Everything you need to know about Canada’s CBDC

by Dan Fournier, published Tuesday, Dec. 20, 13:385 EST on fournier.substack.com

Image source

Introduction

This article will explore what a CBDC is, why it is inevitable, what features are currently being considered in its design and what potential impacts – positive and negative – it may have on Canada, its citizens and businesses moving further into the digital age.

Central Bank Digital Currencies, or CBDCs, are digital currencies that countries propose to replace their current cash, coin, and digital entry systems (such as the money in your bank account).

People and companies would hold the CBDC in their digital wallets, make payments for the purchase of goods & services, conduct money transfers, and so on.

For added clarity, there is often mention of a ‘retail’ CBDC and a ‘wholesale’ one. The former is for citizens and businesses while the latter is one to be use for cross-border settlements, mostly between commercial and central banks.

Project Jasper, introduced in 2016, signals the starting point whereby Payments Canada and the Bank of Canada have embarked on the mission to use DLT (Distributed Ledger Technology), or blockchain technology, as is currently used by Bitcoin, to serve as the foundation on which its CBDC will work.

But unlike Bitcoin, CBDCs would most likely reside on a centralized blockchain rather than a decentralized one.

This means the central bank would have full control over its issuance and management.

While some countries have already launched their CBDCs, many like Canada are currently in the ‘Development’ phase.

The European Union block is developing its own digital euro CBDC which will serve its member states.

In late 2021, Finance Ministers and Central Bank Governors of G7 members which includes Canada, the U.K., the European Union, among others, have agreed to public policy principles for the development of CBDCs and digital payments which will have considerable consequences on their implementation and use.

The push was spearheaded by Rishi Sunak, current Prime Minister of the U.K. who was then the country’s Treasurer. And it caused a lot of worry amongst citizens due to some of its expected features which many consider dystopian, at best.

Designed for Control

Three of the main contentions of the proposed CBDC policy, by which Canada would also need to adhere to, include it being used to directly tax individuals based on their carbon footprints, the requirement of having a Digital ID for its use, and that it can eventually be used as a means of censoring dissenting voices.

These worries are with good reason, for the policy itself clearly substantiates these claims.

Under ‘Principle 8, Energy and Environment’, the CBDC’s infrastructure would align itself with shared commitments to support the net-zero economy and the paper outlines this as follows [emphasis added]:

“With increasing digitalisation, IT infrastructures facilitating the storage, processing and transfer of information and value are becoming an important global user of energy. CBDCs present the opportunity to set a marker for how future payment and settlement ecosystems are designed for optimal energy efficiency, including through utilising carbon-neutral and sustainable energy sources, whilst achieving necessary functional, performance and resilience aims…Energy usage should be factored into the design and implementation of any CBDC from the outset.”

Put simply, this implies that CBDCs of each G7 country will be designed with ‘markers’, or limits, on how payments can be settled, or not settled, depending on prescribed or designated limits that will be set by the issuer. In other words, if you’ve exceeded your carbon-limit for a certain period, your payment will be declined.

Mastercard has already released a card with a predesignated carbon emissions limit. So, it wouldn’t necessarily be that difficult to program this kind of feature in a CBDC.

The policy paper confirms this as a distinct possibility:

“CBDCs can potentially contribute to the safe and efficient use and/or sharing of information in order to make existing processes, such as real-time monitoring and ex post facto investigation of payments and value transfer, more efficient and effective.”

“Sharing of information” and “real-time monitoring”, should they be programmed into a CBDC, could also be quite hellish, to say the least. This could open up the door to a slew of abuses by authorities wishing to impose arbitrary diktats or decrees – like many we have witnessed during the Covid-19 Pandemic.

For example, they could be used as a tool to enforce ‘climate lockdowns’ or similar restrictions imposed by the government. A real-world case that illustrates this involves that of residents in Oxford county in England who are limited in their vehicle movements according to a pilot program being tested for reducing travel-related C02 emissions.

Next, with regards to a perceived requirement to hold a national Digital ID in order to be able to use the CBDC, under ‘Principle 10. Financial inclusion’ outlines how “access to payment services” would work [emphasis added]:

“They include cost, geographic factors (e.g. remote or sparsely populated areas), connectivity, demographics, low levels of economic development, access to verifiable identification and low levels of financial and digital literacy. CBDCs, as part of public infrastructure for digital payments, should be designed to take account of these challenges and encourage private sector innovation in order to address these gaps. Ancillary developments such as digital identity or other improvements to identity verification or authentication systems, if judged appropriate for use in a CBDC ecosystem, might also offer benefits for inclusion.”

Drafters of this policy report included Scott Hendry from the Bank of Canada and Nicolas Moreau from the Department of Finance Canada.

While the G7’s Finance Ministers and Central Bank Governors’ Statement on CBDCs and digital payments does call for “rigorous standards of privacy” and “protection of users’ data”, it does also state the following [emphasis added]:

“Innovation in digital money and payments has the potential to bring significant benefits but also raises considerable public policy and regulatory issues. Strong international coordination and cooperation on these issues helps to ensure that public and private sector innovation will deliver domestic and cross-border benefits while being safe for users and the wider financial system.”

The European Union and the United Kingdom have used the “safety [of online] users” as a premise for censorship.

And many worry that a CBDC designed with a Digital ID and programmability, could easily blacklist or freeze the accounts of users depending on their online behavior such as dissenting or spreading ‘disinformation’ or ‘misinformation’.

Canada will be no exception to these concerns, for it has launched its Digital Ambition 2022 program which would include its own Digital Charter to police online behavior, a national Digital ID, and countless means at its disposal proposed in Bill C-27 that could see users’ online behaviors and private information accessed and even shared with multiple parties. This author will soon publish a separate article which will explore and reveal Canada’s Digital ID plans.

Moreover, as Canada has already partnered with the World Economic Forum (WEF) and its multiple private partners for pilot programs to spearhead a global Digital ID, many are concerned that a Digital ID could also hinder their cross-border movements and limit their ability to spend while traveling abroad.

The ArriveCAN app in Canada has certainly demonstrated the pitfalls and overall public disgust (and distrust) with regards to their mobility rights.

Next, the G7 document also stressed their commitment to the G20 Roadmap for enhancing cross-border payments, managed by the Financial Stability Board (FSB). It will be the FSB that will be in charge of determining the rules by which cross-border payments can occur. Furthermore, it is the FSB that sets targets that are in line with the United Nations Sustainable Development Goals (SDGs).

It is worth noting that the FSB recently created the Task Force on Climate-related Financial Disclosures (TCFD) which will eventually require all companies, in Canada and abroad, to set climate-related goals and mandatorily make climate disclosures upon which they will be taxed. Failure to comply could mean that they would be shut out of the financial system and/or unable to transact using the CBDC, either domestically or internationally.

As such, some worry that implementing a CBDC with this amount of power and control will put a noose on businesses wishing to freely participate in the digital economy.

Other worrisome aspects of the G20 revert back to the issues discussed above, namely those of travel mobility, “online safety”, and censorship.

Last month during the G20 Summit in Bali, Indonesia, member states agreed on standards to establish a ‘digital health certificate’, i.e., vaccine passport, to be able to travel internationally; in addition, Article 24 of their joint Declaration stipulates [emphasis added for clarity]:

“We acknowledge the importance to counter disinformation campaigns, cyber threats, online abuse, and ensuring security in connectivity infrastructure…We will advance a more inclusive, human-centric, empowering, and sustainable digital transformation.”

In other words, they seek to establish a common framework to censor dissenting voices. Of course, this is nothing new, for we have seen the likes of WEF servant and New Zealand Prime Minister Jacinda Ardern utter authoritarian pronouncements such as “We will continue to be your single source of truth."

Part of crushing dissent could entail freezing citizens’ CBDC accounts. This already has precedent in Canada, for some citizens who donated to the Truckers Convoy saw their personal bank accounts frozen upon the unjustified and unlawful orders from our federal politicians such as our Deputy Prime Minister and current Minister of Finance Chrystia Freeland.

A dramatization video produced by Rich Planet TV astutely and simplistically sums up how CBDCs could potentially evolve and be used to control populations. The eye-opening explanatory video is definitely worth the watch.

Rich Planet’s Johnny's Cash and The Smart Money Nightmare video.

On the flipside, what positives could emerge from a CBDC?

One advantage Canadians have over other countries, China being a prime example, is access to publicly available information and a greater level of government transparency.

A lot of information regarding the development of its CBDC is accessible online for all to see, if one takes the time to do so.

Both Payments Canada and the Bank of Canada, our central bank, provide research papers, meeting notes, thoughts and discussions about what should be considered in the design and implementation of the upcoming Digital Loonie.

While the process of developing a CBDC – both at the retail (for individuals & businesses) and wholesale (internationally) levels – is rather broad and complex in scope and nature, it can nonetheless present opportunities for improvements and increased efficiencies for the digital age.

Payments Canada’s CBDC: The Fundamentals correctly points out that though cryptocurrencies such as Bitcoin are becoming more popular in Canada, they can experience price volatility, and thus not serve as an ideal store of value. Moreover, they currently don’t serve as a viable digital payments’ mechanism due to a lack of infrastructure supports and relatively low levels of adoption.

One of the biggest worries about CBDCs is that they would be centrally managed, unlike Bitcoin which is decentralized and thus not under the control of any single entity.

The same Fundamentals document does leave the door open to a decentralized model with the possibility of a token-based model rather than an account-based one.

Such a decentralized, token-based model would offer users more control and freedom to transact freely without the worry of having their transactions scrutinized and possibly blocked by unscrupulous central entities.

A token-based, decentralized, model could also enhance user privacy and anonymity in transactions.

Those currently developing the new digital currency are cognizant that a non-anonymous, less private CBDC design could reduce overall adoption.

Consumers are concerned about the privacy of their transactions.

Focus group testing by the Bank of Canada “has emphasized the importance of privacy for users of payment systems,” noted Payments Canada in their CBDC Retail Considerations document.

And with regards to anonymity, the document also acknowledges “Should CBDC not offer the same level of anonymity and privacy as cash, some users may be driven to alternative private digital currencies or continue using cash.”

Citizens of Japan recently rejected their central planner’s CBDC due to its lack of privacy and overall benefits. The same could occur here if peoples’ concerns are not considered.

While a token-based, decentralized retail CBDC could be more advantageous and attractive, it is less likely to occur; for, authorities are always concerned with illicit activities, money-laundering and the like, and will thus want a system that will offer verifiable traceability.

A hybrid solution – one with both a token-based and an account-based CBDC system – could potentially solve this dilemma and increase the likelihood of acceptance and adoption among the masses.

Payments Canada’s CBDC Retail Considerations document does make room for this possibility, for they state that it could be accomplished based on the value of the transaction:

“In two countries, Canada and Sweden, the access model may be “tiered” based on the value of the transaction, with smaller transactions using anonymous tokens while requiring user identity to protect public safety for large transactions.”

Another clear benefit could be with cross-border payments. Currently, these can be quite slow and expensive through commercial banks and private institutions such as Western Union. But with optimal CBDC design and international coordination, such payments could become very cheap and occur at lightning speed.

A retail CBDC could also more efficiently handle disbursements to citizens through the elimination of ‘friction’. In other words, governments could more easily and directly provide payments directly to users’ CBDC wallets.

A well-programmed CBDC could also incentivize and optimize capital flows into sectors of the economy that need to be stimulated.

Lastly, the Bank of Canada’s Contingency Planning document notes that with “the advent of cryptocurrencies and stablecoins, increasing consideration has been given to the possibility that one or more digital currencies created by private sector entities could play an increasing role in payments.”

In other words, the central planners are not excluding the possibility of allowing parallel digital payments systems whereby users could opt to use stablecoins (which are digital tokens that are pegged to a currency such as the US dollar or Canadian dollar) and cryptocurrencies (such as Bitcoin) to transact in lieu of the Canadian CBDC.

Conclusion

While it currently unclear what kind of CBDC system will emerge in the coming years, Canadians need to make efforts to be adequately informed on the potential benefits and pitfalls which may result.

Holding physical cash and other forms of money such as gold, silver, and Bitcoin now can help Canadians’ hedge monetary, economic, inflation, privacy and security risks going forward.

“Everyone has a plan 'till they get punched in the mouth,” stated famous boxer Mike Tyson.

So, the lesson here is to prepare now and devise our own ‘contingency plan’ which considers various scenarios, rather than when it will be too late.

Addendum:

John Titus, an American attorney, published a related video titled CBDC and the Fed's Plan to Weaponize Money on Nov. 23, 2022 which provides insightful complementary information and is definitely worth the watch:

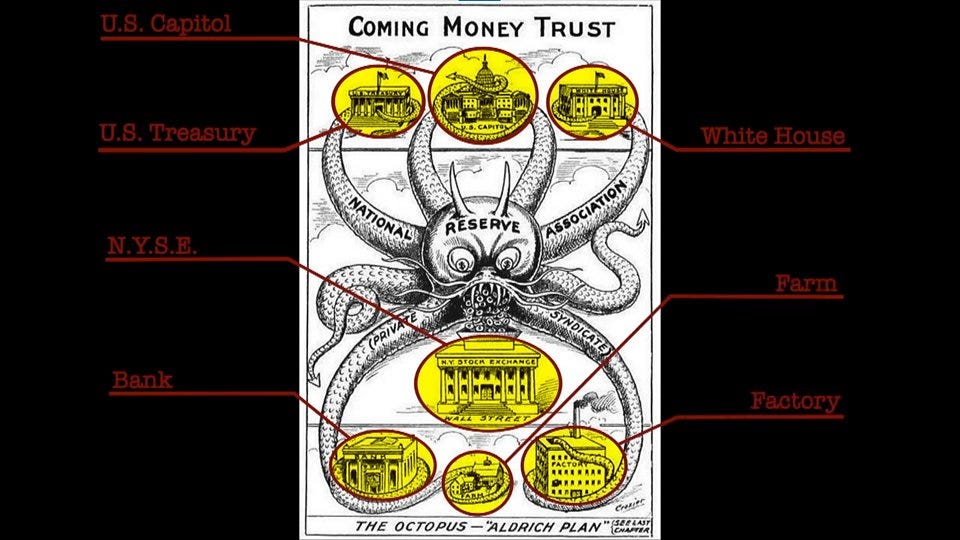

In the video, he also references a 1912 book - U. S. Money vs. Corporation Currency (Aldrich Plan) by Alfred Owen Crozier which foretold the creation of the U.S. Federal Reserve and its move away from real money to a fiat-based currency. The PDF for this book can be viewed or downloaded via tinyurl.com/2th2zje5. You may recognize the following image which comes from this book.

Notes:

This article is also published in The Counter Signal.

Related post:

See my Nov. 18, 2022 article UK’s PM Rishi Sunak desperate for G7 countries to launch their CBDCs which contains a lot of complementary information.

Disclaimer:

See the author’s About page for full disclaimer.