no longer be at the mercy of American and British imperialism with regards to trade and finance, nor be financially bullied through sanctions, colour revolutions, wars, and other deceptive tactics.

Moreover, eastern powerhouses such as China, Russia, and India who have historically been humiliated and bullied by western powers are much stronger now (economically, militarily, and socially) and will continue to assert their own influence with neighbours and allies who espouse similar morals, virtues, and values.

To think that dominant members from both blocks would be willing to agree to a new common Bretton Woods style system is a total fantasy, even if gold were to serve as its anchor.

Therefore, it would be most reasonable to expect two monetary systems to emerge in the coming years.

4.1 SYSTEM #1: Tokenised Digital Currency for Western-Bloc Countries

In this Western monetary system, the United States wishes to retain its imperial economic hegemony and will continue to do so through both its military and economic might.

The dollar will still remain a strong reserve currency – albeit mostly in the West, but it will simply take on its new digital (tokenised) form.

The U.S. Federal Reserve itself is telling us that the dollar will be tokenised as per their own statements [with emphasis added]:

“For the avoidance of any doubt, any bank liabilities (including deposits) that meet the definition of dollar token are dollar tokens.”

Cash will eventually be eliminated not only in the United States, but across all nations from the Western bloc.

Apart from the United States, it remains to be seen how other Western G20 countries (minus China) will roll out their tokenised currencies (or CBDCs).

I personally doubt each would dare to attempt to launch their own respective Central Bank Digital Currencies (CBDCs) given catastrophic failures such as with Nigeria’s eNaira and Canada’s now scrapped Digital Loonie (dollar) CBDC project.

Instead and most likely, they will all fit the same mould that the Bank for International Settlements (BIS) has been working on for several years already.

I described this BIS-led project in a previous post outlining how projects from their seven Innovation Hubs scattered around the globe will collectively bring about their beast enslavement system.

While there are at least eight such projects, I will not go over them now given the size and scope of each. Instead, through their own documentation and related articles, I will outline the key ones of importance that really show their intentions.

The BIS has an important arm called the Committee on Payments and Market Infrastructures (CPMI) which sets international standards for payments, clearing and settlements as well as central bank coordination.

Their work programme reveals a very telling card with regards to their upcoming plans, namely with cross-border payments:

“Enhancement of cross-border payments [with emphasis added]:

...

The CPMI will further strengthen its cross-border payments stakeholder engagement with both private sector stakeholders and non-G20 central banks. It will work with the G20 Presidency to deliver on South Africa's priorities for 2025.”

The bolded segment from above states that the BIS will work with the “G20 Presidency” meaning the Finance Ministers of each G20 country (with the likely exception of China and India) to deliver on “South Africa’s priorities for 2025.”

“South Africa’s priorities for 2025” essentially mandates a common ‘Digital Public Infrastructure’.

I previously interviewed Tim Hinchliffe who published the article G20 South Africa commits to advancing digital public infrastructure globally to learn more about this Digital Public Infrastructure (DPI). He explained that it consists of a “technology stack” with three main components:

Digital Identity

Fast Payment Systems

Massive data exchanges between public and private entities

Hinchliffe also stressed that interoperability is key to these systems – meaning that even though separate countries might have their own systems (for Digital IDs, CBDCs/digital currencies, and surveillance), ultimately, they will be shared and centralised for centralised control.

Digging deeper into related BIS documents, it is quite easy to see that interoperable programmable tokenised bank money is being planned for implementation among BIS member banks (with the likely exception of China).

The following two excerpts from the BIS’ October 2024 document titled Tokenisation in the context of money and other assets: concepts and implications for central banks Report to the G20 (archived here) pretty much reveal their intended plan – which happens (very closely) to match my thesis presented in this work. To wit [with emphasis added]:

As you can see from the excerpt above, there will be TWO kinds of tokenised monies:

Private sector ones: stablecoins and commercial bank money

Public sector one: central bank money

A stablecoin is a digital token that is pegged to a given currency such as the U.S. dollar, for instance.

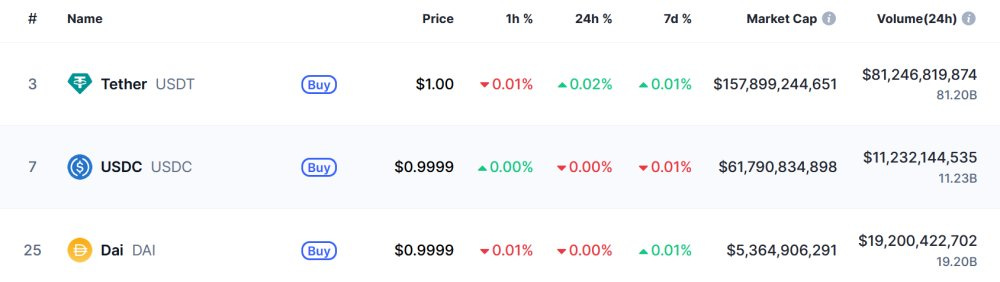

The stablecoins will be from the likes of Tether (USDT), among a few others, as explained in this article.

By “commercial bank money,” they mean the money that will be issued from private banks such as JP Morgan, Standard Chartered, Bank of Montreal, etc.

The sentence from the excerpt that reads “and a number of central banks are actively exploring how programmable platforms could be implemented,” says a lot. It basically means that they plan to integrate programmable features into the tokenised currencies.

For example, such features could include restrictions such as spending limits, expiry dates, geofencing, black lists (for dissidents / those critical of their governments), and the like.

Deputy Managing Director Bo Li from the International Monetary Fund (IMF) described how such programmable features could be used which raises important concerns about how private-sector players (like commercial banks and stablecoin issuers) could control the usage of money, punishing those they wish to punish.

The last sentence from the excerpt above confirms how the BIS Innovation Hubs are working on these kinds of features through their various projects.

So, don’t take my word for all of this; simply read what they are stating in their own documents, for they are openly telling you what their intentions are.

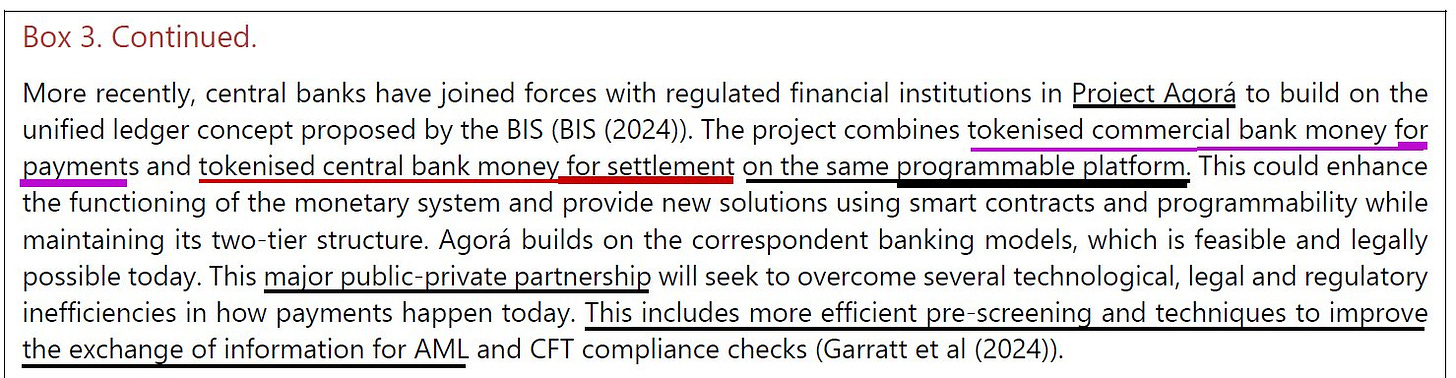

The second excerpt of importance provides additional insights on the two digital bank money models they are devising [with emphasis added]:

As you can see from the “Box 3” segment above, the tokenised commercial bank money will be used for payments; that is to say, payments you make at retail stores or online using your bank card (with funds from your bank account).

The tokenised central bank money (i.e., the money parked at the central bank) will be used for settlements. What “settlements” means in this case include payments made between nations’ governments accounts, for trade payments (settlement) between corporations for international business, and the like.

It is difficult to know for now, but it is possible that cross-border remittances – such as funds sent between individuals in located in different countries – could fall under the purview of this central bank money category.

There’s little doubt that this would cause concerns in that individuals could be restricted from either sending/receiving money abroad to/from others, or even fall victim to their country’s capital control measures (should they have them in place). In other words, this could be a good mechanism by which countries ensure that capital (like from the super wealthy) don’t easily leave their shores.

The last sentence from the excerpt above explains how “more efficient pre-screening and techniques” could be used to further their AML (Anti Money Laundering) policies – which is really code word for preventing dissident types or entities whom are in their disfavour to transact on their network.

Are you starting to see the dangers with regards to this level of control over your money?

4.1.1 Same Boss, New Structure

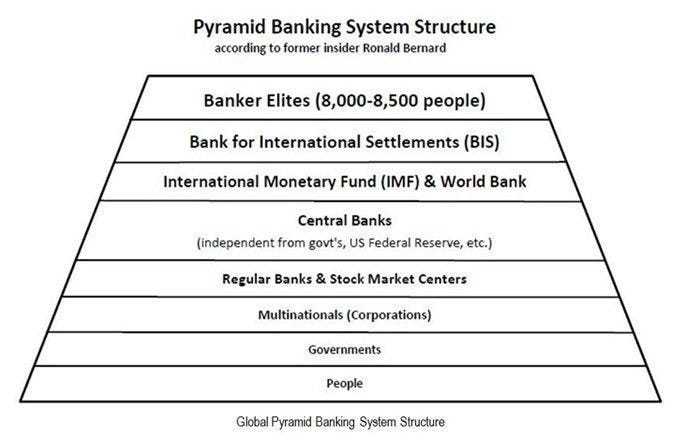

Those who conceived and brought about the Federal Reserve System and have exploited it since 1913 are still in charge of not only the most powerful central bank in the world, the Fed, but also its lesser known parent organisation – the Bank for International Settlements (BIS).

The International Banking Cabal is a common moniker used to describe this group of high-level elite bankers.

Years ago, I created the following image that is based on former high-level Dutch elite banker turned whistleblower Ronald Bernard.

The pyramidal structure above perfectly encapsulates the power structure upon which our global society is managed and controlled. It has been in place for centuries and is unlikely to change any time soon.

Personally, I would add one more layer to the top of the pyramid shown above – the very capstone we see on the back side of the U.S. one Dollar Federal Reserve note with the all-seeing eye as illustrated in the image below.

This layer or level is representative of those at the very top pulling all the strings, namely the rich families including the Rothschilds, Rockefellers, Morgans, Lazards, Warburgs, and so on who own not only the private U.S. Federal Reserve, but many other powerful banks and multinational corporations.

Members of these families are hundreds of billions, if not trillions, ahead on the wealth scale compared to what the media they control claim are the richest people on earth (like Elon Musk and Jeff Bezos, for instance). They have amassed tremendous multi-generational wealth over the past centuries and their current generations like to keep themselves as unrevealed and secluded as possible.

Needless to say with such vast wealth comes absolute power.

Absolute power over politicians, CEOs, financial institutions, etc., etc.

As they control the printing presses of central banks, they have an unlimited supply of money that can be used to bribe and incentivise any individual or organisation to do their bidding.

An that, they have been doing for a very long time.

If gifts, incentives, and bribes (carrot) are insufficient to get what they want, they have ample means to use blackmail, extortion, and the like (stick) to get what they want.

Furthermore, they employ countless operatives or enablers – which I will describe in the following sub-sections – to do their bidding and implement their plans and agendas.

To conclude this sub-section, it is rather clear that going forward we are ultimately stuck with the “same boss”; and by “new structure” I am merely referring to the new iteration of their monetary system, as the current one has served them well but is on its last legs.

4.1.2 Agents of Change (those implementing the new Western Monetary System)

As mentioned in the previous sub-section, it is those chosen – often covertly – by the real bosses than run the world. I will refer to these agents of change as both enablers and operatives.

I will also use the term handlers to refer to the bosses that scheme from the shadows.

Both groups are described hereunder.

Handlers & Enablers

In a previous post, I described two type of agents: handlers & enablers.

Handlers are comprised of the parties who wish to establish and maintain certain agendas and accompanying narratives (such as “climate change is destroying the earth”, for instance).

They are those who yield a significant amount of power and influence over our institutions (governmental, regulators, think tanks, business, etc.).

Handlers largely operate from the shadows and are mostly comprised of extremely wealthy multi-generation bloodline families such as the Rockefellers and the Rothschilds, but to name a few.

They are the ones that have the largest level of ownership in the private central banks (such as the Federal Reserve) as I have outlined in a previous post of mine.

So, they are the ones largely calling the shots.

The enablers, however, are the ones implementing their agendas.

The enablers consist of organisations (at the higher level – such as international/supranational institutions, banking cartels, NGOs, intelligence agencies, philanthropies, think tanks, secret societies, media conglomerates, lobby groups, and large/multinational corporations) and the operatives or individuals that are employed by these organisations.

Here is a broad, non-exhaustive list of organisations in which many nefarious agendas, including war, are front and center:

International/Supranational Institutions:

The United Nations (UN) (chiefly spun by the Rockefellers) and its various sub-agencies like the WHO, UNESCO, ICAO, etc.)

The Royal Institute for International Affairs (RIIA) better known as Chatham House

The Council for Inclusive Capitalism (Rothschilds-led)

Banking Cartels:

Non-Governmental Organisations (NGOs) & Philanthropies

for an excellent overview and list of culprits watch this

George Soros’ Open Society Foundation

The Tides Foundation

Intelligence Agencies:

The United States’ Central Intelligence Agency (CIA)

The United Kingdom’s MI6

Think tanks:

Lobby Groups:

The American Israel Public Affairs Committee (AIPAC) (Israel lobby)

Mercury Public Affairs (Big Pharma lobby)

These organisation enumerated above employ millions upon millions of individuals – many of whom are enablers.

Enablers (Operatives)

As my distinguished podcast guest Dr. Paul Craig Roberts (former Assistant Secretary of the Treasury for Economic Policy under President Reagan) once told me, presidents don’t run things. Rather, presidents are advised by various advisors, secretaries, and assistant-secretaries who were appointed.

As a related and recent case in point, just look at how President Trump, though Commander in Chief, is not even in charge of his own military with regards to what is happening in Ukraine, as evidenced by the recent attacks on Russian nuclear bombers deep inside Russia. The intelligence agencies, namely the CIA, MI6, and Mossad who were behind it are clearly in control.

Let us not forget that these intelligence agencies are controlled or under the direction of the aforementioned handlers.

In the case of those tasked to be in charge of implementing the new monetary system presented in this work, the primary enablers consist of those holding the two most important economic positions in Trump’s administration, namely:

OPERATIVE #1: Scott Bessent, Secretary of the Treasury of the United States; and

OPERATIVE #2: Howard Lutnick, Secretary of Commerce for the U.S. Department of Commerce

Secretary of the Treasury Scott Bessent (left), President Donald Trump, and Secretary of Commerce Howard Lutnick (right) at the Oval Office. Photo taken on April 9, 2025.

Bessent and Lutnick are the top operatives who have been specially chosen to bring about the new financial architecture that will underpin the tokenised digital dollar.

They’re the Big Guns so to speak, as they yield a tremendous amount of power with regards to finance and trade.

It should also be observed that Lutnick was also Co-Chair of the Trump-Vance Transition Team.

Like Trump, both Bessent and Lutnick are billionaires.

While providing extensive backgrounds of Bessent and Lutnick would be beyond the scope of this article, I will merely point out some key salient facts.

As for Scott Bessent, it is quite worthy to know that he is a current member of the Council on Foreign Relations (CFR) – an organisation that has longly controlled the halls of political power in Washington be it at the military or administrative level. CFR members have been omnipresent in countless U.S. administrations for decades. And their purpose is to ensure that U.S. policies remain in line with their own goals.

Also of notoriety, while employed at George Soros’ Quantum Fund (now called Soros Fund Management), 29-year old hedge fund manager Scott Bessent played a pivotal role in the "Black Wednesday" trade of 1992, when Soros famously "broke the Bank of England" by betting against the British pound. The trade helped Soros net over $1 billion in profits. Bessent later served as Chief Investment Officer (CIO) from 2011 until 2015 at Soros Fund Management.

The point being here, is that Bessent was directly involved in a highly controversial financial ploy which attacked a nation’s currency all in the name of profit. While business is business, many would argue, it nonetheless goes to show Bessent’s immoral and unethical nature.

As for Howard Lutnick, it should first be noted that he was the CEO of Cantor Fitzgerald at the time of the September 11, 2001 attacks in New York City and that the company’s headquarters were located in the 1 World Trade Center building. On that fateful day, 658 employees of his firm (including his brother Gary) were killed. Controversy arose when Lutnick halted the paychecks of those employees, financially mistreating the bereaved families. After much public backlash, Lutnick had to change his tune with regards to compensating the families.

While Lutnick’s tenure as Cantor Fitzgerald’s CEO (from 1983 until early 2025) faced several financial misdeeds (including misleading investors as of December 2024) with the Securities and Exchange Commission (SEC) along with a nasty dispute with the firm’s founder’s wife over succession, the current Secretary of Commerce is criticised for his potential financial conflicts of interest with regards to Cantor acting as a custodian to Tether – the largest U.S. dollar-pegged stablecoin in all of crypto.

As of late last year, his son Brandon Lutnick became Cantor’s Chairman and CEO and has taken over the helm for the Cantor Fitzgerald companies (SPACs).

Brandon Lutnick recently held a fireside chat with Tether CEO Paolo Ardoino at the Bitcoin 2025 Conference held in Las Vegas where the pair discussed much, including the formation of a Cantor-backed company called Twenty One Capital (see ‘Jack Mallers’ further below in this post for related details) also with the backing of Tether and financial behemoth SoftBank Group.

Importantly, AI-driven data collection (Tether Data / Tether AI) was also discussed. “The project will facilitate integrating native USDt and Bitcoin payments into autonomous systems and software agents,” states a report by TradingView on the subject, adding: “Tether AI will facilitate direct execution payments on peer-to-peer networks without any role for intermediaries.”

In other words, it appears that Tether is planning to integrate an AI-driven feature that can determine (“facilitate”) the execution of payments.

Presumably, if the AI-feature deems a certain transaction as not following certain rules, it would fail to execute.

This is one of the main concerns in crypto – that transactions would no longer be permissionless but would instead be overseen by a central authority.

Since Tether Ltd. Is a private company, there would be little to no oversight nor guarantees that it wouldn’t block certain USDT transactions from taking place. As a private company and legally-speaking, this would be left at their discretion.

Needless to say, the implications for this – given that their stablecoin is the most widely used one in the world – are enormous.

Cantor Fitzgerald LLC is also a private company, meaning that we have no way of verifying that it indeed has the U.S. Treasurys that purportedly back USDT as Brandon Lutnick claimed.

Perhaps to reassure skeptics, Brandon Lutnick told the audience of Bitcoin enthusiasts that Cantor Fitzgerald [Asset Management] had just launched a Gold-Backed Bitcoin Fund (official name: Cantor Fitzgerald Gold Protected Bitcoin Fund, L.P.) which combines direct Bitcoin exposure with downside protection based on the price of gold.

Though it is currently unclear who the custodian of the actual (physical?) gold will be, the firm already announced that its Bitcoin Financing Business (with $2 billion of fresh capital) has successfully executed its first transactions.

With lingering doubts about gold [supposedly] held at the LBMA and COMEX, one has to wonder whether Cantor’s gold custodian will actually hold the physical metal as will be claimed in their prospectus; this is certainly something to keep an eye on.

OPERATIVES #3 & #4: JD Vance and Peter Thiel

While it may come as a surprise to many, the third main operative of importance is none other than U.S. Vice-President James David “JD” Vance.

Despite only getting his feet wet into politics (as a Senator for Ohio) for a few years, Vance quickly rose in rank and clout thanks to his mentor Peter Thiel who took him under his wing back in 2013.

For those unfamiliar, Peter Thiel is a billionaire member of the Bilderberg Steering Committee, has defense contracts with the U.S. military – particularly with his outfits Palantir and Anduril – fuelling wars in Ukraine and Gaza (with his Lavender AI killing machine), and is engaged in various AI-related endeavours.

Peter Thiel was recently confronted at this year’s edition of Bilberberg in Stockholm Sweden by Canadian independent reporter Dan Dicks from Pressfortruth.ca for his ties to sexual predator Jeffrey Epstein and for his Big Brother surveillance system he is developing with Palantir.

Needless to say, Thiel is no angel. Rather, he is a profit-seeking, immoral individual who is obviously serving the interests of the military-industrial complex, the intelligence community, and the rich oligarchs who really control the United States.

So, this is JD Vance’s mentor?

Really?

Just a personal thought here but I do believe that the plan is for Vance to replace Trump – perhaps as early as after the U.S. Mid-term elections coming up in 2026 that could shift the balance of power and see Orange Man impeached should the Democrats take a majority in the House of Representatives.

Speculation aside, allow me to put forth more verifiable claims that Vance is indeed acting on behalf of higher interests wishing to bring about the tokenised digital dollar.

Vice-President Vance recently provided a very telling keynote speech at the 2025 Bitcoin Conference that was held in Las Vegas, Nevada.

U.S. Vice-President JD Vance speaking at the 2025 Bitcoin Conference in Las Vegas, Nevada on May 28, 2025.

Here are some key points and remarks Vance made about the direction in which his and Trump’s administration is moving with regards to digital assets and accompanying reforms (with timestamps and some emphasis added) followed by my accompanying observations under each:

6:44 “...I see crypto as a hedge against one of the most dangerous trends in the digital era in both the public and private sectors. And that’s of elites who rather than innovate themselves prefer to take over and co-opt cutting edge technologies to assert their control over other people.”

With this statement, Vance is actually being two-faced since those he serves (Oligarchs and rich Families) are the elites and the system – as detailed in this post – is the very one that will assert control over said people.

7:39 “Will we lead our nation into a future of financial sovereignty, of innovation, and of prosperity? Or, will we let unelected bureaucrats and foreign competitors write the rules for us?”

What he is getting at here is simply re-asserting U.S. financial sovereignty through the digital transformation of its dollar system to maintain its hegemony. Furthermore, by letting “unelected bureaucrats” such as the next unelected (by the people) operative in David Sacks the White House’s crypto czar(see details further below) write the rules, this is exactly what his administration is enabling.

10:24 “Now this is my vow to every single person here: you will never see this administration trying to handicap your [crypto/Bitcoin] community or diminish the impact it’s had on the economy.”

Although Vance is showing that he and his administration is pro-Bitcoin and pro-crypto, he is uttering a bold-face lie since stablecoin cryptos such as USDT are already being re-configured to handicap its usage through AI-driven data collection (of those transacting) and transaction blockage mechanisms (as detailed in this post). But the naive and ignorant crowd in attendance nevertheless gobbles it up hook, line, and sinker. This is sad, given that there are extremely smart folks in crypto.

11:45 “We are trying to create a clear pro-growth legal framework for stablecoins in this country.”

12:30 “Now, I know led by Cynthia [Lummis] and other great legislators, Congress is hard at work getting the GENIUS Act passed and across the President’s desk as quickly as possible.”

13:14 “And once the Genius Act is enacted, it’s poised to vastly expand the use of stablecoins as a digital payment system for millions of our fellow Americans.”

13:32 “And let me be emphatic on one other point: in this administration we do not think that stablecoins threaten the integrity of the United States dollar, quite the opposite.”13:47 “In fact, we view them as a force multiplier of our economic might.”

There’s a lot to unpack in the five passages above, but let me attempt to give a succinct summary of their combined implications.

The GENIUS Act is a senate bill that is before Congress whose purpose is to allow stablecoins (such as Tether/USDT and USDC) to be insured by depository institutions meeting regulatory standards with which they would be fully (100%) backed by U.S. dollars or short-term Treasury Securities.

“This bill represents a once-in-a-generation opportunity to expand dollar dominance and U.S. influence in financial innovation,” stated Scott Bessent on May 8 via his X account with regards to the GENIUS Act. A “once-in-a-generation opportunity,” spoken by Bessent implies that this is indeed a long term, multi-decade, endeavour thus catalising it into the next digital monetary system.

To “expand dollar dominance” is no small feat given that the world’s reserve currency is actually on the decline across the globe. Yet, such statements pretty much assert the intent which is to further expand demand for U.S. dollars through stablecoin demand in the crypto sector that is booming and seeing huge adoption not only in the United States, but throughout the world.

So, it is not difficult to see that this bill will soon find its way to Trump’s desk and be signed into law.

14:25 “when the administration will then fully shift to our third priority, which is to enact a transparent and tailored regulatory framework for digital assets.”

There’s no doubt that, here, JD Vance is indirectly (or deceptively) referring to a second important piece of legislation, namely the H.R. 2392 - STABLE Act of 2025 bill (full name: STABLECOIN TRANSPARENCY AND ACCOUNTABILITY FOR A BETTER LEDGER ECONOMY ACT OF 2025) or H.R. 2392.

The STABLE Act aims to establish a regulatory framework for the issuance and operation of dollar-denominated payment stablecoins in the United States.

If passed, it would establish a de facto centralised federal registration system for all U.S. dollar stablecoin issuers, including not only banks but also non-bank financial institutions.

Under the proposed text of the STABLE Act, the Federal Reserve will coordinate with the Office of the Comptroller of the Currency (OCC) and other federal regulators (such as the Financial Crimes Enforcement Network, or FINCEN) to maintain oversight over stablecoin issuers.

Accordingly, and if enacted, under provisions of the Bank Secrecy Act the legislation would require each permitted payment stablecoin issuer to:

maintain Anti Money Laundering (AML) measures;

maintain customer identification programs (i.e., adhere to Know Your Customer (KYC) standards);

file reports of suspicious transactions;

maintain reports of all payment stablecoin transactions.

Simply put, this would pretty much remove the possibility of conducting anonymous transactions with U.S. stablecoins for crypto purchases, trading, and redemption.

Needless to say, this would be utterly catastrophic for the crypto industry and their adherents who are ardent believers in decentralisation and anonymity.

I wonder why JD didn’t mention this part to the crowd of crypto enthusiasts.

Finally, with regards to Bitcoin itself, Vance praised the peer-to-peer, permissionless cryptocurrency and contemplated its long term strategic implications, noting that BTC is owned by over 50 million Americans. He further stated:

“I actually think that where Bitcoin is going is as a strategically important asset for the United States over the next decade.”

“It’s one of the reasons why President Trump with the help of our great AI guy David Sacks. It’s one of the reasons why we started the Bitcoin Reserve because we want to start to put in motion the strategic importance of Bitcoin for the United States Government.”

Again, a long term view, this time by the Vice-President of the United States and with the granddaddy of crypto, Bitcoin itself, implies that this digital asset will also be integrated into the new Western-led digital monetary system.

Through an executive order from last March, President Trump has already initiated the process of establishing a Strategic Bitcoin Reserve.

While the Trump Administration has yet to announce an official Strategic Bitcoin Reserve registry nor one for its U.S. Digital Asset Stockpile, it is only a matter of time until they are launched.

OPERATIVE #5: AI Crypto Czar David Sacks

Regarding the aforementioned STABLE Act and how it would require each permitted payment stablecoin issuer to monitor users’ transactions, it is important to recognise that this would entail millions of transactions (on a daily basis) involving U.S. stablecoins.

Accordingly, such monitoring will inevitably require AI-level technology to ensure compliance.

Moreover, it would be unfeasible to see each stablecoin issuer use different monitoring means or entities to perform these tasks since they would have to be performed in a consistent manner.

Therefore, it is to be presumed that a single entity would be tasked with such kinds of AI monitoring and that all approved stablecoin issuers would exclusively use that particular entity. Alternatively, each stablecoin issuer could be required to use the same AI program to monitor transactions for consistency across the U.S. stablecoin ecosystem.

This is where our next operative of importance comes into play.

I am referring to Silicon Valley’s tech titan David Sacks.

David Sacks is currently the Chair of President's Council of Advisors on Science and Technology.

On December 5, 2024, Trump announced on Truth Social that Sacks will be the “White House A.I. & Crypto Czar.”

Peter Thiel helped to advance JD Vance’s campaign by introducing the Vice-President candidate to Sacks who hosted a fundraiser for him and personally donated $1 million to a pro-Vance Super PAC.

In early June of 2024, Sacks hosted a fundraiser event at his San Francisco mansion with $30,000 to $300,000 tickets, raising $12 million for then Republican presidential candidate Donald Trump. When Sacks spoke at the event, he thanked Vance saying “this all started with J.D. Vance calling and asking if we could host an event for President Trump.”

David Sacks stands in the crowd on the first day of the Republican National Convention in Milwaukee on July 15, 2024. Photo source and credit: Tom Williams/CQ Roll Call/AP via the Washington Post.

Late in 1999, Thiel recruited Sacks Chief Operating Officer (COO) and product leader for PayPal.

It should also be observed that a year later Peter Thiel’s Confinity Inc. (the original creator of the PayPal product) merged with Elon Musk’s X.com Corporation and officially rebranded as PayPal Inc.

I’ll get back to Musk further below.

Continuing with David Sacks, his ties to Peter Thiel should not be underestimated.

Sacks was an early angel investor in Thiel’s Palantir.

Even amidst recent disclosures regarding Sacks divestments due to his advisory role as AI & Crypto Czar, there is no indication that he is not still invested in Palantir.

Needless to say, this poses tremendous potential conflicts of interests given his ties to Thiel’s Palantir which has military and data analytic services contracts with the federal government.

Even for a while now, there have been significant worries about Palantir's ability to surveil, track and, ultimately, control every aspect of peoples’ daily lives through their various projects.

Add to this Sacks’ newly found ability to leverage AI with Palantir resources to further track citizens’ stablecoin transaction data which could essentially dictate who will be permitted to conduct financial transactions and who won’t.

This level of power and control in quite concerning, to say the least.

If that weren’t enough, we must also take note of Sacks’ investments in multiple Musk companies, including xAI and X Corp (Musk’s purchase of Twitter) (see also this New York Times article).

When Must took Twitter private in 2022, he invited Sacks to help as an advisor for the transition.

It is also somewhat ironic that Sacks, a prominent member of the so-called PayPal mafia, railed against censorship by AI companies; yet with his current position as AI Crypto Czar within the Trump administration, he will be in a position to financially censor stablecoin users.

Sacks also holds an antagonistic view on China. "For the U.S. to outmaneuver China in the race to be the global leader in artificial intelligence, Washington needs to trash its traditional regulatory playbook in favor of a private sector-friendly model that aims to “out-innovate the competition,”” he recently said adding “we’ve got to let the private sector cook.”

Similar to Musk (with DOGE), Sacks didn’t have to go through the Senate confirmation process before being placed as AI & Crypto Czar, which has drawn concerns over potential conflicts of interests and lack of oversight.

To sum up on Sacks, there are multiple concerns given his numerous inherent conflicts of interests and connections in Silicon Valley, with Palantir, Thiel, Musk, and other private entities and power players in tech.

OPERATIVE #6: Elon Musk

Don’t let the recent [totally-not-staged] Trump-Musk spat deceive you.

Like David Sacks, Elon Musk was appointed as a ‘special government employee’ without any Congressional oversight to head the Department of Government Efficiency (DOGE) with the cover of cutting wasteful government spending (which it did for a measly $180 billion – compared to nearly $2 trillion annual deficits and $37 trillion in debt).

Sure some modest savings were accomplished.

But the real reason Musk was put in this role was to, immorally if not illegally, obtain personal information (including home addresses and taxpayer data) on millions of Americans through Social Security databases.

Importantly, it must be recalled that it was Treasury Secretary Scott Bessent (OPERATIVE #1) himself who granted Musk access to a massive pool of data which administers $6 trillion in annual payments to individuals, companies, and organizations – a colossal treasure trove of Big Data.

As an unelected ‘special government employee’ Musk gain access to this private information.

And now that his role as DOGE’s leader is finished, one has to wonder how much of Americans’ personal data and information has been stored in private databases held by the tech entrepreneur.

Moreover, without any public transparency as to what information was collected by Musk leads us to ask what he will do with all this data.

It is no secret that Musk has long talked about rolling out an all-encompassing X app similar to Tencent’s WeChat in China which will certainly include some kind of wallet for digital payments (like WeChat Pay).

This author taught for two years at Tencent’s headquarters (and at other departments in other locations) in Shenzhen, China, learning about how Big Data was used for various purposes, particularly with its AI systems. This permits Tencent (and indirectly the Chinese government) to monitor data of over a billion of its users with ease.

So just imagine a company like X having access to such kind of Big Data about American users (and likely users from many other countries). Obviously, this can be easily used for both censorship and de-banking (from the upcoming X wallet).

Additionally, we know that in China, the government can easily block citizens’ ability to make digital payments with WeChat.

Similar measures could very easily be programmed in X’s ‘everything app’, particularly for its digital payments service called X Money which is set to launch this year (2025).

WEF acolyte and X CEO Linda Yaccarino said “payments and banking” will be a focus for the rebranded business. She confirmed on her X account that X Wallets will be able to be funded via Visa Direct, users will be able to make P2P payments and instantly transfer money to their connected bank account.

Accordingly, X will have access to your banking information.

And the service has been approved for money transmitter licenses in 41 US states, according to the X Payments LLC website.

There are concerns that X Payments LLC could face less stringent oversight for data privacy in their policies (which almost nobody ever reads when they agree to them) and opting-out of data sharing (which almost nobody ever does). In addition, there are concerns about potential fraud that could occur (think of all those bots roaming around X just waiting to sniff out your personal banking information).

Furthermore, there is the concern that as a non-bank entity, X Payments would not be held to the same level of scrutiny as banks on how nonpublic personal information about consumers is shared with non-affiliated third parties.

In addition and perhaps more importantly, as X Payments LLC is registered with the Financial Crimes Enforcement Network (FinCEN), should any payments made be in the form of [the aforementioned] tokenised stablecoins like Tether (USDT), rest assured that each and every single one of the transactions made via X will be subject to monitoring as described earlier in this post (per the official documents of the proposed legislation).

Are we starting to see a common pattern folks?

But don’t worry. Elon is a good guy and is here to save us, no?

Other Operatives

There are certainly many more operatives or enablers at play here. But for the sake of brevity, I will just name a few more that we should keep an eye on:

Jack Mallers, CEO of Twenty One Capital (a Bitcoin treasury company)

since Twenty One (backed by Tether) is merged with [the aforementioned] Brandon Lutnick’s Cantor Equity Partners through a special-purpose acquisition company (SPAC)

since the Bitcoin they’ve acquired (of the 42,000 planned) with Tether could eventually be used for the U.S. Government’s Strategic Bitcoin Reserve or the U.S. Digital Asset Stockpile

Billionaire Winklevoss twins (Cameron and Tyler)

given their ties to David Sacks and President Trump and Bitcoin reserves (estimated at 70,000 BTC currently valued at over $7.3 billion)

for being installed as a puppet Prime Minister in Canada who would have no qualms in imposing a tokenised Digital Canadian dollar in the interest of the banking cabal he serves

for explicitly stating the following in his book Values: “The most likely future of money is a central bank stablecoin, known as a central bank digital currency or CBDC.”

4.1.3 When will the new system be launched?

Though it is very difficult to predict the timing of a said launch, there are indications that it could happen as early as the third or fourth quarter of 2025, as per statements and executive orders referenced in this post.

Behind the scenes, there also appears to be a lot of coordination between some of the largest banks in the United States (JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo) and crypto firms in the space such as Coinbase and BitGo, jockeying for stablecoins to be an integral part of the new system.

Personally speaking, even though a lot of elements (as described in the previous section) have already put in motion I doubt that there would be enough time to implement them all in a seamless, cohesive and coordinated fashion, at least in this year.

There certainly exists the possibility of a grand scale false flag crisis (such as a cyberattack or nuclear exchange) which could accelerate the launch of the new system.

As more information comes out about these plans (such as this particular article) along with the masses becoming ever more aware of them, it’s certainly possible that they may either have to put their plan for a monetary technocracy on hold, or return to the drawing board.

Time will certainly tell.

4.2 SYSTEM # 2: The Eastern/Chinese Gold-backed Trade Settlement System

4.2.1 Contextual Background

A little bit of recent context first in order to set the tone.

Just a couple of months ago U.S. Treasury Secretary Scott Bessent showed his (or his real masters’) colours by attempting to bully China with crushing tariffs.

Bessent is not a dumb man. Having done business around the world for decades, he most likely knows about key cultural differences as well as business culture differences.

The Chinese have very different, mostly non confrontational, style of negotiating compared to Americans. Having lived and taught in China for 13 years, I have learned a thing or two on the topic.

While it may be difficult to assess whether the bullying strategy emanated from President Trump or Bessent’s true masters, one thing remains certain – this almost appears like a planned economic assault on the Middle Kingdom given the significant amount of exports it has with the United States.

While the nominal figure for these exports may be quite large, in percentage terms, they account for roughly 14.7%. That is to say, no more that 14.7% of trade goods from China are exported to the U.S. with the rest going to other countries (150 countries and regions). In terms of imports into China from the U.S. we are talking about only 6.3%.

Chinese manufacturers have experienced similar challenges during Trump’s first administration and have since learned from those lessons. In other words, they have adapted their strategies to become less dependent on U.S. exports and are opting to sell their good to friendlier markets instead.

In terms of global trade dominance, the following infographic by VisualCapitalist clearly shows how China has overtaken the United States by 2024:

Needless to say, China can no longer be easily bullied by the United States given its current dominance in global trade.

The United States trade balance overall has been on a sharp decline for decades, reaching a deficit of over $971 billion for 2023 alone.

Even though Trump rightfully wishes to repatriate manufacturing onshore to the U.S., this could take decades, if even feasible.

For decades U.S. companies have outsourced manufacturing and production to China and other low-wage nations. This strategy, while extremely profitable to the owners and oligarchical class, has put the country at a clear disadvantage compared to its main rival China.

4.2.2 China is strengthening its relations with its neighbours / ASEAN

Having learned from the pitfalls of the first Trump Administration and his second term’s recent follies, China has basically had enough and has decided to strengthen and further solidify its relationships in Asia in particular.

China is even mending its relationship with its long time bitter enemy, Japan.

And it appears that Japan could be having a change of heart with regards to its strategic relationship with the United States.

“Japan intends to push back against any US effort to bring it into an economic bloc aligned against China because of the importance of Tokyo’s trade ties with Beijing,” states an April 24, 2025 article from Bloomberg citing Kono Taro, who previously served as Japan’s Foreign Minister and Digital Transformation Minister.

This sentiment was further conveyed by former Japanese Prime Minister Yukio Hatoyama who told China Daily in an exclusive interview that although Japan has largely pursued a national strategy of aligning with the United States, domestic voices in Japan have begun questioning this strategic direction.

"There is growing reflection on whether Japan, as an Asian nation, should redefine its position and role in the region. I believe Japan must actively work toward such a recalibration," he said.

There were even threats of Japan dumping their U.S. Treasurys. Keep in mind that Japan is the largest foreign holder of U.S. Treasurys.

Japan's finance minister, Katsunobu Kato, said the country's $1.1 trillion in Treasury holdings – the highest of any foreign creditor – could be a "negotiation card" in its trade talks with Washington.