Meet Unicoin (UMU), the Global Digital Currency the Banking Cartel is Rallying Behind

by Dan Fournier, News & Commentary, published Tuesday, June 13, 12:52 EDT on fournier.substack.com

The current world monetary system which came about just after the Second World War is on its last legs and is soon coming to an end.

The new system which will replace the old will also be global, but will be adapted to the digital age of the 21st century.

The window is fast closing on the use of cash and thus financial privacy and freedom.

In 2022, certain Canadians had a rude glimpse into what the new monetary system may look like (and already does to a certain extent) when they saw their bank accounts frozen for donating funds to the Truckers Convoy protest movement, and that without any legal due process or consideration.

An endless supply of such kinds of abuses are inevitable should the masses choose to remain asleep at the wheel and ignore and allow what is coming our way from those who pull the global and financial levers of control through their sellout minions.

Let the reader note that the first three sections of this article will provide the necessary context for the digital currency that the world’s major central banks and the International Monetary Fund (IMF) appear to be endorsing. They are there to better explain the true nature of not only the IMF, but other banking institutions that are working in unison to create the new global digital monetary system of the future. The last three sections of this post will provide additional context and insights.

Feel free to skip to section 4 should you wish to just find out what Unicoin is all about.

This post is structured as follows:

Introduction to the International Banking Cabal & the IMF (International Monetary Fund)

What is the International Monetary Fund (IMF)?

CBDCs, Crypto & Digital Currency Global Regulatory Environment

Unicoin (UMU), The Digital Currency Monetary Authority (DCMA), & The Unicoin Network

The Bank for International Settlements (BIS) and its Projects Icebreaker & Aurora (for AI-based electronic surveillance)

The Bitcoin Alternative

Conclusion & Final Thoughts

1. Introduction to the International Banking Cabal & the IMF (International Monetary Fund)

The vast majority of individuals in this world haven’t a clue how money is created and how our monetary and financial systems & markets really work.

While even providing a brief overview of the global financial and monetary systems would be well beyond the scope of this article, it is nevertheless worthwhile to consider the structure and power of the entities that dictate and drive them.

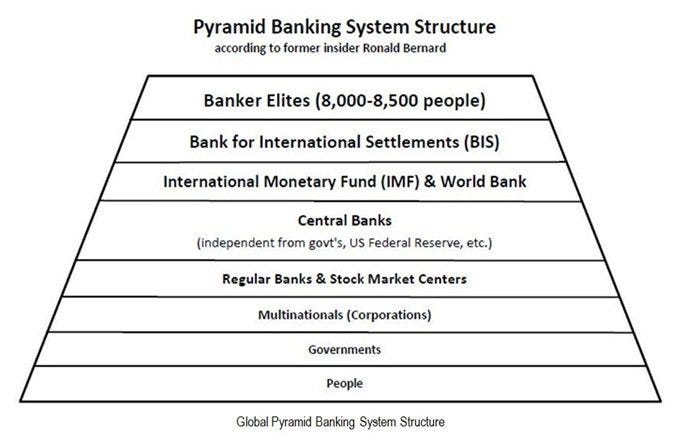

A former high-level Dutch Banker turned whistleblower Ronald Bernard explained the overall structure of the international banking system as is precisely depicted in the following graph:

Those in the higher rungs yield the most power while governments and the people sit at the very bottom.

Very high up the “food chain” we can see two organizations that yield unfathomable amounts of power, namely the Bank for International Settlements (BIS) – the central bank of central banks, and the International Monetary Fund (IMF).

As the IMF appears to advocate for proposed upcoming Unicoin global digital currency, it is very much worthwhile to consider who they are and how they operate (see section 2 hereunder). The same ought to be contemplated for the BIS which will be slightly touched upon in Section 5 of this post.

For those interested, former Dutch banker Ronald Bernard also reveals in meticulous detail the intricate secrets of banking in a highly-revealing interview. Viewers will learn more in this 33-minute video about the global financial system than they ever would taking a 45-hour university course on the subject; for, the banking expert discusses how banking works in the real world, as opposed to the fairy tales that are told in academia. And this author says this as one who studied business in university and has worked in education for over 35 years, including teaching business at the collegiate level for roughly a decade.

2. What is the International Monetary Fund (IMF)?

In a nutshell, the IMF was launched in 1945 after WWII with its headquarters based in Washington, D.C., to supposedly “foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world.” The IMF currently has 190 member countries.

But according to author John Perkins, author of Confessions of an Economic Hitman and The New Confessions of an Economic Hit Man, the IMF and the World Bank act as predatory lenders.

They go into economically-challenged or developing nations to offer huge loans that they can never repay with steep and onerous repayment schedules, and often seize their resources for non-payment; that is the primary modus operandi under which they operate, Perkins has described in many talks and interviews.

A fairly recent example given by Perkins was when Greece ran into debt problems in the European Union (EU) around 2014.

In an article and interview of the same year, Perkins demonstrated how Greece had fallen victim to the “Economic Hit Men” of the IMF and other predators, stating:

“And once [they were] bound by that debt, we would go back, usually in the form of the IMF - and in the case of Greece today, it's the IMF and the EU [European Union] - and make tremendous demands on the country: increase taxes, cut back on spending, sell public sector utilities to private companies, things like power companies and water systems, transportation systems, privatize those, and basically become a slave to us, to the corporations, to the IMF, in your case to the EU, and basically, organizations like the World Bank, the IMF, the EU, are tools of the big corporations, what I call the "corporatocracy.”

Needless to say, the IMF along with these other supranational organisations (such as the World Bank and EU) going into countries to basically loot their public sector utilities and hand them over on a silver platter to private corporations while further impoverishing their citizens showcases their true colors and intentions.

The Canadian Centre for Policy Alternatives (CCPA) stated the following in the conclusion of their 2004 report titled Impoverishing a Continent: The World Bank and IMF in Africa:

“TWENTY YEARS of World Bank and IMF SAPs have de-developed Africa and left it in a state of economic and social collapse. The destructive effect of these two institutions cannot be over-emphasized.”

Similar to the Bank for International Settlements (BIS), the IMF it is a supranational organization that has total immunity from prosecution, as this author has described in a recent interview.

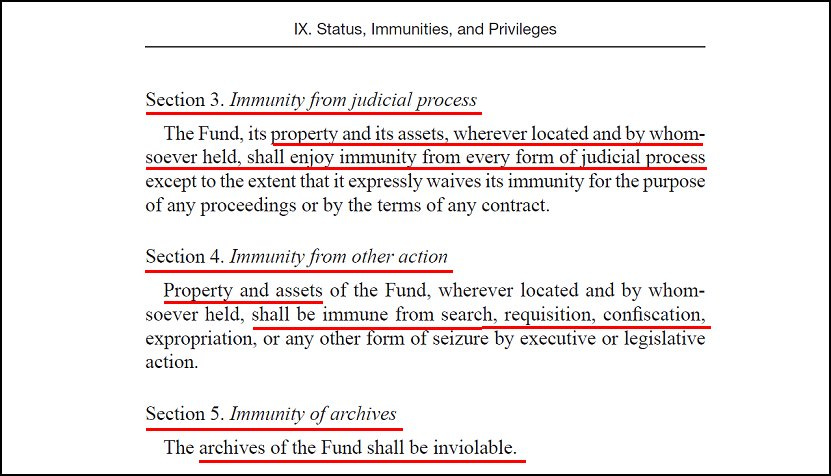

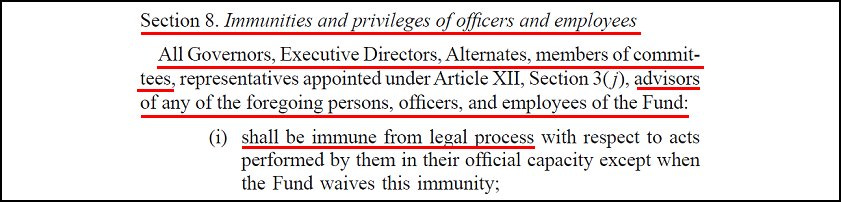

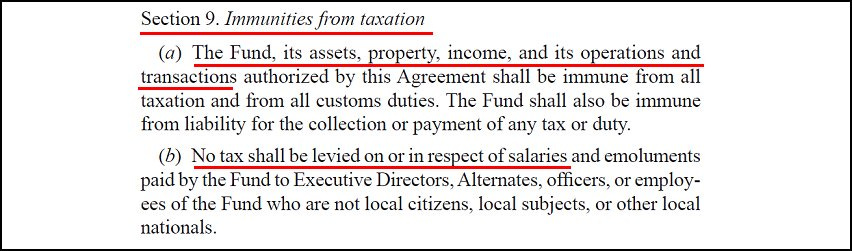

More specifically, the reader can have a look at the Articles of Agreement of the IMF itself.

Under section ‘IX – Status, Immunities, and Privileges’ of that agreement, you will find some of the immunities which the IMF and its personnel enjoy:

As you can see from the above sections, the IMF, their employees, and individuals who work for them can never be prosecuted and don’t even need to pay taxes.

No records, archives, or assets of the IMF can be seized or search – even if criminal wrongdoings have occurred (which has been the case in the past).

And all buildings and premises of the IMF are inviolable which means that local and national law enforcement aren’t even allowed in.

The new Bretton Woods System

Back in October of 2020, the Managing Director of the IMF – Mrs. Kristalina Georgieva – called for a “new Bretton Woods moment,” or ‘Great Financial Reset’, if you will.

For those unfamiliar with the Bretton Woods agreement or system, it is basically an agreement which took place after the Second World War whereby most countries agreed to rules for commercial and financial relations along with the use the U.S. dollar in international trade and as a reserve currency.

The IMF is center to that agreement in that it monitors exchange rates and lends reserve currencies to nations in need.

In this new Bretton Woods agreement Georgieva explains its rationale amidst the backdrop of the Great Reset which was brought about by the Covid-19 Pandemic.

Bank analyst Simon Dixon also provided an excellent analysis on the Bretton Woods systems – old and new. Never let a good crisis go to waste, many have observed.

In short, the new agreement is focused on re-inventing a new global monetary system that is more adapted to the digital age and whereby the unipolar, U.S. dollar-centric system is nearing its end.

Undoubtedly, the new agreement will incorporate monetary and financial systems that are more digitized and “inclusive” (as they put it, for it can include poorer/unbanked members of the lower rungs of society), and to help “combat climate” change (which is code word for collecting massive carbon taxes through the new digital plumbing infrastructure).

3. CBDCs, Crypto & Digital Currency Global Regulatory Environment

Central Bank Digital Currencies (CBDC)

What are CBDCs?

As per the online course titled Digital Finance created by this author, CBDCs sometimes get misunderstood as countries' respective digital fiat currencies (i.e., the digital deposits of dollars, euros, yen, etc. in depositors' bank accounts). CBDCs are not this.

Rather, CBDCs are digital currencies that countries propose to replace their current cash, coin, and digital entry systems which would thenceforth entirely reside on a centralized (or decentralized) blockchain or ledger.

Moreover, people and companies would hold the digital currency in their digital wallets, make digital payments for the purchase of goods & services, transfers to others, etc.

Cash may be still be used during the transition period when countries migrate toward 100% CBDC-only usage. Thereafter, countries may choose to keep cash or eliminate it altogether.

The majority of central banks around the world are currently working on their own national/domestic CBDCs with many factors being considered for their development and implementation.

Here are some basic characteristics CBDCs would have:

They would most likely reside on a centralized rather than decentralized blockchain ledger, for it would allow them to retain more control, and, arguably, more security;

Their supply though initially fixed at a certain quantity would easily have the possibility of being increased (unlike say Bitcoin which has fixed supply of 21 million coins that will never be increased);

Every single transaction can be checked, monitored (traced & tracked) and taxed directly. Participants would basically have no anonymity or privacy (unless it is programmed otherwise with a publicly-verifiable source code);

Each wallet to hold the digital currency would have to be identifiable (personal digital IDs for citizens and some other digital ID for companies, organizations, and other entities);

Digital IDs of wallet holders will most likely be connected to centralized national databases (tax authorities, among others);

CBDCs have the potential to usurp Fiscal-policy making from governments;

e.g., Central Banks could deposit digital currency directly in citizens’ wallets.

What about an international/global CBDC?

The IMF along with the BIS have long been interested in the development of CBDCs, for they have been conducting research and trials for many years now.

At a 2022 IMF conference called Central Bank Digital Currencies for Financial Inclusion: Risks and Rewards, Bo Li, the Deputy Managing Director at the IMF elaborated on many of the features being considered for their development.

Some of its highlights were enumerated in a prior post by this author which included how CBDCs would be programmable, how digital funds could flow and be targeted (to certain recipients), how large amount of “Big Data” would be collected (which would serve as the basis for a credit-score system like which currently exists in Bo Li’s native country, China), and how a CBDC ecosystem would be built through private-public partnerships (the private part meaning that corporations will have access to users’ private personal and financial data, most likely without their knowledge or consent).

While certain benefits could certainly arise from such a proposed digital monetary ecosystem – such as with much cheaper and faster cross-border transactions costs, abuses will undoubtedly also plague it.

Concerns and apprehensions expressed by detractors of CBDCs include the following:

The possible requirement of a Digital ID to be able to create and hold a CBDC wallet;

Providing personal biometric data (such as fingerprints, face or iris scans, and the like) for the CBDC wallet;

Instantaneous taxation on financial transactions;

Having one’s funds being “turned off” for frivolous reasons such as political beliefs of “bad” online behaviour such as posting so-called mis/disinformation (these could be based on their “credit scores” should those be developed as is currently the case in China);

Funds one holds in their CBDC wallet could have expiration dates assigned to them (i.e., where one would have to spend their funds by a certain date, lest they become “expired” and thus no longer existent and spendable);

Climate/Carbon taxes could be levied on the purchase of certain items (e.g., gasoline, beef, airline tickets);

Geolocation tracking which could be used as the basis for restricting people’s mobility or travel;

Inflation – devaluation of the fiat digital currency (CBDC) whereby the central monetary authority increases its supply.

American attorney and financial expert John Titus warned about the dangers of CBDCs as a means of control and a form of “weaponized money.”

A dramatization video produced by Rich Planet TV astutely and simplistically sums up how CBDCs could potentially evolve and be used to control populations. The eye-opening explanatory video is definitely worth the watch and can be viewed hereunder:

Regulatory Environment for Crypto & Digital Assets

Last month, the IMF hosted several of its Spring Meetings.

Among them was an extremely insightful and revealing one called New Economy Forum: The Future of Crypto Assets: Pains, Policies, and Possibilities held on April 12, 2023.

It took the form of a panel talk in which participants exchanged on their views of how the future of the crypto assets ecosystem – which includes cryptocurrencies and digital currencies – should be considered and governed.

One of the key guests of the talk was a former central banker from the U.S. Federal Reserve called Linda Jeng who is now the Head of Global Web3 Strategy at the Crypto Council for Innovation (CCI).

It should also be noted that the CEO of the Crypto Council for Innovation (CCI) is Sheila Warren – who also happens to be a prominent member and agenda contributor to the World Economic Forum for which she founded the ‘blockchain and digital assets team’ and was a member of the Executive Leadership Team for the Centre for the Fourth Industrial Revolution. As such, she is extremely influential in the implementation of WEF policies and agendas which include a mad push for Digital IDs (which is often justified as a means to counter online hate and so-called “dis/misinformation”) as well as crypto regulation.

During the IMF talk, former Federal Reserve central banker and panelist Linda Jeng shared a treasure trove of insights regarding which institutions will lead the digital assets ecosystem and set its rules, as well as what factors they will consider and include in its construction and eventual rollout.

Screenshot of Linda Jeng speaking at the IMF’s Spring Meeting session titled New Economy Forum: The Future of Crypto Assets: Pains, Policies, and Possibilities on Apr 12, 2023.

Without getting into too many technical details put forward by Jeng, here are some key highlights that must be retained from the former central banker (with accompanying explanations, links, and examples).

A global regulatory framework is sought for the crypto and digital assets and monies space;

The Crypto Council for Innovation (CCI) appears to be a key influencer in defining policy and regulations for crypto and digital assets;

Once policies are adopted, regulations will likely be enforced by the Financial Stability Board (FSB) through G20 members;

- Note: the FSB, headquartered in Basel (Switzerland) and associated with the Bank for International Settlements (BIS) is an international body that monitors and makes recommendations about the global financial system;The FSB will not recognize cryptocurrencies, including Bitcoin, as currency;

The FSB wants the ability to access transaction data;

A Digital ID is an essential feature which will be attached to the “legal frameworks”;

The digital assets ecosystem will be run by AI (Artificial Intelligence) based on “Big Data” held in repositories (much like how the Chinese CBDC – the eCNY – collects transaction and user data through its mobile phone app);

Collected data will include geolocation data (i.e., peoples’ physical location as determined by their mobile phone app or wallet), possibly restricting people’s mobility rights (as with “Climate Lockdowns”) or ability to protest as has occurred in China.

Data aggregators (private corporations such as Intuit, Plaid, and Yodlee) who work with banks will have access to individuals’ & businesses’ bank account data and possibly even their personal data;

The “digital economy” will be based on “digital identity”;

Digital money will be programmable;

Individuals’ or entities’ crypto/digital transactions could be blocked, seized, or sanctioned by OFAC (Office of Foreign Assets Control) or other agencies;

This regulatory framework has a target date of September, 2023.

The insights enumerated above provide the necessary backdrop and context to better understand the monetary, financial, and regulatory environments under which cryptocurrencies (such as Bitcoin and stablecoins), CBDCs, and digital currencies (such as Unicoin) will operate.

For the moment, they only appear to be suggestions. However, given the respective positions of some the panel members, they are likely to be taken seriously by the key institutions who have the power and desire to implement them.

4. Unicoin (UMU), The Digital Currency Monetary Authority (DCMA), & The Unicoin Network

This section will cover three main topics that are the key components of the newly proposed global digital currency called Unicoin, namely: Unicoin (UMU) itself, the Digital Currency Monetary Authority (DCMA) and the Unicoin Network which will govern and operate it.

Unicoin Overview

Unicoin – a global digital currency – was unveiled at the International Monetary Fund (IMF)’s Spring Meetings held this Spring in Washington, D.C.

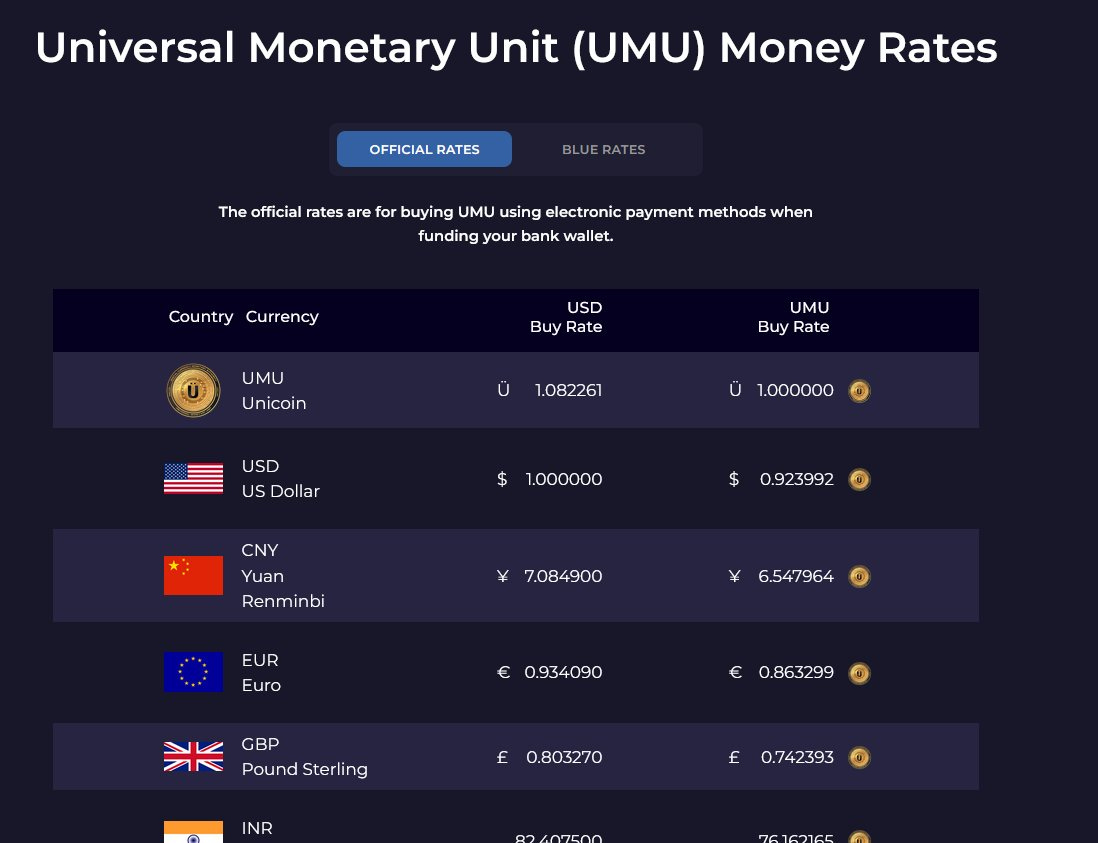

The Unicoin currency is abbreviated UMU which stands for Universal Monetary Unit and even has its own symbol Ü, similar to how the major currencies such as the dollar ($), British Pound (£), Japanese Yen (¥), and the euro (€) have their own distinct symbols.

Its official website is

They also have a sister site called

https://unicoinnetwork.com/

which provides a lot more information about their services and the stakeholders they serve, including a FAQ section.

It has been created and is defined as a money commodity which means that in the United States, it would fall under the regulation of the U.S. Commodity Futures Trading Commission as is currently the case for Bitcoin (click the link to view the CFTC’s ‘BITCOIN BASICS’ guide, archived here).

Though it is not technically seen as a CBDC, UMU “functionally operates like a CBDC,” states its principal architect, Darrell Hubbard who is a Harvard MBA and Computer Science graduate.

“UMU is our monetary asset, and we back it,” stated Hubbard in the BeInCrypto interview, though he didn’t specify how or by what it is backed.

He adds: “you can always redeem the value from us for the value paid to us,” though, once more, he fails to explain how exactly such “value” would be redeemed or for what.

Hubbard further explains how UMU will not be legal tender for negotiating domestic prices, but will rather function as a store of value, be used as a method of payment, and mitigate currency devaluation.

The BeInCrypto article further noted:

“UMU has premium exchange rates built into its wallet and can convert any settlement currency amount to the equivalent UMU amount.

Its creators hope that one day merchants could accept UMU for the equivalent market value for their goods and services priced in any national legal tender.”

Their website displays a chart for the circulating money supply and exchange rates for UMU, as per the following screenshot (taken on 2023-06-07).

In an article by Yahoo! Finance, Hubbard astutely explains a current problem plaguing many across the globe [emphasis added for relevancy]:

“The international monetary system has some inherent encumbrances that have caused many countries to adopt de-dollarization monetary policies. Many of these de-dollarization projects are seeking digital currency solutions as an alternative to the current international monetary system.”

“De-dollarization” refers to how there’s an increased reluctance to use the U.S. dollar in trade for fear of sanctions by the American Empire. For instance, countries like Russia and Iran are heavily sanctioned and are largely excluded from transacting in the world’s reserve currency. Hubbard thus implicitly suggest that such encumbrances could be mitigated with the use of UMU. This could also suggest an alternative to the U.S. dollar acting as the world’s reserve currency.

Hubbard further explains that banks and Fintech companies can easily integrate existing apps with a UMU store of value wallet to conduct real-time cost-efficient digital banking, digital trade, and digital payments worldwide which certainly does sound appealing.

In a separate article by Kitco News, a referenced press release states that UMU “adopts a central banking monetary policy framework” to ensure it has continuous purchasing demand, minimal price volatility, and annual asset pricing targets.”

This “central banking monetary policy framework” is likely to be defined by the DCMA (note: the DCMA is explained in the next subsection). The press release fails to explain how the “continuous purchasing demand”, “minimal price volatility”, and “annual asset pricing targets”, would be achieved.

But the Kitco article does affirm that banks will be able to utilize the new currency by attaching SWIFT Codes and bank accounts to a UMU digital currency wallet.

In other words, this would enable users to conduct SWIFT-like cross-border payments using the “best-priced wholesale FX rates achieving instantaneous, real-time settlement while bypassing the correspondent banking system.”

The Kitco News article also cited Tobias Adrian, a Financial Counsellor at the IMF (who also appeared in a related IMF Spring Meeting titled New Economy Forum: IMF Approach to Central Bank Digital Currency Capacity Development) who added the following:

“Cross-border payments can be slow, expensive, and risky.

In today's world of payments, counterparties in different jurisdictions rely on costly trusted relationships to offset the lack of a common settlement asset together with common rules and governance.

But imagine if a multilateral platform existed that could improve cross-border payments—at the same time transforming foreign exchange transactions, risk sharing, and more generally, financial contracting.”

To this point, the press release further added:

“Adopting a global localization public monetary system architecture, UMU can be configured to operate according to the central banking regulations of each participating jurisdiction.”

Put simply, the Unicoin Network is designed facilitate cross-border payments while allowing local jurisdictions to impose their own regulations on how UMU can be transacted.

This could imply that should a local jurisdiction, like Canada for instance, decide that an individual or entity has behaved badly (as was alleged during the Truckers Convoy), the local regulator could easily forbid or inhibit transactions with the UMU digital currency.

Such a system design could prove quite appealing to participating countries, for they would have the capacity and prerogative to decide who may or may not transact and who may be sanctioned, depending on their own established rules and conventions.

David Lin who is best known as an interviewer for Kitco News interviewed Darrell Hubbard on his recently launched YouTube channel on May 1st, 2023 in which the Unicoin architect and DCMA founder provided the background story and mechanics of the ambitious project and addressed some of its criticisms. The interview can be viewed hereunder:

During the interview, Hubbard stated that there was currently 100 million UMU units in circulation. For comparison, Bitcoin has a fixed supply of 21 million coins.

UMU started at around 5 cents in 2018 he explained and is now (at the time of the interview) around one dollar in a private network setting. It is not clear how exactly this price appreciation has occurred over the last five years and what factors contributed to it.

UMU has yet to start trading publicly.

The long-time computer whiz stated that he poured tens of millions of dollars of his own money into the project but walked away from “hundreds of millions” of dollars in investment opportunity, conveying that he did not want to be “held hostage to the private sector.”

When asked by David Lin whether there were any pre-miners, stakeholders, or investors in the project, Hubbard responded in the negative, adding that he was the sole owner of DCMA and UMU and was merely investing in it to secure his legacy [as a tech entrepreneur and enthusiast]. “I want to bring a more fair and open monetary system to the world,” he further added.

Though Hubbard conveyed an altruistic tone about the project, he nonetheless stated the following [with emphasis added]:

“I probably [will] make billions of dollars in the process, but I can assure you the team who will understand it knows me that money does not motivate me; I walked away from a lot of money so far.”

Lin pressed further asking how parties can invest in the project. Hubbard stated that there were 2 options: they can buy the [UMU] coin, or take an equity stake in the “business,” further cautioning that they are trying to find the “right partners” for the long term which won’t include Venture Capitalists (VCs).

It is strange here that he said “business,” for it implies that the project is indeed a business enterprise which would likely take the form of a corporate entity – not dissimilar to a bank or central bank. As such, it would inevitably have stakeholders. And those stakeholders would almost assuredly have voting rights and/or decision-making power which could influence or steer the project, including the value of the UMU coin and its DCMA governing body.

Though the IMF denied official involvement with the UMU/DCMA project, Hubbard did confirm that much of his project’s work was based on alleviating their (and other central bankers’) concerns while providing a means by which it could complement and strengthen the existing monetary system. He also confirmed that his legal team held talks with the IMF.

When asked whether governments could track UMU transactions, Hubbard replied that “no one can track and trace our transactions,” but added that they know internally who is making all the transactions.

For tracking and tracing to occur, there would have to be some sort of criminal activity or criminal probe. He clarified that governments or other entities such as a central bank or a Fintech company can only access transactions that originate within their respective jurisdictions.

This is in line with the concept of ‘global localisation’ which Hubbard described as a unique feature of his digital monetary system (this feature is detailed in the project’s whitepaper).

Hubbard’s team – which appears to have grown to over a hundred employees – has been in contact with numerous central banks from countries of nearly every continent in the world, for which he stated “we have full exposure in the most advanced economies,” implying the likes of G20-type countries.

In addition, they have a “very solid and strong” relationship with the U.S. Treasury, the U.S. Securities and Exchange Commission (SEC), and the Commodity and the Commodity Futures Trading Commission (CFTC) – the latter two being the top financial regulators in the United States.

This is no small feat, for the United States currently sits atop the throne of global monetary system.

Darrell Hubbard boasted that his system is the only cryptocurrency that has the ability for users to transact in a direct, private, point-to-point (or phone-to-phone [using Bluetooth]) manner, similar to physical cash. He states that Bitcoin cannot even do this, for it uses a [blockchain] ledger and is thus not private.

Finally, in this fascinating interview Hubbard stated that their system implemented two forms of cryptography: peer-to-peer and point-to-point. The former, also called ‘electronic cash’ involves a [verifiable and traceable] ledger while the latter doesn’t and acts more like physical cash between two people.

Digital Currency Monetary Authority (DCMA)

On Unicoin’s website, there is a major section called DCMA for which if you click, it will lead you to a separate website, namely https://dcma.io/.

As per the project’s whitepaper, their physical office is located at the following address:

300 New Jersey Avenue N.W., Suite 900, Washington, District of Columbia 20001.

There is also a Twitter account for DCMA: https://twitter.com/DcmaPress though not much has been posted yet and it currently only has 528 followers. And a LinkedIn page exists for the group, though information on it is quite scarce at the moment.

Founded in 2018, the Digital Currency Monetary Authority, or DCMA, appears to be a fairly broad-based governing body that has been in the making for a while now with key players shaping its role and mandate.

One needs to examine both the website for the DCMA and the whitepaper to gain a more thorough understanding of the entity and its functions.

Apart from its founder, Darrell Hubbard, the group remains quite secretive and anonymous. The founder, originally from America, stated in his interview with David Lin that they have all signed NDAs (Non-Disclosure Agreements) and that they are forbidden from posting news about the DCMA and Unicoin on social media, including LinkedIn.

The DCMA’s stated role is to establish monetary policy governing the Unicoin cryptocurrency.

The DCMA hosts a Unicoin Monetary Policy Committee (UMPC) consisting of up to twelve leading economists, banking, and financial leaders around the world, though the people who hold these positions have yet to be revealed.

The primary goals of the UMPC are “to establish a monetary policy framework for realizing Unicoin as a continuous demand store of value and a medium of exchange cryptocurrency and to ensure Unicoin qualifies as a cash reserve deposit currency for central banks around the world.”

Its whitepaper describes the DCMA as “a world leader in the advocacy of digital currency innovations for governments and monetary authorities and has innovated a best-in-class design for international Central Bank Digital Currency (CBDC) leveraging a digital economic union.”

In other words, the main focus is enabling an “international Central Bank Digital Currency (CBDC),” as they put it.

Next, the DCMA has a mandate to “provide economic and financial stability to its member states.”

The whitepaper also states that several sovereign states have collaborated with the DCMA on a Model Law for the international CBDC, or money commodity, though it didn’t mention which specific countries contributed to the draft legislation; there was only a brief mention that the DCMA had consulted with the People’s Bank of China (PBOC) since as far back as in 2018, and subsequently met with “several other central banks in both advanced and emerging market countries.”

But what is perhaps even more concerning than consulting with China, known for its strict and tightly-controlled authoritative regime, is that they also worked with two very powerful unelected bodies, namely the European Commission and the World Economic Forum (WEF).

Conducting a simple search on the WEF’s website with the keywords “Unicoin” or DCMA render no results, which would indicate that their work together is mostly secretive since, usually, the WEF details the vast majority of their agenda projects on their website.

As stated on its Universal Monetary Unit web page, the DCMA is also responsible for conducting open market operations (note: OMOs are frequently used by central banks to stabilise asset prices), defining cash reserve requirements and incentives, to “offer interest rate yields to entice customer deposits,” and offering the “best-priced cross-border FX rate market worldwide” for Unicoin.

In short, these services are typical of what central banks do.

Under the Hood: The Unicoin whitepaper

The DCMA recently (April 19, 2023) published a whitepaper called A Best-in-Class Money Commodity for Strengthening Monetary Sovereignty with a Digital Economic Union which explains the details of the Unicoin project and the DCMA.

Too many aspects of the project are covered in this whitepaper; so, this author has chosen to cover only some of the key ones that are bound to be impactful should the UMU coin come into global circulation.

Concerns of the IMF

Part of the document addresses concerns from the International Monetary Fund (IMF) about how crypto assets, such as Bitcoin and stablecoins, could disrupt the current global monetary system.

The IMF outlined nine potential crypto assets risks (with policy recommendations) in particular which were addressed in the whitepaper by which the author demonstrates how UMU will provide a sound monetary sovereignty model (and environment) for economies which are listed as follows:

Safeguards and strengthens monetary sovereignty and economic stability of the banking system.

Minimizes or eliminates capital outflows from the monetary banking system.

Has a global tax classification status as a money commodity and does not impose fiscal risk.

Establishes legal certainty of UMU as a money commodity.

Establishes corporate and monetary governance to prevent bad actor and illicit activity.

Complies with domestic and international financial integrity agencies (FATF, FSB, BIS, and IMF).

Enables governments, central banks, and financial institutions to configure UMU to comply with their domestic banking and crypto assets regulations.

Measures the impact of UMU on each country’s economic and financial stability.

Collaborates with governments and central banks for the research and development of crypto and other innovative solutions to improve cross-border payments and trade finance.

The whitepaper also noted that: “the DCMA has engineered a new generation of cryptography with monetary policies reimagined for the banking industry that supports and strengthens the international monetary system, Crypto 2.0.”

Three of the nine points above were highlighted, as they are particularly relevant. With number 2, “Minimizes or eliminates capital outflows from the monetary banking system,” the concern is really about how cryptocurrencies such as Bitcoin and stablecoins (such as USDT and USDC) have the potential to remove money from the traditional banking system which they control.

Number 6 is particularly noteworthy, for it lists the five most powerful financial regulators in the world, namely the Bank for International Settlements (BIS), the International Monetary Fund (IMF), the Financial Action Task Force (FATF), and the Financial Stability Board (FSB) who is closely affiliated with the BIS. These are the “big guns” of global finance with the BIS & IMF sitting high atop the global international banking system, as was illustrated in the image earlier in this post.

For those unfamiliar with the FSB, it is a BIS-affiliated institution that monitors and makes recommendations about the global financial system. Former central banker to Canada and England Mark Carney served as its chairman for many years amidst the Great Financial Crisis of 2007-8. Following that financial crisis which saw major banks go bust, Carney was instrumental in helping to protect criminal actions committed by HSBC (who was under a U.S. Department of Justice investigation at the time) which was meticulously documented and exposed in John Titus’ All the Plenarys Men documentary film (watch from 21:10 to 25:25 in particular).

Such kinds of transgressions to protect the banking and financial institutions themselves in lieu of the customers they serve are unfortunately commonplace with institutions such as the FSB and the FATF.

As for the FATF itself, back in 2021 they published a paper called Updated Guidance for a Risk-Based Approach to Virtual Assets and Virtual Asset Service Providers which outlined what they deemed as risks and threats posed by VAs, or Virtual Assets such as Bitcoin and stablecoins, and how to mitigate them via recommendations. Crypto expert Guy from Coinbureau made a very thorough and informative video explaining the FATF’s approach in face of this perceived risk to their financial hegemony.

Number 7 from above (“Enables governments, central banks, and financial institutions to configure UMU to comply with their domestic banking and crypto assets regulations,”) simply touts Unicoin as a viable instrument to help mitigate the international financial institutions’ concerns amidst the crypto/digital assets environment backdrop.

Four Key Functions of Unicoin’s monetary policy framework

Continuing with the whitepaper, the Unicoin monetary policy framework is discussed and consists of four parts: open market operations, cash reserve incentives, FX discount rates, and depository interest rates. These are all common central-banking operations that the author demonstrates how they would be performed with Unicoin.

For the first, “open market operations,” the idea basically consists of a form of price-fixing. Central bankers such as the Bank of England, the Bank of Canada, and the U.S. Federal Reserve often employ their resources (such as a trading desk at the New York Fed) to buy or sell assets in huge quantities to perform price-fixing activities, including depressing the price of gold and silver. The whitepaper specifically states how these operations would occur for “managing” the price of Unicoin [with emphasis added for relevancy]:

“The use of open market operations will assist in minimizing price volatility over time and should prevent Unicoin from being traded in the same pattern of the broad cryptocurrency market.

Unicoin open market operations will utilize a collaborating network of open market traders to buy and sell Unicoin to stabilize any aggressive volatility that may arise in the open market.

Unicoin open market operations will also be a strategic tool for achieving short-term and longer-term monetary policy targets and goals. The Unicoin open market operations will deploy artificial intelligence and machine learning trading bot to assist in achieving Unicoin monetary policy goals.”

As can be seen from the statements above, the price of Unicoin would be fixed and determined not by market forces, but by interventions carried out by traders and AI-driven bots. These passages can also be seen as a criticism of Bitcoin which is still a volatile cryptocurrency. The central bankers and DCMA founder Darrell Hubbard know all too well that should Unicoin be as volatile as Bitcoin, its adoption will suffer tremendously, losing the opportunity to promote UMU as a more stable, international digital currency.

Consensus Protocol & Transaction Speed

The whitepaper also discusses the “trust model” or consensus protocol under which UMU operates.

Briefly put, a consensus protocol is simply a set of coded rules that validate transactions. Bitcoin uses a consensus protocol called proof-of-work (PoW), and Ethereum, another cryptocurrency, uses one called proof-of-stake (PoS). These are basically mechanisms to ensure that no cheating takes place and that accepted transactions get properly recorded on a blockchain ledger; this is similar to paper ledgers and accounting books once used by businesses to record business transactions and account balances, with the exception that transactions on a digital blockchain ledger are immutable (permanent and irreversible) and can never be changed (like with a thief trying to cheat the books).

Unicoin uses a Staked Proof of Trust (SPOT) consensus protocol.

Certain cryptocurrencies can be “staked,” that is to say locked for a certain time period in order to earn interest (much like a short-term bond or term deposit that banks offer).

Participants called transaction validators to the UMU network can earn up to 20% annually for staking their UMU coins, though the DCMA nor the whitepaper mention how they will obtain the funds to to pay such interest rewards. Transaction fees on FX exchanges (e.g., buying UMU from $U.S.) will be one source of revenue which can be employed to pay staking rewards.

The following is stated in the whitepaper [with emphasis added]:

“Unlike public blockchains deployed with trustless consensus protocols, central banks and monetary authorities are trusted entities for providing a safe and secure monetary system.”

Here, we can see two words: trustless and trusted. For trustless and public blockchain, they are referring to Bitcoin without mentioning it by name.

The term is confusing, for trustless seems to mean that trust does not exist. Actually, it is the opposite. With a trustless system, it simply means that transactions can be verified and validated by the network’s program code (protocol) without the use of an intermediary (person or institution).

In traditional finance, if you want to move money from your bank account to friend’s bank account in another country, you need an intermediary to validate and execute the transaction. This intermediary will ensure that you have the sated funds in your bank account, are not a criminal, and will check all the necessary banking information to ensure the funds flow properly. But this intermediary also has the power and authority to refuse executing the transaction for particular reasons.

The passage then says “central banks…are trusted entities,” which is true for the most part, but is not always the case. Many people around the world have had their accounts frozen for various reasons – some not illegal, but more politically-driven – or have seen actions such as wire transfers refused.

If for whatever reason, your respective government or its central bank deems you an unsavory character, they could prevent you from sending your UMU coins to a friend’s account overseas or refuse any payment that comes from your digital wallet, and there would probably be very little you could do about it other than get a lawyer to fight your case.

In terms of transaction speed, the whitepaper states that the protocol can process over 100,000 transactions per second (TPS) which is far superior to payment processors such as Visa and Mastercard as well as Bitcoin.

Multi-Currency Settlements & Transaction Costs

The Unicoin network is designed to sit atop a multi-currency ledger that can, using AI, perform instantaneous “best-priced” cross-border FX rates and transactions.

As mentioned before, cross-border transfers of Unicoin can be accomplished at much faster speeds and with lower costs than which currently exists. The whitepaper states that such transactions can occur in 1 second without the participation of a corresponding bank at a cost of less than US$0.05.

Undoubtedly, if proven true, this would be a radical paradigm shift in international banking, for it would have the potential to disrupt the status quo.

One may also ponder the incentive for commercial banks, given that a lot of their current profits are generated from such transfer fees and FX premiums.

But, perhaps the design of this new digital monetary network is focused on workability with central banks rather than commercial banks.

Speculation aside, it is too early to tell since this is only a proposed system that has yet to face scrutiny and possible resistance from current establishment players in the space who have been around for, literally, centuries.

Know Your Customer (KYC)

Screenshot of the KYC section of the DCMA whitepaper, page 22.

The whitepaper explains that under the Unicoin network, Know Your Customer KYC would basically be required for participants to transact, though they seem to disguise it as not being the case under their ‘global localization’ moniker. Here are some key passages to this effect [with emphasis added]:

“This global, yet decentralized, registry would create a unique global identifier for every person and entity for every bank account opened in the international monetary system, or at least, the participating member banks.

The Unicoin Network has implemented a global electronic KYC registry for its participating members in the UMU digital economic union.

Combining global electronic KYC with artificial intelligence and machine learning is showing major promise as common avoidance patterns are more easily recognized and alerted to network monitoring systems.”

Though the paper does state that global network monitoring can occur without sharing of personally identifiable information (PII), such privacy is a fallacy for, if a regulatory institution demands such data about a person or entity who transacts on the network, the DCMA will not be able to refuse and will have to hand it over to them.

The same could be said about their point-to-point system where they claim transactions between two parties would be direct (without the use of an intermediary such as a bank) and private, this is simply not the case; for, as DCMA founder Darrell Hubbard stated in the aforementioned interview (“we know internally who is making all the transactions”), they have access to all the transactions on their network – and this data could also be demanded by the financial authorities/regulators.

UMU Supply: Minting/Creating Ü

A common contention with government or central bank fiat issued currency is that its money supply can by increased by money printing (which means physically printing cash and minting coins and increasing digital deposits in accounts). Obviously, increasing the money supply creates inflation.

Historically, governments and their central banks have increased money supplies and this was accelerated during the Covid-19 Pandemic as can be witnessed in the following graphs for the United States and Canada.

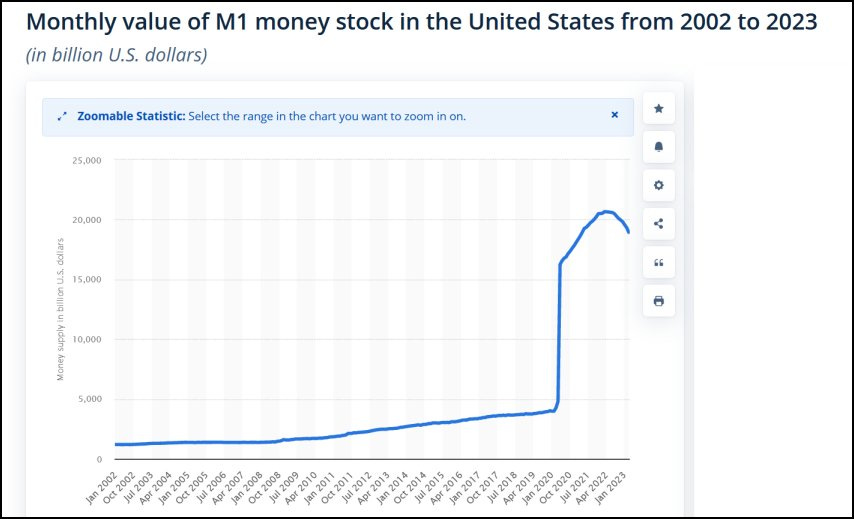

Increase in U.S. Money Supply (M1) from 2002 until January of 2023. From 2020, the supply increased from roughly $5 trillion to $20 trillion. Source: Statista. See also: The Mises Institute – Why Prices Have Gone Up.

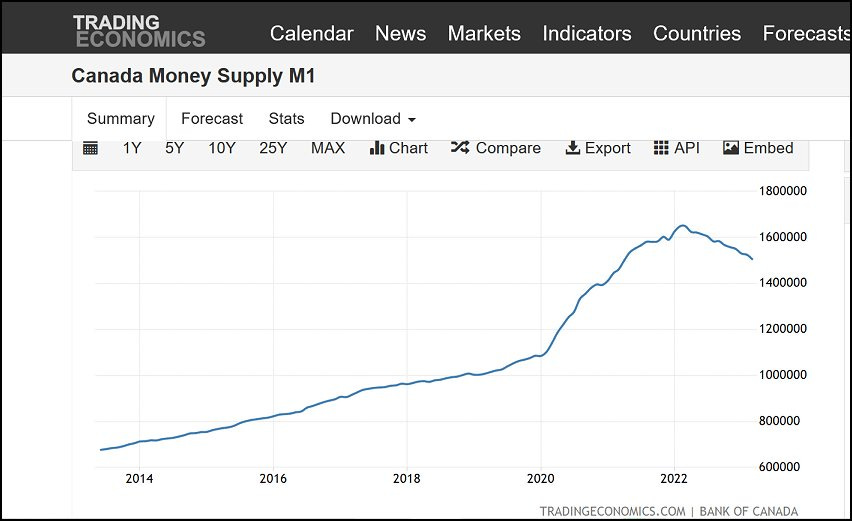

Increase in Canada’s Money Supply (M1) from 2013 until the end of 2022. Source: Trading Economics.

Under the centralised Universal Monetary Unit (UMU), the current supply is at 100 million, but there is nothing to indicate that this supply cannot be increased, unlike Bitcoin which has a fixed supply of 21 million which will never increase.

In fact, to achieve its stated monetary policy, those who control the supply of UMU would inevitably have to either increase or decrease its supply to achieve its price stability and minimal volatility objectives.

Hence, those wishing to either invest or hold UMU may face the same currency depreciation risks, i.e., see the value of their holdings decrease in terms of purchasing power.

What seems to make the case of Unicoin worse is that, according to its whitepaper, any bank can mint Unicoin (tokens/coins) much like is done with the current existing fractional reserve banking system:

“With tokenized deposits the funds remain on the balance sheet of the depositing institution and can be monetized according for fractional reserve lending and other banking transactions.

The Unicoin Network has implemented a globally decentralized tokenized deposit mechanism where any bank can mint Unicoin on deposit or purchase transaction.”

What the two passages above from the whitepaper appear to imply is that banks – including commercial banks – can issue (create) more Unicoin tokens by simply making loans, as they currently do in the existing fractional reserve banking system. Stated differently, they expand the money supply which will inevitably decrease the value of the token over time hence reducing its value and purchasing power.

There is no way around it, for in absence of a fixed supply (like Bitcoin) or a strict mechanism to tightly control the supply of Unicoin, the digital currency is designed to fail as miserably as any fiat currency.

Overall, the monetary policy designed by the DCMA as described in the whitepaper, mathematically speaking, holds zero potential in the long run to avoid the pitfalls that are morbidly apparent with the current monetary system.

Programmability & Control

A very important aspect of CBDCs or digital currencies lies with the way in which they are designed and programmed. All cryptocurrencies and digital currencies have computer code which define their attributes and rules of use.

It is really up to those designing and programming the code to define what parameters they want to set for their digital coin or token.

Earlier in this paper, several concerns and apprehensions people have about CBDCs were listed – for which many were of a dystopian nature.

With paper cash and coins, things are pretty straight forward when conducting transactions between parties. Unless the notes or coins are fake/counterfeit, people will usually have no problem or reluctance in transacting with one another. And they needn’t worry about their notes or coins suddenly becoming unusable.

The same cannot be said with programmable digital currencies, for it all depends on the attributes and rules that dictate how, when, where, for what, and with whom they can be used.

Just like CBDCs, the global digital currency Unicoin is one that is designed with this programmability.

According to the whitepaper, the DCMA is certainly not only onboard with this philosophy, but is actively catering to the wishes of the top bank in the world – the Bank for International Settlements (BIS) which is the central bank of central banks.

“Augustin Carstens, General Manager of the Bank of International Settlements (BIS), gave a keynote speech at the Monetary Authority of Singapore (MAS) on February 22, 2023.

He stated “Around the world, central banks are exploring how to give money new capabilities... But to fully realise the transformative potential of these new financial technologies, we need some way to bring them all together. In this regard, there is great promise in developing the idea of a "unified ledger" with a common programming environment.”

Without getting into the dirty details of the keynote speech referenced and linked in the passage above, it is rather instructive to hear what Augustin Carstens – who is arguably the most influential banker in the world – had to say about CBDCs and the potential of their programmability.

Back in 2021, when Carstens was talking about CBDCs and how they would be programmed, he publicly confirmed that central banks would hold absolute control over their use and that they would have the technology to enforce it:

Carstens is not joking when he contends that they would have absolute control to enforce it; but that would inherently require a totally centralised control apparatus for enforcement.

In the citation from the whitepaper above Carstens stated both “we need some way to bring them [capabilities/programmability of money] all together” along with the necessity of a “unified ledger" with a common programming environment.”

Fortunately for him (and all central bankers around the world), the Unicoin monetary system would fulfill those requirements. Specifically, Unicoin would have both the centralised ledger and the programmability of UMU.

Another extremely important factor must be considered with the employment of such a unified ledger; and the surreptitious warning is there in black and white in the whitepaper for all to see:

“A unified ledger is a digital infrastructure with the potential to combine the monetary system with other registries of real and financial claims. It would need to be a public-private partnership with a clear division of roles, and where the central bank is tasked with underpinning the trust in money.”

The “potential to combine the monetary system” with “other registries” is quite worrisome, for it can imply that the system would have the potential of being easily integrated with other registries such as health registries, intelligence agencies, black lists, no-fly lists, and so on.

For example, a person’s digital account could be tied to a country’s national health registry; if that person didn’t get their latest vaccination (for whatever virus is deemed a health threat), then their money could be frozen or become unusable for travel until they are up-to-date with their vaccination schedule.

While this example may appear an extreme one, the reader should note that such restrictions actually took place in many countries around the globe when countries such as Canada and many in Europe imposed travel restrictions through vaccination passports.

Moreover, this author described how the World Health Organization (WHO) is in fact planning to implement such restrictions (see pages 48 to 65) and which was also re-emphasised just last week by the WHO.

Another example of such an Orwellian overreach and abuse of such power could involve intelligence agencies ordering the freezing of digital wallets of individuals they deem are spreading online mis/disinformation. Once again, as this author has explained in prior posts, the unelected globalist supranational organisation in the WHO is seeking such powers, not to mention worldwide abuses in this regard even by so-called democracies like the United States, Canada, Australia, and New Zealand.

As we saw during the Covid-19 Pandemic, the powers-that-be were unswervingly unbending when it came to maintaining singled-sided narratives about public health measures whilst crushing and censoring “dissenters” who held and expressed counter-narratives.

Turning off one’s money and ability to transact would, needless to say, be an extremely compelling incentive to shut people up and keep them in line.

All these monetary mechanisms could easily contribute to a massive control grid over populations. Of course, some countries would prove more restrictive than others. And this is also baked in to the Unicoin model, as per its global localization strategy.

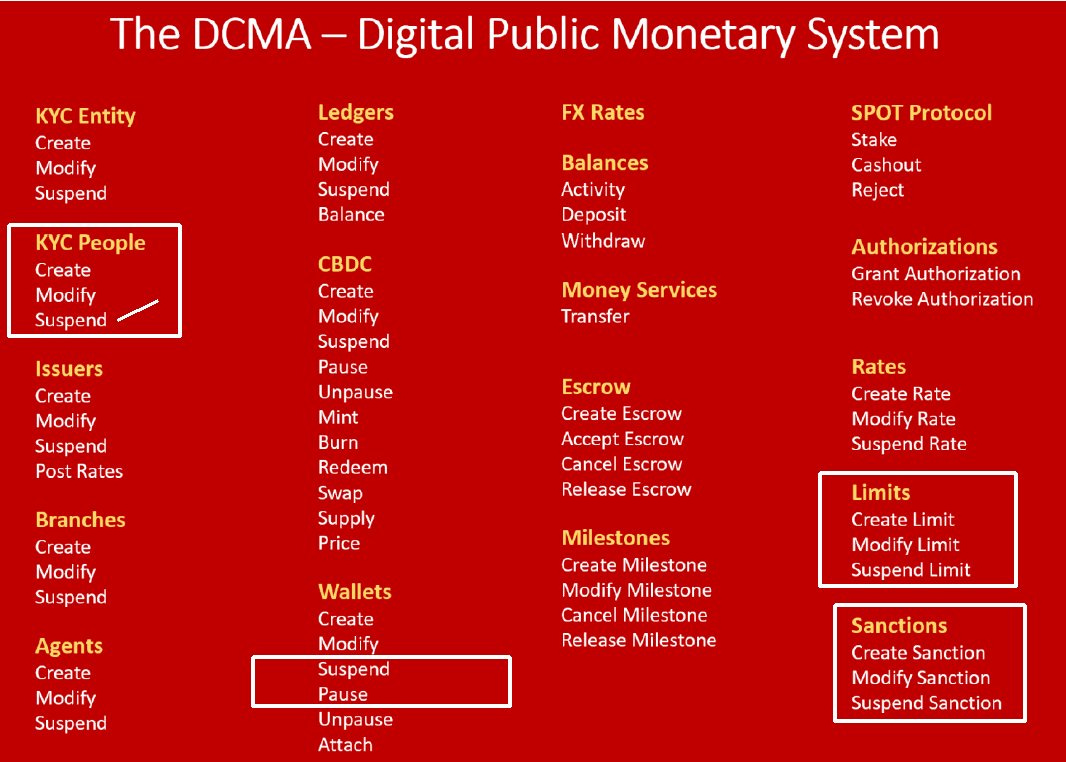

The whitepaper clearly demonstrates these abilities with its Figure 9 [with emphasis added in white rectangles]:

Figure 9: Unicoin Global Localization of a CBDC Public Monetary System (page 18 from the DCMA’s white paper A Best-in-Class Money Commodity for Strengthening Monetary Sovereignty with a Digital Economic Union.

As can be seen from the figure above, peoples’ Unicoin wallets could easily be paused (frozen) or suspended, sanctions imposed, and have money spending (or account holdings’) limits.

In addition, with its “Smart Wallet technology,” the whitepaper makes reference to different wallet classes that would exist.

“With Smart Wallet technology each wallet issued is assigned a different wallet class, and each wallet class is like a role that is granted varying access to the public monetary system.”

There are different categories of wallets which include those for merchants and individuals. Should any of them “misbehave” their “access to the public monetary system” could be hindered, depending on the rules programmed and determined by either the central authority (the DCMA) or the local (domestic) authority (a country’s central bank or its commercial banks).

To conclude this section, it has become quite apparent that despite the stated advantages of the Unicoin monetary network (both locally and cross-border), its disadvantages are brazenly apparent, if not entirely dystopian, leaving much to be desired for the proposed project in its current form.

5. The Bank for International Settlements (BIS) and its Projects Icebreaker & Aurora (for AI-based electronic surveillance)

The BIS – along with its nefarious tendencies – has already been slightly discussed in this work. But if the reader wants to gain a more thorough historical perspective and true nature of this globalist institution, an essay titled Ruling The World of Money written by Edward Jay Epstein will serve that purpose.

That essay was written in 1983, right at the onset of personal computing and just a few years before entering the digital age of the internet.

Fast-forward to today and literally everything that has to do with finance, banking, and personal transactions is indeed enmeshed in the digital realm of the digital age in which we are are now ensnared into.

Over the last three decades, the protracted series of incremental steps by which almost every facet of our lives have migrated into these digital systems have radically changed how we go about our daily lives – some for the better and some for the worst.

And we have forsaken much of our privacy for so-called convenience.

The old era of mom and pop stores are almost as scarce as a customer-service department with an actual living and breathing human being who answers the telephone and have been replaced by giant retailers and wholesalers who almost exclusively care about maximizing profits while minimising the level of quality and service they provide to their customers.

Moreover, we all feel the frustration of trying to get help from these corporations – or even government institutions for that matter – (when we need them) who, for the most part, will use the most enraging runarounds and ill-conceived online systems to make our lives a living hell.

A centralised CBDC would be the final nail in that coffin.

This is where the BIS’ Project Icebreaker comes into play, for it, along with a global digital currency/CBDC such as Unicoin would literally spell the end of financial freedom, privacy, and possibly even private ownership.

Project Icebreaker

An excellent article from a prolific writer named Brandon Smith from the The Alternative Market Project, better known as Alt-Market.us, touches upon the BIS’ Project Icebreaker in prophetic fashion. Over the last decade, this author has made numerous predictions about the global and U.S. financial systems which have turned out to be true. I have been following him for years and greatly value his analytical skills and judgment.

Last April, Smith wrote an excellent piece called Project Icebreaker: The Beginning Of A One World Digital Currency System? (alternate link via ZeroHedge) which is very much worth the read and provides a crystal-ball view of what is to come in the next few years and as early as later this year.

There is only one piece of the puzzle that I believe is missing in Smiths’ analysis – Unicoin.

Here are some key highlights and citations from the article.

Near the start of the article, the author commences:

“The Orwellian nature of CBDCs cannot be overstated. In a cashless society most people would be dependent on digital products for exchanging goods and labor, and this would of course mean the end of all privacy in trade. Everything you buy or sell or work for in your life would be recorded, and this lack of anonymity could be used to stifle your freedoms in the future.”

He adds: “CBDCs give establishment officials the leverage to starve their political opponents with algorithmic precision. It would be a new world of technocratic oppression.”

“It’s important to understand that central bankers are moving at breakneck speed to develop and introduce digital currencies. It’s not a matter of experimentation, they already have these systems ready to implement. The Federal Reserve’s instant transfer program “FedNow” is set to debut this July, which is not a CBDC but it is an intermediary step towards instituting CBDCs in the near term.”

Though the Federal Reserve, the central bank of the United States, states that FedNow is not a CBDC and has “has made no decision on issuing a central bank digital currency (CBDC),” we must be cautious. First, their website www.federalreserve.gov uses the high-level domain indicator .gov even though this bank is a private corporation and not a government institution. The Fed, as they are more commonly referred to, is an exceedingly deceptive entity for which its shareholders consist to large member banks (JP Morgan, Citi, et al) as well as rich families. It very much acts as a banking cartel, really serving the interests of their shareholders rather than Americans. And, as the reign of the U.S. dollar as the global reserve currency nears its Grand Finale, the Fed has no choice but to reinvent its dominant position in a digital form should it wish to survive as the dominant central bank in the world. In short, it is not to be trusted.

Now back to the BIS. Smith further notes:

“The BIS is at the forefront of the movement towards the adoption of CBDCs. They have been funding a vast array of projects to test and refine CBDC technology and as of this year they estimate that at least 81 central banks around the world are in the midst of introducing digital currency systems.”

And here is where he gets to the heart of the matter, for he touches upon Project Icebreaker; so, pay attention.

“Project Icebreaker in particular grabbed my attention for a number of reasons. The BIS describes the project as a foreign exchange clearing house for Retail CBDCs (retail CBDCs are digital currencies used by the regular public and businesses), enabling the currencies to be traded from country to country quickly and efficiently. This is accomplished using the “Icebreaker Hub”, a BIS controlled mechanism which facilitates data transfers for an array of transactions while connecting banks to other banks.”

Though Project Icebreaker is merely at the conception stage (possibly and likely already also in the design stage), it main objective is to “use domestic retail CBDCs for cross-border payments,” as is stated on its website. This is what Smith is referring to in the passage above.

To be able to achieve such cross-border payments cheaply and efficiently – for both Retail (common citizens) and Wholesale (banks, businesses) players, the “Hub” or mechanism required would have to have those two attributes and also be secure.

The BIS often refers to this term “Hub” and even has its own BIS Innovation Hub which is central to its CBDC ambitions.

A “hub” in this case would refer to a centralised location in which all the magic will occur, so to speak. The magic being a place in which cross-border monetary transfers and payments could occur in a seamless and efficient fashion. This hub would require a very fast, efficient, highly-secure and surveilled setting.

It should be noted that such a hub wouldn’t necessarily have to be the brainchild of the BIS. The important thing here is the hub itself, not who designs it or to whom it is attributed.

Last January at Davos 2023 in the halls of the World Economic Forum with the hobnobbing of the world’s “financial elites” (I prefer to call them the more fitting term parasites) there was a very relevant panel discussion titled In the Face of Fragility: Central Bank Digital Currencies (click the link to view the video). In it, speaker Amir Yaron who is the Governor of the Central Bank of Israel, goes over the merits of such a hub and how one was piloted between a few countries (Sweden, Norway, and Israel) for a test drive. But more importantly, he states the following at around the 13:02 mark:

“…the important question down the road is who will build this hub if we do it globally? Is it going to be a consolidation of central banks, international bodies like IMF, BIS, private companies like SWIFT or others?”

Screenshot from Central Bank of Israel Governor Amir Yaron speaking at a January 18, 2023 Davos 2023 panel discussion In the Face of Fragility: Central Bank Digital Currencies. Source: World Economic Forum’s YouTube Channel (comments are off, by the way).

This means that despite the success of the pilot project, they are in search (note that this statement dates from January 2023) for who will build and run the hub.

As for the who, the attributes of the Unicoin Monetary Network described earlier in this paper appears to be the only viable and possible candidate that is poised and positioned to fulfill the purpose of this hub. It is centralised, fast (at 100,000 TPS), efficient (cross-border & cross-currency FX transactions occurring in seconds), and programmable.

Furthermore, Unicoin can be used for both wholesale (central banks, financial institutions) and retail (individuals and businesses) transactions, as per the requirements Yaron discussed in the panel talk.

In addition, UMU appears to have already gained the attention (and possible approval) of the IMF - which often coordinates with the BIS - and who is just lusting to get its new digital Bretton Woods monetary system anchored for the next several decades (or centuries) to come.

In other words, the Unicoin Monetary Network ticks all the required boxes.

One characteristic that this author was tempted to share earlier in this work is that UMU, the Universal Monetary Unit, is much like something called the SDR (Special drawing rights) which essentially acts like a monetary store of value in the form of a basket of the largest currencies (i.e., the U.S. dollar, euro, Chinese yuan, Japanese yen, and pound sterling). SDRs are used mostly as a store of value and for exchanges between central banks.

The following passage from Smith’s article is the only place I think he got things wrong which I will explain in a moment [with emphasis added].

“Well, “luckily” for all of us the BIS and IMF have been working on their own GLOBAL CBDC. In the case of the IMF, this one-world currency would be based around the Special Drawing Rights basket system they have been using for decades to broker currency transfers between national governments. The BIS then uses this one world currency product as the bridge in Ice Breaker going forward.”

In my opinion, I have always found that an SDR could never work or serve as a global currency in a retail setting, but rather only in a wholesale one.

But all we need to do is substitute the SDR with UMU in Brandon Smith’s analysis and voila! You have the perfect fit for the sought global digital monetary instrument which would now prevail as a one-size-fits-all de facto standard.

An official video from the BIS about Project Icebreaker can be viewed hereunder in which cross-border transactions would be done with ease using this type of global CBDC.

The video is very typical of those from these types of institutions, for they always presents things in the form of a problem to be solved (i.e., in Hegelian Dialectic, Problem-Reaction-Solution fashion), so as to make it appear both desirable and necessary.

Smiths’ article goes on to demonstrate the Orwellian horrors that would await us should such a beast system come to fruition.

For example, just like Russia and its businesses and citizens were sanctioned and excluded from the SWIFT international banking system due to the invasion in Ukraine, the same type of sanctions could be imposed on any other citizen, business, or entity around the world for which the central power deems hostile or a threat to their dominance and supremacy. There is plenty of precedent in this regard.

Apart from sanctions, another problem areas lies in standards that are set by these financial institutions. I already touched upon things such as KYC (Know Your Customer) and there is also another big one called AML (Anti-Money Laundering) which are measures defined and often abused by these banks, governments, and financial institutions alike.

Who or what is to prevent the central authority from creating new additional standards to gain even more power?

The answer to this question should be quite obvious. For, the ease in which these could be created with such a powerful centralised CBDC system would be tantamount to child’s play.

Smith provides the following example which illustrates this chasm:

“What if you had to meet certain standards in order to be allowed use of the hub, and the BIS dictates the standards? What if the BIS decides that your company needs to meet woke ESG related categories before you can get permission for Icebreaker transactions? Now the BIS has the ability to manipulate social and cultural trends using your business and millions of other businesses as forced messengers.”

To “manipulate social and cultural trends” equates to a very pernicious form of social engineering which has been occurring for decades and has been ramped up lately.

In recent years and months, we have seen how many corporations such as Anheuser–Busch/ AB InBev (the maker of Bud Light) and Target, but to name a few, have force-fed woke ideology onto its customers – most likely to cater to the ESG (Environmental Social and Governance) models which is designed to keep businesses in check and subservient to help carry out certain agendas. Smith also recently published an article explaining this troubling business trend.

Snapshot of Brandon Smiths’ ESG Dystopia: Why Corporations Are Doubling Down On Woke Even As They Lose Billions from June 9, 2023.

With this level of woke madness, who is to say that they won’t cut a parent off from their money should they not accept irreversible gender-transitioning treatments if their 7-year-old now identifies as a member of the opposite sex? Such laws are already becoming commonplace in Canada and in California.

The possibilities for such kinds of abuses are too numerous and too dystopian to even contemplate.

Placing such absurd amount of power in a single centralised entity could prove disastrous for humanity.

There is no doubt that we are at the cusp of a radical change and shift in our global financial system.

Banks in the U.S. have been failing as of late with many more to come.

Financial crashes of the past – many of which were planned, as well as crises such as global pandemics are often the springboards from which an old system dies, and a new one emerges to save the day.

Enough can be said about the Covid-19 Scamdemic and how it has brought about unprecedented amounts of abuses and power-grabs. But money, after all, is what drives the world.

Without privacy, there will be no financial freedom.

Absent of a framework to transact freely and privately, humans will but become pawns of serfdom and slavery.

In his article Project Icebreaker: The Beginning Of A One World Digital Currency System?, Smith breaks down how this crash (problem) will occur and how the new system (solution) will be spawned from it:

“Let’s say there is a global scale economic crisis event which causes many currencies to fluctuate wildly. Lets say, for example, that the US dollar loses its world reserve status and petro-status and this sends FX (foreign exchange) markets into a panic. Price inflation becomes rampant and banking institutions falter under liquidity pressures. Lets say that central bankers introduce CBDCs as a solution to the problem, and the BIS Icebreaker Hub as the intermediary for international trade. The populace is so frightened by the economic crash that they then embrace the digital framework. Now let’s say that the BIS claims they still can’t find a currency they consider stable enough to act as a means to bridge most global transactions. What happens then?

Well, “luckily” for all of us the BIS and IMF have been working on their own GLOBAL CBDC. In the case of the IMF, this one-world currency would be based around the Special Drawing Rights basket system they have been using for decades to broker currency transfers between national governments. The BIS then uses this one world currency product as the bridge in Ice Breaker going forward.”

Again, just substitute ‘Special Drawing Rights’ (SDR) with Unicoin (UMU) – which could be the “one world currency” he is referring to and there you have it. The disastrous global economic/financial/monetary crisis has a chance to prevail and save humanity.

It gets worse.

Smith contends that that would only be a first step. Another step would entail even more centralised power and control:

“Eventually the BIS, IMF and various central banks will ask the public the inevitable question: “Why are we bothering with these national currency exchanges when we have a perfectly good bridge currency in the form of this one-world CBDC? Why don’t we just get rid of all these superfluous national CBDCs and have one currency for everyone?”

Thus, total global financial centralization would be achieved. And once you have a one-world currency, a completely centralized and micro-managed global economy and the most vital trade systems in the world controlled by a tiny handful of faceless unelected bureaucracies, why then have nations at all? Global government would be the next and final step.”

That could mean that eventually, in a few years or a couple of decades in the future, all national currencies could be eliminated and replaced with a single global currency and even global government.

While this presumption may appear quite far-fetched, should the BIS, IMF, FATF, FSB, and all these parasitical unelected, unaccountable, technocratic entities who are totally immune from prosecution have their way, it will be the end of human freedom.

They have been planning and executing for this ultimate goal for decades, if not centuries. And if we continue to sleep as ignorant sheep, we will get what we deserve.

Project Aurora

What good would a centralised CBDC super-hub be without AI to help monitor millions of financial transactions daily by a myriad of participants?

This is where the BIS’ Project Aurora comes into play.

As can be observed from the video above, the same formula previously described as “problem-reaction-solution” is employed.

The problem? Money laundering. The solution?

“Detecting money laundering patterns is a complex task. Spotting these patterns requires the ability to collect data across firms and borders to identify suspicious networks and dubious flows of funds.”

They then double-down on the problem, yet again:

“However, the problem is that financial institutions which bear most of the responsibility for detecting suspicious activities rely on siloed data and systems that are often forbidden from sharing information with other financial institutions. This makes it hard for them to detect these complex money laundering networks and flows.”

While money laundering is a serious crime and should be monitored by authorities, including some international collaborative efforts, attempting to bypass countries’ privacy laws to obtain such information appears to be the ultimate objective here.

Under the current state of affairs, countries like Canada have strict privacy laws in place to protect citizens and consumers of financial products and services.

Thus, circumventing these privacy laws would further erode financial freedom of individuals and businesses to transact in a private and a trustworthy manner.

Moreover, usurping countries’ domestic laws for such an international standard by a unaccountable and immune supranational organisation would leave little recourse for individuals and businesses. In other words, they could not defend their innocence or cases in domestic courts, but rather be judged by an AI algorithm.

Such precedents already exist as is the case in China where some court decisions are 100% rendered by AI programs.

AI programs and “Big Data” (siloed data) are also prevalently used to establish Social Credit Scores for citizens and businesses. Alibaba uses these.

A South China Morning Post article also warns about how “Smart Courts” (which use AI) are seamlessly integrated with police, government, and social credit system databases. A Chinese law professor further warns “We must be alert to the erosion of judicial power by technology companies and capital.”

“The erosion of judicial power by technology companies,” is precisely a risk to be contemplated. Big Tech and Fintech companies in the West already enjoy a tremendous amount of power over user data.

In Canada, for instance, there has been abuses relating sharing of private financial data between private corporations, the government, and intelligence agencies.

According to a ZeroHedge article on the subject, Project Aurora is designed to “use "machine learning" (AI) as a tool to monitor vast flows of financial transactions from all over the world in order to identify specifically flagged patterns.”

The article states that though some banks have already implemented their own AI systems to detect “unusual” bank account activities, “Aurora would require international access on a scale that would be incredible as well as horrifying.”

The article further warns: