Is the Bank of Canada working for the interests of Canadians or for the private Bank for International Settlements (BIS)?

Commentary by Dan Fournier, published Monday, Dec. 2, 2024, 9:45 EST on fournier.substack.com

This article is segmented as follows:

2. What is the BIS, Basel Committee, and when did the Bank of Canada join it?

3. How our Debt Burden has soared since joining the Basel Committee in 1974

5. The Bank of Canada’s stake in the Bank for International Settlements (BIS)

6. The BIS’ Toronto Innovation Hub & CBDC / Digital Payment System Plans

7. The Senate Bill that would further erode the Bank of Canada’s Independence

1. Introduction

Earlier this year in March, I published a Commentary article titled How the [Public] Bank of Canada was taken over by the [Private] Bank for International Settlements (BIS).

It provides a lot of historical information and data (such as debt levels by year) about the Bank of Canada, and also about its relationship with the Bank for International Settlements (BIS) with a focus on the Basel Committee which was established in 1974 thanks in large part to former Prime Minister Pierre Elliot Trudeau.

The piece also touched upon how our national debt has steeply risen since 1974, reaching over a trillion dollars by 2023.

Not excluding years of reckless fiscal irresponsibility on the part of the Federal Government (i.e., running large budget deficits), the principle reason for this colossal level of debt appears to be attributable to the costs associated with servicing this debt, i.e., paying interests on loans from private banks as opposed to our public bank – the Bank of Canada.

“Once a nation parts with control of its currency and credit, it matters not who makes the nation’s laws. Usury, once in control, will wreck a nation. Until the control of the issue of currency and credit is restored to government and recognized as its most sacred responsibility, all talk of the sovereignty of parliament and of democracy is idle and futile” - William Lyon Mackenzie King, Tenth Prime Minister of Canada, 1935

All this since 1974 when the Bank of Canada joined the Basel Committee and thenceforth took on expansionary monetary policies.

As I had included in my previous post, a 2018 article by Canadian Dimension states the matter quite succinctly [with emphasis added]:

“In 1974 the Bank for International Settlements (the bank of central bankers) formed the Basel Committee to ostensibly establish global monetary and financial stability. Canada, i.e., the Pierre Trudeau Liberals, joined in the deliberations. The Basel Committee’s solution to the “stagflation” problem of that time was to encourage governments to borrow from private banks, that charged interest, and end the practice of borrowing interest-free from their own publicly owned banks. Their argument was that publicly owned banks inflate the money supply and prices, whereas chartered banks supposedly only recycle pre-existing money. What they purposefully suppressed was that private banks create the money they lend just as public banks do. And as banking specialist Ellen Brown states:

The difference is simply that a publicly-owned bank returns the interest to the government and the community, while a privately-owned bank siphons the interest into its capital account, to be reinvested at further interest, progressively drawing money out of the productive economy. ”

I had also mentioned that put simply, it is a scam since a public central bank could lend the same money to a Government interest-free whereas a private central bank (or chartered banks) charges interest – which inevitably leads to increased levels debt, as was clearly and painfully outlined in that section of my article.

Furthermore, what journalist John Ryan from Canadian Dimension wrote back in 2018 is to the point [with emphasis added]:

“It appears that this decision was made without informing Canada’s parliament. This was such a fundamental change of policy that it should not only have been debated in parliament, this should have been put to a national referendum. Strangely, even when this became known, this was apparently never questioned by the opposition parties, especially the NDP, and never revealed in the media. Strange indeed.”

So, many questions remain and the purpose of this present post is to get to the bottom of some of them.

I have made media inquires to both the Bank of Canada as well as the Bank for International Settlements (BIS) and most of their answers will be included in this post in the relevant sections.

2. What is the BIS, Basel Committee, and when did the Bank of Canada join it?

2.1 Quick Introduction to the Bank for International Settlements (BIS)

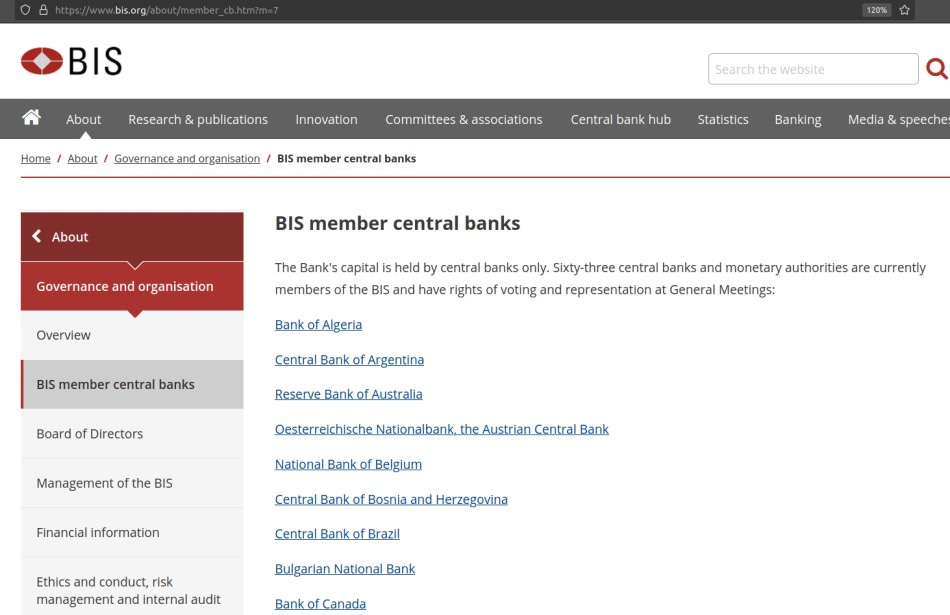

Firstly, the Bank for International Settlements, or BIS, is the central bank of central banks which steers its member banks towards monetary and financial cooperation.

For an excellent introduction to the BIS, I would encourage you to watch the following video titled The Bank for International Settlements -The Most Powerful Bank in The World (alternate video link here) by Stephan Smith.

It should be noted that the Bank of Canada became a shareholding member of the Bank for International Settlements (BIS) in 1970.

Section 5 of this article provides information about share ownership in the BIS, including the Bank of Canada’s stake.

The last point I would make in this very brief introduction about the private Bank for International Settlements is that, similar to the United Nations (and all its various bodies) and the World Economic Forum (WEF), not a single employee of this supranational organisation has ever been elected by members of the public nor by countries themselves; rather, they are appointed by insiders.

As such, can we really expect that they would be working for our benefit versus those of their shareholders?

2.2 The BIS’ Basel Committee

As per a BIS’ document from March 2001, the “Basel Committee was established as the Committee on Banking Regulations and Supervisory Practices by the central-bank Governors of the Group of Ten countries at the end of 1974 in the aftermath of serious disturbances in international currency and banking markets.”

As a member of the Group of Ten, Canada was an integral part of the Basel Committee (formally the Basel Committee on Banking Supervision) which was formed in 1974 with Pierre Trudeau’s Liberal Government joining in on the deliberations.

In short, Basel Committee members agree on standards for bank capital, liquidity and funding.

Since 1994, each Governor of the Bank of Canada has been a member of the BIS’ Board of Directors.

3. How our Debt Burden has soared since joining the Basel Committee in 1974

At the end of the government fiscal year of 1974, the Canadian Debt was C$21 billion, compared to over C$1.2 trillion today.

Screenshot of www.debtclock.ca taken on November 25, 2024. It shows Canada’s Federal Debt at over 1.241 trillion Canadian dollars with a daily increase of over C$109 million.

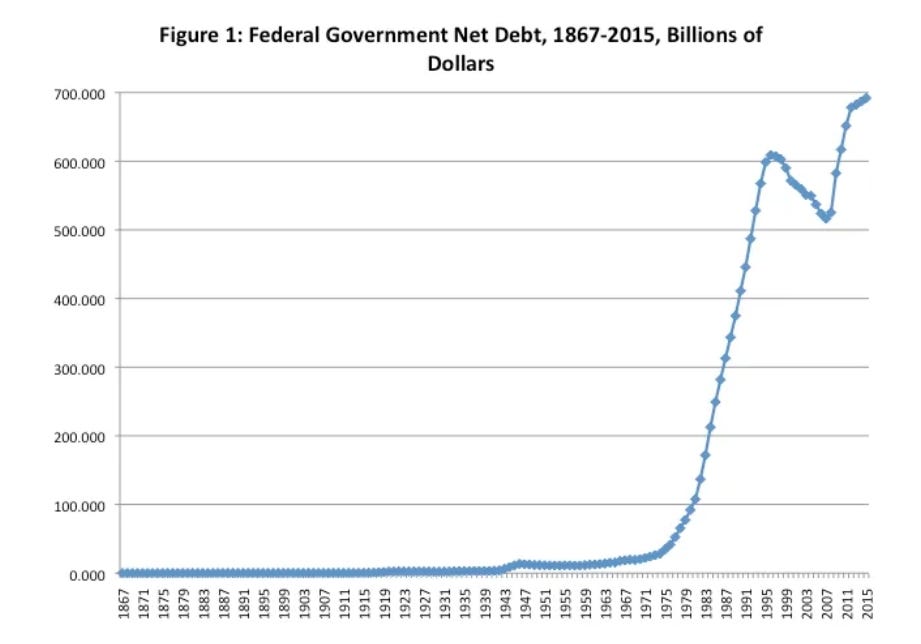

The following chart from The Fraser Institute (until 2015) provides a stark visual indication of the upward, hockey-stick, trajectory of how our debt starting ballooning from 1975, the year after the Bank of Canada joined the BIS’ Basel Committee:

Federal Government Net Debt, 1867-2015, Billions of Dollars. Source: The Fraser Institute’s A really quick history of Canada’s federal debt, March 9, 2016.

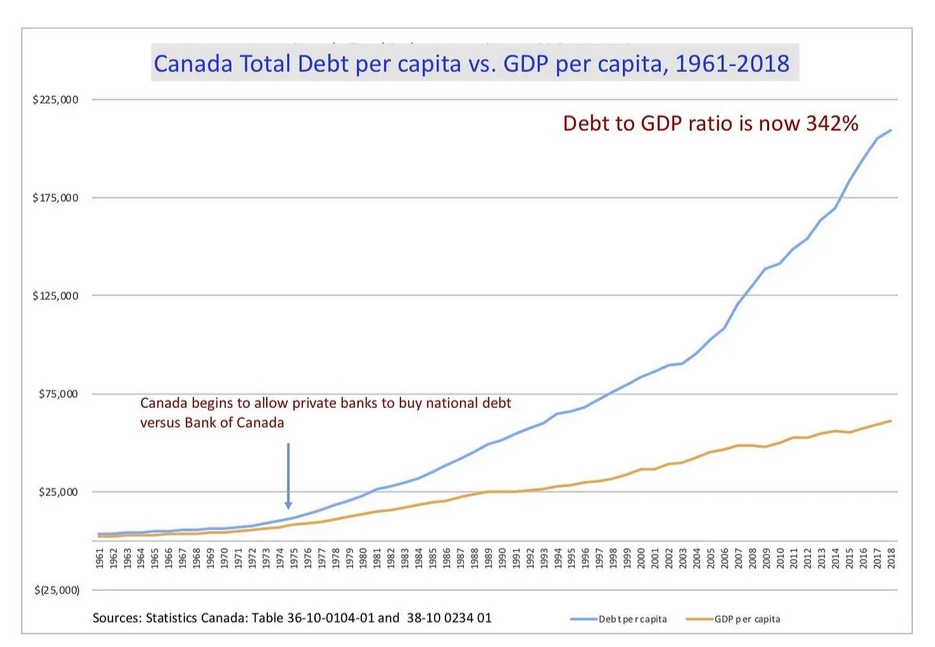

For additional reference on the matter, here is another chart showing Canada’s Total Debt per capita vs. GDP per capita (from 1961 to 2018):

In my media inquiry to the Bank of Canada, I asked them for their explanation as to why our debt began to exponentially soar from 1974/1975 – the point at which it joined the Basel Committee. Their response was as follows:

“Fiscal policy for Canada is set by the Government of Canada.”

That’s a strange response, or a very incomplete one since their explanation does not take into account monetary policy - which is what the Bank of Canada is largely concerned with.

To clarify their meanings, here are some broad definitions for the two courtesy of Investopedia.com:

Fiscal policy is a collective term for the taxing and spending actions of governments.

Monetary policy is primarily concerned with the management of interest rates and the total supply of money in circulation and is generally carried out by central banks.

Our central bank manages interest rates which affects borrowing costs, and by increasing our money supply (of Canadian dollars) it causes inflation that is due to the dilution the purchasing power of our currency, thus making things increasingly expensive for Canadians.

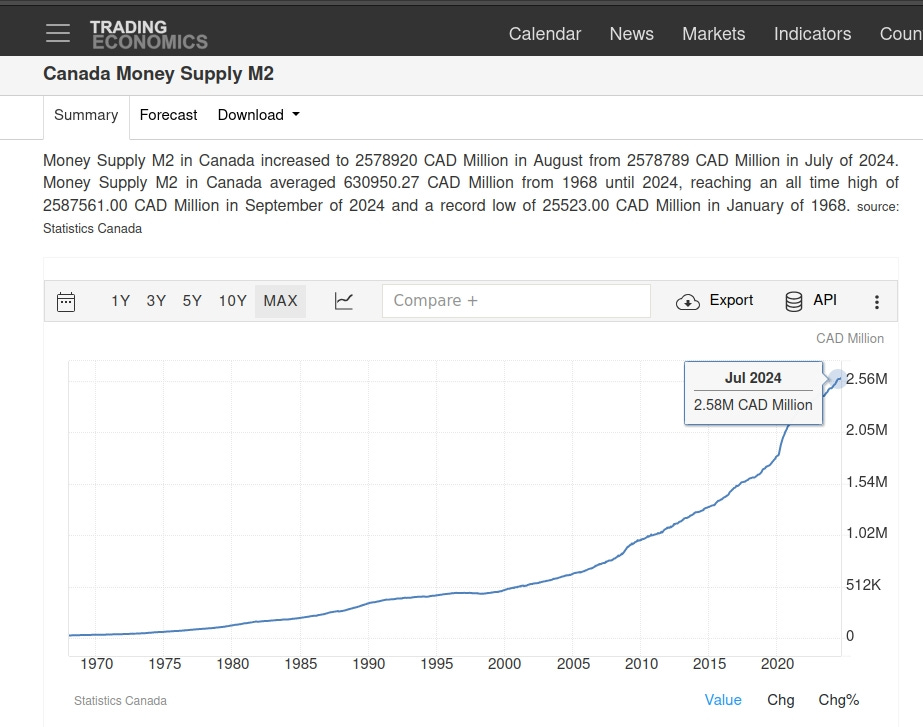

For a visual representation of this phenomenon, simply have a look at the following chart where you can see the gradual rise in M2 (money supply) since around 1975.

As goods and services get increasingly expensive (due to inflation caused by increases in the money supply brought about by the Bank of Canada with large-scale asset purchases, for instance), the Federal Government needs to take on additional debt to pay for these respective increases in debt-services costs.

Accordingly, all this national debt must be serviced by incurring interest payments.

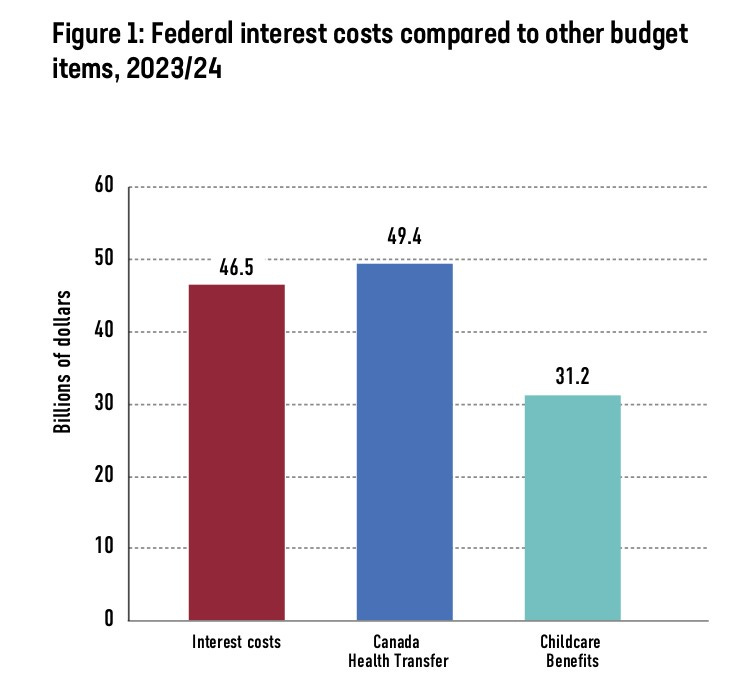

To give the reader sense of the amounts involved, here are the figures on how much in interest expense payments Canadians need to pay for 2023-2024 (according to the Fraser Institute):

$81.8 billion (federal + provincial)

$46.5 billion (federal)

If we are to stick just with the Federal interest costs, we can see that it amounts to C$46.5 billion.

And that’s just for one year.

Gulp.

For those who wish to check the official government numbers, you can head over to Statistics Canada’s Statement of government operations and balance sheet, government finance statistics (x 1,000,000) page, look for Interest under the Expense section, or play around with the Reference period settings to check the respective amounts for specific quarters or years.

In the absence of taming our debt and its associated servicing costs, we are looking at adding approximately half a trillion dollars over the next decade alone.

So, the key question that remains and needs to be demystified is:

“Exactly who do we owe this debt to?”

This is where it gets a bit challenging.

Honestly, I wish I had the financial acumen equivalent to the likes of John Titus who is an American attorney, specialising in financial forensics.

But sadly, the reader is stuck with yours truly.

The bread crumbs I have managed to find, however, at least provides us with an indication of who is holding the bag.

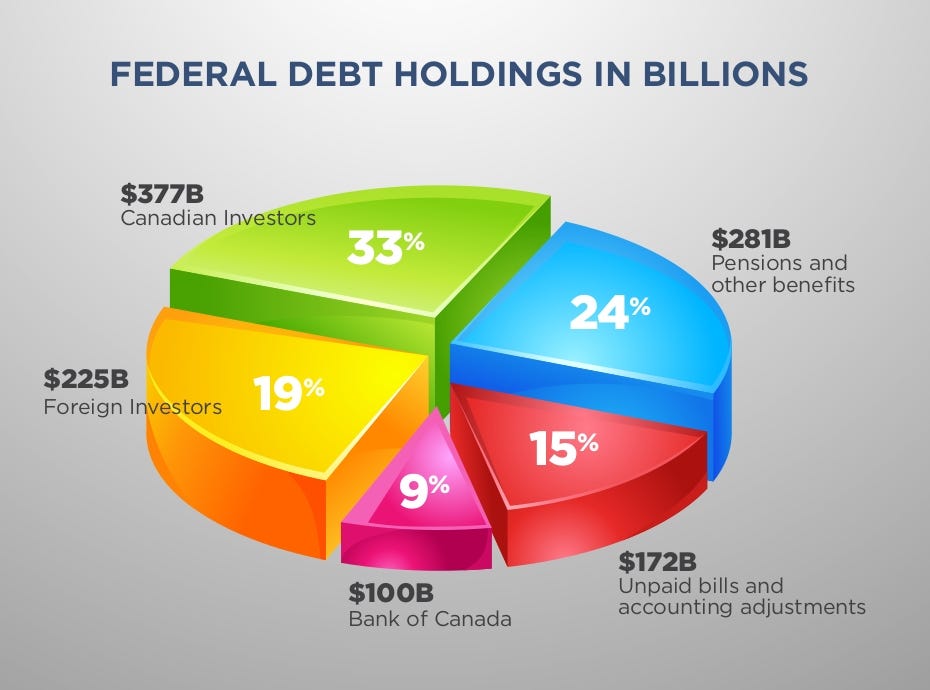

The best and most recent data I could find comes from a Fall 2019 leaflet from the Canadian Taxpayers Federation authored by Jeff Bowes called To whom do we owe the federal debt and how much in interest do we pay them every year?

Here is an excerpt from this leaflet for the section titled FEDERAL DEBT HOLDINGS IN BILLIONS:

Partial screenshot from The Taxpayers Federation 2019 leaflet To whom do we owe the federal debt and how much in interest do we pay them every year?

As can be seen from the pie chart in the figure above, the two largest debt holders are Canadian Investors and Pension Funds. It should also be observed that the Bank of Canada itself holds $100 billion of this debt, or only 9% of the overall total.

The third largest, Foreign Investors, is the one that interests us most though because it is in this slice that we would find the foreign private banks and financial institutions which are lending us hundreds of billions of dollars for which interest payments must be made. The figure for 2019 sat at $225 billion.

I inquired to the Canadian Taxpayers Federation who produced the leaflet to obtain more details about who exactly were the parties for the Foreign Investors part of this $225 in debt or which sources were used to tally them. Should I receive a response, I will append it to this post.

Meanwhile, if ever any of you have information about this, please post it in the Comments section below.

4. The Bank of Canada & Basel Committee Today

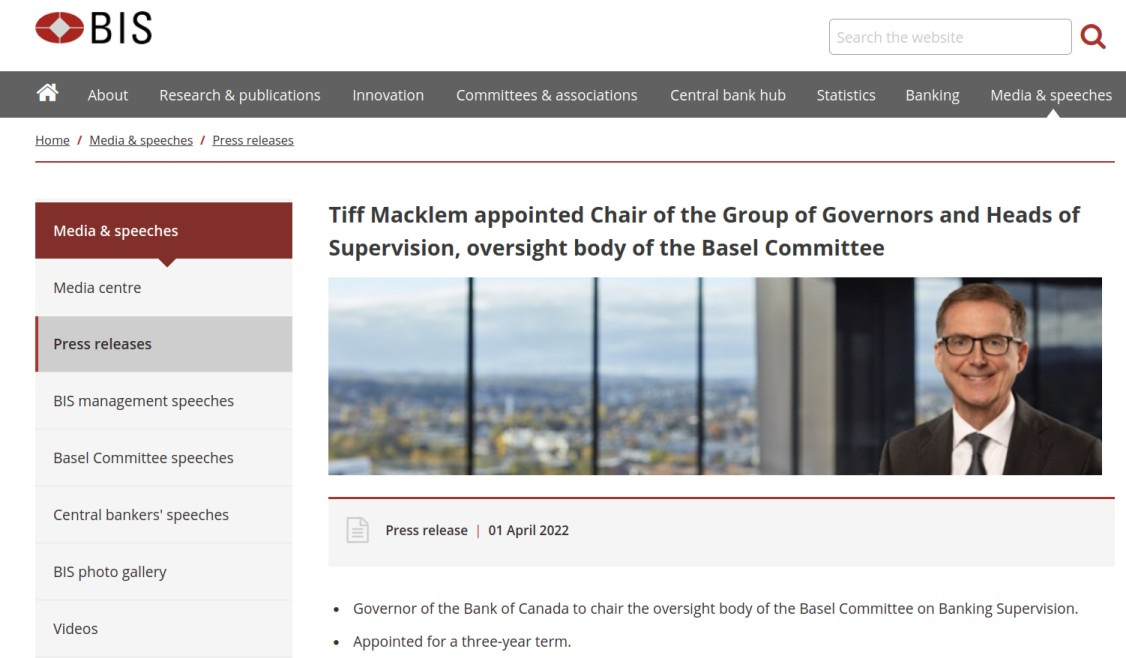

The Bank of Canada Governor Tiff Macklem currently serves as a member of the BIS’ Board of Directors.

On April Fools day of 2022, Governor Macklem was appointed as Chair of the Group of Governors and Heads of Supervision, the oversight body of the Basel Committee.

Every two months, member bank Governors attend a confidential (private) Basel Committee meeting in Basel, Switzerland.

Macklem is also co-chair of the Financial Stability Board’s Regional Consultative Group for the Americas.

Also based in Basel, Switzerland, the Financial Stability Board (FSB) is a very powerful body overseen by the BIS that makes makes recommendations about the global financial system. Between 2011 and 2018, it was chaired by then Bank of Canada Governor Mark Carney.

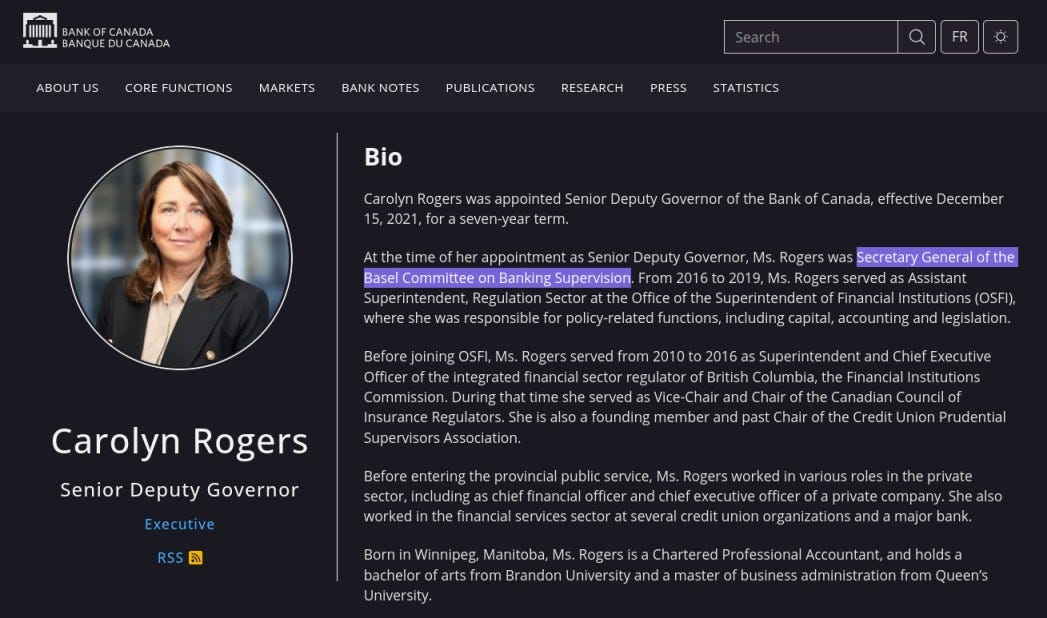

The Bank of Canada’s second-in-command, Senior Deputy Governor Carolyn Rogers, previously served as the Secretary General of the Basel Committee on Banking Supervision.

What is a bit head-scratching is the fact that there is zero mention of any of these crucial bi-monthly secret meetings at the Basel Committee on the Bank of Canada’s committees web page.

Why?

Why aren’t those meetings that are most likely playing a key role in our central bank’s policies not being referred to?

In addition to the secrecy of the bi-monthly meetings (see section 4.1 below), this adds to the lack of transparency on the part of this institution whose role is supposedly “to promote the economic and financial welfare of Canada.”

Accordingly, one can reasonably question whether they are really serving the interests of Canadian citizens and businesses, or those of private bankers.

4.1 The secretive nature of this relationship

When I previously mentioned that the Basel Committee’s bi-monthly meeting of its member central bank governors are completely conducted in secrecy, I was not joking.

As previously mentioned, member central bank Governors meet every two months at the BIS.

All its meetings are conducted in secrecy and their minutes, speeches, and documents remain strictly confidential and privy only to attendees.

This is not conjecture, it is clearly affirmed by a spokesperson for the BIS as per the following official video from the BIS’ own YouTube channel:

Near the end of the video the BIS’ spokesperson states:

“Well, as I expected we had to leave the meeting right on time. These discussion among the [central bank] Governors can only be really open and honest if confidentiality is maintained.”

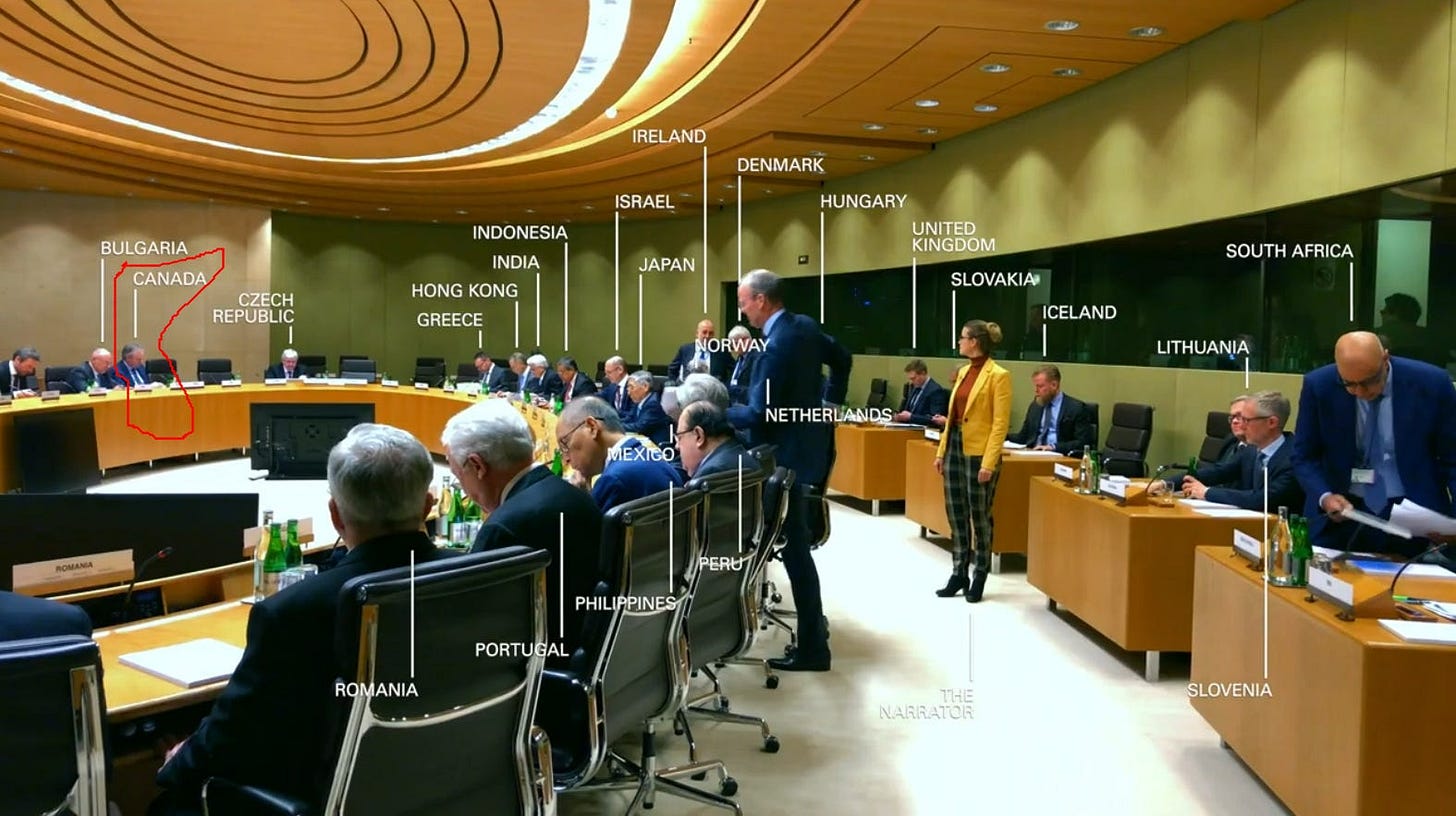

Screenshot of the video ‘This is the BIS’ showing various central Bank Governors during a bimonthly ‘All Governors’ Meeting’ including Canada’s (labelled and circled in red, presumably Tiff Macklem, the Bank of Canada Governor). Source: Bank for International Settlements YouTube channel.

And such “confidentiality” (i.e., secrecy) is strict at that.

Not even our elected officials (Members of Parliament) and appointed officials (Senators) can know of the secret dealings that take place with this committee.

Earlier in the video, she also says:

“The main purpose of BIS meetings is to build consensus among central banks and supervisory authorities. Once consensus is reached here, it is up to each central bank or supervisory authority to see to it that the outcome is implemented in their home countries.”

The narrated excerpt from above speaks volumes; these statements are overtly and ominously telling, as they appear to confirm that ultimately it is the BIS (by consensus of its member banks) itself who gets to dictate which monetary or financial policies get implemented by individual countries’ central banks.

I have asked the Bank of Canada about this point and you can see what they replied in Sub-section 4.2 below.

The only information the BIS shares about these bi-monthly meetings come from their press releases.

Did you also notice that Comments are turned off for this BIS video – as is the case for all their videos.

Why?

Why do they not allow comments from the general public to be given on their videos?

One last point I would make for this sub-section is the fact that the BIS has a special agreement with the Swiss government in that it enjoys total immunity from prosecution.

This is not conjecture, for it is clearly written and can be consulted in their own official document titled Agreement between the Swiss Federal Council and the Bank for International Settlements to determine the Bank’s legal status in Switzerland (archived here).

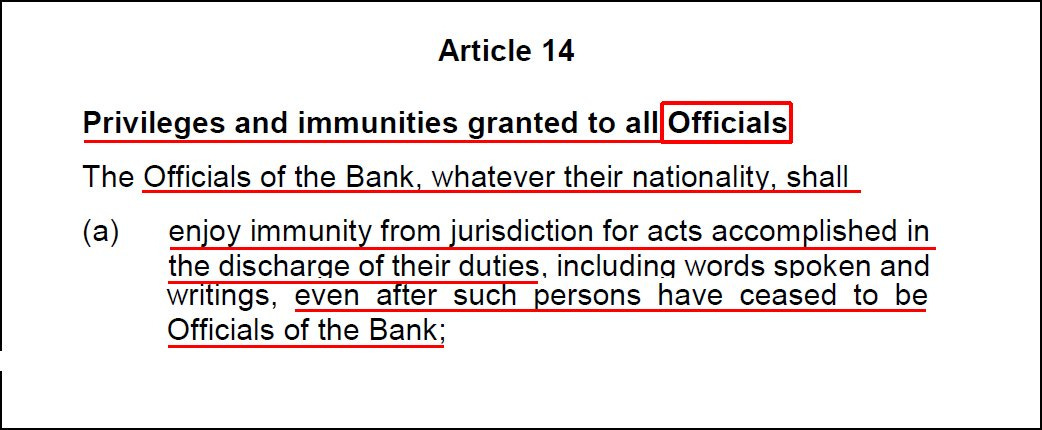

Without going into all the privileges and immunities this agreement entails (which I have previously covered elsewhere), I will simply show that all BIS officials – which includes the current Bank of Canada Governor Tiff Macklem given his chairmanship in the Basel Committee’s oversight body – enjoys immunity even after he ceases to be employed by the BIS:

Screenshot (with emphasis added in red) of Article 14 of the Agreement between the Swiss Federal Council and the Bank for International Settlements to determine the Bank’s legal status in Switzerland (archived here).

This means that neither our political (MPs/Senators) nor officers from our law enforcement agencies such as the RCMP would be able to obtain testimony or documents from Mr. Macklem should any investigation of impropriety arise from activities he performed while employed by the BIS or even afterwards.

4.1.1 Canadian Law: Bank for International Settlements (Immunity) Act - Addendum added on 2024-12-03 at 9:25 am:

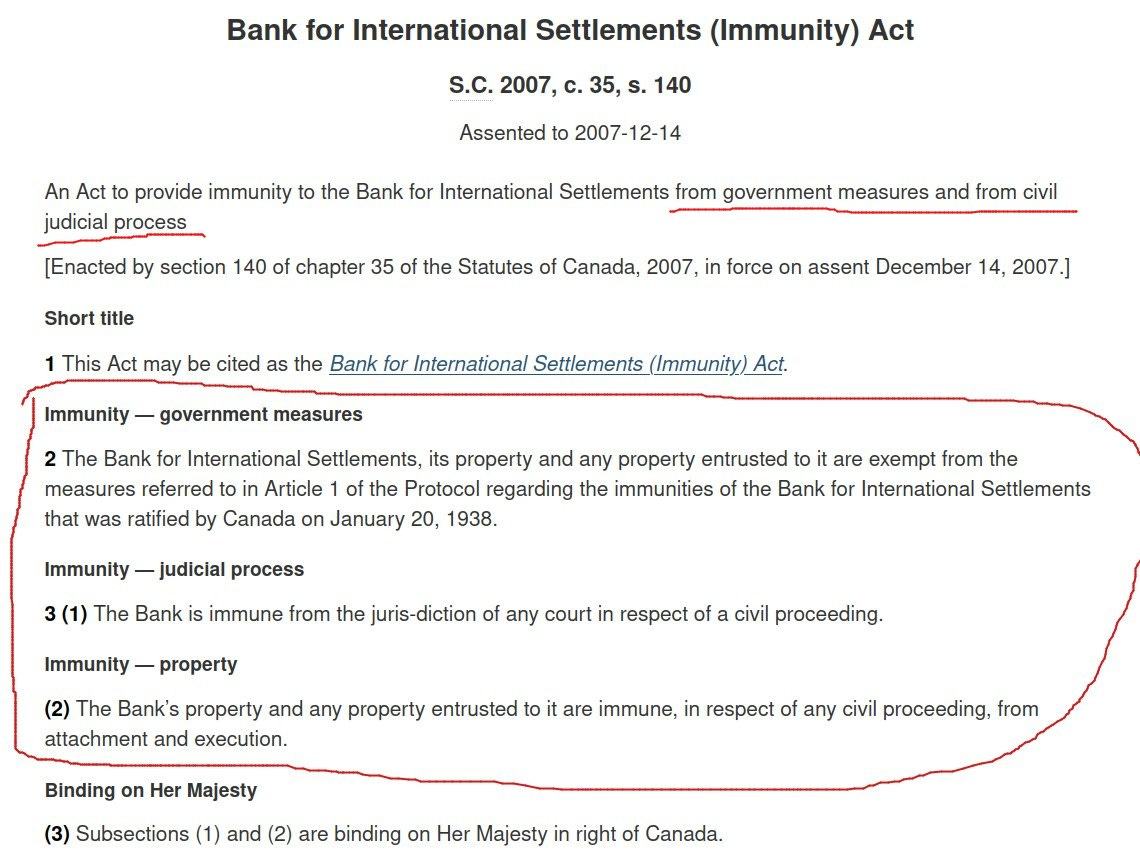

A little-known Canadian law has come to my attention, namely the Bank for International Settlements (Immunity) Act which was assented to on December 14, 2007 amidst of the 2007-2008 Financial crisis.

[CORRECTION (added 2024-12-16): The Bank for International Settlements (Immunity) Act was introduced as a Private Member's Bill in the House of Commons by Jean-Luc Pépin, who was a Member of Parliament (MP) for Mercier (Quebec) and passed by the Canadian Parliament (Pierre Trudeau Government) in 1978; in 2007, it was amended and re-enacted as a revised version.]

It’s a short Act which I will show in full hereunder beginning with the immunities granted to the BIS [with emphasis added in red]:

As you can see from the screenshot above, the Act provides for the BIS to be immune from government measures, civil judicial process, and property seizure.

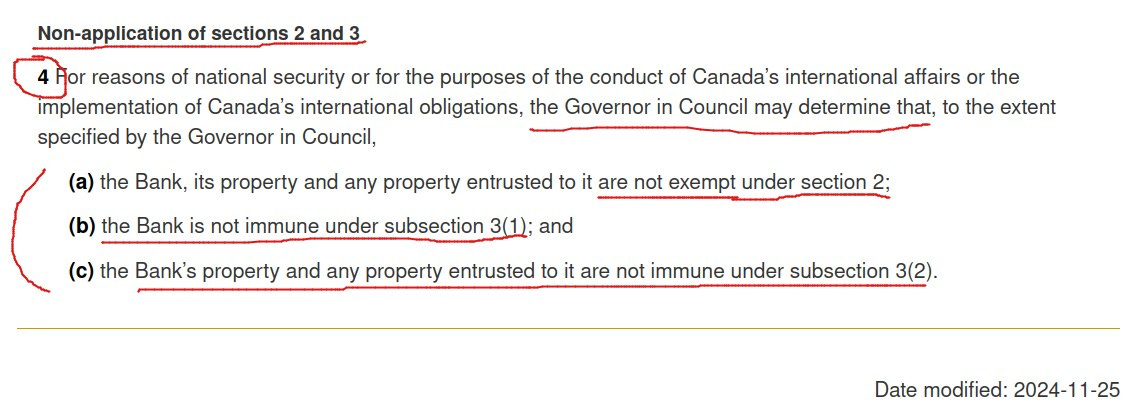

Clause 4 of the Act, however, does appear to provide exceptions [with emphasis added in red]:

It’s a bit odd that there is this exception clause. The text of clause 4 specifies that for reasons of “national security” or “for the purposes of the conduct of Canada’s international affairs” or for the “implementation of Canada’s international obligations” the Governor in Council (i.e., the Governor General of Canada acting on the advice of the Cabinet led by the Prime Minister) can basically remove all the immunities granted to the BIS (in clauses 2 & 3).

Accordingly, one may be reasonably inclined to ask:

Is our level of Canadian Debt which is now at more than C$1.2 trillion and is expected to grow another half a trillion dollar in the next decade plus related interest expenses not a “national security” concern?

Well, the way this Governor in Council (i.e., the Prime Minister and his Cabinet) is running the country, I guess they don’t deem this existential financial calamity enough of a threat to act and do the right thing by completely severing ties with this supranational, unelected organisation.

[End of Addendum]

4.2 If this relationship is non-binding, then why are we in it?

As I mentioned in a recent interview on The Jason Lavigne Show and previously wrote about, the BIS is an unregulated supranational entity that has no supervising authority and is not accountable to anyone or any country.

Moreover, this is stated in the BIS’ own document on the Basel Committee from March 2001:

“The Committee does not possess any formal supranational supervisory authority. Its conclusions do not have, and were never intended to have, legal force.”

Put simply, what this means is that any standards, guidelines, recommendations, best practices coming out of its meetings are non-enforceable and non-binding. They do not have to be followed.

A similar statement is repeated in most of their official Basel Committee press releases, as clarified in a Note at the end of these. Here is an example for a recent press release dated November 20, 2024 [with emphasis added]:

“Note to editors

The Basel Committee is the primary global standard setter for the prudential regulation of banks and provides a forum for cooperation on banking supervisory matters. Its mandate is to strengthen the regulation, supervision and practices of banks worldwide with the purpose of enhancing financial stability. The Committee reports to the Group of Central Bank Governors and Heads of Supervision and seeks its endorsement for major decisions. The Committee has no formal supranational authority, and its decisions have no legal force. Rather, the Committee relies on its members' commitments to achieve its mandate. The Group of Central Bank Governors and Heads of Supervision is chaired by Tiff Macklem, Governor of the Bank of Canada. The Basel Committee is chaired by Erik Thedéen, Governor of Sveriges Riksbank.”

Despite this disclaimer, the note from above does state that the Basel Committee “relies on its members' commitments to achieve its mandate.”

The wording choice, “mandate” though is rather contradictory to the general disclaimer; wouldn’t you say?

Looking at the definition for mandate, we can see that they imply that their members (i.e., participating member central banks via their respective Governors) are indeed expected to carry out their standards, guidelines, recommendations, and/or practices which come about from their bi-monthly secretive meetings.

The extent to which these standards/guidelines/recommendations/practices actually get implemented as Bank of Canada as policies is very difficult, if not impossible, to determine given the secrecy regarding the contents of those meetings.

Could there be any warnings or threats directed to central bank governors who don’t toe the line?

Possibly.

Again, given the secrecy of what actually takes place at those meetings (and in hotels and related dinners there) leaves us totally in the dark as to what the heck subsequently happens at our central bank and who is actually calling the shots.

In a response to my media inquiry on the subject, an unnamed employee from the Bank of Canada replied with the following:

“While no minutes of these meetings are published, these meetings do not provide direction for monetary policy. The Bank of Canada conducts monetary policy subject to its mandate in the Bank of Canada Act and under the inflation-targeting agreement we have had with successive Canadian governments. We are clear about our goals for price stability, how we pursue them and what we’re looking at as we make monetary policy decisions.”

The unnamed employee also added:

“We participate in international committees like the Basel Committee to exchange views on important global and international economic and financial developments. This sharing of perspectives helps each of us get a better sense of the forces that might be affecting our own economies. Ultimately, each central bank does what’s best for its own economy. As Governor Macklem put it, “the global system… affects everyone and is critical to our shared prosperity.” You can read the full speech on the importance of international cooperation here: The long and short of it: A balanced vision for the international monetary and financial system - Bank of Canada”

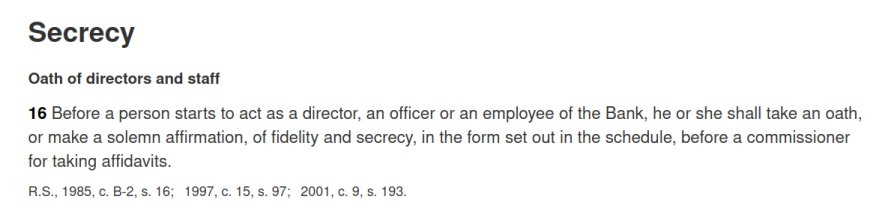

As the Bank of Canada Act was referenced in their response, it should be remarked that provision 16 of the Act also entails an oath of secrecy on the part of its directors and staff:

Of course such kind of clause is to be expected given the nature, sensitivity, and importance of decisions made by the central bank. This is to avoid potential leaked information that could be used for insider, time-sensitive, or improper trading in the financial markets.

But at the same time, it nevertheless further shields not only the Governor, but all employees of our central bank from divulging information that could stem from mandates emanating from the BIS.

5. The Bank of Canada’s stake in the Bank for International Settlements (BIS)

5.1 Some background information first

I should preface this section by stating the fact that on November 25, 2002 the Arbitral Tribunal in The Hague made public its decision regarding the mandatory withdrawal of all 72,638 shares of the Bank for International Settlements (BIS) formerly held by private shareholders (see BIS press release).

Put simply, due to this tribunal’s mandatory withdrawal of all privately-held shares in the BIS (i.e., by “privately” this suggests ownership by individuals and/or businesses, for instance), the BIS appears to remove the possibility of ownership by private entities.

What I mean “appears to” is simple. While it is very well possible that no individuals or businesses currently and directly own shares in the BIS, we know for a fact that certain private central banks such as the U.S. Federal Reserve do own shares in the Bank for International Settlements.

And the owners of the Federal Reserve itself consists of wealthy individuals such as the Rothschilds and the Rockefellers as well as large banks such as J.P. Morgan and many others.

To be more specific each one of the 12 regional banks that make up the Federal Reserve System are entirely owned by private member (commercial) banks who are also guaranteed an annual 6% dividend payment.

As an example, here are the ten largest shareholder banks of the New York Federal Reserve (the most important of the 12 regional banks):

JPMorgan Chase & Co.

Citigroup Inc.

Goldman Sachs Group, Inc.

Morgan Stanley

Bank of New York Mellon

HSBC USA Inc.

Barclays PLC

Wells Fargo & Co.

State Street Corporation

Deutsche Bank Group

These are all private, profit-seeking, commercial banks.

Cross-ownership in these banks by each other, other banks and financial institutions, wealthy individuals (though their investment firms, e.g., the Rockefellers & Rothschilds) as well as multinational corporations also muddies the waters in terms of who exactly owns these commercial banks, and hence the U.S. Federal Reserve and other private central banks.

Accordingly, to state that the BIS put an end to private ownership in its shares is patently false.

Herein consists of one of the BIS’ most sacred secrets.

5.2 The Bank of Canada’s Slice in the BIS

The Bank of Canada figures among one of 63 central banks that own the BIS.

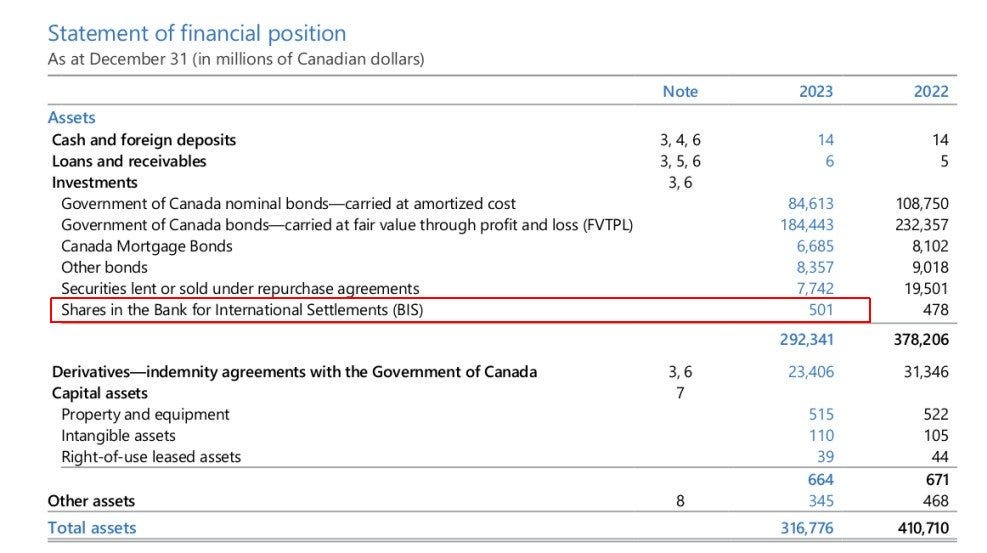

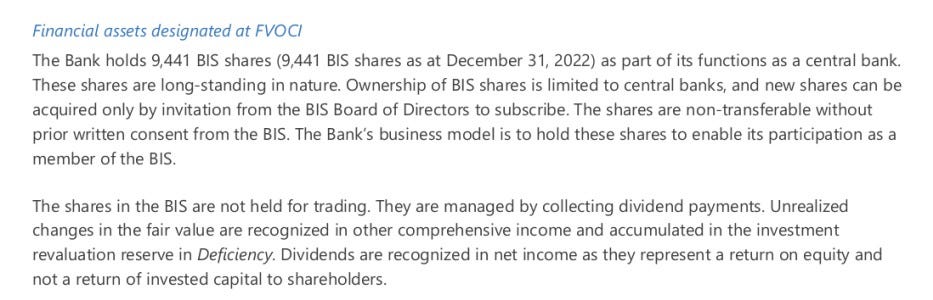

A spokesperson from the Bank of Canada confirmed to me that our central bank owns 9,441 BIS shares and their fair value is at $501 million (as at December 31, 2023).

This can be verified from their 2023 Annual Report (Financial Statements) and here is a screenshot from page 6 [with emphasis added in red]:

These shares are not for trading but they enable their participation as a member of the BIS.

The shares also pay dividends which are included in the total for net income; the spokesperson for the bank affirmed that the payment it has received (for these dividends) this year equalled roughly C$6.3 million.

6. The BIS’ Toronto Innovation Hub & CBDC / Digital Payment System Plans

6.1 BIS’ Toronto Innovation Hub

As was mentioned in the BIS’ 2023-2004 Annual Report, the supranational organisation solidified an agreement for the opening of the BIS Innovation Hub Toronto Centre.

Cover page of the BIS’ 2023/2024 Annual Report featuring Tiff Macklem (bottom left) and Agustín Carstens (bottom middle) – General Manager for the BIS.

The BIS has seven Innovation Hub Centres in all.

As per its web page on the BIS’ website, the Toronto Innovation Centre’s focus is on developing the basic infrastructure needed to enable new technology and innovation in the financial system.

The opening ceremony for the Toronto Innovation Hub featured remarks by the BIS’ General Manager Agustín Carstens and Bank of Canada Governor Tiff Macklem, among others. It is well worth the watch in its entirety, for it outlines the mission, role, and projects the Canadian arm is involved in.

The Toronto Hub’s main project is called Project FuSSE (Fully Scalable Settlement Engine) which aims to “modernize financial market infrastructures for the demands of the digital age.”

Key projects from other centres include:

Project mBridge: a multi-central bank digital currency (CBDC) platform shared among participating central banks and commercial banks.

Project Icebreaker: cross-border retail CBDC payments.

Project Agorá: tokenised commercial bank deposits / how tokenisation can enhance wholesale cross-border payments.

Project Aurora: build public-private stakeholder awareness, engagement and governance initiatives / combat money laundering across institutions and borders.

Project Hertha: how network analytics could help identify financial crime patterns.

Project Aurum: a two-tier retail CBDC system.

Project Raven: using AI to assess cybersecurity resilience.

Project Genesis 2.0: smart contract-based carbon credits attached to green bonds / digitising green bonds with carbon forwards.

While all the projects of the seven BIS Innovation Hub Centres appear distinct or separate from one another, they are actually individual components that will make up the architecture, plumbing if you will, of the next international financial and monetary system.

Due to its isolated silos, it is reminiscent of how the Manhattan Project was set up and brought to achievement.

As was stated in the talk, the BIS Innovation Hub’s mission is [verbatim with emphasis added]:

“To develop technological public goods to support central banks and improve the functioning of the entire global financial system.

...

The BIS Innovation Hub is a collaborative enterprise. The BIS Innovation Hub[s] do not operate as silos each pursuing its own narrow agenda[s]. They all play their part forming a coherent whole.

Each center works pro works program is structured around six core teams which are common to the entire Innovation Hub.

Because they work together, their combination is greater than the sum of its parts.”

The “entire global financial system” is no small potatoes and goes to show the level of importance and ambition the BIS places on the Innovation Hub network.

Later in the talk during a Q&A session, Governor Tiff Macklem explained three main reasons for the Bank of Canada to get involved in the BIS’ Innovation Hub. Around the 33:20 mark he mentioned some possible dangers as “everything goes digital,” further inquiring on what we are to do in the event of potential failures, cyberattacks, privacy breaches, and fraud – which are certainly very important considerations.

He then rhetorically asked where central banks come into play, emphatically stating they “we [central bankers] are in the business of trust.”

TRUST indeed.

Let me ask the reader, how can we trust the BIS when its Basel Committee meetings are strictly confidential?

How can we trust the BIS when it and its employees enjoy total immunity from prosecution even if they do commit crimes?

How can members of the public trust the BIS when they don’t even allow comments on every single one of their videos from their YouTube channel?

How can we trust that the Bank of Canada is (and will be) actually serving the best interests of Canadians rather than private interests?

How can we trust the Bank of Canada when they reply anonymously to a journalist’s media inquiries?

These are but some questions that need to asked with regards to trust.

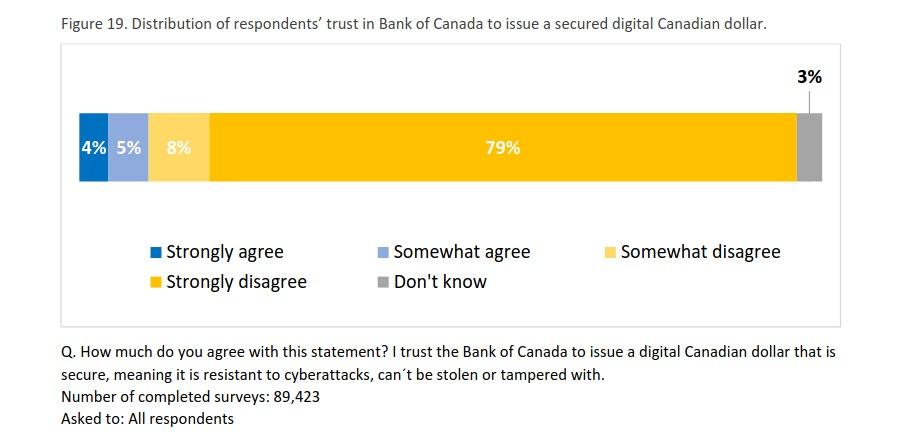

This author is not alone when sharing this negative sentiment with regards to trust. There are at least 77,798 (87%) Canadian respondents who lack trust in the Bank of Canada to issue a secured digital Canadian dollar, as per the results of a comprehensive survey issued by the bank in 2023:

I will cover more aspects of the results of this survey regarding the Digital Canadian Dollar (CBDC) in the following sub-section.

Trust is the single most important factor which determines whether a[n unbacked] fiat currency has, holds, and maintains value over time.

To conclude this sub-section, projects and activities emanating from the BIS Innovation Hub are something we need to keep an eye on in the coming months and years; for, if they achieve and implement what they are seeking, it will undoubtedly have a profound effect on how we financially transact (if we are even permitted to do so) in this new digital financial system.

6.2 CBDC / Digital Payment System Plans

There’s been a lot going on in the last several years with regards to Central Bank Digital Currencies (CBDCs) not just in Canada, but around the world.

While this subject is quite large in scope, I will just focus on the latest developments for Canada as well as the BIS’ greater ambition on a multi-nation digital currency.

6.2.1 Canadian plans for a Digital Dollar (CBDC)

Since 2017 with Project Jasper, the Bank of Canada along with Payments Canada have been looking to develop a Digital Dollar, a kind of Central Bank Digital Currency (CBDC).

During a six week period in the summer of 2023, the Bank of Canada in collaboration with Forum Research conducted an online public consultation to gather community views and preferences from across Canada regarding the potential introduction of a digital Canadian dollar.

A total of 89,423 responses were received from members located in all provinces and territories which represents a significant level of response and interest for the subject.

This was a very well designed and worded online survey which included questions covering a variety of key aspects related to the potential use and transition to a digital dollar as well as consumer preferences with regards to payments (cash and electronic/digital).

The Bank of Canada heard not only from members of the general public, but also from other financial sector stakeholders to obtain feedback on the following themes:

accessibility and financial inclusion

privacy

continued access to bank notes

security and technology

digital dollar ecosystem

financial stability

As per results of the survey which were published in November of 2023, two major areas of concerns from those surveyed included the right to continue using cash (bank notes and coins) as well as financial privacy.

Without going through the entire Digital Canadian Dollar Public Consultation Report, here are some of the key highlights/concerns expressed by those consulted.

Cash was the largest used form of payment among respondents at 93% (see Figure 9)

Anonymity was stated as the reason for using cash (see Section 2.3)

In terms of access to money issued and backed by the Bank of Canada, 44% of respondents (the largest group) said that this was “very important” followed by 16% saying it was “somewhat important” (see Section 3.1)

In terms of accessibility, or the importance of a digital Canadian dollar be designed to be accessible to all Canadians, 34% of respondents stated it as “important” while 52% stated it as “unimportant.” (see Figure 13)

The most important feature in the design of a digital Canadian dollar was that “it would need to be private.” (see Figures 14 and 22)

90% of respondents said they would not consider giving their children digital Canadian dollars for day-to-day transactions. (see Figure 15)

87% of respondents distrust the Bank of Canada to issue a secured digital Canadian dollar (see Figure 19 – which is shown in the preceding section of this post)

85% of respondents said they would not use a digital Canadian dollar, 13% said they would use one, and 3% said they don’t know. (see Figure 23)

Distrust Trust in organizations (Financial Institutions, Bank of Canada, Government of Canada, and Technology Companies) with regards to handling of data privacy and protection is very high, ranging from 72% to 86% among these four groups. (see Figure 21)

The two most telling results from the summarised points above show that 87% of respondents distrust the Bank of Canada to issue a secured digital Canadian dollar with 85% stating that they wouldn’t use it.

So, needless to say, the general sentiment with regards to a digital Canadian dollar is quite negative.

In a response to an inquiry from last April probing whether or not the bank was currently working on the development of a digital Canadian dollar, a spokesperson for the Bank of Canada stated that:

“The Bank continues its research on a digital form of the Canadian dollar, to be ready if Canadians’ payment preferences or needs change. Whether and when Canada will need a Digital Dollar is uncertain. Ultimately, the decision about whether to issue one rests with Canadians and their representatives in Parliament. You'll find updates on our Digital Canadian Dollar work here: https://www.bankofcanada.ca/digitaldollar/”

As reported on by The Canadian Independent last September, the Bank of Canada has announced that it is “scaling down its work on a retail central bank digital currency and shifting its focus to broader payments system research and policy development.”

With regards to the future of payments, the bank also stated that its mandate to oversee retail payment service providers is coming into force in 2024 which includes “policy development related to wholesale and retail payments infrastructure.”

It should be noted that the Bank of Canada was granted responsibility for supervising payment service providers under the new Retail Payments Activities Act (from 2021), and that with regards to international collaboration on the regulatory agenda, the bank works with the BIS and its Financial Stability Board (FSB) as well as the International Monetary Fund (IMF).

Put succinctly, aligning Canadian domestic regulations with regards to payments (particularly cross-border ones at the wholesale level) with those of financial (supranational and unelected) bodies such as the BIS and IMF represents cause for concern.

With regards to the IMF specifically, financial forensic investigator John Titus produced an excellent video report called CBDC and the Fed's Plan to Weaponize Money which shows the dangers of the institution’s plans for a CBDC which is well worth the watch.

The use of “wholesale” and “retail” payments infrastructure suggests and underlying architecture is being designed for digital payments.

In CBDC parlance, “retail” generally refers to a domestic (national) CBDC or digital currency whereas “wholesale” refers to cross-border (international) payments and remittances.

Accordingly, all this appears in accordance with what was mentioned earlier in Section 6.1 of this post whereby the Toronto BIS Innovation Hub is currently working on Project FuSSE (Fully Scalable Settlement Engine) which aims to “modernize financial market infrastructures for the demands of the digital age.”

Furthermore, on July 10 of 2024 the Bank of Canada published a paper/document titled The Role of Public Money in the Digital Age whose Conclusion stated that [with emphasis added]:

“Given this role of retail public money, it is likely that a digital form of cash, a CBDC, will be needed in order to maintain the status quo.

...

A retail CBDC with qualities like those of cash would be able to work with other components of the monetary framework (e.g., financial regulation, deposit insurance) to support a well-functioning monetary system.”

To sum up, even though Canadians are clearly averse to the introduction of a digital Canadian dollar, the Bank of Canada nevertheless appears to be moving forward with plans to, at the very least, develop the digital payments infrastructure that would underpin its use (of a retail digital Canadian dollar) or that of an international one – such that may be currently, and secretly, planned for by the Bank for International Settlements.

This is ever more likely, given the mission statement (see section 6.1 above) outlined by the BIS’ General Manager at the opening ceremony for the Toronto BIS Innovation Hub.

This, needless to say, once more brings into question whether the Bank of Canada is really independent from the BIS.

6.2.2 The BIS’ plans for a Digital Currency (CBDC)

Agustín Carstens, General Manager of the Bank of International Settlements (BIS), gave a keynote speech at the Monetary Authority of Singapore (MAS) on February 22, 2023 in which he stated [with emphasis added]:

“Around the world, central banks are exploring how to give money new capabilities... But to fully realise the transformative potential of these new financial technologies, we need some way to bring them all together. In this regard, there is great promise in developing the idea of a "unified ledger" with a common programming environment.”

Back in 2021, when Carstens was talking about CBDCs and how they would be programmed, he publicly confirmed that central banks would hold absolute control over their use and that they would have the technology to enforce it:

“A key difference with the CBDC [as opposed to cash] is that central bank will have absolute control on the rules and regulations that will determine the use of that expression of central bank liability. And also we will have the technology to enforce that.” - Agustín Carstens, General Manager of the BIS

Put simply, the General Manager for the Bank for International Settlements (BIS) – a supranational institution which none of us elected and whose members enjoy total immunity from prosecution – is stating that [member] central banks will have “absolute control” on the rules and regulations that will “determine the use,” i.e., who can and cannot buy, what the digital currency will be allowed to buy, or whom it can be transferred to.

The dangers and potential for abuses such a system would entail is simply mind-boggling.

Not only would there be a huge lack of privacy, but citizens – particularly dissidents or critics of the government – could find themselves in a situation where they are totally de-banked and cannot transact financially.

Is that the kind of system you want to live under?

Is that what the Bank of Canada and the Canadian government stand for and would allow to materialise?

Are they knowingly letting this happen or helping to enable it?

7. The Senate Bill that would further erode the Bank of Canada’s Independence

The revelations that appear in this section have received next to zero attention in the Canadian media – including the so-called alternative media.

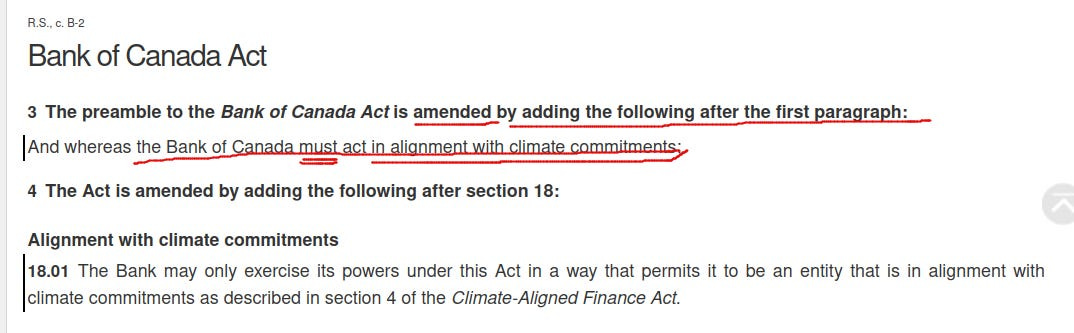

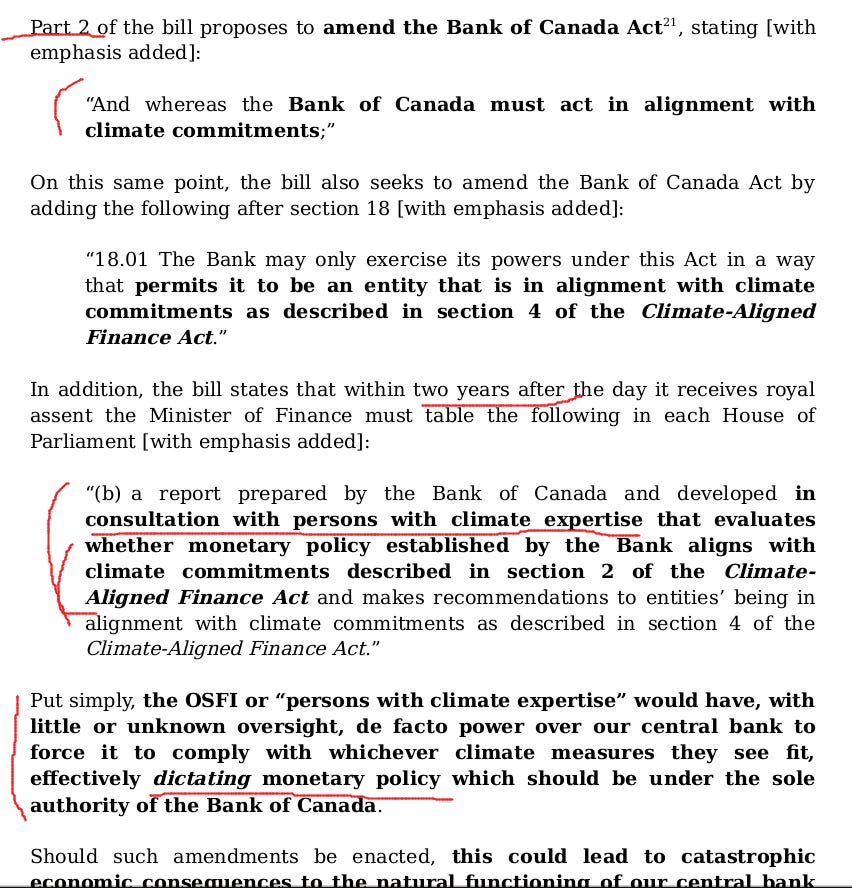

In two of my recently published articles, I outlined the dangers of Senate Bill S-243 regarding the Climate-Aligned Finance Act:

Canada’s Carbon Colony: You will Not own a Home, nor be Happy (see Addendum 7.2), June 3, 2024

My Open Letter to 105 Canadian Senators about Bill S-243 regarding the Climate-Aligned Finance Act, October 01, 2024

In an addendum for my first article, I showed how should Bill S-243 become law, the Bank of Canada would essentially cede a very significant portion of its authority to an outside entity as per the bill’s proposed amendment to the Bank of Canada Act [with emphasis added in red underlining]:

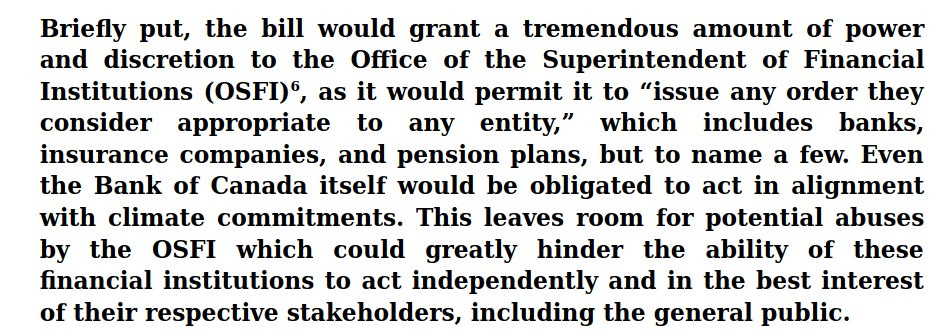

And this outside entity consists of the Office of the Superintendent of Financial Institutions (OSFI).

In the opening part of my Open Letter to all 105 Senators I summarised the inherent dangers involved in this radical proposal to amend the Bank of Canada Act:

I also warned how the proposed amendments dictates that after two years of receiving royal assent, the Minister of Finance would require the Bank of Canada to prepare a report showing that its monetary policy would have to be in line with “climate commitments” dictated by an outside entity – likely the OSFI:

In other words, as I sated in my open letter, the OSFI or “persons with climate expertise” would have, with little or unknown oversight, de facto power over our central bank to force it to comply with whichever climate measures they see fit, effectively dictating monetary policy which should be under the sole authority of the Bank of Canada.

This would inevitably create an incredibly dangerous precedent in Canadian history.

Why?

Because [at least currently] the Minister of Finance in Canada does not have direct authority over monetary policy; monetary policy decisions are made independently by the Bank of Canada.

Do you realise how incredibly significant and potentially catastrophic this would be to Canada and Canadians should Bill S-243 ever become law?

De facto, it would essentially put a nail in the coffin of the Bank of Canada’s independence with regards to monetary policy, and cede this extremely important function to a regulator (the OSFI).

Pure insanity.

It should be noted that not a single Canadian Senator has responded to my open letter.

8. Conclusion

Let this exposition serve as a dire warning as to the consequences and dangers involved in permitting supranational, unelected, organisations such as the BIS, its Basel Committee & Financial Stability Board (FSB), and the IMF dictate not only our monetary policies, but also the rules, standards, and dystopian perils that would emerge should a CBDC or digital currency replace cash altogether.

While the Bank of Canada has specifically stated that it would scrap its plans for a domestic digital Canadian dollar (read CBDC), it is nonetheless collaborating with the BIS Innovation Hub Centres which are currently developing and enabling this nightmarish financial architecture of absolute control.

This is not time for Canadians, or citizens living in the BIS’ member central banks’ jurisdictions for that matter, to become ignorant, indifferent, and complacent as to what’s really taking place behind the scenes, lest they face the ensuing dire consequences on their financial futures and overall well-being.

Heed the warning.

Get informed.

Get vocal & active.

Share this article.

Do not comply (should they ever try to implement/impose such a dystopian digital currency or related Digital ID).

They are getting prepared. Are you?

What are your thoughts regarding the issues in this post and with the Bank of Canada, the BIS, and their plans? Share them in the Comments section below.

Support Independent Journalism

Can you get this kind of reporting from Canadian mainstream outlets such as the CBC, CTV News, or Global News?

How about from Rebel News, True North, or even Blacklocks?

Do they publish articles covering these types of agendas against we the people like I do?

You can support my work by considering a paid subscription to my Substack – Dan Fournier’s Inconvenient Truths (for only $5 a month, or $50 a year).

For one-time donations, you can also buy me a coffee.

If you are unable to support my work financially, it is greatly appreciated if you can share it on your social media feeds, for this brings additional exposure (and much needed eyeballs) which can lead to new paid subscribers.

Your comments are most welcome and appreciated and can be given in the Comments section below.

I sincerely thank you for your time and support.

Disclaimer:

See the author’s About page for full disclaimer.

Follow me on X, formerly known as Twitter:

I can also be followed on:

Primal (which is a Nostr decentralised alternative to X that cannot be censored, and where users cannot be de-platformed). If you are tired of X, you can create your own account on Primal.

We can all rant and rave as much as we want.

The tentacles of the banksters are manipulating or controlling finance worldwide.

No use going for the tentacles.

The octopus must be decapitated.

Thanks Dan for your thorough work on this topic. If there is one topic that needs reform it is this, monetary reform. You convinced me to support your work, haha!

At the core of this issue is just a simple sleight of hand, and bold faced chicanery. The authority that money and power gives the 'owner' of it, makes the other players in the economy believe that everything is legit. Renting the money supply at interest has indeed intensified in Canada since 1974, giving an unavoidably increasing debt that grows exponentially. Permanent debt for temporary currency.